Top 3 Largest IPOs Scheduled for June 2023

5 minutes for reading

Maison Solutions Inc., Lafayette Energy Corp., and BranchOut Food Inc. are on the Top 3 list of companies with the largest IPOs by market capitalisation scheduled for June 2023.

Today we will explore the issuers’ business models, the outlook for their target markets, and the details of their scheduled initial public offerings. We will also look at the financial position of these companies, and their strengths and weaknesses.

1. Maison Solutions Inc. IPO – 79 million USD

- Year of registration: 2019

- Registered in: the US

- Headquarters: Monterey Park, California

- Sector: consumer defensive

- Date of IPO: 15.06.2023

- Exchange: NASDAQ

- Ticker: MSS

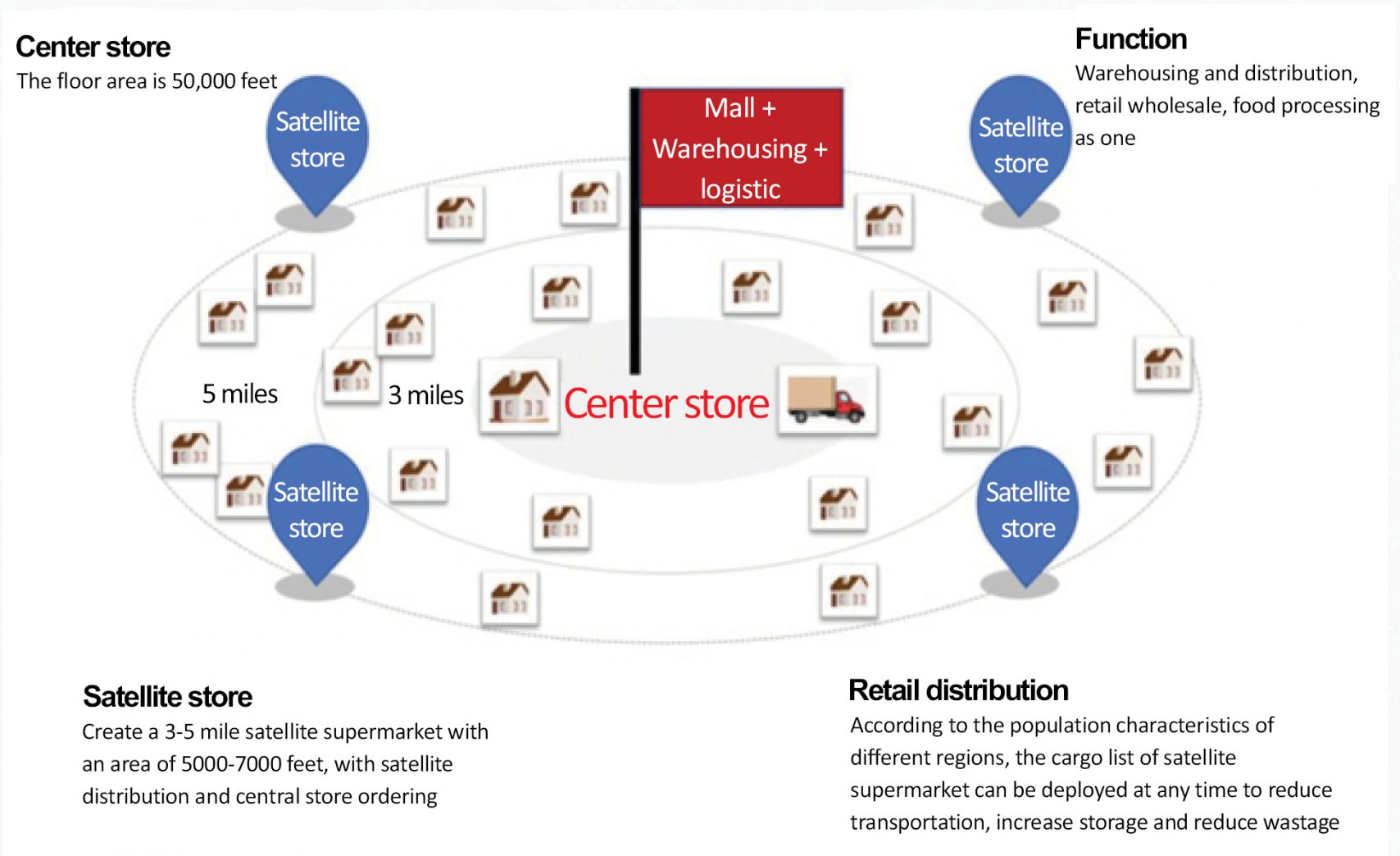

Maison Solutions Inc. is a grocery retailer of Asian food products for US consumers. The issuer supplies vegetables, fruits, seafood, meat, and other products that are rarely found in US supermarkets.

Investments raised (as at 31.03.2023) amount to 0.19 million USD.

The main investors are Golden Tree USA Inc., Stratton Arms Holding LLC, and Amsterdam NYC Fund LP.

The outlook for Maison Solutions’ target market

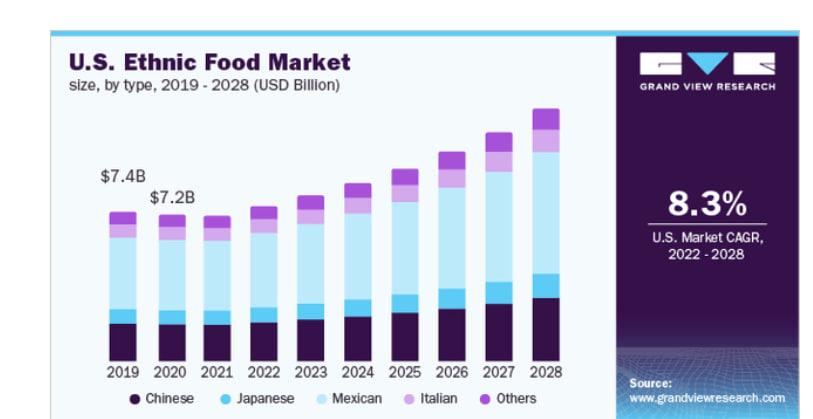

According to a report by Grand View Research, the global ethnic food market was valued at 39.5 billion USD in 2022 and could reach 70.8 billion USD by 2028. The compound annual projected growth rate from 2022 to 2028 inclusive is 8.3%.

