Analysis of the US Banking Industry's Profitability: BoA, JPMorgan and Wells Fargo Stock Forecast

9 minutes for reading

The three largest US banks by market capitalisation Bank of America Corp. (NYSE: BAC), JPMorgan Chase & Co. (NYSE: JPM), and Wells Fargo & Co. (NYSE: WFC) published their quarterly earnings reports from 13 to 17 October 2023, reporting better-than-expected results. Investors' response was, however, mixed with the shares first rising but in a few days returning to their previous levels. At the time of writing on 23 October 2023, they continue to decline. What results for Q3 2023 did the financial institutions post? Why are investors not rushing to buy their shares and what does technical analysis of these stocks show? We will answer these and other important questions in today’s article.

Analysis of JPMorgan’s Q3 2023 report

The largest US bank by market capitalisation JPMorgan Chase & Co. reported its Q3 2023 financial results on 13 October 2023.

- Revenue increased by 21% from the corresponding period of 2022, reaching 40.7 billion USD

- Net profit rose 35% to 13.15 billion USD or 4.33 USD per share

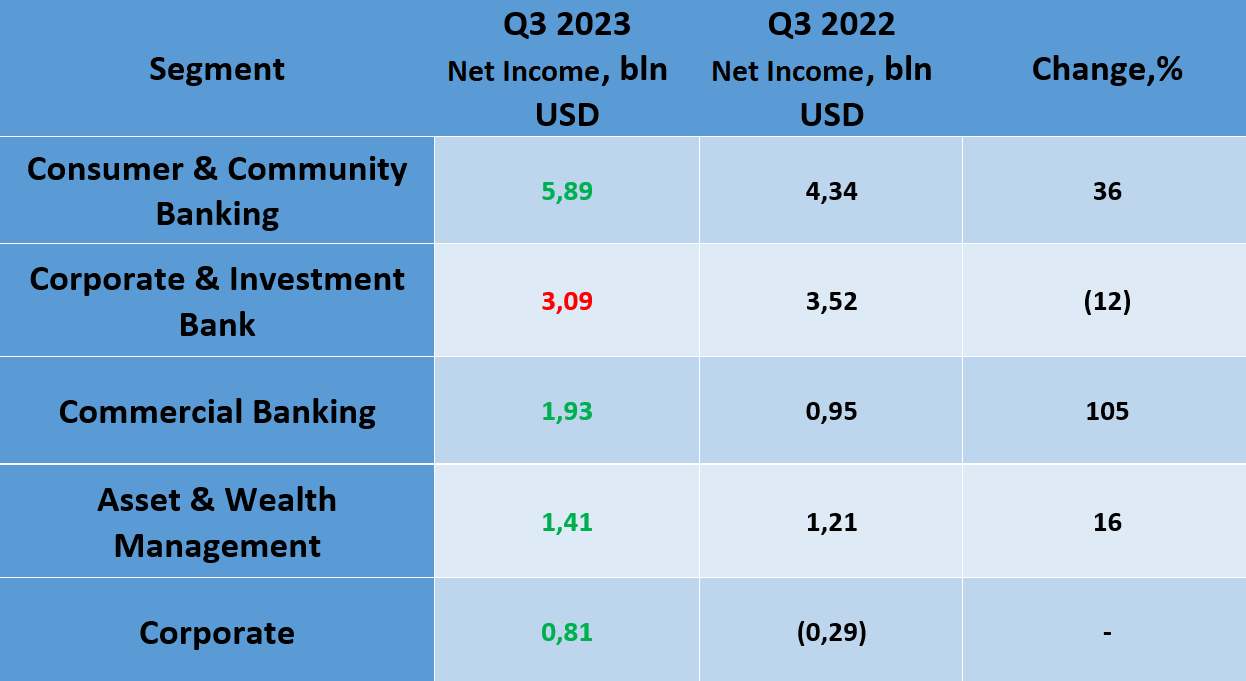

JPMorgan profits for Q3 2023 by segment

The Consumer & Community Banking segment generated the biggest profit of 5.89 billion USD in Q3. Demand for home lending is growing. The Corporate segment became profitable, bringing in 0.81 billion USD. Interest income has increased, driven by discount rate hikes by the Fed. Commercial Banking showed the biggest percentage gain in profit, reaching 1.94 billion USD, probably driven by a rise in the number of loans granted.

