Opera Limited: Traders Awaiting the Report

3 minutes for reading

Opera Limited (NASDAQ: OPRA) is publishing its earnings report on Feb 21. The company's IPO happened just 6 months ago, and this is just its second quarterly report. However, we have already got some data for analysis.

Opera financial details

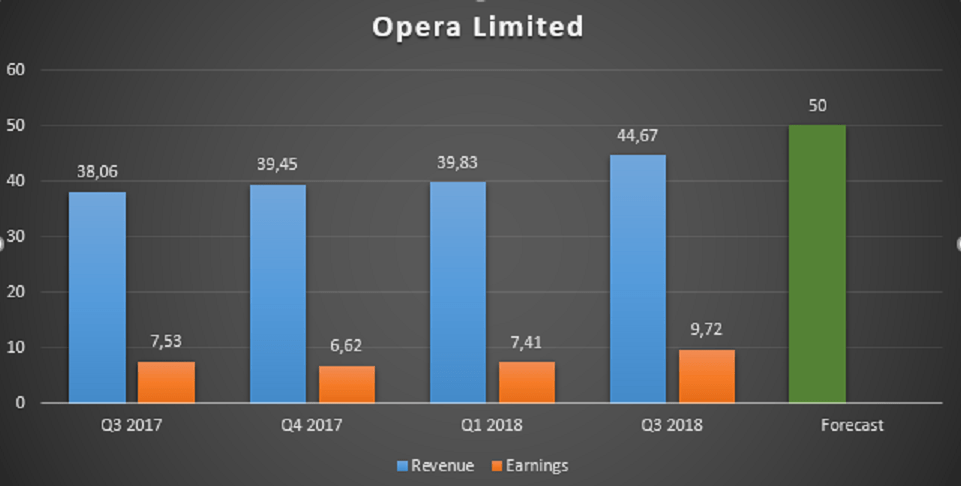

First, let's see its financial details for Q3 2018 and compare them to those before the IPO.

The chart shows the revenue and profit are both increasing; still, the stock price has fallen by around 50% since the IPO and are just recovering now. This IPO was very far from a successful one.

Opera IPO

The investors who bought Opera shares during the road show were then able to sell them gradually in order to lock in the profit. They could have also sold them all at once when the price started going down, but the lockup was still on. Now that it's finally off, the stock is floating freely.

In Q3, there were two main sources of the company's profit:

- 42.70%: Search engine

- 39.40%: Ads

After the IPO Opera reached record highs in revenues, hoping to get $50M in Q4. The company is actively operating in Africa, its flagship product now being Opera News, an AI-based content platform with 121.40M of active users.

Partnership with Ledger Capital

In October, the company partnered with Ledger Capital, a blockchain company; this partnership may also help Opera to get more profits. The company also invested $30M into StarMaker, a quickly growing social network company that enables recording and sharing audio clips, cooperating with musicians and subscribing to your favorite ones.

Opera's share in StarMaker is now 19.35%, and the company wants to make it 51% by 2020. As mentioned above, Opera's IPO was quite unsuccessful, with the share price going down from $12 to $5.50. The management's opinion on the price was not at all the same as the market's. Frode Jacobsen, Opera's COO, said the plunge in prices has nothing to do with the financial data and the company plans. The Board even bought back around 15% of the sold shares in order to show the investors they are sure about the company's future.

Opera stocks tech analysis

Due to tech analysis, a reversal head and shoulders pattern is forming, which may mean the price is ready to rise to $12 again. It was also able to break out the 50-day SMA and stay above, which confirms the possibility of rise. The immediate support is at $7, and it may well get tested soon; if the price bounces, it may reach $12 or even higher numbers.

Opera Limited is currently not a very large company with the market cap of $900M, so large institutional investors don't take it into account yet. It is not in the media either, that's why it's still in the background of the giants. Once the professional investors decide to start buying it out, everything may change and the price is then sure to rise. The management is very much sure of the company's future, which can be confirmed by the buying out. By investing into Opera Limited, one may be rather sure they will get some good profits in at least a year.