Will NVIDIA Stock Rise on the Quarterly Earnings Report?

8 minutes for reading

Among the companies that have gone public on US stock exchanges with a market capitalisation exceeding 200 billion USD, NVIDIA Corporation (NASDAQ: NVDA) stands out for showing the highest returns. Since the beginning of 2023, the value of its shares has skyrocketed more than 200%. The closest competitor in this category is Meta Platforms Inc. (NASDAQ: META), whose shares have seen a remarkable 155% surge over the same period.

NVIDIA Corporation will release its quarterly report on 23 August 2023. If revenue exceeds the management’s forecast of 11 billion USD, the technology giant’s stock price could reach an unprecedented high of 480 USD.

In this article, we will analyse the stock chart of the GPU and chip developer and manufacturer. We will aim at projecting potential levels to which the stock quotes could rise, identify signs of a potential uptrend coming to an end, and explore factors that could contribute to further growth in the company's revenue.

NVIDIA’s profit structure

According to NVIDIA Corporation’s Q1 fiscal 2024 report, revenue for February to April increased 13% from the same period of last year, reaching 7.19 billion USD. The data centre revenue was 4.28 billion USD, accounting for 59% of the quarterly revenue. The gaming market brought the company 2.24 billion USD (31%), while the automotive technology segment and professional visualisation products generated 0.3 billion USD each (totalling 8%).

Compared to the results for Q1 of last year, the revenue of NVIDIA Corporation’s above-mentioned segments added 14%, 38%, and 114% respectively, while the professional visualisation area saw a decrease of 53% in the indicator.

NVIDIA’s main products for the data centre market

- Server platforms. The corporation partners with various companies, offering a wide range of servers capable of performing a variety of AI, HPC, and accelerated computing tasks

- DGX systems. A series of special-purpose supercomputers for AI

- AI Enterprise platform. A comprehensive, secure, and cloud-based AI solution that expedites data analysis and streamlines the development and deployment of AI-based products

- EGX platform. Ensures accelerated computing

- NGC. A centre of accelerated software for deep learning, machine learning, and HPC

NVIDIA’s main products for the gaming market

- GeForce RTX graphics cards

- GeForce RTX-based gaming laptops and PCs

- GeForce NOW service. A cloud-based service enabling game execution on remote servers with GeForce RTX graphics cards, with the ability to stream the process to any device

- Gaming accessories. G-SYNC monitors, LIGHTSPEED mice, LIGHTSYNC keyboards, 3D Audio headsets, and other devices enhancing the gaming experience

NVIDIA’s main products for the automotive industry

- NVIDIA DRIVE. A platform for developing and deploying autonomous driving systems, combining hardware and software for functions like object recognition, trajectory planning, motion control, mapping, and simulation

- NVIDIA Jetson. A series of computers designed for use in robotics, unmanned aerial vehicles, medical devices, and other industries demanding high performance at low energy consumption. Can be used to create intelligence systems in cars, for example, lane change warning systems and parking assistance systems

- NVIDIA GeForce NOW. A cloud gaming service that can be integrated into in-vehicle infotainment systems to enable passengers to enjoy games while driving

NVIDIA’s main products for the professional visualisation market

- NVIDIA RTX and NVIDIA Quadro GPUs. Offering high-speed and high-quality rendering and graphics for devices of different types

- NVIDIA RTX platform. Providing an advanced set of tools for diverse professional visualisation tasks

- Software. Streamlining GPU operations and supporting numerous third-party applications across various industries

- Cloud platforms. Granting users remote access to powerful graphic resources for work and learning

Chips produced by NVIDIA for AI technologies

NVIDIA Corporation boasts an extensive range of products for the AI market, enabling the company to meet diverse client requirements.

