IPO of Dynasty Financial Partners: A SaaS Platform for Brokers

4 minutes for reading

A business digitalisation trend is clearly seen in many areas, including financial consulting. And the appearance of outsourcing digital platforms provides significant boost to this process.

On 19 January, Dynasty Financial Partners Inc., the company that developed a SaaS platform for wealth management, filed for an IPO on the NASDAQ under the “DSTY” ticker symbol. The IPO date hasn’t been announced yet.

The business of Dynasty Financial Partners

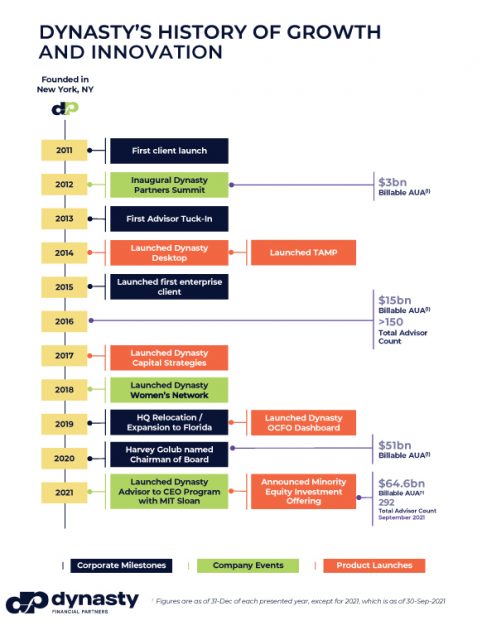

Dynasty Financial Partners was founded in 2010 with headquarters in Saint Petersburg, Florida. The company’s founder and CEO is Shirl Penney, who earlier held different management positions in Citigroup and Salomon Smith Barney. The company currently employs 75 people.

Services provided by Dynasty Financial Partners’ SaaS platform:

- Consulting. Brokers are provided with the opportunity to work with their clients in private practice. This area earns 27% of the company’s total net profit per year.

- Investment platform. Software for performing transactions on financial markets – 54% of the net profit.

- Wealth management. Algorithm-driven risk manager that helps to distribute investment capital – 19% of the next profit.

The platform uses technologies developed and patented by the company. It’s a great competitive advantage over other representatives of the segment.

Dynasty Financial Partners’ clients are 46 companies and 292 individual financial consultants. As of 30 September 2021, the amount of assets under their management was $64.6 billion.

