Let's get acquainted with the history of its appearance and development, its main statements and rules of Wave analysis.

All posts

Price Action is focused on the price movement, uses indicators scarcely, features simple and clear rules, it remains an efficient instrument in the hands of an experienced trader.

One of the set phrases of tech analysis goes: "The current trend will be developing until it reverses". It pushes us to the idea that every trend will finish and reverse sooner or later. In this article, we will learn to detect such reversals.

On Forex, under a signal, we mean a complex of circumstances, indicators, and events that show the trader in which direction they should open a trade, in other words, whether they should buy or sell.

To answer the question in the heading we need to understand what is a flat. In literature, this is characterized as a sideways movement without clear direction up- or downwards. To put it simply, the price is moving to the right, the local maximums and minimums are on the same level.

Hi everyone, today I'm going to talk about false breakouts. In certain cases, it might be unclear to the trader whether there has happened a breakout of the resistance level and, hence, the bullish trend will continue. Such a breakout might be false so that the price will reverse quite soon and go in the […]

Non-Farm Payrolls (NFP) are essential data on employment in the USA, which shows changes in the number of employees out of the agricultural sector of the country during the last month. The indicator is based on a poll answered by some 400,000 companies and 50,000 households. Empirically, it has been figured out that if the NFP increases stably by +200,000 every month, the GDP surplus equals roughly 3%.

The Head and Shoulders pattern is a classical pattern of technical analysis. Let s have a look at its main elements as well as the characteristics of trading with the use of it.

The Flag and Pennant patterns appear rather frequently on price charts. They are trend continuation patterns, working in the presence of a strong trend, same as trend reversal patterns. When such patterns appear, we may forecast that the trend will continue.

A trend is defined as a sequence of maximums and minimums. If we say that there is a bullish trend on the market, it means that every next maximum is higher than the previous one and every next minimum is also higher than the previous one. In this case only, we may presume that the trend is ascending and try buying.

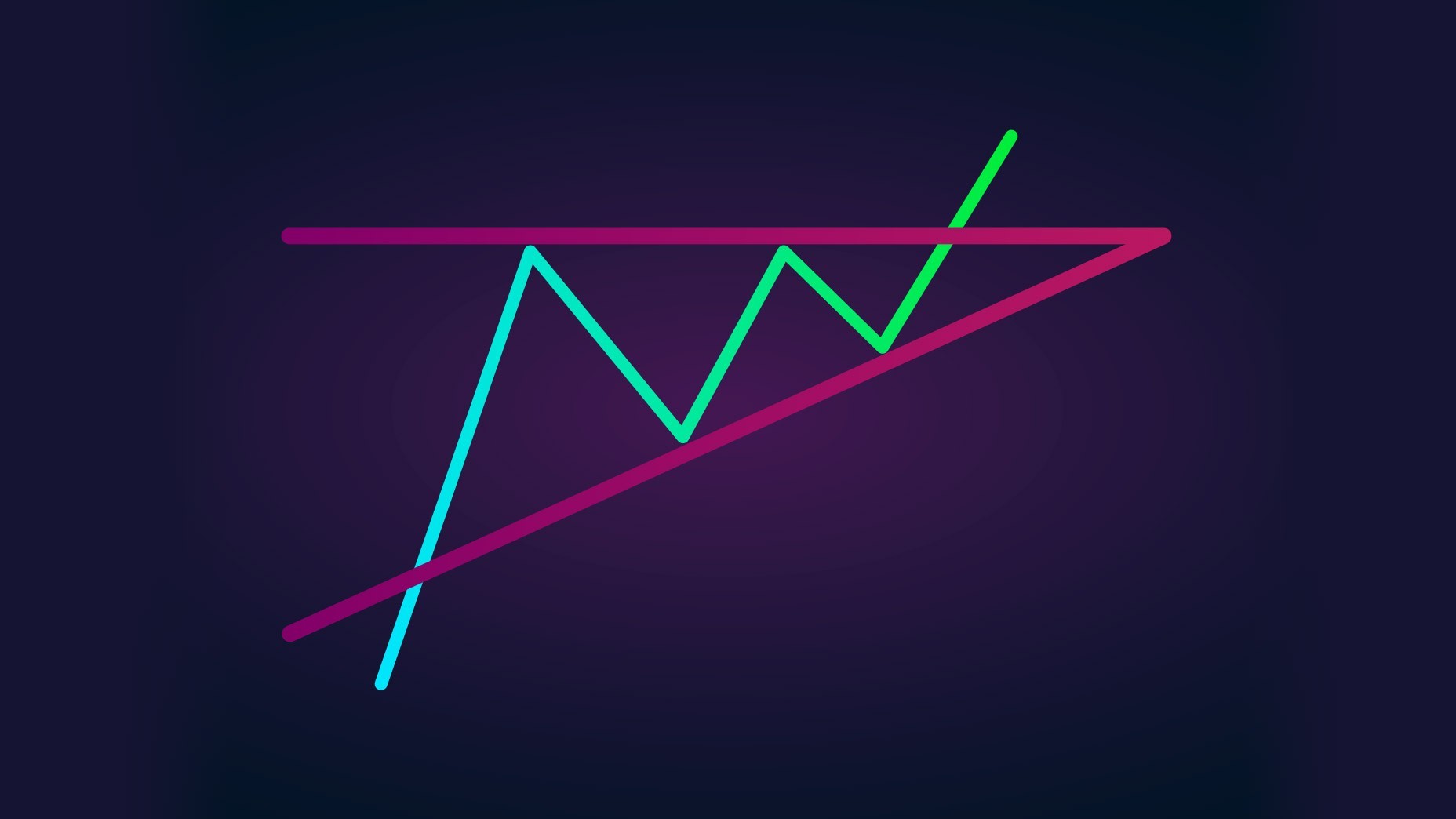

The Triangle pattern appears on different charts rather frequently. Normally, the Wedge is considered a reversal pattern, forming on maximums and minimums of a price chart in an up- or downtrend. A Wedge is quite similar to a Triangle, forming between the two converging support and resistance lines.

This structure of price movement is, in fact, a Wedge pattern. According to the author of the method, a trader should have their unique features and use rare trading instruments in order to be different from the rest of the market players. The Wolfe Waves pattern is able to provide a beginner trader with the keys to a new understanding of market behavior. However, as with any other trading strategy or technical instrument, no matter how successful its trading history may be, much depends on the hands the instrument gets in.

Forex is the largest market across the globe that accounts nearly 90% of all capital markets. Its yearly turnover is ten times bigger than the overall world's GDP.