IPO of Duolingo, Inc.: a New Level of Learning Foreign Languages

6 minutes for reading

Sooner or later, many of us start thinking of learning foreign languages. As a rule, the school course is not enough to be fluent and talk to foreigners without a language barrier, that’s why people tend to deepen existing knowledge. And when there is no time for attending classes or hiring a tutor, different services for distant learning are to the rescue. The most popular of them are mobile applications due to their simplicity and user-friendliness.

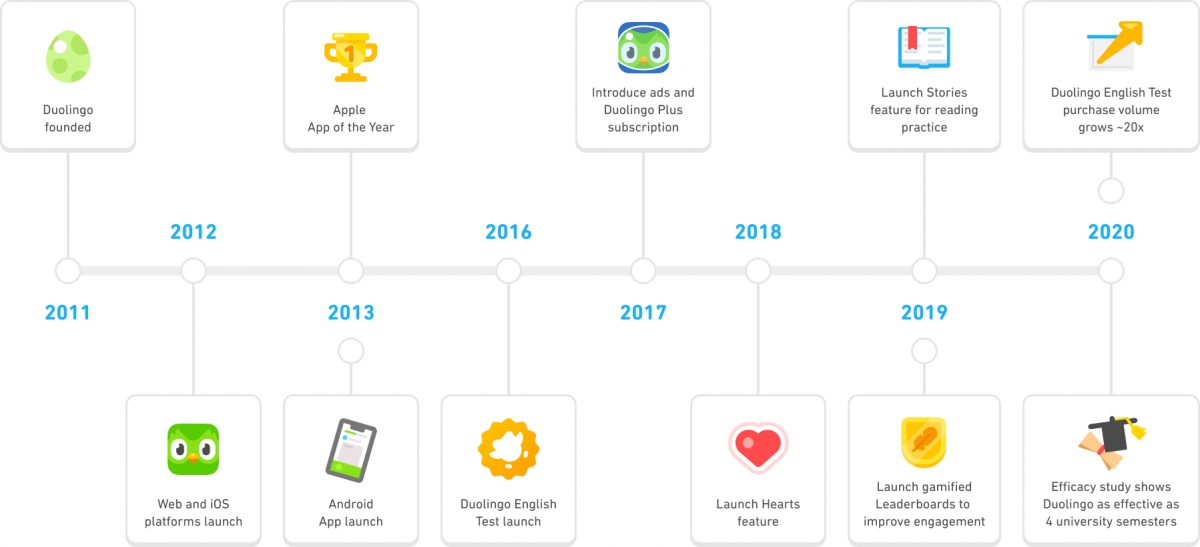

Duolingo developed a mobile application for learning foreign languages. Using the platform, you can learn even High Valyrian from the Game of Thrones. The company is going to have its IPO at the NASDAQ, and its shares will be available for trading tomorrow, under the “DUOL” ticker. Let’s take a closer look at this issuer.

