Criticism of Chinese Government Drew Down Tencent, NetEase, Kuaishou, and Bilibili Shares

4 minutes for reading

At the beginning of August, the Chinese authorities already provoked a decline in the stock prices of game companies. Seems that they like it because the story repeats itself less than a month later. Right you are: the shares of Tencent, NetEase, Kuaishou, Bilibili, and other game-makers are falling again. What was the reason this time? How deep have the shares fallen? Find out right now.

Chinese regulatora meet game companies

On September 8th, as CNBC reports, the representatives of Chinese regulating institutions met the representatives of such large game developers as Tencent and NetEase. The aim was to remind of the recent restrictions.

By those new regulations, minors may only play video games Friday through Sunday, 8 p.m. through 9 p.m. exclusively.

Note separately that the authorities casually recommended to concentrate not on competition and making profit but on improving the quality of the product to decrease the psychological and physical dependency of young minds on this type of entertainment.

Shares of game developers and the Hang Seng index fall

After this meeting and recommendations given by the government, the quotations of large game companies started falling fast. On September 9th, the shares of Tencent Holdings Ltd (HK: 0700) at the Hong Kong exchange dropped by 8.48% to 480 HKD.

The stock price of NetEase Inc (HK: 9999) dropped by 11.03% to 133.9 HKD; Kuaishou Technology (HK: 1024) — by 6.9% to 92.4 HKD, and Bilibili Inc (HK: 9626) — by 8.89% to 635.5 HKD. Alongside the corporations, the most important index of the Hong Kong exchange Hang Seng (HSI) also dropped. It lost 2.3%, falling to 25,716 points.

On September 10th, the quotations of all the four game developers restored a bit: Tencent — +2.08%, NetEase — +3.14%, Kuaishou — +5.47%, and Bilibili — +3.62%. Hang Seng also increased by 1.91% to 26205.91 points.

Tech analysis of Tencent, NetEase, Kuaishou, and Bilibili shares by Maksim Artyomov

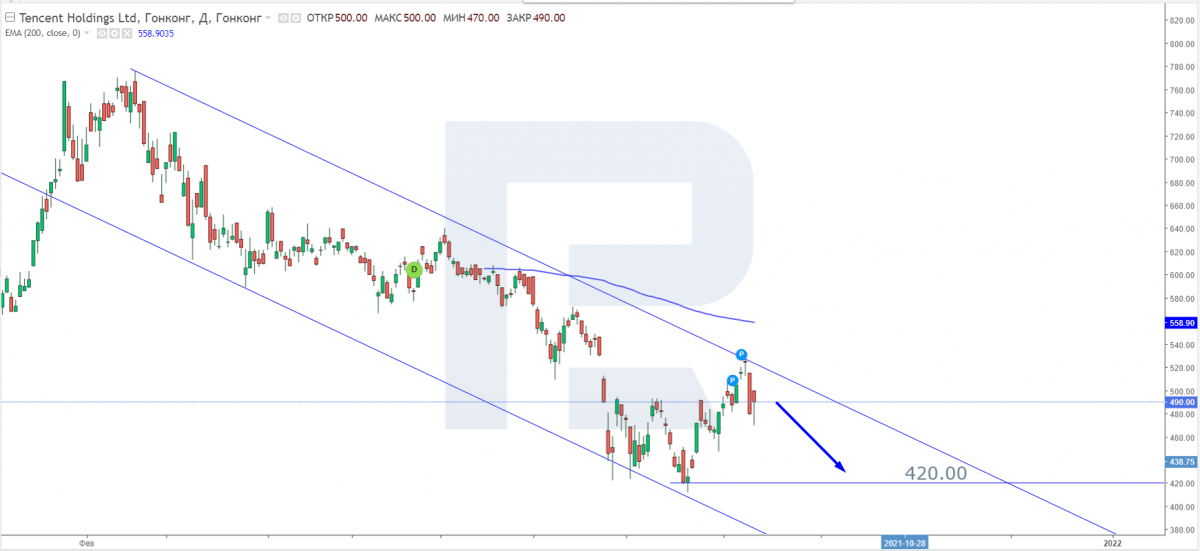

Tencent Holdings Ltd

After a correctional wave, the shares of Tencent Holdings Ltd tested the upper border of the descending channel. At this stage, with all the negative news, we expect further falling of the quotations.

