Quarterly statement from Tesla: record-breaking profit and moderate response from shares

3 minutes for reading

The next in line to report on its financial results for April-June is a famous American electro car manufacturer Tesla. Elon Musk’s company reported record-breaking profit and put its critics to shame by showing what heights it reached. We just can’t wait to tell you about the sum and how Tesla shares responded to the quarterly statement.

Tesla’s net profit for Q2 2021 exceeded $1 billion

On July 26th, perhaps the most famous electric car manufacturer in the world releases a financial report for the second quarter of 2021. Speaking in a roundabout way, we should note that the company has recorded the net profit for the eighth consecutive quarter. Moreover, it’s been the first time ever Tesla’s quarterly profit exceeded $1 billion, reaching $1.14 billion.

Important data from the report

- Total revenue — $11.96 billion, +98%, forecast — $11.4 billion.

- Car sales revenue — $10.21 billion, +97%.

- ZEV credit sales revenue — $354 million, −17%.

- Return on share — $1.02, +920%, forecast — $0.93.

- Net profit — $1.14 billion, +998%.

Tesla ramp up electro cars production and delivery

In the second quarter, Tesla manufactured 206,421 electro cars with a 151% increase if compared with the similar period of 2020. As for the number of cars delivered to buyers, it was 201,304, a 121% increase. By doing this, the car manufacturer put its intentions to deliver 750,000 cars in 2021, thus increasing the number by 50% (if compared with the last year’s statistics), into action.

And if the production of Model 3 and Model Y added 169% up to 204,081 cars, then Model S and Model X were not so optimistic – the report showed only 2,340 cars, with a 63% decrease in comparison with the second quarter of 2020. Model 3/Y deliveries added 148% up to 199,409 cars. Model S/X deliveries lost 82% down to 1,895.

Tesla shares responded calmly

On the day the report was released, Tesla (NASDAQ:TSLA) shares demonstrated moderate growth and added 2.21% up to $657.62. The next day, the price movement direction changed and they lost 1.95% down to $644.78.

Some analysts blame this decline on Elon Musk’s statement that from now on he will attend videoconferences with investors only on very important occasions. Another point of view explains the cheapening of the company’s shares with rising competition in the sector.

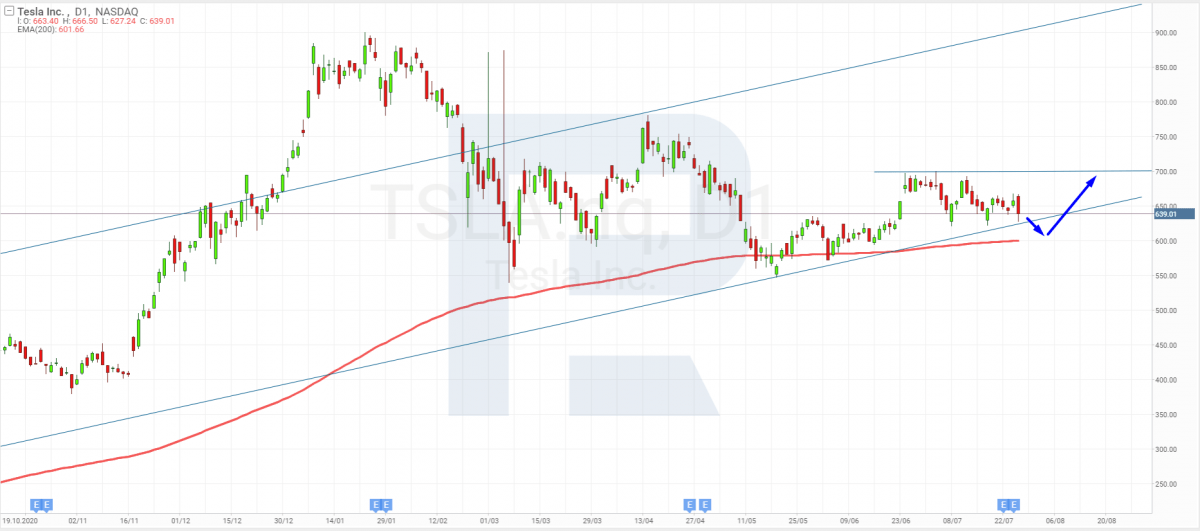

Tech analysis of Tesla shares by Maksim Artyomov

“In the daily chart, Tesla shares continue trading sideways within the rising channel; by now, the price has reached its downside border. Despite record-breaking profit, investors take a cautious approach towards the company and do not cause any upsurges and fluctuations.”

In the future, the asset may break the channel’s downside border and fall towards the 200-day Moving Average, which acts as a support level. After testing the level, the instrument may rebound and resume growing to regain its positions. In this case, the upside target is the resistance level not far from the closest highs”.

Summing up

Tesla released a strong quarterly statement with a record-breaking net profit of over $1 billion. Experts believe that such a large number of sales in the second quarter can be explained by the economic recovery.

Another thing worth mentioning is that the company somehow managed to resolve the global problem of microchip shortage. Unfortunately, interruption in deliveries ща other parts didn’t go anywhere. Also, one shouldn’t forget about a serious plunge in Bitcoin, which significantly cheapens car manufacturer’s digital assets.