Jamie Dimon, CEO of JPMorgan Chase & Co., noted that the business continues to develop and adds new clients. According to him, the bank ranked first in US retail deposits based on Q3 results and growth from new open accounts was over 3x that of peers. He also expressed concerns over a developing conflict in the Middle East, which threatens the stability of energy and food markets. Dimon noted that a tight labour market, increasing US debt levels, and fiscal deficits may fuel inflation and lead to further monetary tightening.

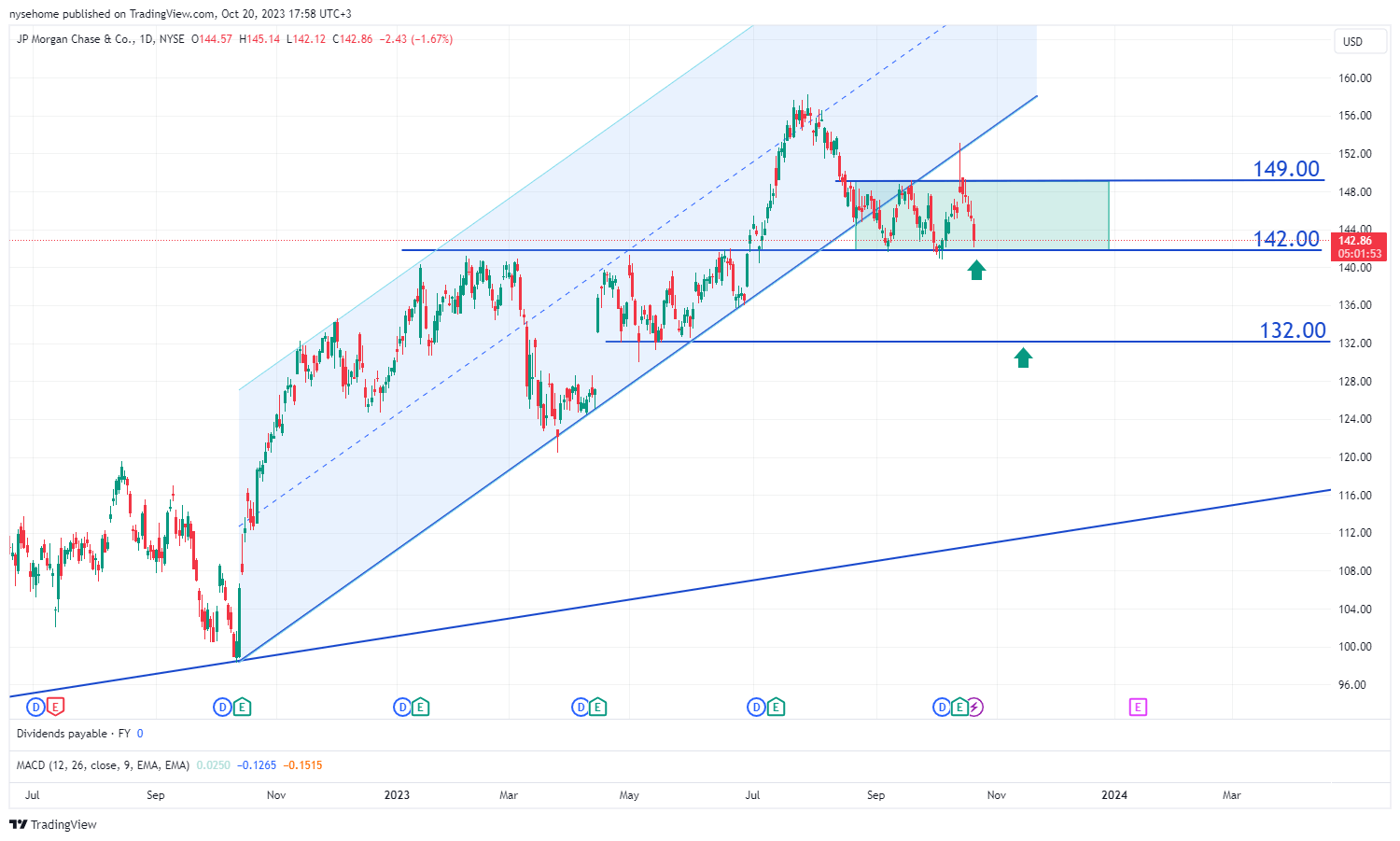

JPMorgan Chase stock live price chart

JPMorgan Chase stock live price chart

Investors’ response to JPMorgan Q3 2023 report

JPMorgan Chase & Co. stock is trading 12% below its all-time high, which may be an indication of investor interest compared to competitors’ stocks. According to technical analysis, the quotes have broken the ascending trend line, signalling a potential completion of the previous trend and a price decline.

The stock is testing the support level at 142 USD. A breakout of this mark might push the price down to the next support level at 132 USD. The financial performance of JPMorgan Chase & Co. appears excellent, but technical analysis of the shares in a short time frame indicates a potential drop in the quotes.

Analysis of Bank of America Q3 2023 report

Bank of America Corp. released the Q3 2023 report on 17 October 2023.

- Revenue rose 2.8% from the corresponding period of 2022, up to 25.2 billion USD

- Net profit increased 9.8% to 7.8 billion USD

- EPS gained 11.1%, reaching 0.90 USD

From July to September 2023, Bank of America allocated nearly 2.9 billion USD for dividend payouts and stock buybacks. All financial indicators exceeded the statistics for the corresponding period of 2022. Furthermore, the bank has reported stronger-than-expected results for the fifth consecutive quarter.

