Trade Balance: How to Use It in Forex

4 minutes for reading

This article is devoted to trade balance, its influence on the national currency, and to using it for Forex trading.

What is Trade Balance?

Trade Balance, or International Trade, is a macroeconomic index that demonstrates the difference between the added up prices of all exported goods and added up prices of all goods imported in the country over a certain period. In other words, this is the difference between export and import volumes in monetary terms. Trade balance is one of the key indicators of competitiveness of goods and services produced in the country.

Trade Balance = Export - Import

Depending on which index is bigger, Trade Balance can be positive or negative:

- Trade surplus appears when export exceeds import.

- Trade deficit means that import exceeds export.

Countries present their Trade Balance monthly. It accounts for seasons and has several categories:

- Consumer goods

- Food

- Raw materials and Industrial supplies

- Autos

- Capital goods

- Other merchandise.

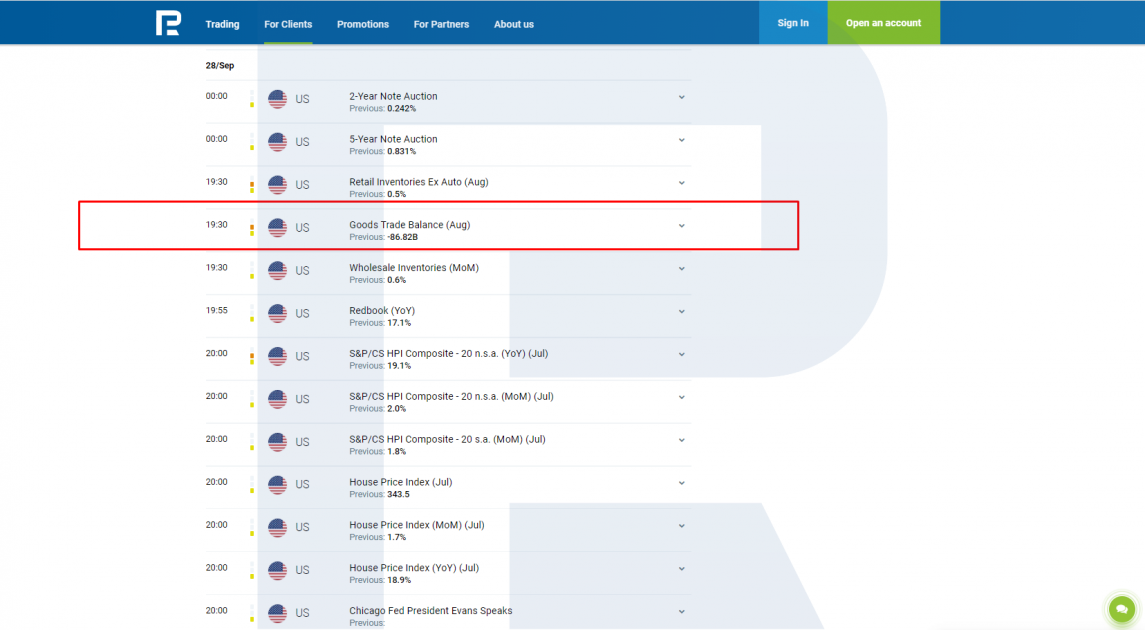

As a rule, for Forex trading you need the overall balance without specific details. You can find changes in the Trade Balance on the Economic Calendar.

How does Trade Balance influence the national currency?

Trade Balance has a direct influence on the exchange rate of the national currency. Current dynamics of the import-export ratio that it demonstrates has a direct connection with both local and foreign currencies. The country has to use international currency reserves paying for import and, on the contrary, its trade partners form demand for the national currency to pay for the goods they buy

A country suffering a trade deficit (where import exceeds export) needs access to lots of foreign currency to cover up for import expenses. Falling demand for the national currency alongside growing demand for foreign money has a negative influence on the local money. A decrease in export volumes might lead to an increase in sack leaves in industry and growth of unemployment, which will also make national currency cost less.

Trading surplus, on the contrary, has a good influence on the national currency. A country that exports more goods than it imports will enjoy stable demand for its currency from international trade partners. Increased demand for exported goods leads to the expansion of production, which in turn, means new workplaces and stimulates consumer spending. As a result, the exchange rate of the national currency grows.

Using Trade Balance in Forex

You can use Trade Balance for playing in Forex as any other important economic index of a country. See below two trading options.

Long-term trading

This is an approach for investors that requires a large capital and long investment time. Such trading uses fundamental analysis that evaluates changes in Trade Balance alongside other important economic indices: CB rates, GDP, unemployment rate, inflation indices, industrial production, etc.

Positive dynamics (growth of surplus) will confirm good perspectives of the national currency. If other fundamental indices agree, the growth of surplus will increase chances of the currency for growth an heat up interest towards it. Buying the currency, investors will form an uptrend.

Negative dynamics (trade deficit), on the contrary, warns of a possible decrease in the rate of the national currency. If other indices are also negative, an increase in the deficit makes a decline in the currency exchange rate even more probable, and investors will start selling to buy more promising ones. As a result, the market will form a downtrend.

Short-term trade

This is the easiest and most accessible way of using the index in Forex. It is based on the short-term influence of publisher Trade Balance on the rate of the currency. In other words, this is about trading news, as they say. Unexpected growth of surplus can cause temporary growth of the currency, and an increase of deficit can provoke falling. This impulse can be caught in trading.

For such trading, you will need to analyze the price chart and decide where and how to make a trade after the news emerges. Use tech analysis here as it will show the nearest strong support and resistance levels, price patterns, and other instruments you can use.

Find the main principles of short-term trading in the article "Trading News: How to Use Strategies and Form a Trading Plan?":

Bottom line

Trade Balance is an important macroeconomic indicator that represents the export against import ratio of the country. Publication of this index can influence the national currency a lot.

Trade Balance can be used for long-term trading (alongside other indicators) and short-term trading on news.