Amazon and Apple Quarterly Reports Are Failure: Shares Falling

5 minutes for reading

Let me share with you some more quarterly reports of large companies. At the end of last week, the results of Q3 were presented by two tech giants – Amazon and Apple.

In short: the statistics turned out a disappointment for investors and Wall Street analysts. The quotations of both companies reacted immediately by a decline. Want to know more? Believe me, I have something to tell you about.

Amazon report for Q3, 2021: the weakest growth of revenue since 2018

Amazon and Apple presented their reports for Q3 on the same day – October 28th. The report showed that in Jeff Bezos’s company, the growth of revenue kept slowing down.

I’d note separately that in July-September, the revenue from retail turned out inferior to the income from other services of the corporation - $54.9 billion against $55.9 billion. Statistics show that if not for that profit from the services, Amazon would have suffered losses in Q3, 2021.

The income from Amazon cloud service leaped up by 39% to $16.1 billion.

As for forecasts for the current quarter, the company expects revenue of $130-140 billion, which is below what analysts forecast ($142.2 billion). The net profit in October-December, 2021 is to amount to $3 billion. As you remember, last year in the same quarter it reached $6.9 billion.

Andy Jassy, director general of the company, explains the decline in the revenue from retail sales by the fact that people have returned to offline shops. As for such a weak forecast for this quarter, he mentions not only the necessity to increase spending but also serious supply problems, expensive shipping, and a shortage of employees.

Since the beginning of the year, Amazon shares have grown by less than 4%.

The quarterly report was published when the trading session closed already; hence, poor results of the last quarter and not more optimistic forecasts hit the quotations on the next day. On October 29th, the shares of Amazon (NASDAQ: AMZN) closed with a decline by 2.15% at $3372.43. Since the beginning of the year, the shares have grown by less than 4%.

Important report details

- Revenue - $110.8 billion, +15%, forecast - $111.6 billion.

- Return on stock - $6.12, -49.5%, forecast - $8.92.

- Net profit - $3,2 billion, -50.2%.

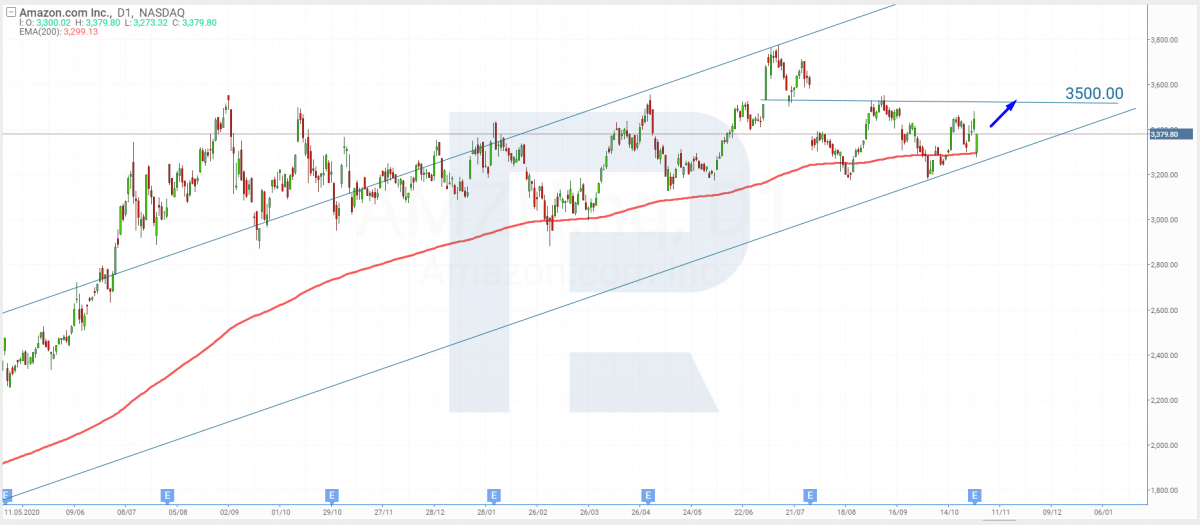

Tech analysis of Amazon shares by Maksim Artyomov

After the quarterly report of the company saw light, the shares formed a gap and dropped to the lower border of the ascending channel. After some minor agitation, the share price almost recovered, covering up the gap.

