Alphabet and Microsoft Shares Are Growing after Q3 Performance Was Reported

4 minutes for reading

If you want the juciest details of the quarterly reports of such tech giants as Alphabet and Microsoft — make yourself comfortable and let's get started.

Alphabet report for Q3, 2021: revenue from ads keeps growing

Alphabet, the parent company of Google, reported its performance in July-September, 2021 on October 26th, when trades closed. The main financial results exceeded expectations of Wall Street analysts, yet not all the departments did equally well.

The truth is, Google Cloud service and YouTube ads service did a poor job. The revenue of the cloud service reached $4.99 billion, growing by 45% against last year, but if was still unferior to the forecast $5.07 billion.

Overall Google revenue made on ads in Q3, 2021 amounts to $53.13 billion.

YouTube ads in Q3 brought Alphabet $7.2 billion, i.e. 43% more than a year ago. However, the forecast was $7.4 billion. As for the revenue from ads in the browsing system, it amounts to $37.93 billion. This is 44% more than in Q3, 2020 and 4% more than the market expected.

Such impressive growth of ads revenue confirms the words of Alphabet financial director Ruth Porat who promised that changes in the privacy policy of Apple would not influence Alphabet revenue from ads noticeably.

On October 27th, on the next day after the publication, the price of Alphabet class A shares (NASDAQ: GOOGL) grew by 4.96% to $2924.4. Note separately that since the beginning of the year, the shares of the IT giants have grown by 66%.

Important report details

- Revenue — $65.12 billion, +41%, forecast — $63.34 billion.

- Return on stock — $27.99, +71%, forecaat — $23.48.

- Net profit — $18.93 billion, +68%.

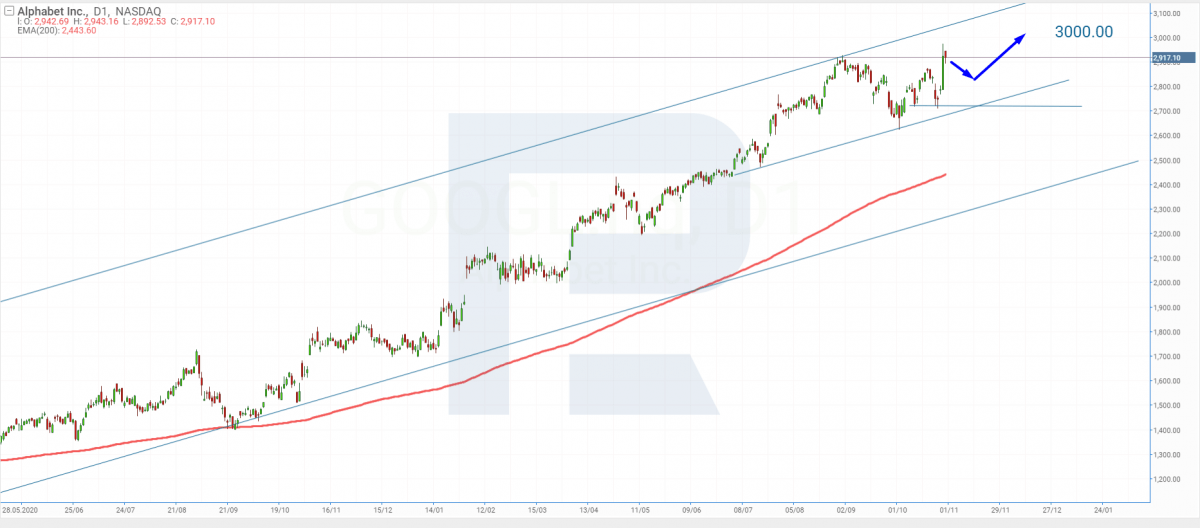

Tech analysis of Alphabet shares by Maksim Artyomov

Renewing their all-time highs again, are forming a correctional wave. As long as the quotations are inside the channel, I think that the correction will be minor, and the uptrend will continue as soon as the correction is over.

