Snap, Twitter, Facebook Shares Fall Abruptly

4 minutes for reading

A month ago I wrote that Facebook shares were declining due to Apple, particularly its updated privacy policy. Wall Street experts suggested at once that changes on Apple devices will affect all companies that make money on online advertising. So, at the end of last week, the shares of Snap, Twitter, and Facebook (again!) headed down abruptly. Let's dig into the details of what happened.

Snap report for Q3, 2021 didn’t live up to Wall Street expectations

On October 21st, the results of Q3, 2021 were reported by an American company Snap that owns the Snapchat messenger. The market paid the most attention to the claims of Evan Spiegel, director general of the corporation. He said that the changes that Apple had made to its ATT (App Tracking Transparency) influenced the business of Snap more than they had expected.

As you remember, Apple updates, so vividly and sharplt discussed by the representatives of tech companies, are aimed at increasing transparency of tracking user data, collected by apps. Or at least this is the official explanation.

Important report details

- Revenue — $1.07 billion, +57%, forecast — $1.1 billion.

- Loss on stock — $0.05, -67%.

- Net loss — $71.9 million, -64%.

Snap forecasts for Q4, 2021

In the corporation, they think that in the next quarter of 2021 they will make $1.16-1.2 billion of revenue. This means growth by 27-32%. Meanwhile, analysts polled by Refinitiv, suggested a quarterly revenue of $1.36 billion.

As for daily active users, Snap experts expect their number to reach 316-318 million. As you know, in July-September there were 306 million active users, which is 23% more than in the same period last year.

How did Snap shares react to the report?

The share price of Snap (NYSE: SNAP) started declining two trading sessions before the report for Q3 was presented. Over this time, the shares lost 1.7%, reaching $75.11. This must have been just the beginning: on the next day after the report was published, the shares of the IT company dropped by 26.59% to $55.14.

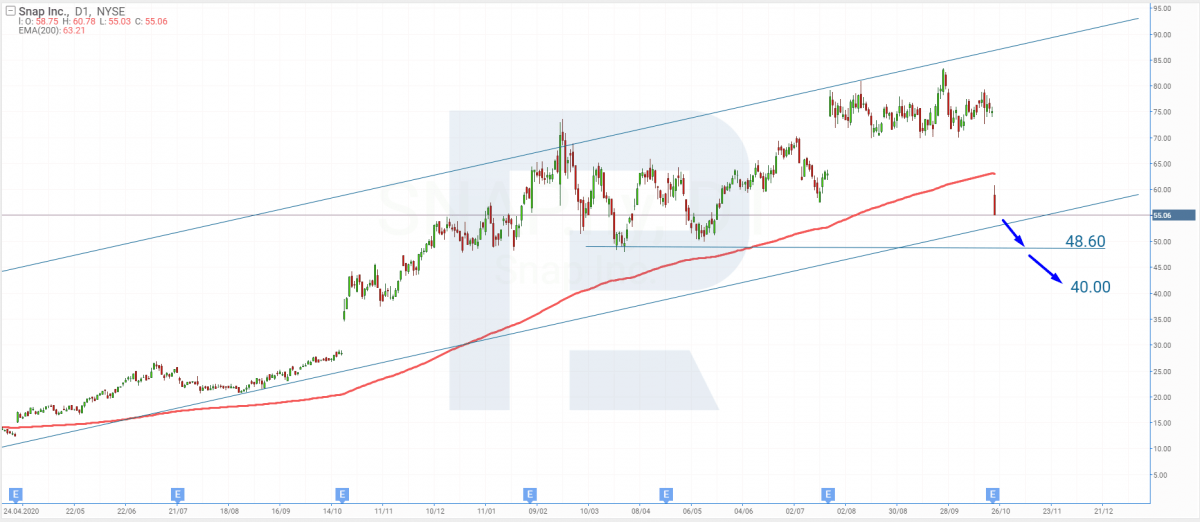

Tech analysis of Snap shares by Maksim Artyomov

After the report was published and capitalization dropped, the shares of the company demonstrated the gravest decline of these days. With a gap, the quotations fell under the 200-days Moving Average and kept falling during the Friday trading session.

Today I would count on further falling and a breakaway of the lower border of the ascending channel. For the nearest future, the aim is likely to be $48.6. As long as in the next quarter, income is going to grow slower, the quotations might proceed to $40.

Twitter and Facebook quotations fall as well

On October 22nd, when Snap shares started falling after we heard that in the last quarter its revenue from ads dropped, the shares of such giants as Facebook (NASDAQ: FB) and Twitter (NYSE: TWTR) also went down. The quotations of the first company closed with a decline by 5.05% at $324.61 and of the second one — by 4.83% at $62.24.

