CopyFX Inside R StocksTrader App Introduces A Commission Scheme for Traders

5 minutes for reading

All Traders who have a CopyFX strategy for their R StocksTrader account now have the opportunity to receive additional income in the form of a “Performance fee” from Investors.

An Investor will pay for the Trader's experience only in case of profitable deals.

What a “Performance fee” is, and how it works

A “Performance fee” is a commission scheme on the CopyFX platform that allows a Trader to receive a commission based on the total profit earned by an Investor through copying the Trader's successful trades. For detailed information about CopyFX, the definitions of Investor and Trader, and how these parties interact on the platform, please refer to this post.

Below, you can find a step-by-step guide with examples revealing how the “Performance fee” works, and how to set it up.

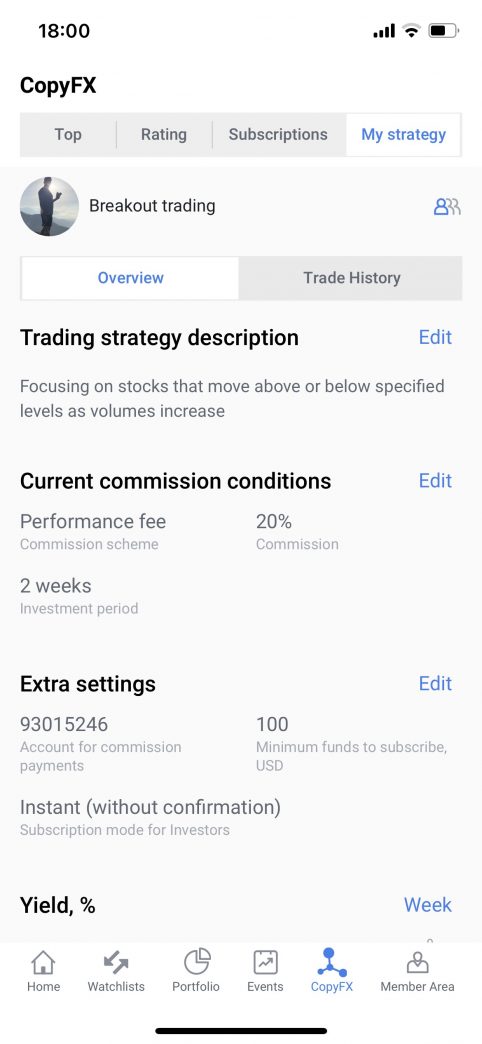

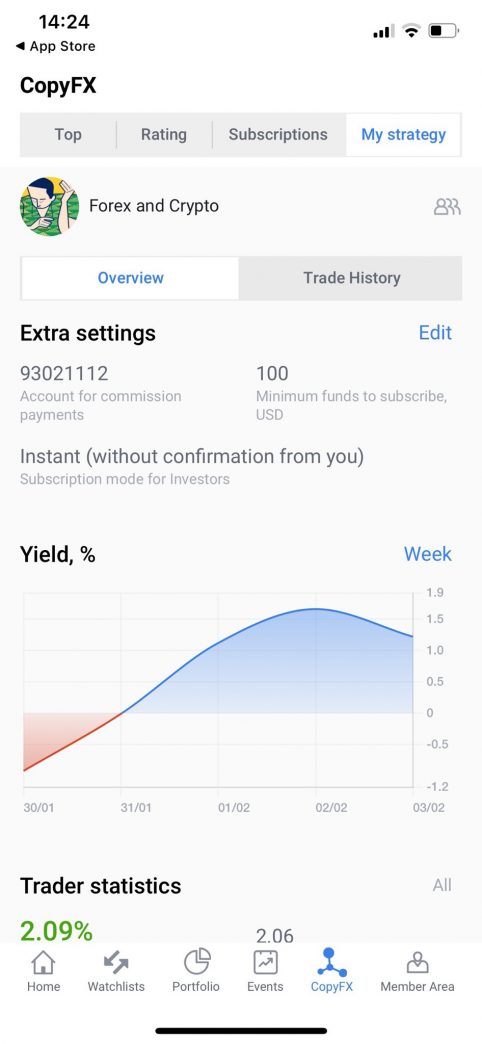

How to set up a new strategy for a Trader

1. A Trader needs to create a new strategy in the R StocksTrader app, using the integrated CopyFX

2. Choose the “Performance fee” commission fee

The calculation of the commission according to the scheme "Performance Fee" is as follows: delta is used to calculate the commission. The "Delta" is the difference between the investor’s current result for the entire subscription period and the current maximum result for the entire subscription period. The result of all copied transactions (both open and closed) is taken into account at the end of the investment period.