The latter perspective is supported by the 200-days Moving Average that is above the price and heading down. The aim for further falling is the support level of 420 HKD.

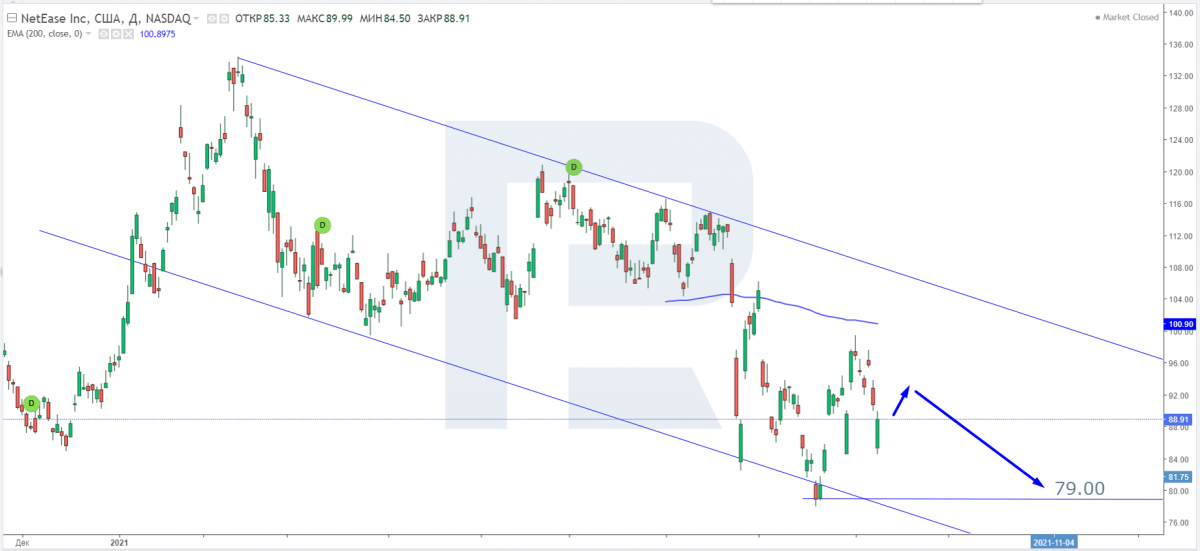

NetEase Inc

Opening the previous trading session with a gap, the quotations of NetEase Inc in NASDAQ managed to partially recover and overlap the gap. We expect a minor increase to 92 USD, test the resistance level, and go on inside the descending channel.

Yet another signal supporting the decline to the support level of 79 USD is the 200-days Moving Average that keeps demonstrating descending dynamics.