Business of Duolingo

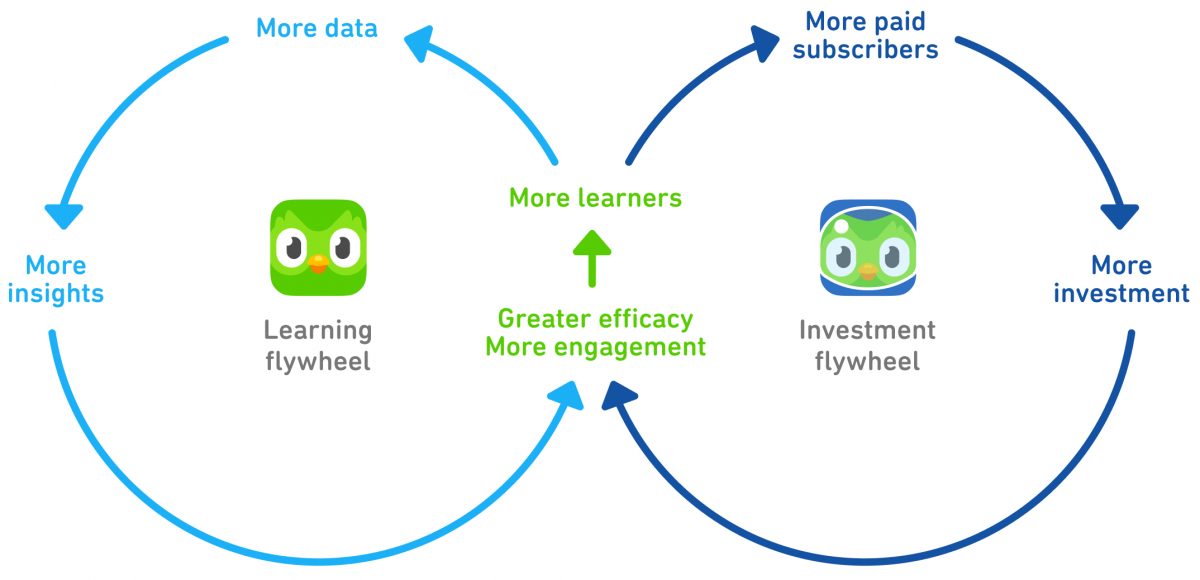

Duolingo is the leading global platform for mobile learning of about 40 languages. The company was one of the first to implement gamification methods, which help to make users stay in the application for as long as possible. The entire learning process is represented as a game.

In order to improve audience engagement, Duolingo administers thousands of A/B tests every year, although clients sometimes find it negative. Apart from direct learning, users can check the quality of their knowledge – Duolingo offers the opportunity to pass language tests at an extra cost.

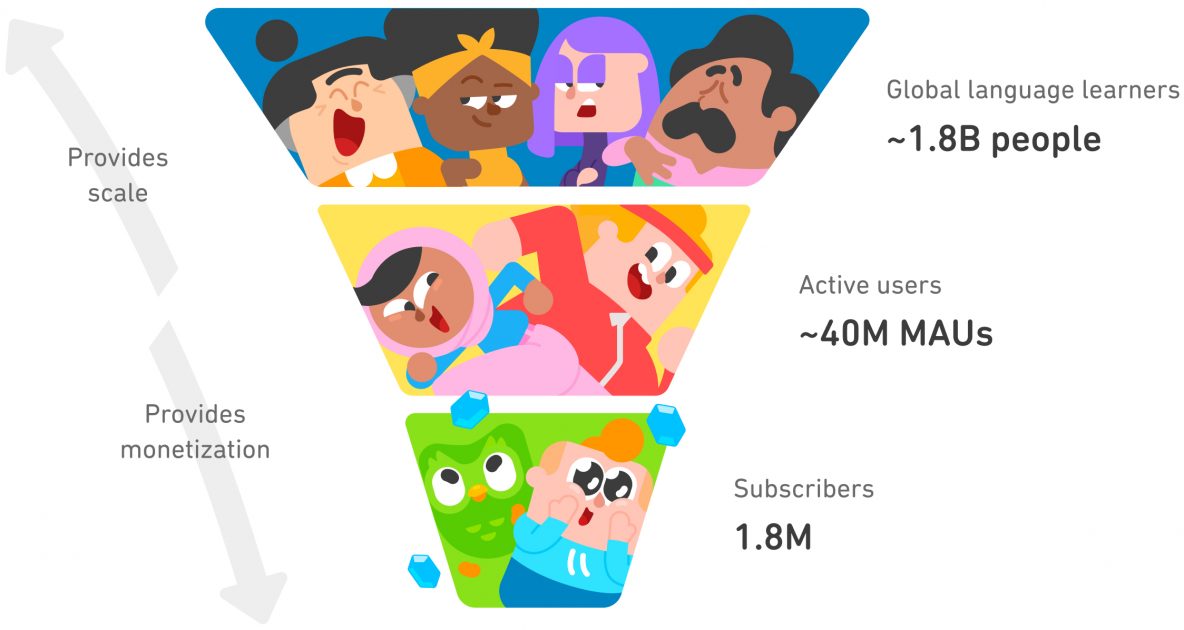

Duolingo English Test costs $49: in 2020, over 340,000 people passed it. More than 40 million users from all over the world use the service every month. The application can be used for free but in this case, you’ll have to watch ads at the end of each lesson. After buying a fee-based subscription (Duolingo Plus), users receive additional features and can get rid of ads. Over 5% of clients are the company’s fee-based subscribers.