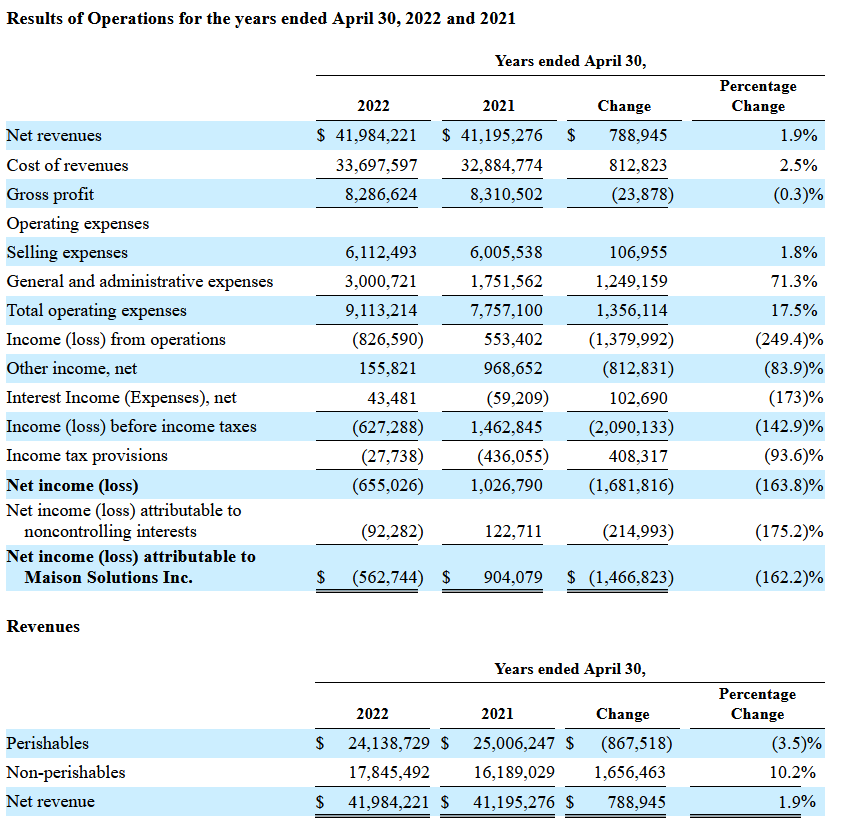

Financial performance of Maison Solutions

Revenue for the fiscal year ended on 30 April 2022 amounted to 41.98 million USD, +1.9%.

Net loss for the same period: 0.66 million USD

Net cash flow (as at 31.01.2023): 1.2 million USD

Cash and cash equivalents (as at 31.01.2023): 2.6 million USD

Liabilities (as at 31.01.2023): 30 million USD

Strengths and weaknesses of Maison Solutions

Strengths:

- A promising target market

- Exclusive products for a specific consumer segment

- Increasing revenue

Weaknesses:

- Intense competition

- Net loss

- No dividend payouts yet

Details of the Maison Solutions IPO

Underwriter: Joseph Stone Capital, LLC.

Volume of IPO offering: 3.8 million ordinary shares

Average price: 4 USD

Gross proceeds: 15.2 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 79 million USD

Potential P/S: 5.19

Average P/S value in the industry: 1.12

2. IPO of Lafayette Energy Corp. – 72 million USD

- Year of registration: 2022

- Registered in: the US

- Headquarters: Denver, Colorado

- Sector: energy

- Date of IPO: 16.06.2023

- Exchange: NASDAQ

- Ticker: LEC

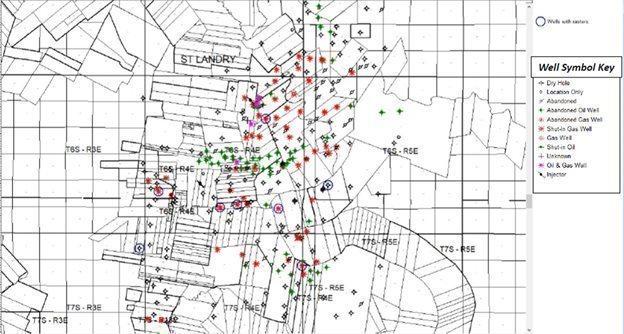

Lafayette Energy Corp. is engaged in oil and gas exploration and production at the Imperial Parish Fields in south Louisiana.

Investments raised (as at 31.12.2022) amount to 1.2 million USD.

The main investors are Naia Ventures LLC, Michael Schilling, Adrian Beeston, and Henry Chamberlain.

