How Did George Soros Make His Money: Top 3 Trades

6 minutes for reading

Today we will dive into the business of George Soros, a trader and manager who became a true legend. We will consider three Soros's trades with currency that made him a celebrity of the financial world.

Who is George Soros

George Soros is a trader, investor, and manager considered by many to be one of the most successful financiers of these days. For long he used to be the manager of the Quantum hedge fund that used to demonstrate stable annual profitability of 30% from 1970 through 2000. Also, he created a network of grantinh institutions known as the Soros Fund.

He was born in Hungary in 1930. After the World War II was over, he left for England to study at the London School of Economy. Upon graduating, he went to New York and began his banking career, later leaving for a broker company. Many years later, he formed the Soros Fund Management that became a part of the mentioned Quantum Fund.

Over the years of active work, Soros made several impressive trades and investments. He is one of the most famous investors in the financial world, known for making trades with currencies that are huge even for the global financial world. Soros's capital in 2022 was above 8 billion USD. Moreover, he donatef more than 30 billion USD on charity and political projects.

Legendary Soros’s trades with currencies

Let us take a look at threw Soros's trades with currencies that made him wealthy and famous.

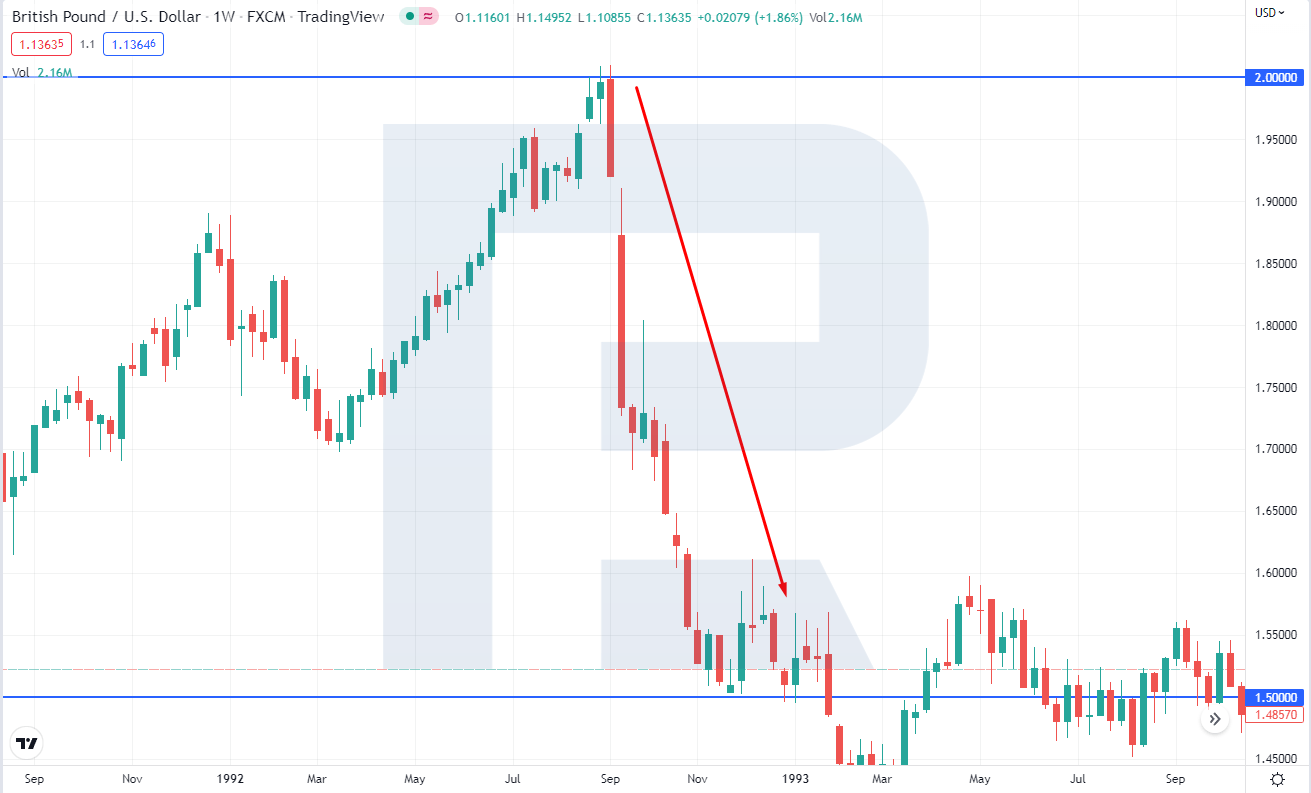

British pound: George Soros and Black Wednesday for the Bank of England

Soros's Forex stake against the British pound is called one of the greatest currency trades of the modern world. Great Britain joined the European Exchange Rate Mechanism (ERM) in 1991, when inflation was high and interest rates were low. By this mechanism, the government planned to hold the exchange rate of the national currency at 2.7 German mark per pound.