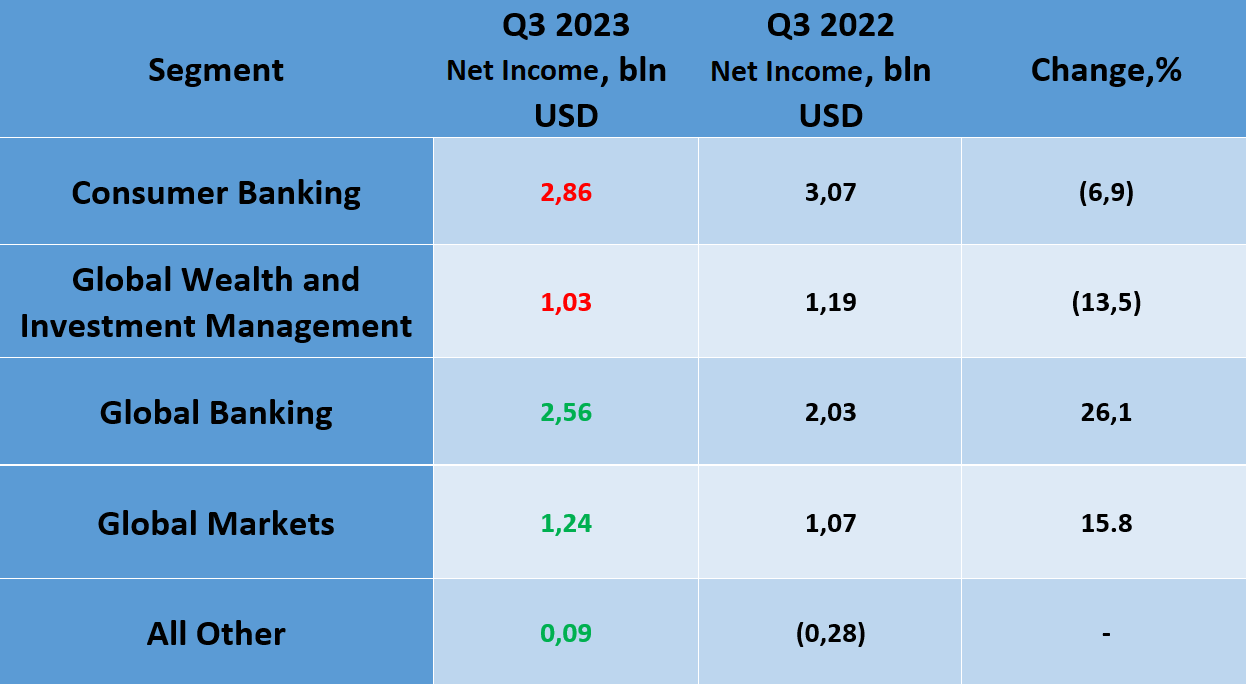

Bank of America profits for Q3 2023 by segment

Based on Q3 results, all segments of Bank of America Corp.’s business generated profits. It is worth noting that Consumer Banking and Global Wealth and Investment Management have seen a decrease in profits compared to the Q2 2022 results.

Brian Moynihan, CEO of Bank of America Corp., noted that the bank had delivered strong earnings results but also pointed to a gradual decrease in consumer spending.

Bank of America stock live price chart

Investors’ response to Bank of America Q3 2023 report

Bank of America Corp. shares are trading 45% below their all-time high despite the bank’s quarterly revenue in 2023 setting new records. The release of another quarterly earnings report, which topped analysts’ expectations, did not inspire investors. Their response to the July to September results was short-lived with the stock price rising and in two days dropping to the previous level.

In March 2023, when First Republic Bank faced problems, which spread panic among clients of financial institutions, Bank of America Corp. shares hit their low of 26 USD. In early October 2023, the quotes tested this support level but did not break it, rising to 28 USD.

The Q3 2023 report could not support an upward movement of the quotes. The price is expected to test the support at 26 USD again. Given the financial performance of Bank of America Corp., it is likely to rebound from this level. If not, the stock value may decline to 22 USD, which could signal a lack of investor interest in the shares.

Analysis of Wells Fargo Q3 2023 report

Wells Fargo & Co. announced its Q3 2023 financial results on 17 October 2023.