The outlook for the Lafayette Energy target market

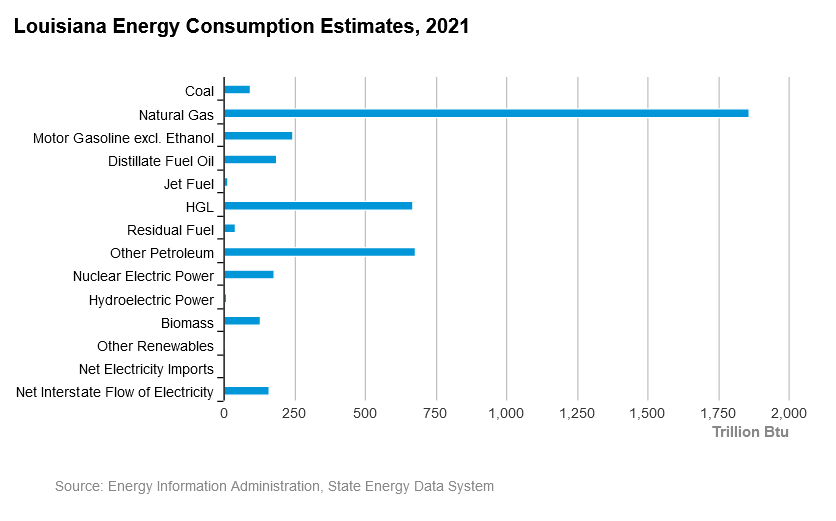

According to the US Energy Information Administration (EIA), Louisiana’s share of natural gas production in 2021 accounted for 9% of the country’s total gas output.

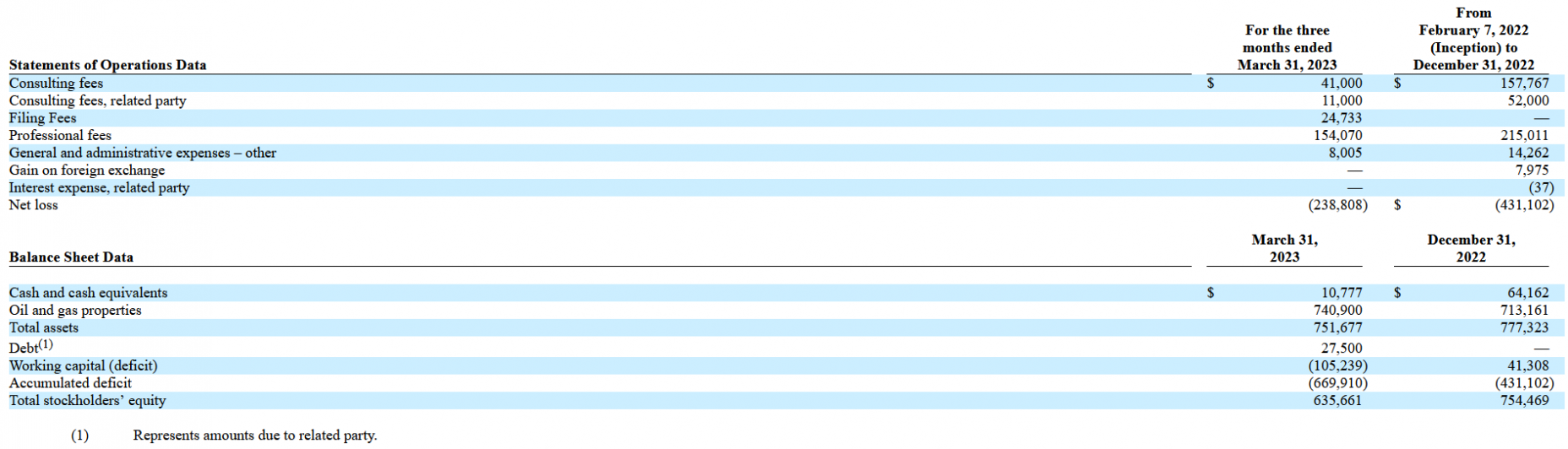

Financial performance of Lafayette Energy

Revenue for Q1 2023: none

Net loss for Q1 2023: 0.24 million USD

Cash flow (as at 31.12.2022): none

Cash and cash equivalents (as at 31.12.2022): 64.16 thousand USD

Liabilities (as at 31.12.2022): 22.85 thousand USD

Strengths and weaknesses of Lafayette Energy

Strengths:

- A promising target market

- Entitlement to lease a deposit

- Favourable market conditions

- A conservative and time-tested business model

Weaknesses:

- Intense competition

- Increasing debt burden

- Lack of revenue

Details of the Lafayette Energy IPO

Underwriter: Aegis Capital Corp.

