USD/JPY 2023 Forecast: Is the Japanese Yen’s Decline Set to Persist?

9 minutes for reading

USD/JPY ranks among the top three most traded currency pairs in international trading. In this article, we will examine the key factors affecting the USD/JPY exchange rate, analyse the dynamics of price changes in 2023, and explore the short-term and medium-term forecasts provided by experts.

You can visit the RoboForex Market Analysis webpage for the latest USD/JPY forecasts.

Overview of the USD/JPY currency pair

The base currency in the USD/JPY pair is the US dollar (USD), the official currency of the US. In addition, it serves as the global reserve currency in international trade and financial markets. The US dollar is considered a benchmark currency and the most widely used asset in transactions worldwide. The Federal Reserve System (the Fed), functioning as the central bank of the US, holds the authority to issue currency.

The second currency in this pair is the yen (JPY), the national currency of Japan. It ranks third by popularity in the foreign exchange market, following the US dollar and euro. The Bank of Japan, the country’s central bank, holds the exclusive right to issue banknotes and coins.

The US dollar to Japanese yen exchange rate shows how many Japanese yen the market gives for one US dollar. Fluctuations in the pair exchange rate reflect the comparative state of the current economic conditions in the US and Japan. USD/JPY is one of the major currency pairs, known for its high liquidity. Together with EUR/USD and GBP/USD, it ranks amongst the top three most traded currency pairs in the foreign exchange market, accounting for approximately 13% of the total trading volume.

Key trading characteristics of the USD/JPY pair

- The currency pair is traded round the clock from Monday to Friday, with significant trading volumes during the Asian and American sessions, leading to major movements for USD/JPY

- The pair is characterised by moderate average daily volatility within the range of 700-800 pips. However, during times of stock market declines, it has the potential for strong movements exceeding 2,000 pips per day

- The spread for USD/JPY is considered minimal thanks to its high liquidity and moderate volatility

Fundamental factors influencing the USD/JPY quotes

The Bank of Japan’s monetary policy

The Japanese economy has been in a state of deflation since the mid-1990s. It is a phenomenon opposite to inflation, in which the general price level of goods and services decreases, thereby negatively affecting the economy’s growth rate. The Bank of Japan and the country’s government have been trying to eliminate deflation over the years by using a zero-interest rate and implementing a policy of quantitative easing (QE), involving injecting added monetary funds into the economy.

In contrast, the Japanese central bank's policy, unlike the aggressive interest rate hikes by the Federal Reserve System and regulators of other countries, led to the yen's devaluation. Its low interest rate made it attractive for borrowing to fund investments. However, inflation has recently begun to rise significantly in Japan.

In June 2023, core inflation in the country reached 4.2%, which is the highest reading in over four years. The indicator has exceeded the central bank’s target level of 2% for 17 months in a row. This development may lead Kazuo Ueda, the Bank of Japan's governor, to consider raising market interest rates soon. Analysts presume that this will happen no earlier than October 2023.

The Federal Reserve’s monetary policy

In recent years, the US Federal Reserve has been actively combating inflation by tightening monetary policies. Since 2022, the interest rate was gradually raised from 0.25% to 5.5%. This significantly affected the USD/JPY quotes, which rose from 115.00 to 152.00 over this period due to the interest rate differential.

The recent comments from Jerome Powell, the chair of the Federal Reserve, suggest that the Fed is poised to bring the rate-hike cycle to an end. Experts expect a maximum of two more rate hikes this year, after which the rate will remain stable for some time. In case economic conditions in the country worsen dramatically, the rate may be reduced, which will allow the yen to strengthen against the US dollar.

JPY’s function as a safe-haven currency during crises

Another important factor influencing the USD/JPY rate is that the yen is used as a safe-haven currency during various crises. When stock markets decline, investors start to actively divest themselves of risky assets and buy safe-haven assets such as the US dollar, the Swiss franc, and the Japanese yen. At this time, the USD/JPY exchange rate may decline considerably owing to the strengthening of the Japanese currency.