Example: let's say the result of the first investment period #1 is 100. As this is the first investment period, there is no previous maximum profit. Therefore, the calculation of Delta is 100 - 0 = 100. A Trader gets 10% of 100 (10), and 100 is set as the maximum Investor result for the subscription period.

If the next investment period #2 produced a result of 150, then Delta = 150 - 100 (current max. profit) = 50. The Trader gets 10% of 50 (5).

If the following investment period #3 produced a result of 140, then the Delta calculation is 140 - 150 = -10. Because Delta is negative, the Investor did not receive any profit during the current investment period, so there is nothing to charge commissions for.

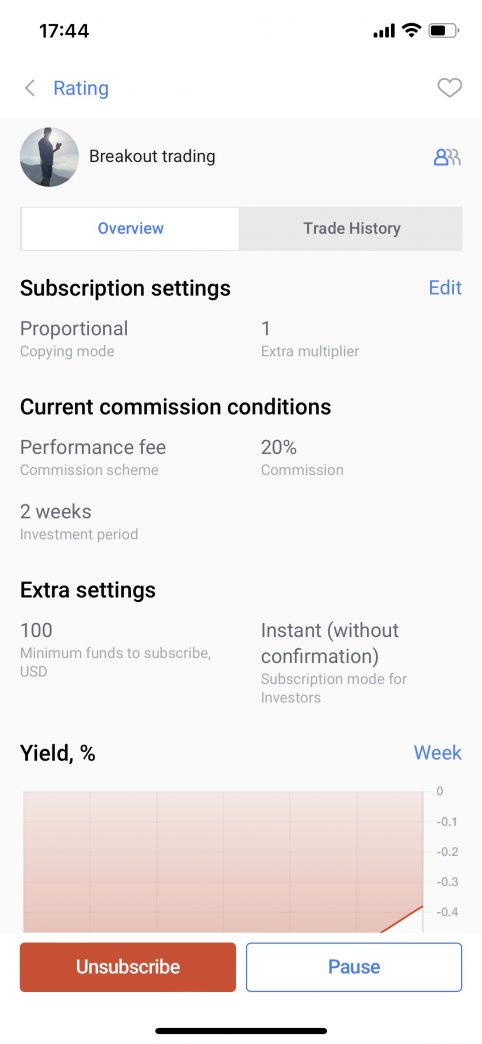

3. Set up a commission value and an investment period

A commission value can be set from 5% to 50% with a step of 5%.

An investment period is the frequency of commission payments to a Trader's account. The commission is charged every Monday. Also, investors are charged commissions at the same moment they unsubscribe from a Traders' strategy. The available options are: 1 week, 2 weeks, or 4 weeks.