Volume of the IPO offering: 1.2 million ordinary shares

Average price: 6 USD

Gross proceeds: 7.2 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 71.7 million USD

3. IPO of BranchOut Food Inc. – 27 million USD

- Year of registration: 2017

- Registered in: the US

- Headquarters: Bend, Oregon

- Sector: consumer defensive

- Date of IPO: 15.06.2023

- Exchange: NASDAQ

- Ticker: BOF

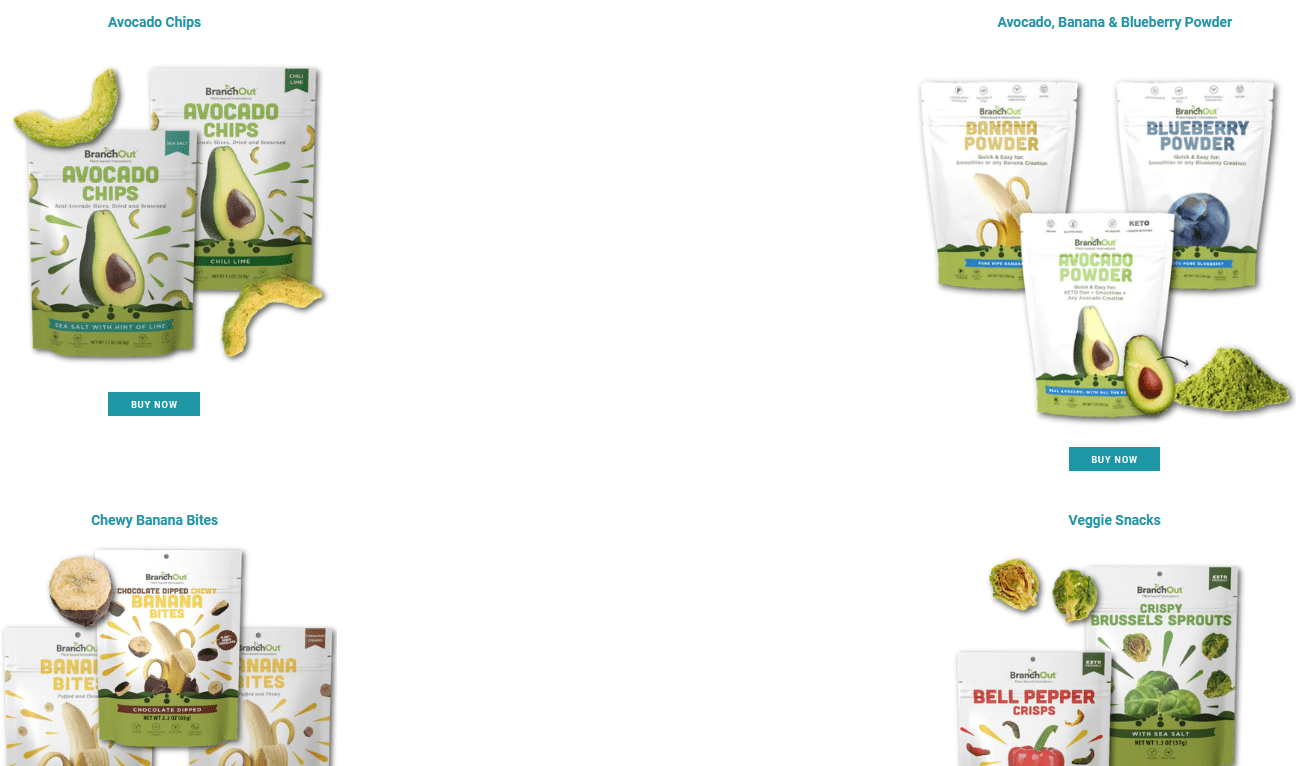

BranchOut Food Inc. produces natural plant-based food products, using its own patent-protected technology. The company is the holder of 17 patents in 14 countries around the world.

Investments raised (as at 31.12.2022) amount to 10.9 million USD.

The main investors are Fluffco LLC, David Israel, and Eric Healy.

The outlook for BranchOut Food’s target market

According to a Persistence Market Research report, the market valuation of the North American natural plant-based food market could reach 23.1 billion USD by 2028. The compound annual projected growth rate from 2022 to 2028 inclusive is 7%.

