Top 5 Affiliate Deals for the End of 2022

3 minutes for reading

Today, we will talk about the companies whose stocks their affiliates actively invested in during the last two weeks of 2022. The top five deals included purchases of the securities of Lucid Group Inc., Dave & Buster's Entertainment Inc., Chargepoint Holdings Inc., STAAR Surgical Company, and Mediaco Holding Inc.

1. Lucid Group – 915 million USD

The largest deal in terms of funds invested was the purchase of US electric car manufacturer Lucid Group Inc. (NASDAQ: LCID) shares. Ayar Third Investment Co., which owns more than 10% of Lucid Group, bought USD 914.9 million worth of the carmaker's shares on 22 December 2022.

According to Form 13F filed by Ayar Third Investment, the fund purchased almost 86 million shares at USD 10.67 per unit. At the time of writing, Lucid Group was trading 40% below this value.

2. Dave & Buster's Entertainment – 39 million USD

Hill Path Capital Partners LP, affiliated with Dave & Buster's Entertainment Inc. (NASDAQ: PLAY), acquired 1.1 million shares in the US entertainment and restaurant chain for USD 39.2 million from 21 to 30 December 2022.

Hill Path Capital Partners' average purchase price for Dave & Buster's Entertainment securities was USD 34.31. At the time of writing, the company's shares were valued at 38.6 USD.

Hill Path Capital Partners' stake in Dave & Buster's Entertainment now exceeds 10%. As a reminder, the fund started buying up the securities of this restaurant and entertainment business in October 2022.

3. Chargepoint Holdings – 12 million USD

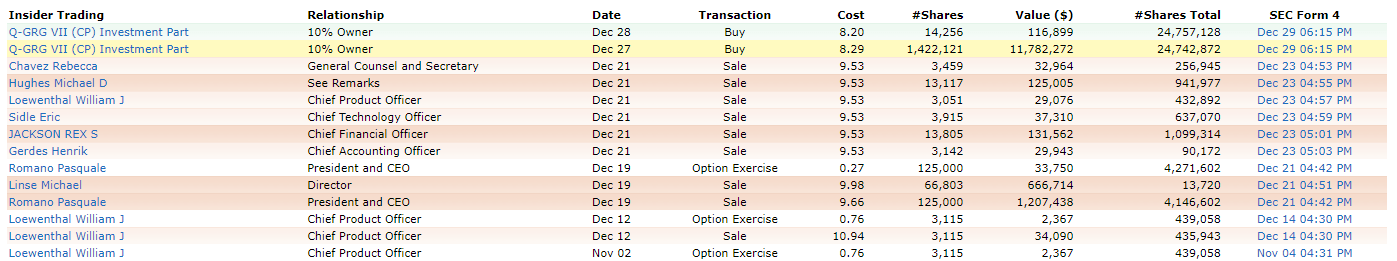

Q-GRG VII (CP) Investment Partners LLC bought 1.4 million securities of Chargepoint Holdings Inc. (NYSE: CHPT) for USD 11.8 million on 27 and 28 December. The average purchase price was USD 8.28 per unit, and the value of the securities was USD 9 at the time of writing.

Chargepoint Holdings is a US company that develops infrastructure for electric vehicles. It specialises in hardware and software for charging stations.

It is worth pointing out that prior to this deal, Q-GRG VII (CP) Investment Partners had a stake in Chargepoint Holdings of more than 10%. Curiously, individuals associated with Chargepoint Holdings preferred to sell their shares in the company last December.

4. STAAR Surgical – 9 million USD

STAAR Surgical Company (NASDAQ: STAA), together with its subsidiaries, designs, develops, manufactures, and markets medical instruments and equipment as well as eye lenses. The company operates in the US, Asian and European markets.

From 27 to 29 December, Broadwood Partners, L.P., a fund with over a 10% stake in STAAR Surgical Company, acquired more than 187,000 shares of the firm for USD 8.8 million. The average purchase price was USD 47 per unit. At the time of writing, STAAR Surgical Company shares were trading at USD 60.

5. Mediaco Holding – 4 million USD

Mediaco Holding Inc (NASDAQ: MDIA), a subsidiary of Emmis Communications Corporation, owns and operates radio stations in the US. On 28 December, the Standard General L.P. fund bought 3.3 million of its shares for USD 4 million. The average purchase price reached 1.2 USD. At the time of writing, the value of the securities was 1.71 USD per unit. The fund's stake in Mediaco Holding exceeds 10%.

Conclusion

The largest affiliate transactions late last year involved the securities of Lucid Group Inc., Dave & Buster's Entertainment Inc., Chargepoint Holdings Inc., STAAR Surgical Company, and Mediaco Holding Inc. One thing that the above-listed purchases have in common is that they all involve investment funds.