What is Happening to Virgin Galactic Shares?

4 minutes for reading

In the last couple of weeks, Virgin Galactic has become one of the most discussed companies in the world. So, today we want to tell you why a space operations company owned by the billionaire Richard Branson invaded the newsfeed, what is happening to its shares, and what forecasts about the company’s future our analyst has to offer.

The regulator allowed Virgin Galactic passenger flights to space

On June 25th, Virgin Galactic published on its official website that it had received a permit from the US Federal Aviation Administration to take passengers on its space flights. This announcement made the first much-heralded and discussed by the general public and investors flight to space with a complete crew more probable.

The stock market literally went nuts for this news: at the end of that very day’s trading session, Virgin Galactic Holdings Inc (NYSE:SPCE) shares skyrocketed by 38.87% and reached $55.91 per share.

The space operations company decided not to stall for time with the flight date and announced that it would happen on July 11th. At that moment, the media took this announcement as Richard Branson’s intention to surpass Jeff Bezos in a space race. We remind you that the Amazon founder earlier said that he would fly into space on its spaceship Blue Origin on July 20th.

Virgin Galactic’s first passenger flight

On July 9th, the last day before the launch of VSS Unity with a complete crew aboard, Virgin Galactic shares ended the trading session at $49.2, thus plunging by 6.62%. If compared with the price on June 25th, which we described above, the company’s shares lost 12%.

On June 11th, a launch plane lifted to a 15-kilometer altitude, and then the spaceship, after launching its own engines, reached 86 kilometers on its own. Several minutes of zero gravity and return to Earth – everything went perfect.

Fall of Virgin Galactic shares

Before the trading session started on June 12th, the next day after the epic success of the space operations company, it became known that it was planning to issue 100 million common shares and raise $500 million.

The news about the additional issue of shares ruined the price of Virgin Galactic shares. On that day, they finished the trading session at $40,69 with a 17.3% decline. On June 13th, they continued falling, although not as fast as earlier: -7,2%, at $37.76.

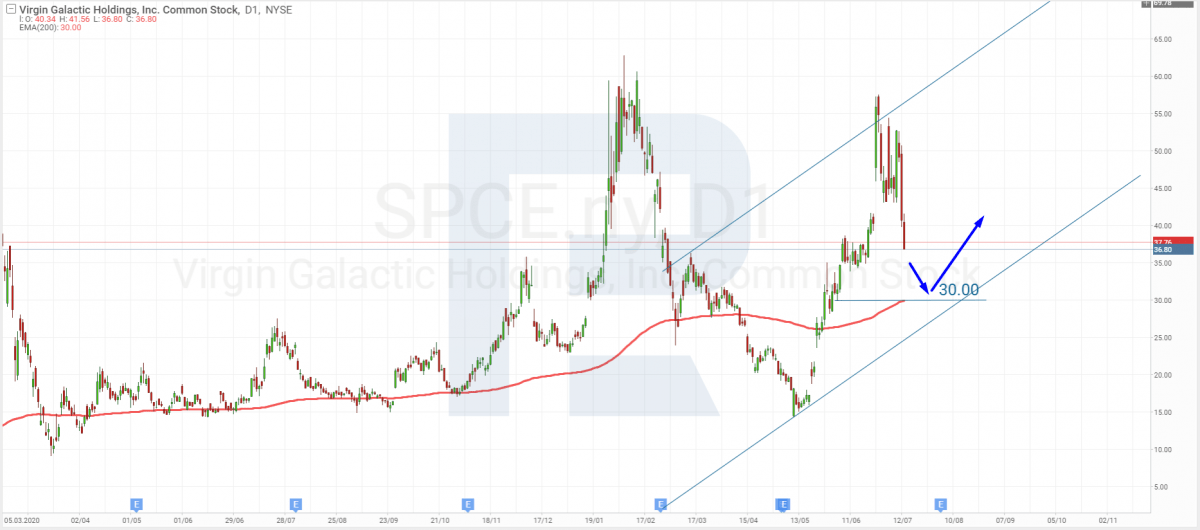

Tech analysis of Virgin Galactic shares by Maksim Artyomov

“Virgin Galactic shares have been falling for the third consecutive trading session since the announcement of additional issue of shares. At the moment, they are trading at $37. Considering the ascending tendency, we may assume that the current decline is a correction, which may reach the 200-day Moving Average.

The target here is the support area at $30. After testing the 200-day Moving Average, the price may rebound and start a new rising impulse. At the same time, one shouldn’t exclude another trading idea, which implies a test of $30 and, a breakout of the support area, and a further downtrend towards the ascending channel’s downside border”.

Summing up

Virgin Galactic managed to carry out its first flight into space with a complete crew onboard. In anticipation of this event, the company’s shares were steadily skyrocketing. However, the next day after Richard Branson “conquered” space, it became known that the space operations company would issue and sell additional shares worth $500 million. Virgin Galactic plummeted and reached $37.76.

Many analysts believe that this very company is leading the space tourism race. We remind you that Morgan Stanley experts are sure that this area will make a $1 trillion profit every year by 2040. We’ll keep following the events on such a promising market – it’s pretty interesting who will eventually win this race.