However, there was no good reason for such a rate, firstly because inflation in Britain at that time was much higher than in Germany. Being an economist, Soros noticed that the pound was seriously overestimated against the German mark, and un summer 1992 started making stakes against the British currency via his Quantum fund. The total sum of the trade is evaluated as about 5 billion pounds.

To hold back the rate and attract investors, Great Britain increased the interest rates above 10% but this never helped. Alongside Soros, many market players started selling the pound against the mark and dollar expecting the exchange rate to drop.

Soon the British government realised that it would have to spend a lot of money due to the extremely high rates and the necessity to hold the rate of the pound that high. Apart from that, German authorities publicly announced possible reorganization inside the ERM.

On 16 September 1992, the British government decided to leave the ERM and unbind the pound, and this day got the name of Black Wednesday. As a result, the British pound abruptly dropped by 15% against the German mark and by 25% against the USD. By different evaluations, Soros made about 1 billion USD on this trade.

Thai baht: Asian financial crisis

Another famous Soros's trade with currency was selling the Thai baht during the Asian financial crisis in 1997. Roughly assessing, he invested in selling the baht against the US dollar more than 1 billion USD from his investment portfolio. He stated that the baht was seriously overpriced and was counting on a serious decline of the Thai currency due to the financial crisis.

In the end, this happened when the Bank of Thailand spent all its resources on supporting the exchange rate of the national currency and decided to let it float. As a result, the Thai baht dropped twice against the USD — from 24 to 52 baht per 1 USD. The true forecast about the falling of the baht let Soros make on Forex another billion USD.

