Investing in European Banks

7 minutes for reading

How to make €1,000,000 out of €40,000? Ingeborg Mootz, an “oldie-trader” who discovered stock exchanges at the age of 75, knows the answer to this question. She started with a 40,000 DM deposit and managed to turn this sum into 1 million.

In her financial operations, she preferred shares of European banks – and we’ll also pay attention to them today.

Fall of European banks’ stocks

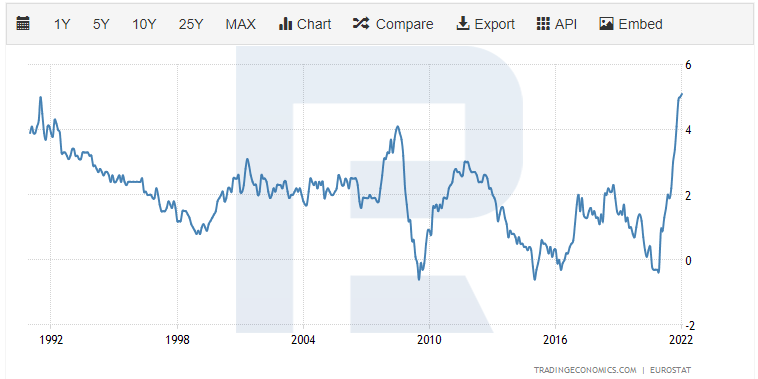

After the mortgage crisis in the US, some of the problems “spilled over” to European economies. As a result, the European Central Bank started easing its interest rate, from 4.25% to 1%.

However, it wasn’t enough. Eventually, the ECB continued easing the rate and in 2015, it reached zero. Such low rate values made it difficult for banks to make a profit and, as a result, investors started exiting the sector.

Please take note of the Deutsche Bank AG (NYSE: DB) chart: since 2007, it has lost 95%.

It is comparable with the losses of TAL Education Group (NYSE: TAL), which, together with other representatives of the Chinese online education sector, took a big hit from new government regulations in the sphere of education.

Inflation forces the ECB to raise the rate

However, right now the situation in the European market is changing: for the first time in 30 years, inflation reached 5.1% and made the ECB raise the rate. It will have a positive impact on financial institutions’ income.

The latest rate decision was made by the ECB on 3 February – it remained intact at 0.00%. However, the ECB Governor Christine Lagarde said recently that she wasn’t so confident anymore about an unlikely rate hike in 2022.

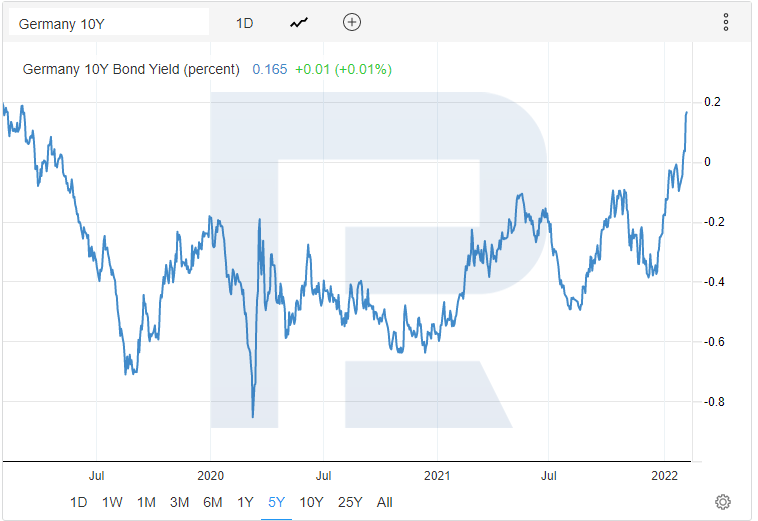

Market players believed it was a signal in favour of monetary policy tightening. As a consequence, the DAX (GER40) plunged and the 10-year bond yield reached the positive area for the first time since 2019. This is the reason why we should pay attention to the European bank sector.

Banks accumulated tons of financial reserves

During the pandemic, banks were preparing for the worst and accumulating reserves. In addition to that, the regulator passed a moratorium on bonus and dividend payouts, and also raise requirements for borrowers in order to reduce the number of originated loans.

In terms of financing, the pandemic went better than expected. Problem loans, the number of which wasn’t great, didn’t trigger a collapse in financial institutions. Eventually, banks accumulated tons of financial reserves and investors now hope that this money will be steered into dividend payments and the stock repurchase.

The regulator, in its turn, lifted a moratorium and lowered requirements to borrowers – this will help financial institutions to provide more loans and grow their revenue.

European banks worth paying attention to:

- ING Group

- Deutsche Bank

- UBS Group

ING Group

ING Group N.V. (NYSE: ING) is the largest banking group in the Netherlands; its key markets are the Netherlands, Belgium, Luxembourg, and Germany. The group ranks among the top 30 largest banks with at least 30% of assets in originated mortgages.

The bank’s underlying profit is interest earnings from existing loans. The Q4 2021 report showed a 4.5% revenue growth, up to $5.28 billion. Interest earnings added 17%, while the return on equity reached 9.2%.

A refinancing rate hike will have a positive impact on the financial institution’s revenue, that’s why its quarterly reports will keep investors happy throughout 2022.

When it comes to American banks, their stocks are already trading close to all-time highs, which is not the case for European ones. The ING Group stock is trading 55% below its highs and, as a result, has a growth potential to reach $34 per share.