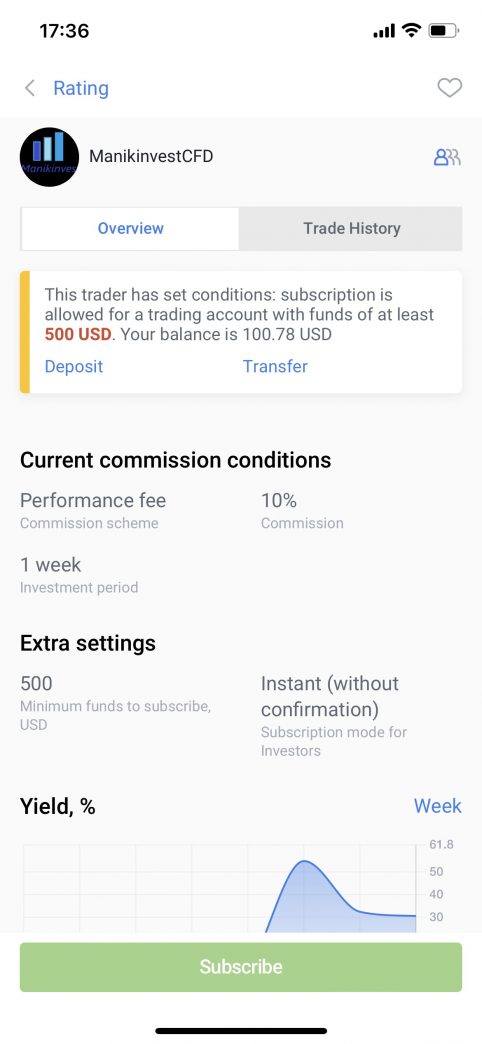

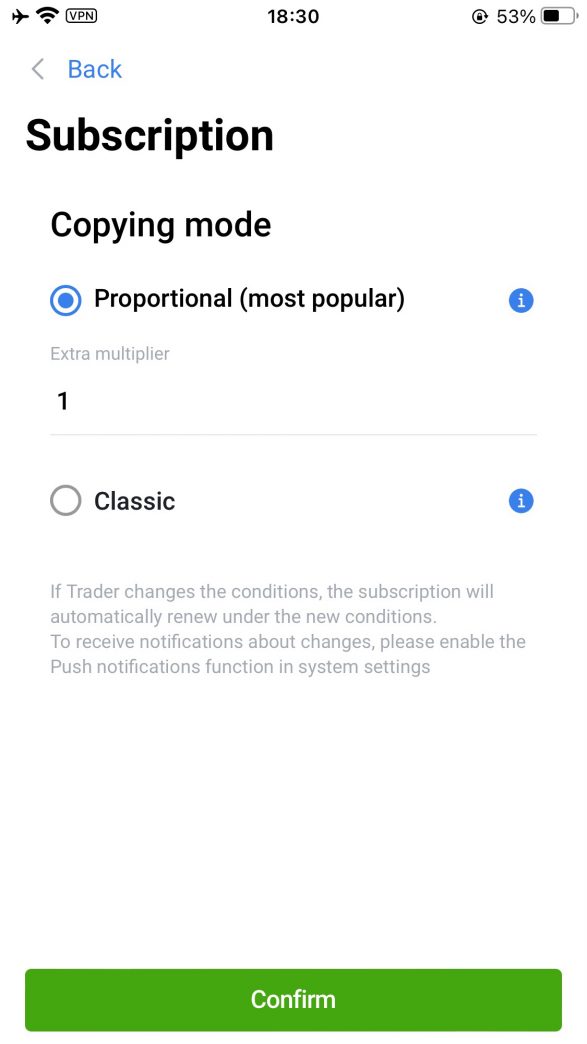

4. Launch a strategy, and attract Investors

Investors can view the performance of the strategy and the commission conditions before subscribing to a Trader's strategy.

The main principles for the commission amount to be paid are:

- the estimate is made for all copied trades since the beginning of the Investor's subscription

- all copied trades are taken into account regardless of their open or closed state

- the calculation is made periodically at the end of each investment period and also at the end of the entire subscription

- only the profit that exceeds the highest previously obtained watermark (the "new" profit is called the "delta") is subject to commission charges

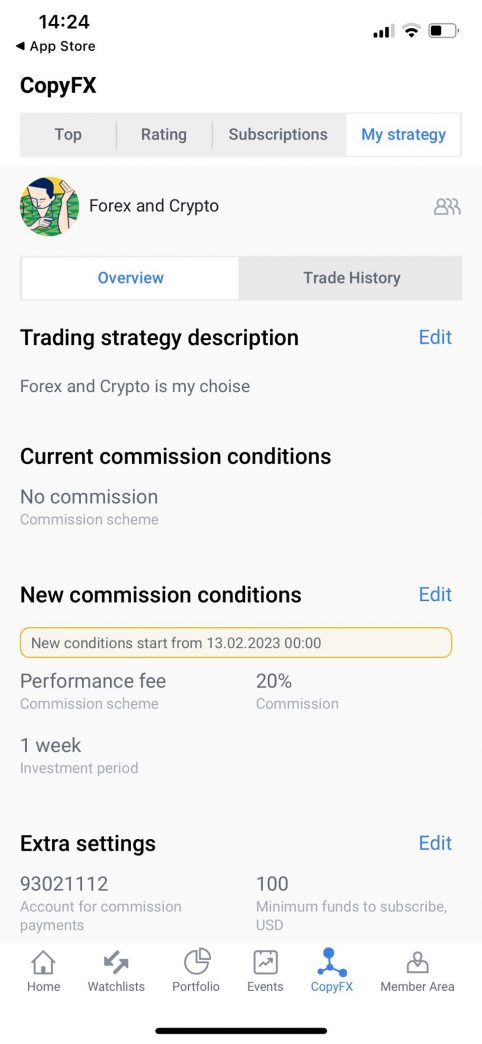

How a “Performance fee” works for existing strategies

If a Trader edits the existing strategy and sets the “Performance fee” commission scheme for it (or only changes the commission rate or investment period), then these changes will be applied on the Monday that is closest to the changes made. If the conditions were changed on the weekend (Saturday, Sunday), then they come into force on the following Monday.

Changing the commission conditions is only allowed once per day.

In this case, there are two strategies: current and planning (not applied yet).

