Reverse Stock Split of General Electric: It is Good or Bad?

8 minutes for reading

On July 30th, General Electric (NYSE: GE) will have its stock go through a reverse split. The number of its shares traded on the stock market will reduce from 8 to 1 billion, while the price of one share will increase eightfold up to about $100. Whether it is good or bad or why the company wants its stock to go through a reverse split in the first place – we’ll discuss these things in this article.

What reasons do companies usually have for a reverse stock split?

There are several reasons for a reverse stock split but the key one is always to upvalue the share price.

But what for? After all, the higher the share price, the fewer investors can afford to buy it. For example, Tesla (NASDAQ: TSLA) shares cost $2,000 apiece before the split, so an investor with a deposit of, for example, $4,000 had to invest 50% of their money if they wanted to buy a Tesla share. This decision would be very risky and unwise.

After the split, a Tesla share dropped to $500, resulting in a wider range of investors being able to invest in the company. Along with that, the demand for Tesla shares also went up, thus having a positive influence on their price dynamics. As of now, they trade at $650 per share.

Conceivably, there is a high probability that after a reverse split GE shares may cheapen.

Why General Electric upvalues its share price

Companies, whose share price drops below $1, get a delisting warning if the cost doesn’t change over three months. This is the reason why issuers decide to have their stock go through a reverse split.

It will fix the problem for some time and give the management the time to improve the company’s financial situation. The management may look for new investors, it may significantly cut any extra expenses, or the company may be merged – in other words, executives assume all possible measures to make investors believe that the company is attractive for investments and start buying its shares. Otherwise, the price may drop below $1 again and the company will be delisted.

General Electric was a part of the Dow Jones Industrial Index from 1896 to 2018, the longest period ever for any company. However, in 2018, the share price fell below $13 and stopped having any significant influence on the index, while its share in the index dropped to 0.5%.

As a result, a world-class company with a 140-year history found itself being an outsider and took the first serious hit – removal from the index.

The second big hit might be a delisting.

To eliminate this possibility and avoid being on the verge of financial collapse, the company made a wise decision to go through a reverse stock split. As a matter of fact, a higher price may attract fund managers to invest in General Electric since many of them have restrictions on investments in cheap stocks and that’s exactly what GE shares are right now. Therefore, a reverse split resolves two problems at once:

- Upvalues the share price.

- Attracts hedge funds.

How the company explains its reverse split

Are there any other reasons for a reverse stock split?

Income diversification

The reason why a once successful and profitable corporation became an underdog was that its shareholders decided to diversify income, which resulted in GE’s entering the financial services and health care markets.

General Electric started swallowing up other companies and expanding, which required a stock split to make its shares cost less. Over its history, GE has gone through 7 stock splits.

As a result, a portfolio of 1,000 General Electric shares from 1971 would increase up to 96,000 shares consider all these stock splits. The total number of the company’s shares over this period of time has increased by 96 times.

General Electric became loss-making

However, the idea of diversification came up short. Instead of protecting General Electric from collapsing in one of the areas in crisis situations, affiliated companies made it sink.

For example, the financial crisis of 2008 led to a huge drop of GE shares as they lost 86% down to $4. The company managed to rebound and decided to revise its business model and eventually get rid of affiliated companies. In this light, shares started to rise and reached a high at 30 USD.

However, the reformation procedure was rather slow and at the year-end of 2015, General Electric failed to generate a net profit. It was quite shocking for investors and the company’s shares lost 78% over a year without any crises. The bottom line is that market players lost their interest in General Electric.

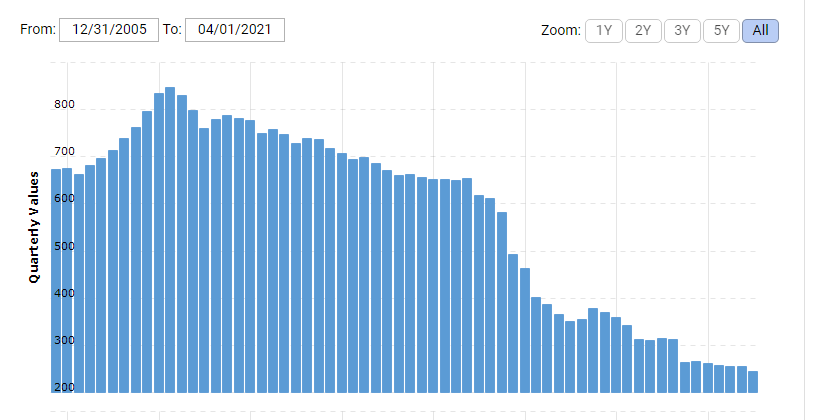

Now, to emerge from the misery the company plunged itself into, GE is selling affiliated companies and trying to reduce its assets, which have gone from $846 to $245 billion since 2008. The most intensive reduction phase, which can be clearly seen in the picture, started after 2015.

Well, GE assets reduced but the number of shares traded on stock exchanges remained the same. When asked about a reverse stock split, GE senior Vice President and Chief Financial Officer, Carolina Dybeck said:

“The reverse stock split will better align GE’s number of shares outstanding with companies of our size and scope. It also marks another step in GE’s transformation to be a more focused, simpler, stronger high-tech industrial company.”

From this point of view, a reverse split is just a planned decrease in shares to adapt them to the company’s size.

Another reason the management refers to is the share price in comparison with competitive companies with the same capitalization. For example, shares of 3m Company (NYSE: MMM), the capitalization of which is more $4 billion higher than GE, cost $200 apiece.

In the Specialty Industrial Machinery sector, the price of General Electric shares is listed the 9th from the bottom, competing with the companies with capitalization below $1 billion.

However, this reason should be considered more of a reputation. After all, the asset reduction and a reverse split are easier to understand and accept than an intention to value up the share price up to competitors.

What market players think

After reading comments from different market players, I jumped to the conclusion that opinions divided, as usual. Some believe that a reverse stock split will work in the company’s favour – shares will cost more, and hedge funds will invest in General Electric with more enthusiasm, thus pushing the price higher.

On the other hand, naysayers think that the General Electric management leaves something out and the company may be on the verge of another crisis, that’s why executives decided to create some kind of a rainy-day fund and rig the share price to prevent the stock from being delisted.

However, all of them have one thing in common – most of them expect the share price to fall short-term after a reverse split.

Correlation between General Electric and Boeing

If we dismiss the news about a reverse stock split at General Electric and pay attention to the chart of its shares, we can see that there has been a high correlation with Boeing (NYSE: BA) recently. It is evident that the growth in orders of Boeing has a positive influence on GE shares.

Boeing is not the only company that gets components and parts for airliners from General Electric – GE also supplies them to Boeing’s major competitor, a European company named Airbus (Xetra: AIRG). It means that the global recovery of the air transport industry and the growth of orders for airplanes will have a positive influence on GE incomes.

Another thing we shouldn’t dismiss is that many countries set a course for the development of renewable energy sources, while General Electric manufactures generators and turbines for this industry. From this point of view, the company has good prospects.

Closing thoughts

A reverse stock split alarmed market players because this procedure is common for the companies that are on the verge of being delisted. But 8 billion outstanding shares with a $111 capitalization, well that’s too much because the company’s competitors with similar funds barely have their number of shares exceeding 1 billion.

It is fair to say that assets of General Electric dropped 4 times over the last 10 years, that’s why an intention to go through a reverse split is nothing but logical. Still, one shouldn’t hurry and buy the company’s shares before the split, there is a chance of a slight decline after all because no matter what investors do not perceive a reverse split as something positive.