How to Use Margin Calculator on Forex

5 minutes for reading

This article is devoted to margin on the Forex market: what it is necessary for, where to find it, and how to use a special calculator for margin on Forex.

What is margin

This term has several meanings. In business, margin is profit in percent minus expenses. In trading it means the money that an investor must deposit to the account of their broker or exchange to cover for credit risks.

Margin on Forex is finance used y a broker to cover for credit risks. Its size depends on the contract and leverage. In other words, margin is a necessary deposit for opening sustaining a position that allows for making trades with leverage for a larger sum than the trader has.

Margin crediting is provided by brokers so that traders with modest deposits could open substantial positions on Forex. Every broker has their own marginal requirements, and this issue should be cleared before the trader starts working with margin.

The idea of margin trading on Forex is that cash is not supplied factually. Trading implies making a profit on growth or falling of a currency pair. All trades in margin trading are two-sided: if a contact opens for buying, it is closed with a sale, and vice versa. As a result, the trader either makes a profit or suffers a loss.

Formula for calculating margin

The formula for calculating margin necessary for opening a position looks as follows:

Required margin = [(Base currency) / (Account currency)] * Position volume / Leverage

Where:

- Base currency is the currency of the trading operation; it is number one in the abbreviation of the currency pair.

- Account currency is the currency of the trader’s account.

- Position volume is the volume of the trading position in the base currency.

- Leverage is the size of the leverage used.

Example of calculating margin by formula

Imagine a trader needs to know what margin they need in USD to open a position sized 0.5 lot in GBP/USD with leverage 1:100.

The current GBP/USD quote is 1.15 USD, which means the ratio of the base currency GBP to the account currency USD is 1.15. A standard lot on Forex is 100,000 units of the base currency.

Let us use the formula:

1.15 * 100000 * 0.5 / 100 = 575

This means that to open such a position the trader needs 575 USD on their account.

How to use margin calculator

All calculations of margin have long become automatic, which means the trader does not need to manually count it by the formula. There is a useful and comfortable instrument for it called margin calculator.

This universal instrument is also known as trading calculator, Forex margin calculator, and leverage calculator. It will be useful for market beginners and experts alike.

With this instrument traders can calculate parameters of trades online and choose the most efficient strategies before opening a position. As an example let us take a look at the Trading Calculator by RoboForex that can be found on the official website.

The calculator has four main input parameters:

- Ticker of the currency pair

- Lot size

- Leverage size

- Account currency

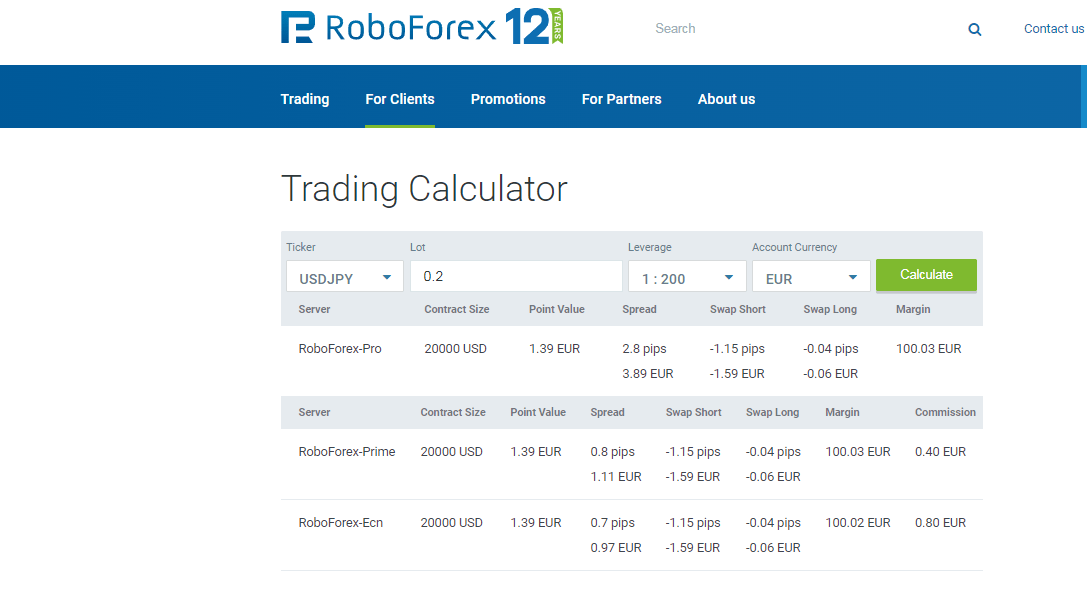

After the trader fills in the boxes and clicks Calculate, they get detailed information about the planned trade (according to the account type):

- Size of the margin required for opening the position

- Cost of changing 1 point of quotes by the position

- Spread size (the difference between the buy and sell prices)

- Swop (rollover) size for long and short positions – the sum that is deposited/withdrawn for transferring the position to the next trading day

Let us look at an example of work of the calculator. The currency pair is USD/JPY, lot size 0.2, leverage 1:200, account currency EUR. See the results on the screenshot below.

What is Margin Call

Apart from the margin necessary for opening a position, there is also the so-called maintenance margin. This is the minimal sum that the trader must have on their account for the position to remain open. The size of the maintenance margin is set by the broker or exchange. As a rule, it is significantly smaller than the obligatory margin and is measured in percent.

In the process of trading, quotes either grow or fall, and if there are open positions on the account, there appears a floating profit or loss. If the quotes go against the trader’s position, and the sum on the account drops to the minimal level of the maintenance margin, Margin Call gets triggered.

This is a notification from the broker informing the trader that they need to either deposit their account or close losing positions to set the margin free.

If the trader ignores this requirement, the broker is authorised to close all or certain open positions a their own discretion. This forced closing of positions by the broker is called Stop Out.

Advantages and drawbacks of margin trading

The advantages of margin trading are:

- The trader gets an opportunity to work with larger sums and thus increase the efficacy of their trading.

- Such trading requires less of the trader’s own capital, leaving money free for use for other goals.

- More instruments become available for trading.

However, margin trading has the following drawbacks:

- Trading risks are high. If the situation in the market goes wrong, losses can be drastic.

- Traders using margin get excessively stressed out. Such trading requires psychological sustainability.

- Brokers and exchanges may charge additional commission fees for trading certain instruments with margin.

Closing thoughts

Margin trading can bring serious profits to experienced traders and increase losses for less experienced ones. The trader needs to learn how to control risks at least by the main rules of risk management. Using special margin calculators and the starting information of the planned trade, a market player can assess possible risks and make a weighted decision.