Regardless of the news, I think that Alphabet shares have a potential to grow. The aim of the correction can be the support level of $2,872. Later the quotations might have a chance to reach $3,000. This is supported by the 200-days Moving Average that also preserves ascending dynamics.

Microsoft report for Q3, 2021: the revenue of the cloud service grows by 36%

Like Alphabet, Microsoft published its financial results for Q3 on October 26th. As you know, its performance has been improving for 11 quarters in a row. This is impressive, indeed.

According to the tech company representatives, the net profit has reached its all-time highs. This is thanks to the department that maintains cloud services. They have made a revenue sized $20.7 billion, which is 36% more than in Q3, 2020.

The revenue of Microsoft cloud services in Q3, 2021 reached almost $21 billion.

Note separately that Microsoft cloud products take the second place in the market after Amazon cloud services. That's right, Google and IBM are losing yet.

After the report was published, Microsoft (NASDAQ: MSFT) shares grew by 4.21%, reaching $323.17. Since the beginning of the year, the share price of the IT company has grown by 46%.

Important report details

- Revenue — $45.32 billion, +22%, forecast — $43.94 billion.

- Return on stock — $2.71, +49%, forecast — $2.07.

- Net profit — $20.5 billion, +48%.

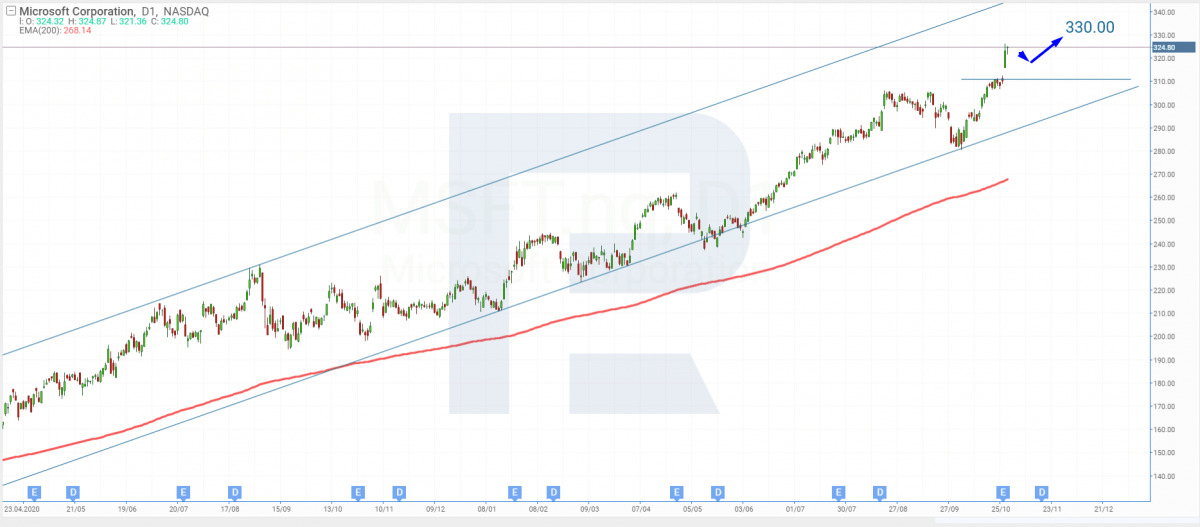

Tech analysis of Microsoft shares by Maksim Artyomov

With the all-time high profit, Microsoft shares are getting stronger. The quotations broke through the resistance level, renewed the high, and continue an uptrend inside an ascending channel.

Judging by the 200-days MA, I figure that in the nearest future the uptrend will keep on. The aim of growth after the correction is $330.

Summing up

On Tuesday, financial performance in July-September was presented by Alphabet and Microsoft. Both companies reported quite a substantial increase in their quarterly net profit — by 68% and 48%, respectively.

With the published statistics, the quotations of the tech corporations headed up high. Class A shares of Alphabet grew by almost 5%, while Microsoft shares rose by 4%.