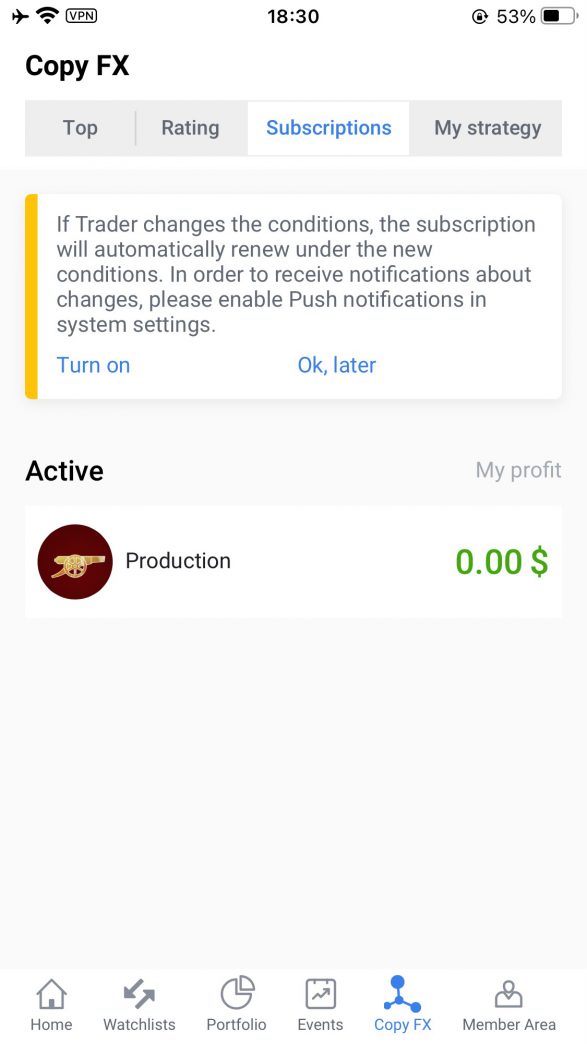

Investors will see the changes in the commission conditions on the trading details screen. Investors will also receive push notifications if they are turned on in the phone settings for R StocksTrader Application (iOS, Android). Investors can unsubscribe from a Trader’s strategy if the conditions are not satisfying.

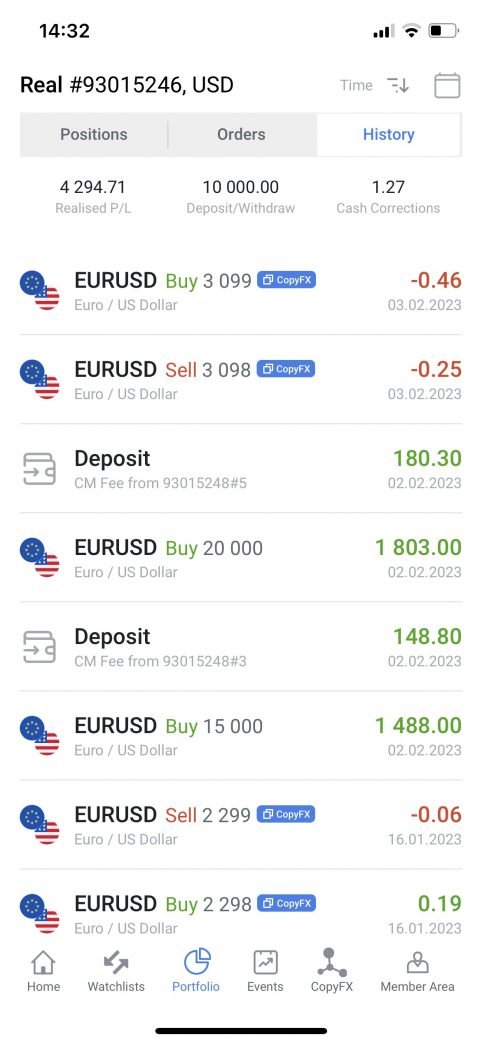

Investors can view the withdrawal of the commission from their account on the History screen.

And Traders can view the deposit of the commission into their account on the same screen.

Conclusion

The new commission scheme “Performance fee” allows Traders to receive an income from the Investors who subscribed on their strategies and copied their trades. The commission is paid by the Investor only in case of profitable trades. This is beneficial for both parties – a Trader is motivated to perform highly with the aim of achieving TOP rating to attract subscribers, while an Investor is able to save time by copying the successful trades of a high-profile professional Trader, with both the Trader and Investor making profits on these trades.

Find out more about the CopyFX system on the multi-asset trading platform R StocksTrader in this post.