Economic development indicators of the US and Japan

- Unemployment Rate

- Nonfarm Payrolls

- GDP Growth Rates (GDP)

- Inflation Indices (CPI, PPI)

- Industrial Production (Industrial Production Index)

- Retail Sales

- Trade Balance

- Consumer Confidence Index

- The US Business Sentiment Index (ISM)

- A business activity report by the Bank of Japan (Tankan survey)

USD/JPY movements in 2022-2023

In 2022, the US dollar was greatly supported by steady growth of the key interest rate in the country and strengthened significantly against the yen. The pair rose from 115.00 to 152.00, which was the highest reading over the last 32 years. After the price hit a high of 152.00 at the end of 2022, a downward correction followed, which was caused by expectations of the potential tightening of the Bank of Japan’s monetary policy.

In 2023, the weakening of the yen exchange rate against the US dollar persisted with the currency pair trading at 130.00 at the beginning of the year. The yen is under pressure due to the lack of clear signals from the Bank of Japan indicating when the tightening of the monetary policy will start, which contributes to further growth of the USD/JPY quotes.

At the same time, the Fed continued its interest rate hiking policy in response to increasing inflationary pressure. The difference between the rates resulted in the further weakening of the yen and the gradual growth of the pair exchange rate. On 16 August, at the time of writing, the quotes managed to rise above the local daily high of 145.00.