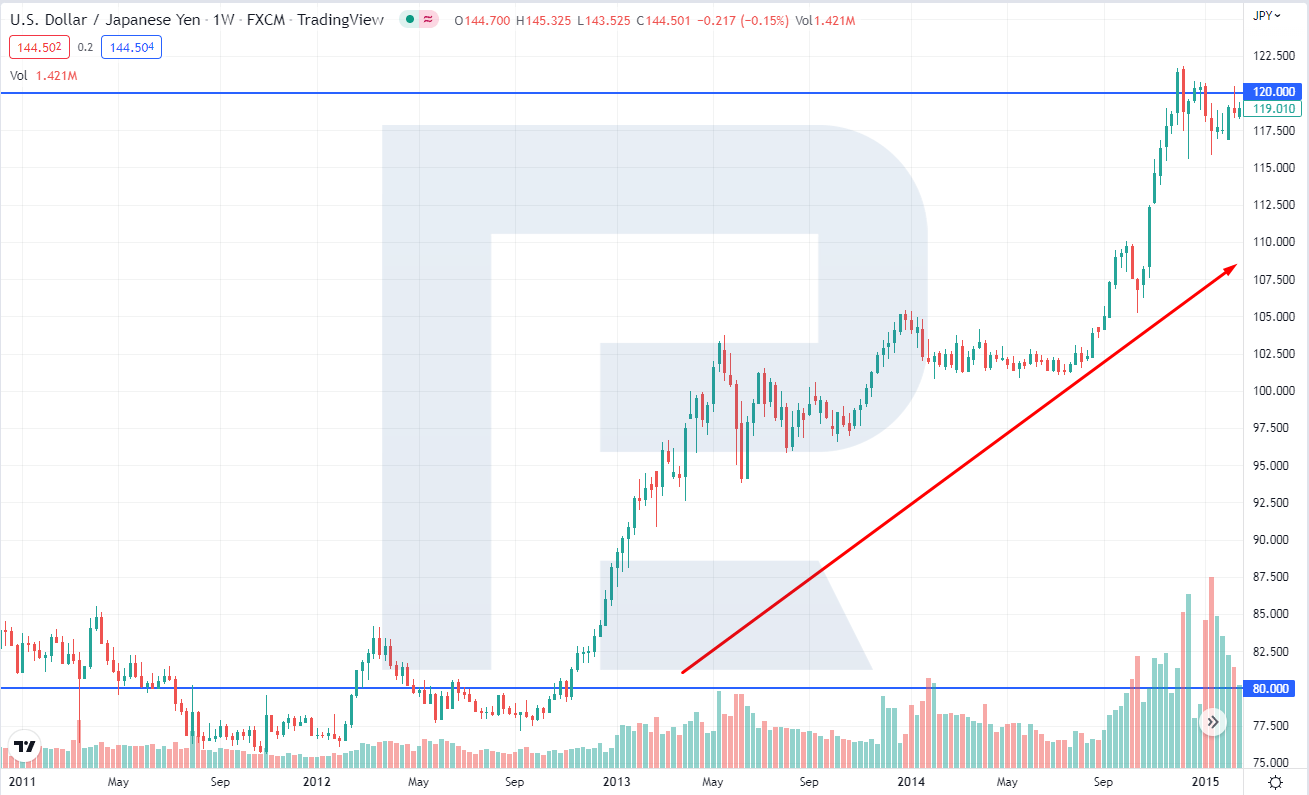

Japanese yen: George Soros and Shinzo Abe

In 2013 and 2014, Soros made a large stake on Forex against one more currency — the Japanese yen. He knew that Shinzo Abe, recently appointed Japanese prime minister at the end of 2012, was planning wide QE of the credit and monetary policy to push the economy forward. This economic policy known nowadays as abenomics, pushes the yen down.

As George Soros had expected, Abe's soft monetary policy led to the devaluation of the yen. At the same time, the trader opened a long position in the Japanese stock index Nikkei. The decrease in the yen supported the stocks of Japanese companies, mainly oriented on export. The national currency lost about 20%, while the Japanese stock market, on the contrary, grew by about 25%. Thanks to his plan coming true, Soros earned another billion of USD.

Quotes by George Soros about investments

- It is not important whether you are right or not; it is important how much you earn when you are right and how much you lose when you are wrong.

- Financial markets are usually unpredictable. So each one must have different scenarios. The idea that you can really predict what happens is against my understanding of the market.

- The market is a mathematical hypothesis. The best solutions are elegant and simple.

- I have created quite a general theory that financial markets are naturally unstable; that when we think about a balanced market, this picture is false.

- Risk is painful. People are either ready to endure the pain themselves or try to pass it to someone else. There is nothing better than danger for focusing your mind; I really need the risk-provoked anxiety to think clearly. Accepting risk for me is an important part of a clear mind.

- If investing seems entertaining, you must not be making any money. Good investing is boring.

Bottom line

George Soros is a trader who can easily be called an outstanding person. Some call him a genius, some say he is a talented manipulator. Thanks to his trades with currencies, Soros has made real money and has gone down to history as a financial legend of modern day.