- GH200 Grace Hopper SuperChip. A two-chip system of the CPU and GPU designed for high-performance AI computing

- A30. A tensor core GPU for AI inference and computing for enterprise servers

- A100. One of the world’s most powerful GPUs for AI training and inference. It delivers 312 teraflops of FP16 deep learning performance and 1.6 teraflops in FP64. It supports TF32, MIG, and NVLink technologies for AI acceleration and scaling

- A800. A new GPU specifically developed for the Chinese market, offering a simplified version of the A100 chip

- Ampere Altra. The 80-core Arm Neoverse CPU for high-performance computing. Can work with GPU NVIDIA A100 and DPU NVIDIA BlueField-2 to create comprehensive AI and HPC solutions

- H100. A new server chip for processing AI tasks that is 3.5 times more efficient than its predecessor

China, Saudi Arabia, and the UAE are acquiring NVIDIA chips

In October 2022, the US imposed restrictions on the export of high-performance AI GPUs to China. To comply with the new US export control regulations, NVIDIA Corporation has developed the A800 chip specifically for the Chinese market. One of the major differences between the A800 and the A100 is their data transfer speed: 400 GB/s versus 600 GB/s.

On 9 August, it became known that China’s internet giants were rushing to proactively buy these chips in their concern that the US would soon extend restrictions to cover these models too. The orders placed amounted to approximately 5 billion USD.

Saudi Arabia and the United Arab Emirates are also procuring high-performance NVIDIA chips in large volumes. For example, Saudi Arabia has secured nearly 3,000 NVIDIA H100 GPUs at a price of 40,000 USD per unit.

The growing interest in generative AI has led to a shortage of NVIDIA H100 chips, which are great for AI model training purposes. In April, there was a surge in demand for GPUs tailored for AI applications, when the company coincidently unveiled its new H100 chip. Overnight, its delivery timelines shifted from reasonable to extended, significantly affecting large enterprises and AI labs.