Now the price bounces off the 200-days Moving Average, which might be a signal for further growth. The aim in these circumstances might be $3,500. Later this resistance level might be broken away, and the quotations might rise to the high.

Apple report for Q3, 2021: net profit grows by 62%

For the first time since 2018, the quarterly revenue of Apple turned out inferior to Wall Street forecasts - $83.36 billion against $84.85 billion. According to Tim Cook, director-general, this is because the corporation failed to satisfy high demand for its products. The reason is the shortage of semiconductors and production failures on Asian plants due to quarantine measures.

Traditionally, the revenue from iPhone sales made the most part of the overall income. In July-September, there were iPhones sold for $38.9 billion, which is 47% more than a year ago but below the forecast $41.51 billion. iPad sales grew by 21.4% to $8.3 billion; the growth of income from services is even higher – by 25.6% to $18.28 billion.

In Q3, iPhone sales grew by 47% to $38.9 billion.

The corporation again gives no exact forecast for the current quarter. The reason is the same: the ambiguity of the market provoked by the COVID-19 pandemic. We only now that even deeper slumps of supply are expected, which will make the revenue even smaller than over the last quarter.

Important report details

- Revenue - $83.36 billion, +28.8%, forecast - $84.85 billion.

- Return on stock - $1.24, +69.8%, forecast - $1.23.

- Net profit - $20.55 billion, +62.2%.

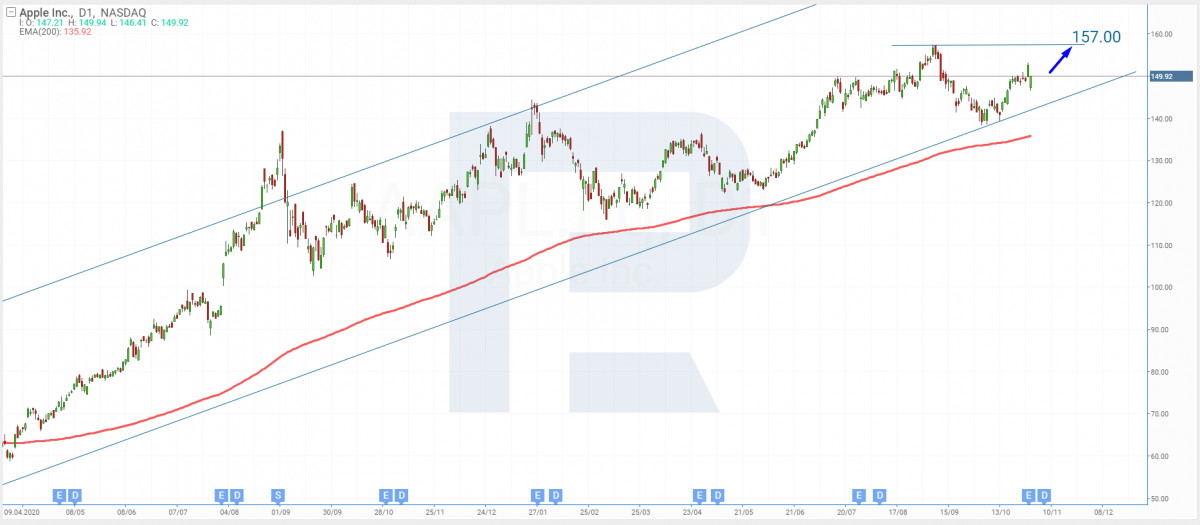

Tech analysis of Apple shares by Maksim Artyomov

On D1, Apple shares are finishing a correction of an uptrend. The quotations demonstrated a decline with a gap that was, however, closed over the trading session. As long as the price is still moving inside an ascending channel, I think that the ascending impulse will continue. The aim of the growth is the resistance level of $157.

Further growth is supported by the 200-days MA that lies below the price and keeps growing. In the nearest future, regardless of the revenue inferior to the forecasts, the quotations have all the chances for renewing their all-time highs.

Summing up

Quarterly reports of two IT giants – Amazon and Apple – that saw light on October 28th didn’t live up to the expectations of experts. The online commerce platform reported a decline in the net profit two times over July-September.

Apple complained about errors in microchips supply and in production in Asia. Thus they explained a slow-down in the growth of revenue. The shares of both companies reacted to statistics by a decline, by 2.15% and 1.82%, respectively.