According to US News and World Report, Duolingo’s 17 tests to assess knowledge were recognised as the best for the US undergraduate education. The company’s application is the most profitable in the “Education” section in the Apple App Store (45% of the total revenue in 2019) and Google Play (33% of the total revenue in 2020). The platform has already had over 500 million downloads.

At the moment, Duolingo management is negotiating with Apple и Google to reduce in-app purchase commissions down to 15% instead of 30%. If the company succeeds, it may improve its financial results.

Now let’s discuss the company’s target market and prospects.

The market and competitors of Duolingo

According to HolonIQ, in 2019, global consumer spending on education was $61 billion. By 2025, this number is expected to reach $115 billion. As a result, an average annual growth rate may be 11%.

Consumer spending on learning foreign languages was $12 billion in 2019 and it may expand up to $47 billion by 2025 with an average annual growth rate of 26%. Therefore, this industry will be the fastest-growing segment of the market.

Users are looking for more convenient formats of online education, that’s why the company’s application has high growth potential. According to a survey from Duolingo, over 80% of users didn’t study any foreign languages in the past. With the expansion of the Internet, the company’s target market may exceed 1 billion users.

The company’s biggest competitors are:

- Coursera

- Udemy

Financial performance

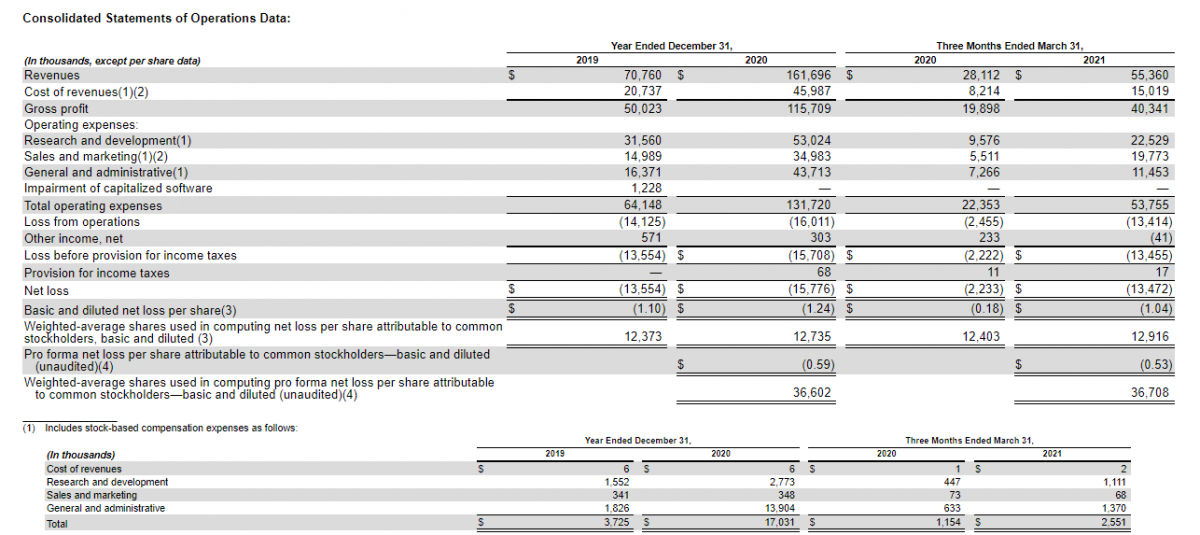

At the time of the IPO, Duolingo doesn't generate the net profit, that’s why we will focus on its revenue.

Sales

- Over the last 12 months – $188.95 million.

- In 2020 – $161.70, a 128.51% increase relative to 2019.

- Over the first quarter of 2021 – $55.36 million, a 96.94% increase if compared with the similar period of 2020.

Gross profit

- Over the last 12 months – $136.15 million; the gross profit margin is 72.06%.

- In 2020 – $115.71, a 131.33% increase relative to 2019.

