What is OPEC, and How It Influences Crude Oil Prices

5 minutes for reading

In this article, we will find out more about OPEC and its activities. We will look at the history of OPEC, and how it was established. We will also try to analyse how the organisation influences world crude oil prices and demand.

What is OPEC?

The term OPEC (Organization of the Petroleum Exporting Countries) refers to a group of thirteen of the world's largest oil-exporting countries. The organisation was founded in 1960 to coordinate the petroleum policies of its member countries and the technical and economic cooperation among them. OPEC is headquartered in Vienna, where the executive body, the OPEC Secretariat, manages the day-to-day operations of the organisation.

OPEC was formed in response to the Seven Sisters alliance, which included major international crude oil corporations such as British Petroleum, Exxon, Mobil, Royal Dutch Shell, Gulf Oil, Texaco, and Chevron. They adversely affected the development of oil-producing countries whose natural resources were actively used.

According to OPEC's charter, the organisation's mission is to coordinate and unify the oil policies of its member countries and stabilise the crude oil market to ensure an efficient and uninterrupted supply of black gold. The basic principles guiding its work are oil for consumers, stable income for producers, and a fair return on capital for those who invest in the crude oil industry.

The history of OPEC

OPEC was created at the Baghdad Conference in September 1960 by officials from countries such as Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. Qatar, Indonesia, Libya, the United Arab Emirates, and Algeria joined in the 1960s followed by Nigeria, Ecuador, Gabon, and Angola joining the organisation in the 1970s.

In December 2016, OPEC formed an alliance with ten other oil-exporting countries: Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan. This new alliance is called OPEC+.

The membership of the Organisation of Petroleum Exporting Countries has changed several times over its history. As of January 2023, it has thirteen countries as members, namely Saudi Arabia, the United Arab Emirates, Venezuela, Nigeria, Libya, Kuwait, Iraq, Iran, Gabon, Algeria, Angola, Congo, and Equatorial Guinea.

Separately, some of the largest oil-producing countries are not OPEC members, for example, the US, Canada, and China.