Deutsche Bank

Deutsche Bank AG (NYSE: DB) is the oldest European bank that was founded in 1870 in Berlin. The bank ranks among the top 30 largest banks and operates in 58 countries.

On 27 January, Deutsche Bank released its financial statement for the fourth quarter of 2021. The net profit was €315 million – this is a 160% increase in comparison with the same period of 2020. The annual income reached €25.4 billion – the best result in the last 10 years.

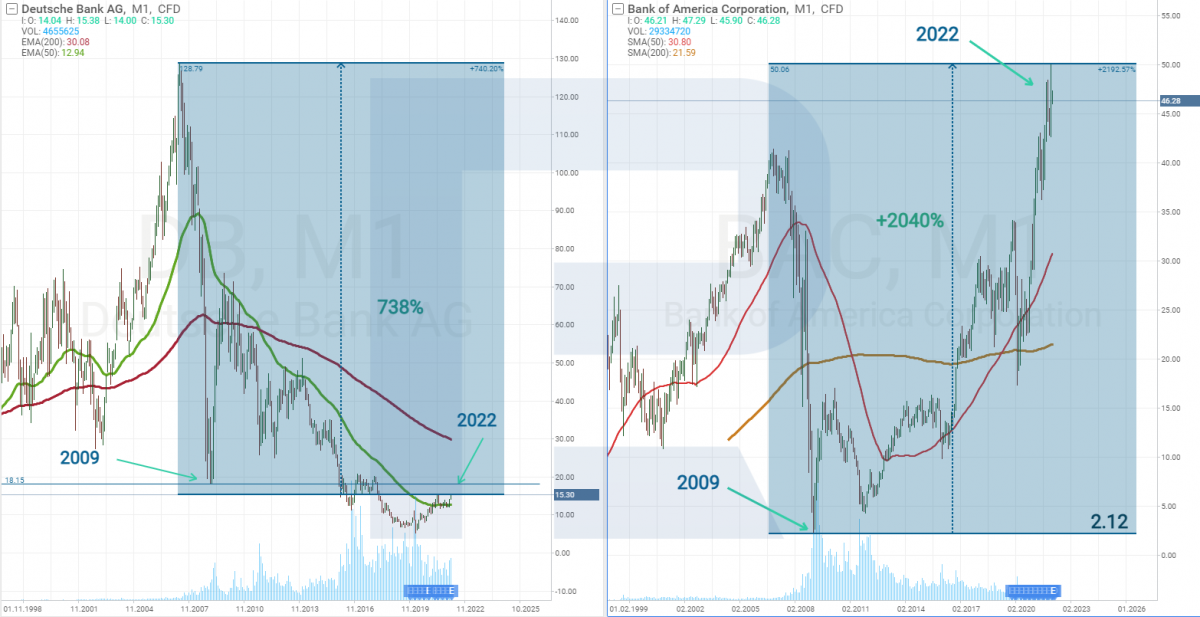

Starting March 2020, the stock added over 200%. It’s possible to assume that the stock “ran out of gas” and we noticed it far too late. However, the weekly chart suggests otherwise: we’re in the very beginning of our pathway. Here we can make an analogy with Bank of America Corporation (NYSE: BAC).

Triggers of the fall in shares of Bank of America and Deutsche Bank are similar but since the companies are regulated by different authorities and operate in different economies, their paths to recovery also differ.

American companies develop faster. The US Fed announces several possible rate hikes in 2022, but the ECB provides nothing but hints. This is the reason why stocks of European banks are recovering much slower than their American counterparts.

Paying attention to the Bank of America stock, we can see that it is trading near its all-time high, although in 2009 it hit the bottom of $2.12. Since then, the stock skyrocketed by 2,185%.

After the mortgage crisis, shares of Deutsche Bank dropped to $20 and, instead of returning to their all-time high, continued falling and reached the low at $5. It’s only now that they are starting to recover. To return to its all-time high, the stock must add 738%. It’s excellent growth potential.

UBS Group

UBS Group AG (NYSE: UBS) is an internationally acclaimed Swiss bank that manages assets or retail and corporate clients. As of now, the bank manages the largest amount of private wealth in the world.

UBS is considered one of the most influential financial institutions on the planet. As of 2021, it’s the third-largest bank in Europe. Half of the world's billionaires are among its clients.

On 24 January, the bank announced that its income in the fourth quarter of 2021 was $8.73 billion, which indicates a 7.5% increase in comparison with the same period of 2020 and 3% above the sum forecasted by financial experts.

In its forecast, the bank’s management is expecting further growth of income and announces an increase in the amount of funds that will be spent on the stock repurchase.

The UBS stock is trading at the New York and Swiss stock exchanges. It’s been at the NYSE since 2014, that’s why we’ll be analysing a chart from SWX.

UBS also suffered from the mortgage crisis in the US, while its shares lost 90%. It’s been 13 years since that moment but the stock recovered only by 14% and is currently trading at the resistance of $20.

If the ECB starts raising the rate and the banking sector “revives”, the UBS shares may return to their all-time high, which implies a growth potential of over 300%.

Conclusion

Early in 2021, Warren Buffett was acquiring shares of American banks, which are now trading at their all-time highs. European banks still live in the shadow.

There are more and more rumours that American stocks are “overbought” and it’s high time to pay attention to other markets. The European banking sector, which is now at the very beginning of its recovery path, could be a good alternative. If the ECB tightens its monetary policy, it will be an excellent catalyst for the growth of the above-mentioned segment.