- Revenue climbed 6.6% to 20.9 billion USD from the corresponding period of 2022

- Net profit rose 60% to 5.77 billion USD

- EPS added 72%, reaching 1.48 USD

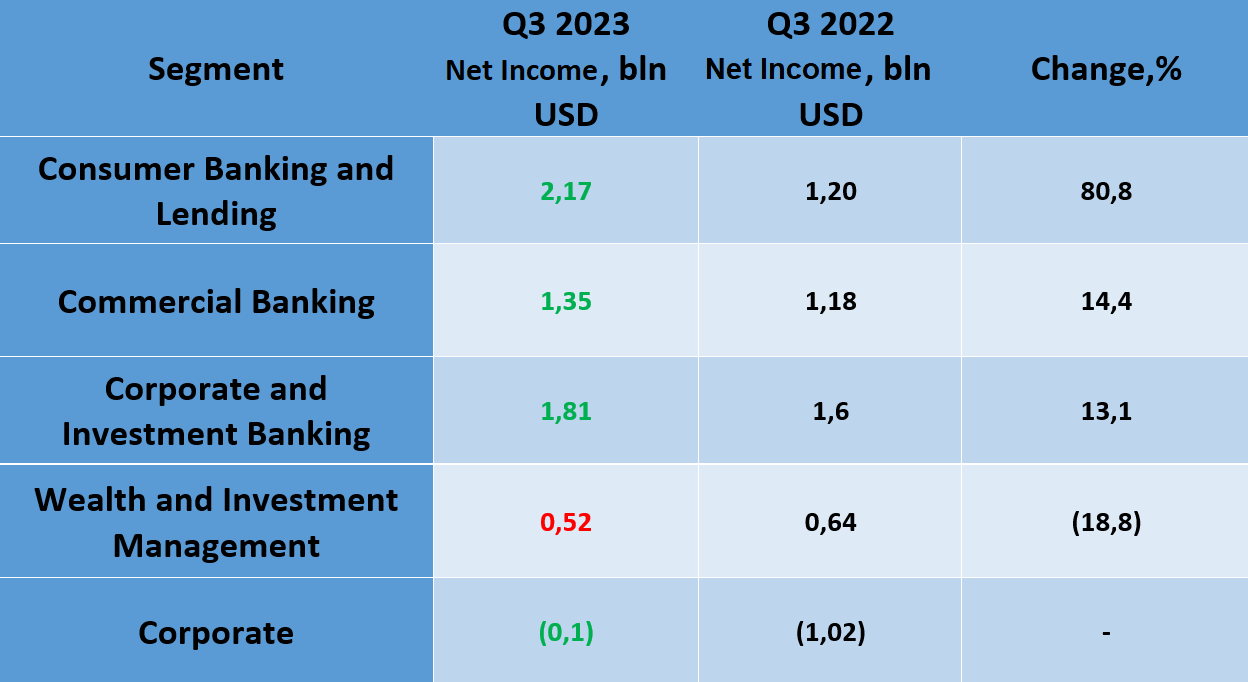

Wells Fargo profits for Q3 2023 by segment

Compared to the same period of 2022, nearly all business segments of Wells Fargo & Co. have seen an increase in indicators, except for Wealth and Investment Management. The company attributes this to clients switching to the bond market, where interest income was considerably higher than in 2022 due to discount rate increases.

In comments to the report, CEO of Wells Fargo & Co. Charlie Scharf noted a slowdown in the US economy, which is affecting the bank’s clients. As a result, loan balances start to decline, which could lead to a decrease in interest income in the future.