How OPEC affects the price of crude oil

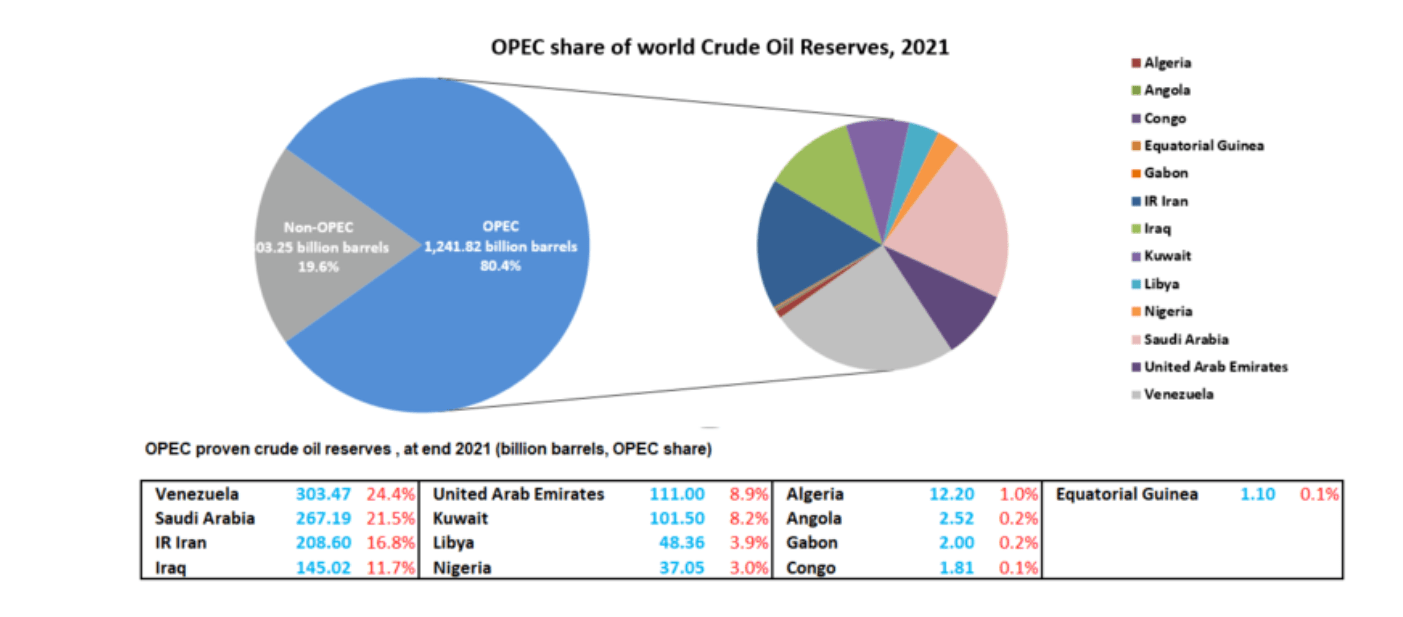

Cartel members produce about 40% of the world's oil, and their exports account for about 60% of global trade in black gold. OPEC estimates that its member countries accounted for more than 80% of the world's proven oil reserves in 2021.

Members meet regularly to agree on how much crude oil to collectively sell on world markets. Each member country is assigned its own production quota to which it must adhere.

In case of sharp price fluctuations, OPEC can regulate quotas and, through them, the world's crude oil supply. If the price of the resource falls, OPEC reduces production – this reduces supply, thereby increasing prices. If the cost of crude oil rises excessively, the cartel can increase production to help bring prices down slightly.

