Falling Metal Prices Will Drag Metallurgist Shares Down

7 minutes for reading

S&P 500 quotations are nearing their all-time highs. It seems like the worst is over, and the market has not slumped, yet market players are somewhat restless. The Fed mentions toughening the monetary policy again and again, the profitability of treasury bonds keeps growing, but no one notices, though earlier a slightest hint on the growing profitability of the shares provoked panic in the media and crazy ideas about the end of the world.

Quarterly reports might be lulling investors. They expected Q2 to be the most profitable, while in Q3, investors expected a decline; however, we can see that companies keep improving their financial performance and setting new records. So, why worry? Companies can show even better results in Q4.

Well, they can, but not all of them. Looking through charts, I noticed a Head and Shoulders pattern forming on one of them. I might have skipped it but for the pattern being so clear.

I checked out the profile of the issuer. It turned out to be a metallurgic company Nucor Corporation (NYSE: NUE). Its stocks have been at the exchange since 1987. So, I decided to see what was going on in the steel market and whether there were any reasons for the decline of shares of metallurgic companies. It turned out there were.

Why metal prices are growing?

Let us get started from the event that made commodity prices grow so much in 2021. The source of the problem was, naturally, the coronavirus. Lockdowns made demand for metals decrease sharply, and many metallurgic companies got onto the brim of survival. To get out of trouble, the government switched on the printing machine like in 2008 (for your information, oil cost 140 USD at that time), which helped companies survive the crisis, yet many of them had to put production on a halt.

For a steel company, a pause in production means extinguishing the blast furnace, which normally happens in case of major overhauls only.

A blast furnace works over its whole lifetime, which is more than 100 years, and gets extinguished for repairs every 10 years on average.

Starting a blast furnace takes at least 10 days and quite a bunch of money. Hence, after extinguishing blast furnaces, metallurgic companies cannot return to normal production volumes fast; so, when quarantine was loosened, demand for metals got over supply quite soon, which led to a sharp increase in metal prices, especially in the USA.

Trump’s customs duties

In the USA, steel prices grew much higher than outside the country. For example, the high of hot-rolled steel was 1,400 USD per ton more than in China and 800 USD more than in Europe.

The reason was Donald Trump’s policy. He introduced tax duties for imported steel to protect metallurgic companies based in the USA. Well, local companies made good money on it. However, they could not satisfy the demand and stabilize the price on their own.

As a result, the Coalition of American Metal Makers and Consumers (CAMMU), uniting over 30,000 US companies, addressed President Joe Biden, calling for an abolishment of customs duties for steel and aluminum.

A decline of metal prices is expected

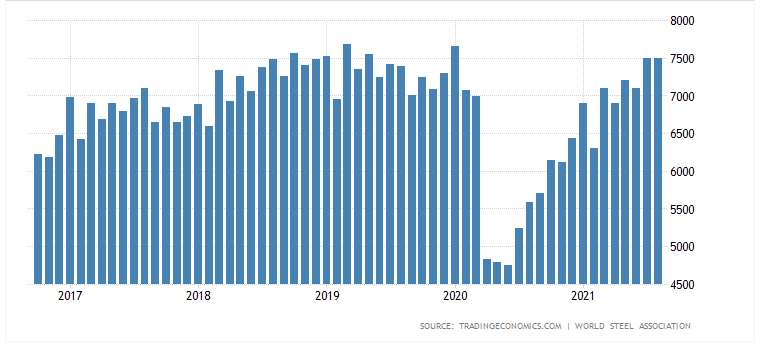

The steel market has overcome the acute phase, and the prices are stabilizing. Why do I make such conclusions? Firstly, steel production volumes in the USA have returned to their pre-crisis levels. You can see it on the diagram.