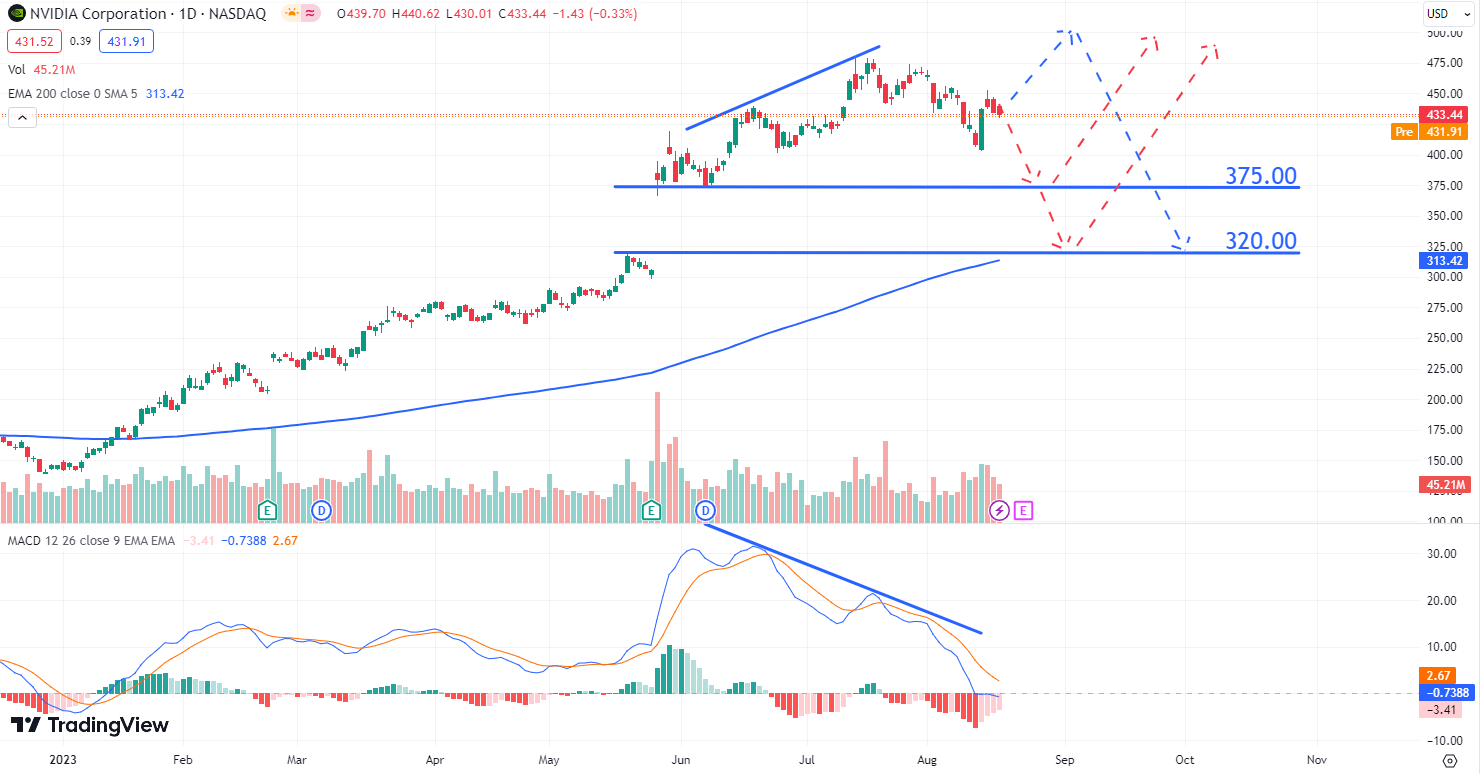

Technical analysis of NVIDIA stock

The stock of NVIDIA Corporation is trading above the 200-day Moving Average, indicating a prevailing uptrend. However, a divergence has formed on the MACD, signalling a possible correction. In this scenario, the stock might seem overvalued, meaning it might decline.

A quarterly report exceeding the expectations of the management and market participants could send the shares skyrocketing. As a result, a new maximum high could be set, while the MACD could form a new divergence. Overall, the probability that the shares will rise further after the quarterly report is low.

If a correction starts, NVIDIA Corporation quotes may drop to the 200-day Moving Average.

Fundamental analysis of NVIDIA stock

Among the fundamental factors that could trigger a correction in NVIDIA shares, two stand out: the release of a weak quarterly report and a pessimistic forecast for the current quarter.

Despite the remarkable upsurge in demand for AI chips, the company might still choose to give a cautious forecast for August to October. This caution could stem from the escalating sanctions against China, which could potentially impede attempts to deliver the corporation’s products to the country.

Another reason for a decline in NVIDIA Corporation shares could be the general negative sentiment in the stock market. On 15 August, the Fitch rating agency warned about a probable forced downgrade on dozens of US banks. If this happens, investors’ risk aversion strategies could trigger the sale of the company's stock alongside a significant decrease in the S&P 500 (US500) and NASDAQ 100 (NAS100) indices.

Summary

NVIDIA Corporation dominates the AI products market, and the progress in this segment significantly bolsters the company’s business. However, it is important to acknowledge that the tech giant’s management has set remarkably ambitious financial goals. For example, the company projects a 64% surge in revenue for the May to July period. It is difficult to say whether the management’s outlook for the current quarter will be as ambitious.

Technical analysis points to an impending correction in NVIDIA Corporation stock. The forthcoming forecast from the company might not be as impressive. In addition, it is essential to recall that sanctions against China are tightening progressively and could lead to the company potentially losing a key client. Should the stock price gain traction following the quarterly report, the quotes are highly likely to subsequently undergo a decline.

However, the situation could radically change following the Fed’s statements hinting at the conclusion of the discount rate hiking cycle. Such information is likely to motivate investors, boosting their willingness to embrace higher levels of risk. Consequently, the stock of NVIDIA Corporation could experience an uptick, further rising in response to advancements in AI. Let us not rule out the prospect of an optimistic outlook for this quarter from the corporation’s management.