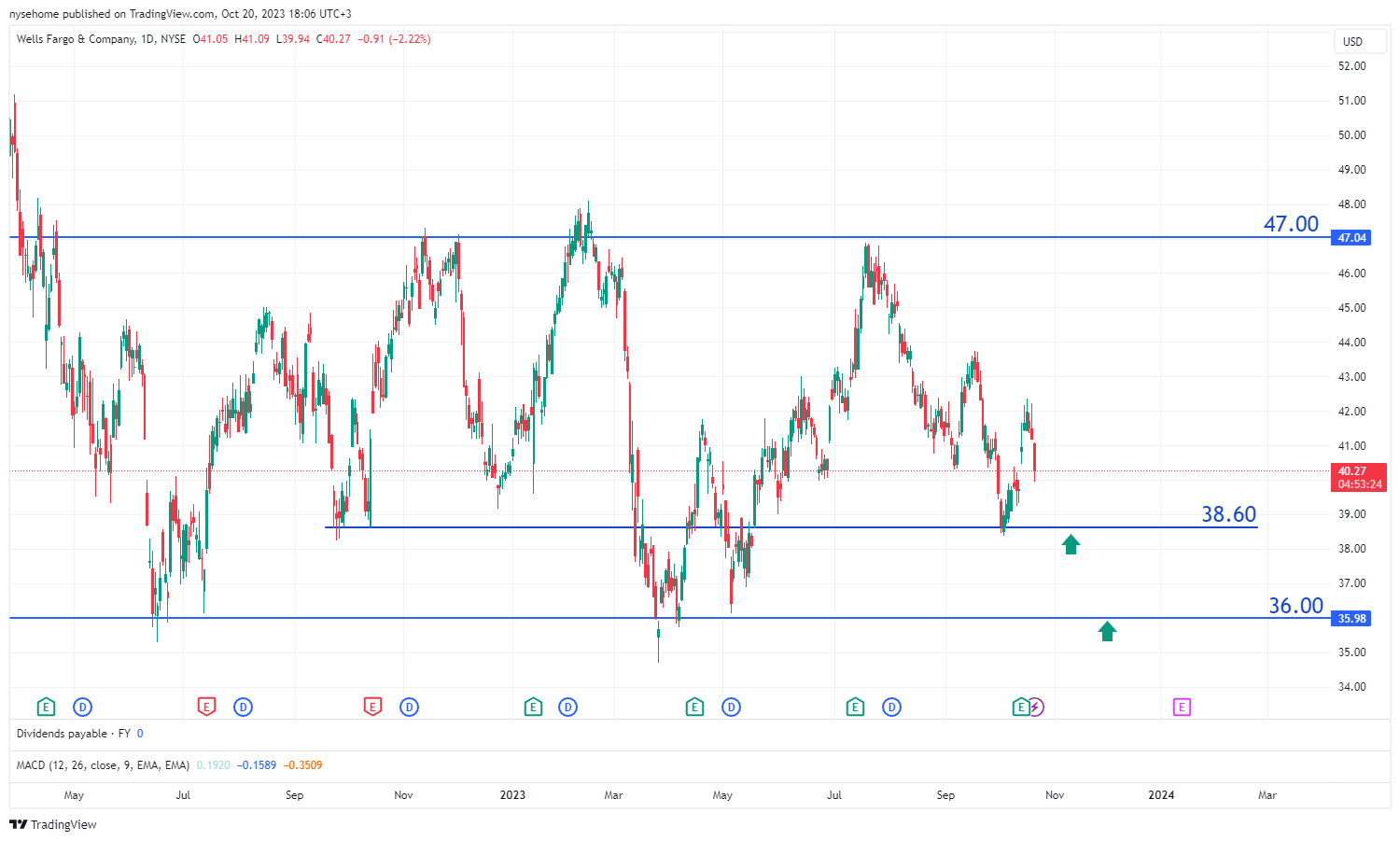

Wells Fargo stock live price chart

Investors’ response to Wells Fargo Q3 2023 report

Wells Fargo & Co. stock is trading 30% below its all-time high. Since June 2022, the stock value has been ranging from 36 to 47 USD on the chart, and it remains within the range. In July 2023, the quotes rebounded from the upper range boundary, heading towards the lower one. Robust quarterly statistics could not stop this decline. The nearest support level at 38.60 USD is likely to be tested. Should this level be breached, the quotes could reach the lower boundary of the range at 36 USD.

Why are investors not rushing to buy shares of these banks?

March 2023 brought shocking news about the bankruptcy of Silicon Valley Bank, caused by clients rushing to return their funds. When opening deposits to clients, the bank invests their funds in various assets, including bonds, and later pays interest on deposits.

When the Federal Reserve began to raise interest rates, the cost of refinancing increased. To support financial stability, companies decided to use funds in their accounts. But Silicon Valley Bank had invested them in bonds, which showed an unrealised loss in March 2023.

Financial institutions have provisions in case clients claim their deposits, but this time, the demand for claims was too high. To satisfy clients’ requests, Silicon Valley Bank had to sell bonds at a loss but still failed to raise enough funds. As a result, on 17 March 2023, Silicon Valley Bank announced its bankruptcy. Unrealised losses now discourage investors from investing in banks.

Bank of America Corp. reported unrealised losses of 131 billion USD in the Q3 2023 report. Unrealised losses of JPMorgan Chase & Co. reached 40 billion USD for July to September, up 6 billion USD from Q2. Wells Fargo & Co. did not provide information on such losses.