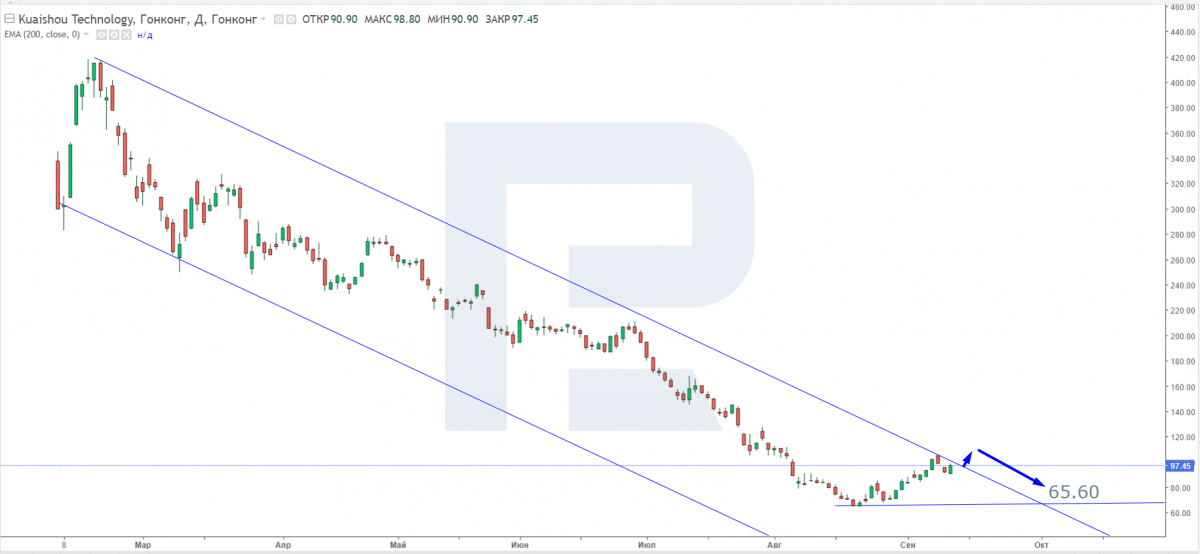

Kuaishou Technology

On D1, the quotations of the company are performing a correctional wave, having bounced off the support level. Currently the shares are trading inside a descending channel. Over the last trading session, the price grew a bit, which might help the situation later on

In the nearest future, the quotations might rise to 100 HKD, and after a test of the resistance level, they might bounce off it and continue the downtrend with the aim at the low of 65 HKD.

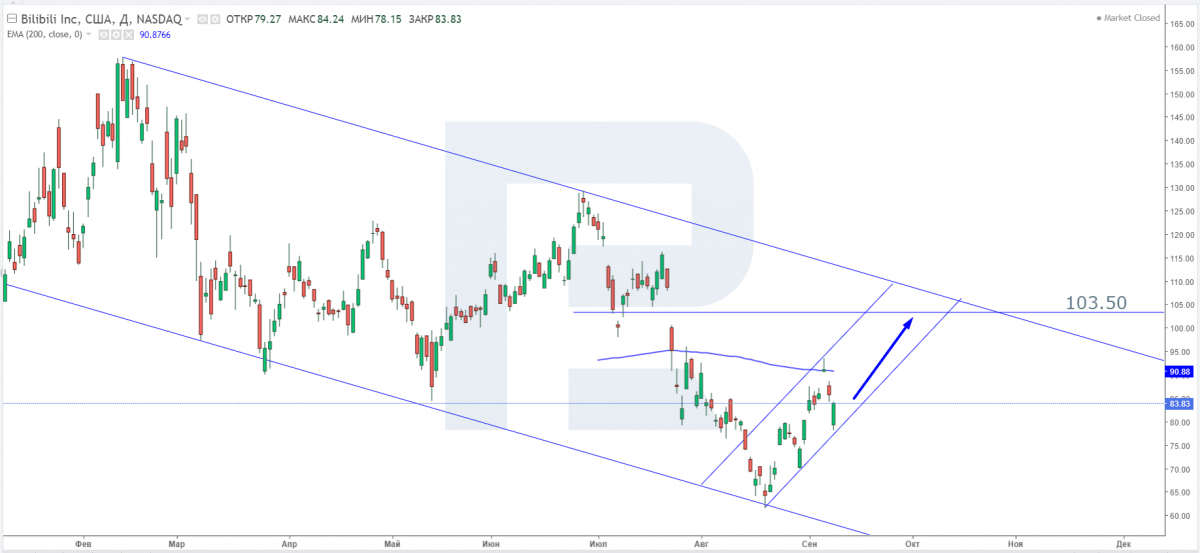

Bilibili Inc

The quotations of Bilibili Inc in NASDAQ continue the ascending wave inside the descending channel. I suppose, the quotations are heading for the upper border of the channel.

The aim of growth is 103.5 USD. An additional signal of the ascending impulse will be a breakaway of the 200-days MA. In the future, after a test of the resistance level, the price might bounce off it and continue the downtrend.

Summing up

The Chinese government is again interfering with the video-gaming business. The last meeting of the representatives of the business and the authorities cost the former party hundreds of millions of capitalization. The market reacted negatively to the event, and the shares of such large game companies as Tencent, NetEase, Kuaishou, and Bilibili over a trading session lost from 6.9% to 11.03%.