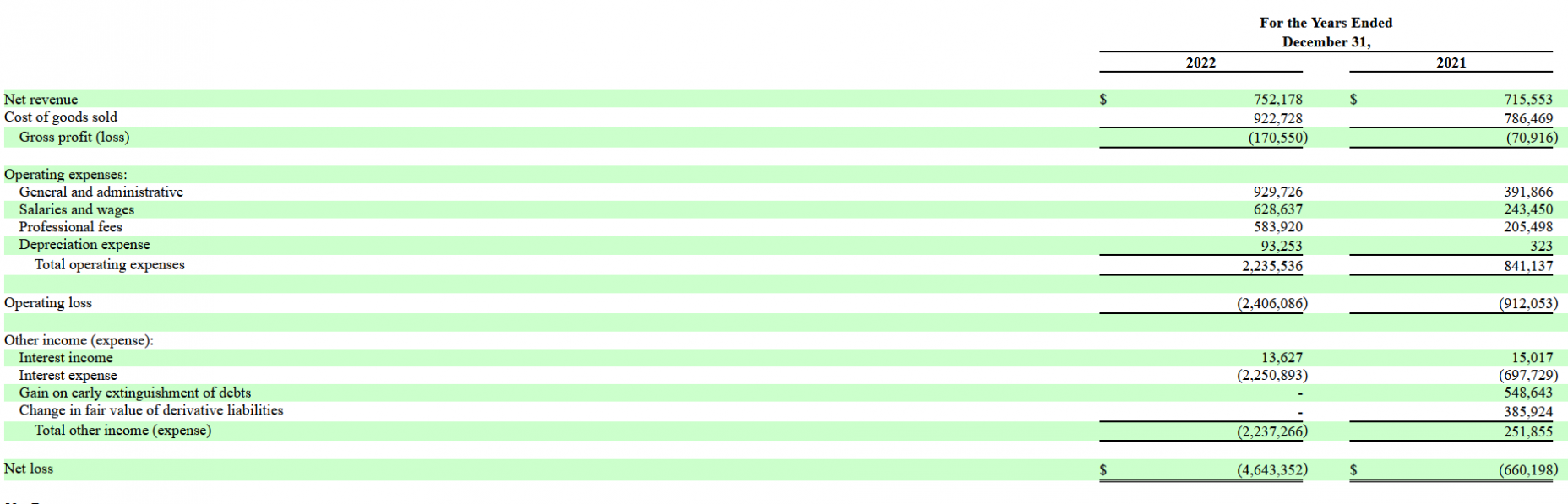

Financial performance of BranchOut Food

Revenue in 2022 amounted to 0.75 million USD, +5.1%.

Net loss in 2022 reached 4.6 million USD, +603.3%.

Net cash flow (as at 31.12.2022): −2.5 million USD

Cash and cash equivalents (as at 31.12.2022): 0.31 million USD

Liabilities (as at 31.12.2022): 8.4 million USD

Strengths and weaknesses of BranchOut Food

Strengths:

- A promising target market

- Holder of 17 patents in 14 countries

- Favourable market conditions

- Increasing revenue

Weaknesses:

- Intense competition

- Increasing debt burden

- Increasing net loss

Details of the BranchOut Food IPO

Underwriter: Alexander Capital L.P.

Volume of the IPO offering: 1.1 million ordinary shares

Average price: 7 USD

Gross proceeds: 7.7 million USD, excluding the sale of options by the underwriter

Expected amount of capitalisation at the time of the IPO: 27.11 million USD

Potential P/S: 36.15

Average P/S value in the industry: 0.78

Summary

Maison Solutions Inc., Lafayette Energy Corp., and BranchOut Food Inc. intend to go public in June. Their IPOs might be the largest placements this month in terms of expected market capitalisation. The first and third corporations represent the consumer defensive sector, while the second one is involved in the energy sector.