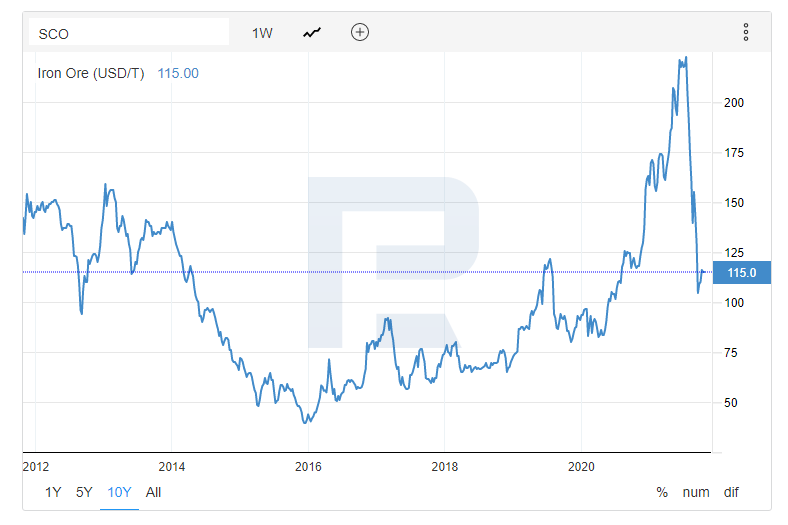

Secondly, the price of iron ore, which metal is made of, decreased two times and is trading at the level of 2019. This will also influence steel prices. Cheap iron ore means cheap steel.

And if Biden cancels customs duties, which will depress metal prices even more.

Can Biden actually cancel customs duties?

On the one hand, canceling the duties will mean increased rivalry, which at some point will negatively affect US companies. On the other hand, Biden is seeking approval of an infrastructure project that costs 3.5 trillion USD. Passing this project will increase demand for products of steel companies, and for the prices not to hit their all-time highs, market supply also has to be increased. Hence, it is quite probable that customs duties will be canceled or decreased.

Making prelim conclusions

Metallurgic companies has brought production to pre-crisis levels, and as long as steel prices turned out too high compared to last years, companies made super profits.

For your information, Russian government has introduced customs duties for steel export to cut a part of the profit off local metallurgic companies.

The super profits are now reflected in quarterly reports and has a good influence on the shares of metallurgic companies. However, prices in the market are going down now, and net profits of metallurgic companies will follow.

We will see the consequences of the decrease in metal prices in future quarterly reports, and, probably, heads of companies will soon be making forecasts, where they ill mention a possible decline of the revenue themselves. And if the income goes down, so does the share price.

Now the puzzle is complete, and the Head and Shoulders, promising a decline of prices, quite agrees with the fundamental analysis. Now let us go back to Nucor Corporation mentioned above.

Nucor Corporation

Nucor Corporation (NYSE: NUE) was founded in 1958; it makes and sales steel and steel products. Its net profit in 2021 grew by 350%, reaching 1.5 billion USD. This is an all-time high. Naturally, the reason for such growth was a high price for steel products.

This could not but reflect in the share price: in 2021, it grew by 95%, sometimes rising even by 150%.

The company started spending the surplus on stocks buyback. While until 2019, they spent about 100 million USD a quarter on this, in 2021, the sum reached 614 million USD, which also caused a good influence on the share price. Nucor plans to spend 3 billion USD on buyback total.

But now there is a Head and Shoulders forming on the chart; by it, there is short-term growth to the area between 110 and 15 USD. And if the quotations escape the area downwards, the price will have a chance to fall to 80 USD.

What can prevent Nucor shares from falling?

There are two factors that can hold the quotations back.

The first factor is Biden canceling customs duties on imported steel and accepting the infrastructure project.

The second factor is the buyback. The terms of the buyback have not ye been settled, but the management of the company noted that the buyback will be carried out in the open market at low prices. In other words, the company will hinder price falling if this happens.

What can provoke a decline of Nucor shares?

This is Biden canceling the duties and a decrease in steel prices. The last process is inevitable because the price of the iron ore has already fallen.

These two factors will make the revenue of metallurgic companies fall and investors react negatively. They will start selling shares, trying to take the profit or make money on falling prices.

Closing thoughts

Previously, I used to analyze charts by tech analysis solely. I noticed that sometimes it reveals the future though, fundamentally speaking, there are no hints on the price going down. But as soon as quotations start falling, the media start making negative publications that explain price movements and depress the shares even further.

Currently, both fundamental and technical analyses give reasons for the price to fall. However, do not hurry too much. Wait for the price to rise above 110 USD and see what happens next.

If the quotations return under 110 USD, this will mean further falling. Then the deeper the quotations will be falling, the more panic the media will create, causing even more pressure on Nucor.