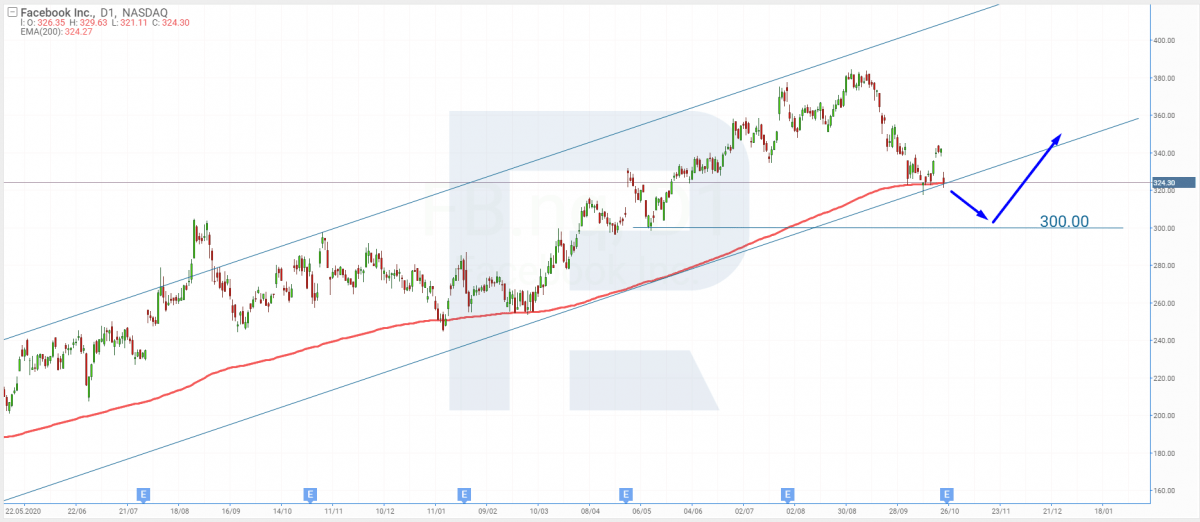

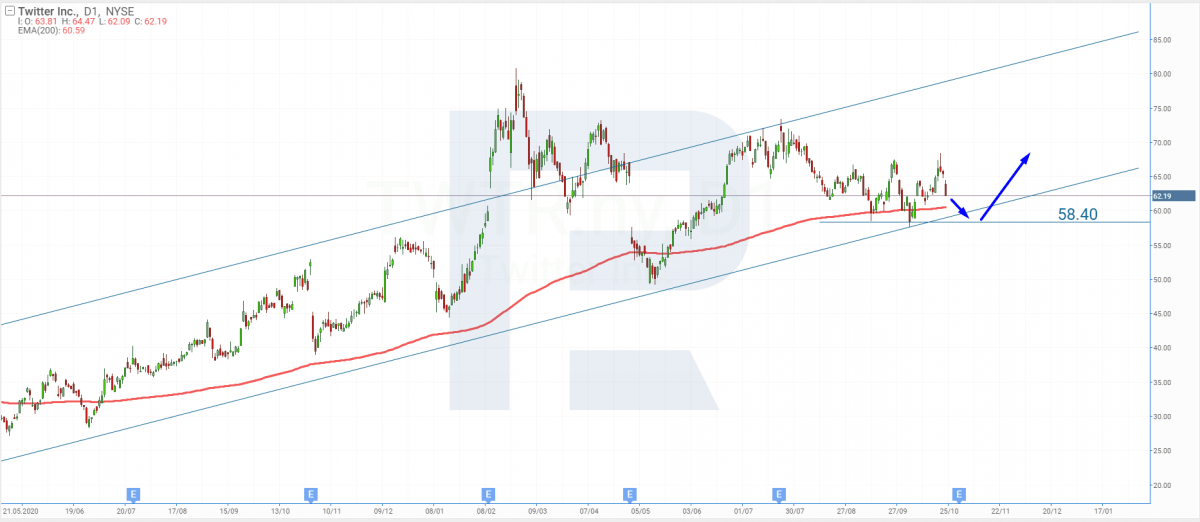

Tech analysis of Twitter and Facebook shares by Maksim Artyomov

The shares of the IT giant keep testing the lower border of the channel. The quotations are at the 200-days MA. If they break through it, the quotations will keep falling. The aim is the support level of $300.

Then, I suppose, the price will bounce off the support line and go on developing the uptrend. However, the price can still bounce off the lower border of the ascending channel and keep growing, without pulling back to the support level.

The shares of Twitter are falling due to the bad news. They are creeping towards the 200-days MA, and if they break through it, they will fall deeper. After a breakaway of the lower border of the ascending channel, the aim will be the support level of $58.4. In the nearest future, if the news is good, the price might bounce off the support line and start growing again.

Summing up

At the end of last week, Snap quotations dropped by almost 27% and dragged behind the quotations of Twitter and Facebook that lost 5% on average. The reason is the speech of Snap director general who claimed that the ATT introduced by Apple would influence the advertising business of the company a lot, and not in a positive way. Investors got worried about other large ads platforms — as a result, the above-named social networks list some of their positions.