How Did Pfizer Shares React to Q3 Report?

4 minutes for reading

This week two world-known pharma companies – Pfizer and Moderna – will replace IT giants on the scene of quarterly reports. The former company has already reported its performance in July-September, and the latter will do it tomorrow.

Was Q3 successful for Pfizer? How much anti-covid vaccine have they sold? What does the company expect from the current quarter? How did the shares react to the quarterly report? Let me try and give you some answers.

Pfizer report for Q3, 2021: revenue and profit grew by over 130%

On November 2nd, before the trading session began, an American pharma company Pfizer presented its report for Q3, 2021. I’d say that the statistics not just lived up to the forecasts of Wall Street analysts but exceeded them.

No wonder that on the same day, the quotations of Pfizer (NYSE: PFE) grew by 4.15% to $45.45. Since the beginning of the year – as we can see on the chart – the shares have grown by 23.5%, i.e. almost $9 per share.

Important report details

- Revenue - $24.09 billion, +134%, forecast - $22.56 billion.

- Return on stock - $1.34, +129%, forecast - $1.08.

- Net profit - $7.68 billion, +133%.

How much revenue each sector of business brought

I think, it will be no surprise to anyone that the largest contribution in the quarterly revenue was made by sales of the anti-covid vaccine. This business segment grew by 749% to $14.6 billion. As you remember, in July-September 2020 the result was $1.7 billion.

Drugs against cancer brought Pfizer $3.08 billion, i.e. 12% more than in the same part of last year. Revenue from drugs against internal illnesses amounted to $2.1 billion, growing by just 1%.

Quarterly revenue from selling drugs for inpatient (hospital) care increased significantly – by 32% compared to last year, reaching $2.37 billion.

Pfizer forecasts

The pharma company revised its forecast for the end of this year. They expect to earn $81-82 billion by the end of the year, and the return on stock to reach $4.13-4.18. As you know, previously they forecast $78-80 billion of income and return on stock amounting to $3.95-4.05.

The management says that by the end of the year, sales of the vaccine against COVID-19 will have reached 2.13 billion doses. This will make the revenue from the segment reach $36 billion. Moreover, there are plans for the next year: in 2022, the company aims at 4 billion doses of the vaccine.

BMJ: violations in testing Pfizer-BioNTech vaccine

Yesterday a British medical journal BMJ reported that Ventavia Research Group, a company that had carried out clinical tests of the drug by Pfizer and BioNTech, had made several rough violations in the process.

According to Brook Jackson, former regional director of Ventavia, the company used to higher underqualified employees, which led to violations of the test procedure, including storage conditions of the vaccine. Moreover, certain research is also reported as falsified.

In the BMJ article it is stated that the claims by Brook Jackson are confirmed by dozens of inner documents of Ventavia Research Group, audio and video materials, photos, and emails.

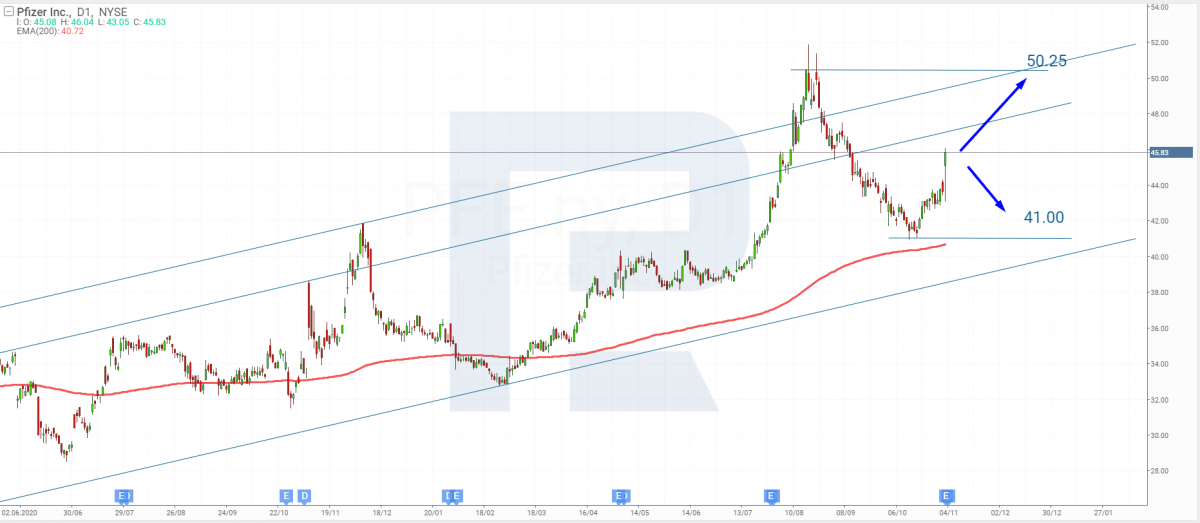

Tech analysis of Pfizer shares by Maksim Artyomov

After the Q3 report was published, the shares of the company grew noticeably. The reason was the growth of revenue in Q3. Now the quotations are testing the resistance level at $45.

If no more bad news about the vaccine and tests are revealed, the shares have a good chance to go on growing. The aim of growth will be $50.25. The uptrend is confirmed by the 200-days Moving Average as well: it has started growing after a sideways move.

However, investors may still react negatively to the violations by Ventavia Research Group. This can drop the quotations to $41 overnight.

Summing up

The news about an American pharma company Pfizer is rather ambiguous. On the one hand, it has shown a strong quarterly report: revenue and profit over July-September grew by over 130%. Moreover, in the USA, they allowed the vaccine for 5-11 y.o. kids.

On the other hand, there are quite substantial accusations of violations of the vaccine tests. The situation is rather complicated, and I wonder how Pfizer quotations will close today.