The market and competitors of Dynasty Financial Partners

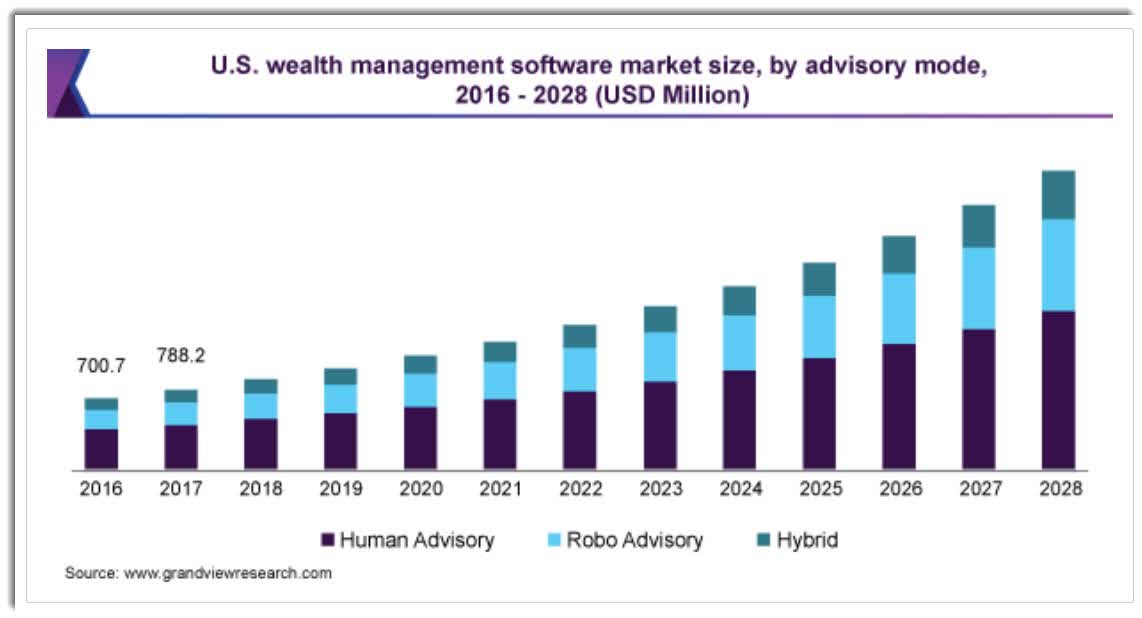

According to Grand View Research, the global asset management software market in 2020 was estimated at $3.3 trillion. By 2028, it is predicted to reach $9.1 trillion. As a result, the average annual growth rate from 2021 to 2022 could be 13.5%.

The key reason for this growth is an expansion of demand for more effective asset management tools. For example, the transition of consulting companies to operations with cloud services, which simplify and boost task execution.

Below you can find a diagram showing past and future wealth management software market size in the US.

Dynasty Financial Partners’ key competitors are:

- SS&C

- SEI Investment

- Fiserv

- Finantix

- AssetMark Financial

Financial performance

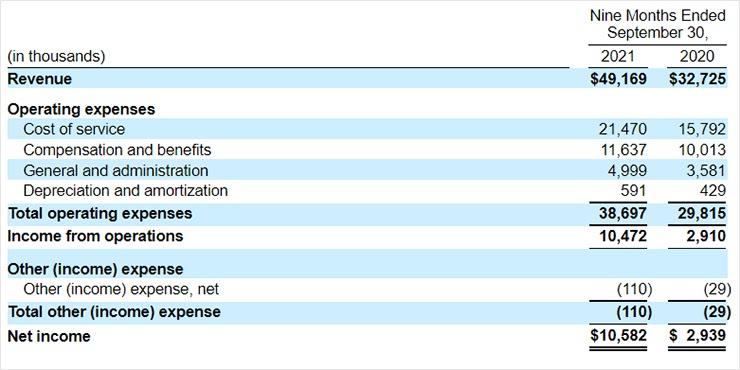

According to the company’s financial statement, its net profit in 2020 was $4.84 million, which indicates a 365% growth in comparison with 2019. In the three-quarter period of 2021, Dynasty Financial Partners’ net profit was $10.58 million after being $2.9 million over the same period of 2020. As we can see, the indicator has been rising for three consecutive years.

The issuer’s revenue in 2020 was $46.2 million, this is a 14% increase in comparison with 2019. In the nine-month period of 2021, Dynasty Financial Partners’ revenue was $49.17 million, which indicates a 50% growth in comparison with the same period of 2020. In case this growth pace continues, the predicted revenue for 2021 is $69.39 million.

As of 30 September 2021, the cash equivalents on the company’s balance sheet were $22.4 million, while its total liabilities were less than $5 million. The free cash flow over the year that ended on the above-mentioned date was $17.4 million.

Strengths and weaknesses Dynasty Financial Partners

The advantages of investing in Dynasty Financial Partners are justified by the following:

- Financial solvency

- High growth rate of the revenue

- Effective management incentive programme

- Market experience and business reputation

Among the investment risks, we would name:

- Strong competition

- No dividends

IPO details, and estimation of Dynasty Financial Partners’ market capitalisation

The underwriters of the IPO are Maxim Group LLC, D.A. Davidson & Co. Keefe, Bruyette & Woods, Inc., RBC Capital Markets, LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, and J.P. Morgan Securities LLC.

The number of shares to be sold hasn’t been announced yet. The IPO volume is a standard $100 million. In the case of favourable market conditions, book-runners might yet increase the IPO volume. The company is planning to spend the money raised during the IPO on the development of its product and acquiring new technologies.

To assess the upside for the technological sector companies, we use a multiplier – the Price-to-Sales ratio (P/S ratio). A P/S value for the technological segment with a rapidly-growing target market and financial performance could be 25-35 during the lock-up period.

The issuer's P/S is unknown so far because we know nothing about the price range. This investment might well be of a venture nature if the actual P/S is over 40. The stock could be interesting to investors who are aiming at excess profits.