PayPal Shares Are Falling due to Q3 Report and Q4, 2021 Forecast

3 minutes for reading

If I were writing sentimental dialogs for sitcoms, I would express my current thoughts like this: “PayPal, old chap! Mind it: if your quarterly reports and forecasts disappoint Wall Street, even a contract with Amazon won’t save your stocks from falling”. Alas, my style is different, so enjoy your usual reading.

PayPal report for Q3, 2021: revenue inferior to assessments of analysts

An American corporation PayPal, owning a payment system with the same name, published a financial report for Q3, 2021 on Monday, November 8th, when the trading session was over. I’ll say at once that the statistics failed to surprise Wall Street experts – in a good way.

The company boasted that in July-September it increased the overall number of active accounts by 12% - +13.3 million new users – so that this number reached 416 million. Among other things, this let the overall payment volume in Q3 grow by 26% to $310 billion.

Payment volume in Q3, 2021 grew by 26% to $310 billion

Cooperation between PayPal and eBay is extinguishing – slowly but steadily. In Q3, the amount of transactions on the platform via the payment system in question decreased by 45%. The reason has long become clear: eBay is integrating its own payment system, pushing out other services.

However, PayPal quickly found a replacement for eBay and started cooperation with a huge electronic commerce platform Amazon. By the agreement, the users of Venmo, belonging to PayPal, will be able to make purchases on Amazon from their accounts, starting the next year.

Important report details

- Revenue - $6.18 billion, +13%, forecast - $6.23 billion.

- Return on stock - $1.11, +4%, forecast - $1.07.

- Net profit - $1.09 billion, +6%.

PayPal forecast for Q4, 2021 and the reaction of the shares

The forecast voiced by the company for October-December was quite modest. The revenue is expected as $6.85-6.95 billion, while the return on stock - $1.12. Nonetheless, the forecast of Wall Street analysis was more optimistic: revenue - $7.24 billion, corrected return on stock - $1.27.

The forecast yearly revenue was decreased to 18% and now amounts to $25.3-25.4 billion. However, analysts expect $25.78 billion. The company explains pessimistic forecasts for Q4 by several factors.

Quarterly revenue in Q4, 2021 will amount to $6.85-6.95 billion

Among the main reasons – abolishment of financial support for US population and certain issues with supply chains, as well as the fact that customers are again opting for offline shops for purchases before and during holidays.

On November 9th, on the next day after the report was published, the share price of PayPal Holdings Inc (NASDAQ: PYPL) decreased abruptly by 10.5%, reaching $205.42. Note that since the beginning of the year the quotations have lost 12.3%.

Tech analysis of PayPal shares by Maksim Artyomov

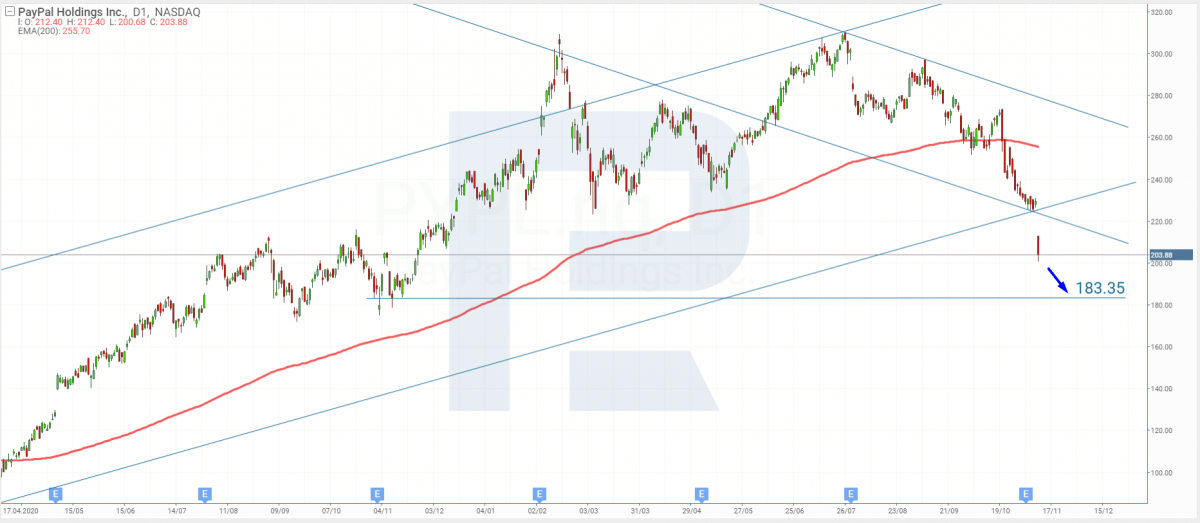

Going down along a correctional channel during the last couple of months, PayPal shares demonstrated one more sharp falling. Previous trading session opened with a gap, and the quotations broke through the lower border of the channel. The reason for such a decline was the financial report that disappointed investors.

Now the decline can continue falling to the next support level of $183.35. This theory is supported by the 200-days Moving Average that has also started a decline. If the partnership with Amazon helps the corporation to restore the trust of investors, the price might then bounce off the support level and return to an uptrend.

Summing up

According to the financial report for Q3, 2021, the revenue and profit of PayPal grew quite modestly, by 13% and 6%, respectively. These results are inferior to the forecasts of analysts, as well as forecasts for Q4. All this muted the good influence of the news about cooperation with Amazon and led the share price to falling by over 10%.