- Over the first quarter of 2021 – $22.53 million, a 135.18% increase if compared with the similar period of 2020.

Considering this revenue growth rate, the company may generate its first net annual profit very soon.

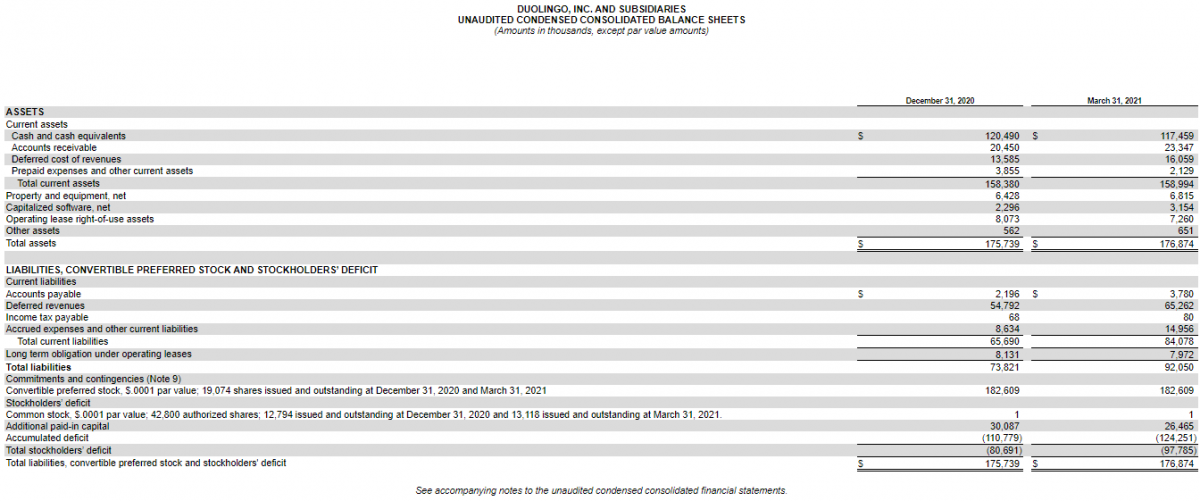

Duolingo’s stockholder equity is $3.23 billion, while cash and cash equivalents on the company’s balance sheet are $117.46 million.

The company’s total liabilities equal $92.05 million and its net cash position is $25.41 million. In general, I may draw a conclusion that the company is quite stable with a high growth rate of revenue and gross profit.

Strong and weak sides of Duolingo

Now let’s talk about the risks and advantages of investing in the company’s shares. I guess Duolingo’s advantages are:

- The target market with an average annual growth rate of over 20%.

- The company’s application is the most popular on App Store and Google Play in the “Education” section.

- The gross profit margin is 70%+.

- Duolingo negotiates with Apple and Google to reduce in-app purchase commissions.

- The company offers free access to the platform, thus helping the number of paid subscribers to grow.

Risk factors of investing in these shares are the following:

- Dependence on App Store and Google Play policies.

- The company is loss-making and doesn’t pay any dividends.

- Strong competition in the field.

IPO details and estimation of Duolingo capitalization

The underwriters of the IPO are BofA Securities, Goldman Sachs & Co. LLC, Deutsche Bank Securities, HSBC, Allen & Company LLC, Goldman Sachs & Co. LLC, Raymond James & Associates, Inc., KeyBanc Capital Markets Inc., JMP Securities LLC, Barclays Capital Inc., Evercore Group L.L.C., William Blair & Company, L.L.C., and Piper Sandler & Co.

During the IPO, Duolingo is planning to sell 5.1 million common shares at the price of $85-91 per share. If shares are sold at the highest price in this range, the IPO may raise $459.9.

Since the company doesn’t generate net profit, to assess its potential capitalization, we use a multiplier P/S (Price-to-Sales ratio ratio). At the time of the IPO, Duolingo P/S is 17.10. For the EdTech sector, an average P/S value during the lock-up period is 27. In this case, the upside for Duolingo shares may be 57.80% (27/17.11 * 100).

Considering all that said, I’d recommend adding Duolingo shares to your portfolio as mid/long-term investments.