The current situation in the banking sector suggests that the bank is not at risk as long as it does not have to sell bonds. Coupon yield is paid on bonds with the bond value paid on maturity. However, once the economy faces problems and clients start to withdraw funds from their bank accounts en masse, this could have serious implications for representatives of the banking sector. To solve problems, banks will be forced to sell bonds at a loss.

According to Q2 2023 data, the free cash flow of Bank of America Corp., JPMorgan Chase & Co., and Wells Fargo & Co. reached 969 billion USD, 1.4 trillion USD, and 318 billion USD respectively. Given this, the problem of unrealised losses may be exaggerated for these banks. However, it is worth noting that no bank in the world can survive clients’ panic without state support.

Summary

Bank of America Corp. stock seems to be weaker compared to shares of the other two banks featured in the article. In addition, the unrealised bond losses of this bank are three times higher than those of JPMorgan Chase & Co., which may also have a negative impact on the quotes.

JPMorgan Chase & Co. is the largest US bank by market capitalisation and has a strong balance and a low ratio of unrealised losses to free cash flow. Its shares are hovering near their all-time high and are the only one of the three stocks to show a positive yield of 10% since the beginning of 2023.

There is no data on Wells Fargo & Co.'s u nrealised losses. Investors are showing mixed interest in the bank with its shares trading within a sideways range for a long time. It is worth noting that the financial performance of all three representatives of the banking sector exceeded experts’ forecasts and results for the corresponding period of 2022.