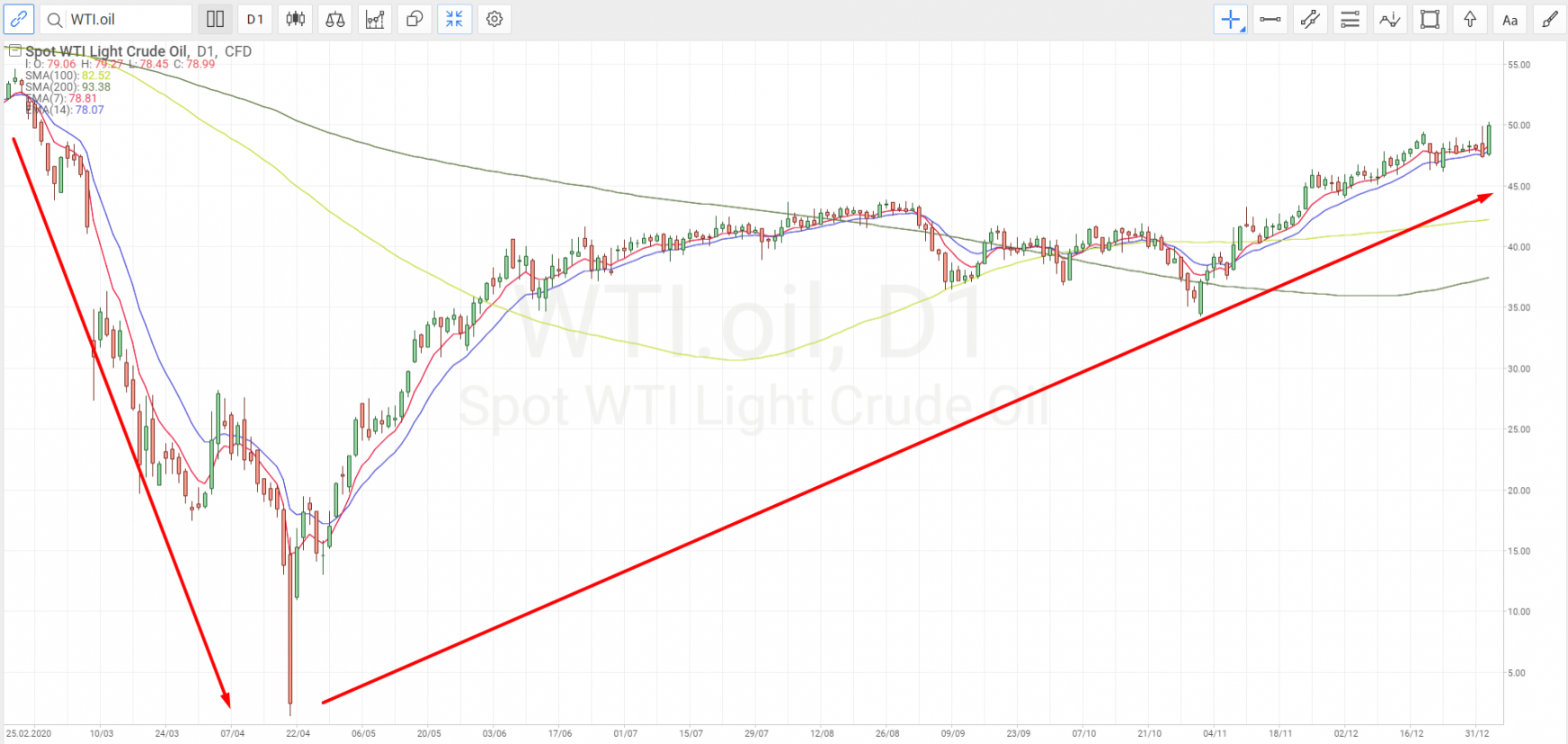

For example, during the economic crisis of 2020 caused by the COVID-19 pandemic, oil became very cheap: at one point, futures went from $50 per barrel to even below 0. To stabilise prices, the OPEC+ participants decided to substantially reduce the volume of crude oil produced by cutting quotas. The supply level fell, which made prices rise gradually and rebound to the level of $50 per barrel by the end of the year. Eventually, the price of crude oil reached $100/bbl.

Criticism of OPEC

OPEC criticism dates back to the 1970s when the organisation was perceived as a monopoly. In 1973, member countries from the Middle East banned crude oil sales to the supporters of Israel in the Arab-Israeli conflict, namely the US, Portugal, the Netherlands, and South Africa. As a result, the price of a barrel of crude oil quadrupled by 1974 and impacted end-users negatively with fuel shortages, and the cost of petrol skyrocketed. The embargo seriously affected the US and other economies.

In response, Western countries in their attempt to reduce their dependence on OPEC stepped up efforts to produce oil offshore in the Gulf of Mexico and the North Sea. Subsequently, global oversupply and lower demand led to a significant drop in the price of black gold.

Still, some countries periodically accuse the cartel of collusion, through which they believe it manipulates the price of crude oil by interfering with market pricing.

The US has drafted a bill, NOPEC (No Oil Producing and Exporting Cartels), which would allow US courts to punish association members and their partners for manipulating production volumes. But the project is still in draft form.

The future of OPEC

The world economy needs stability and predictability when it comes to crude oil prices, production, and export volumes. Therefore, OPEC is likely to retain its position as a price regulator in the short term. The cartel's position looks quite stable in the context of the current energy crisis, and the expected growth in demand for black gold in the coming years.

It is worth noting, however, that in the long term, there are factors that could reduce the impact of the organisation's decisions on the global economy. These could include an increase in the supply of cheap shale oil by non-alliance countries and an increase in the use of renewable energy sources.

Conclusion

The world market for crude oil and oil products plays an important role in the development of individual countries and the global economy. Established in 1960, the Organisation of the Black Gold Exporting Countries has over the years firmly established itself as the main regulator of crude oil prices in the world markets.

This alliance is likely to retain its leading position in the coming years, but in the longer term, it may face challenges; particularly with the growing shale oil production worldwide and the desire of many countries to switch to green energy.