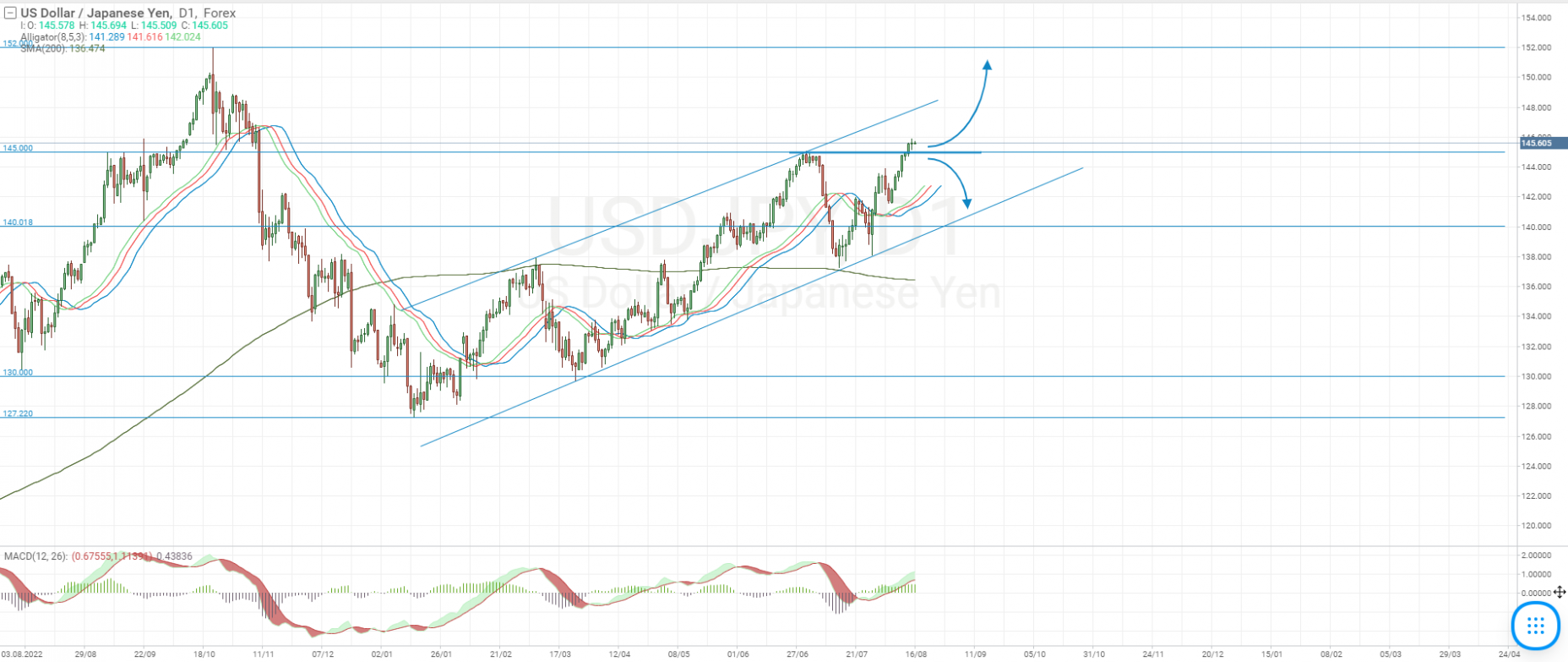

USD/JPY 2023 technical analysis

USD/JPY has been showing steady growth since January 2023, moving in the ascending daily channel. In early July, the price demonstrated a sharp downward reversal from the upper boundary of the channel and the resistance level at 145.00, where there was the 61.8% Fibonacci retracement level from the previous fall. Following this, the quotes rebounded from the lower boundary of the channel and continued to rise.

The quotes are trading at 145.60 on 16 August, with the pair securing above the resistance level at 145.00. The Alligator and SMA 200 trend indicators confirm the uptrend. If the pair holds its ground above 145.00, the highs near 152.00 could be tested. Should the closing price of the day drop below 145.00, a downward correction could follow to the lower line of the daily price channel at 140.00.

USD/JPY forecast for the end of 2023

- J.P. Morgan Research analysts expect the yen to strengthen its position by the end of 2023 due to the risks of a moderate recession in the US. They presume that the USD/JPY pair will hover around 128.00 by the end of the year

- In their forecast, UBS analysts recognise the risk of further short-term rise of the US dollar, but at the same time they believe that the USD/JPY should experience a reversal and drop to 122.00 by the end of the year

- Analysts at Citibank predict that USD/JPY could range from 140.00 to 130.00 at the end of 2023 and at the beginning of 2024

- ING Group analysts believe that the currency pair will end the year near 135.00

Long-term USD/JPY forecast for 2024 - 2028

- Foreign exchange strategists at HSBC believe that the US dollar is presently overvalued and will revert to fair value over five years due to declining US yields and the growth of equity markets. Bank’s experts forecasting the USD/JPY exchange rate to reach 120.00 by mid-2024 and decline further to 108.00 by 2028.

- Specialists at ING Group suggest that the USD/JPY rate will hover around 120.00 in 2025

- Analysts at the Economy Forecast Agency (EFA) predict the US dollar-to-yen rate to reach 166.00 by the end of 2024, 185.00 by the end of 2025, and 188.00 by the end of 2026

- According to the USD to JPY forecast of the Wallet Investor portal, the pair will continue the upward rally with the USD/JPY rate reaching 208.10 in 2028, aligning with a long-term bullish trend

Summary

The USD/JPY currency pair experienced a surge in 2022, reaching a 32-year high. A downward correction only followed at the end of the year. Since the beginning of 2023, the quotes have been headed upwards again, aiming for a new high. Growth is supported by a big difference in the interest rate between the US Fed (5.5%) and the Bank of Japan (−0.1%).

The uptrend persists, but analysts note two factors that may trigger a decline in the currency pair by the end of the year, namely a potential recession in the US and prospects for the tightening of the Bank of Japan’s monetary policy.

FAQ

Why is USD/JPY forecasting important?

Forecasting is important for strategic planning and risk management, helping investors in predicting possible movements of the currency pair.

What methods are used to forecast USD/JPY?

Commonly employed methods include fundamental analysis, technical analysis, and sentiment analysis.

How accurate are USD/JPY forecasts?

While forecasting methods have their advantages, they are not entirely reliable. A wide range of factors can affect USD/JPY and trigger unexpected price movements.

What are the risks in USD/JPY forecasting?

The primary risk lies in the unpredictability of global political and economic events that can significantly affect the USD/JPY rate.

What potential future events could trigger changes in the USD/JPY exchange rate?

The list of potential events is extensive, including shifts in the monetary policies of US and Japanese regulators, geopolitical changes, natural and human-caused disasters, as well as developments in national and global economic crises.

Will the USD/JPY rate continue to remain volatile?

Yes, influenced by various factors, the USD/JPY rate may maintain its volatility.

How does the difference in interest rates affect the USD/JPY rate?

The widening gap in interest rates between the US and Japan has the effect of bolstering the strength of the USD/JPY rate.