Today, we''ll focus more on technical analysis, using fundamentals only to confirm the tech analysis result or prove it wrong. In practice, tech analysis often predicts the events the retail investors are not aware of.

Insider trading exists even in the US stock market, where this can lead to legal actions. The knowledgeable traders thus start acting early, and their actions do reflect in the stock price. A few patterns can well tell where the price may go in the future. Fundamentals are also important. When a large investor wants to lock in their profits, the market's reaction may not allow them to do so. To avoid this, the investor will close their positions when a good piece of news is released. Still, tech analysis will show the true intentions of the investor.

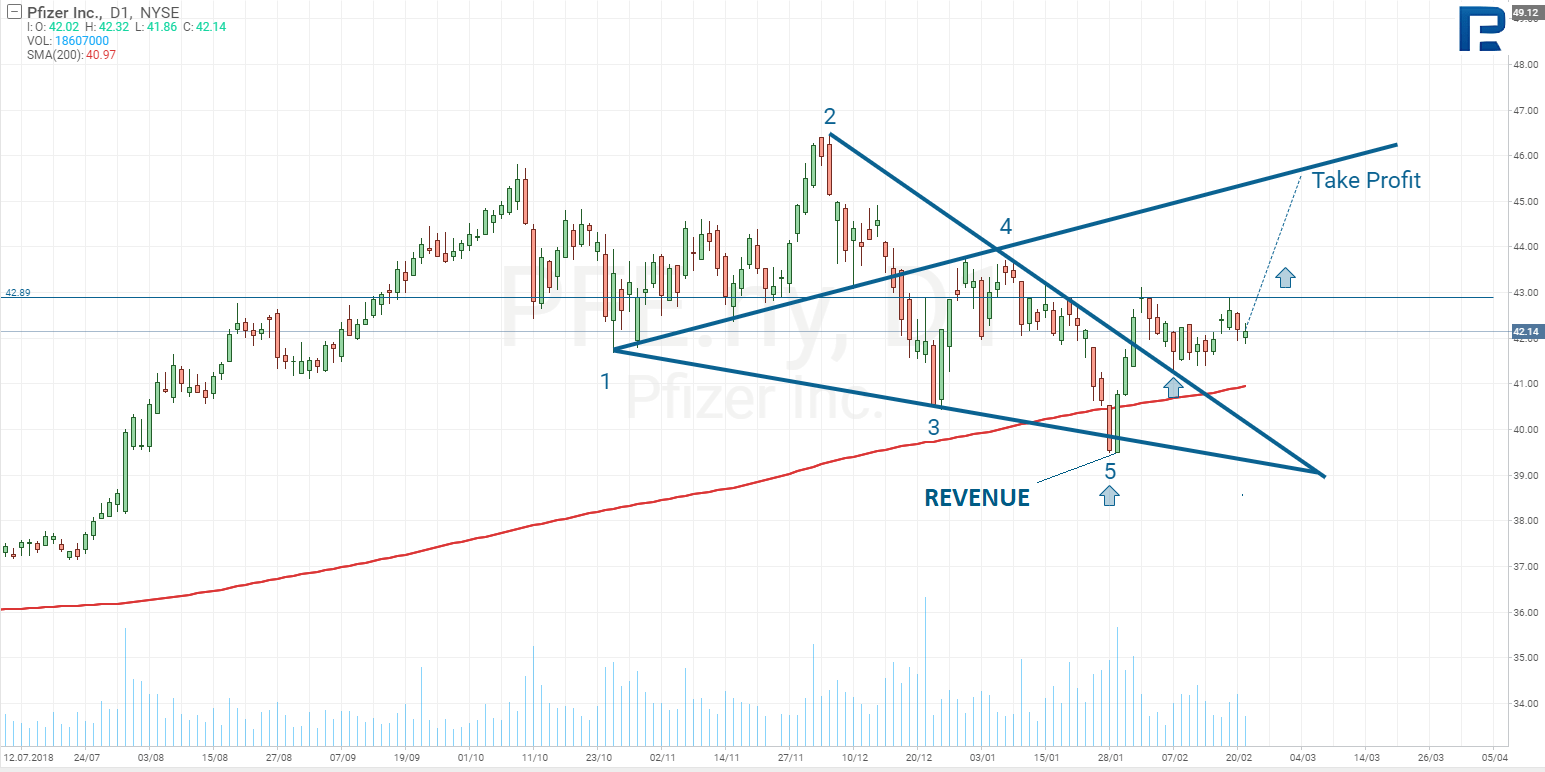

Instead of re-investing the wheel, we'll take the famous Bill Wolf tech analysis model and apply it to Pfizer. Pfizer (NYSE: PFE) is one of the largest pharmaceutical companies in the world. It happened so that the Wolf pattern appeared in this particular stock. Let's analyze it in detail.

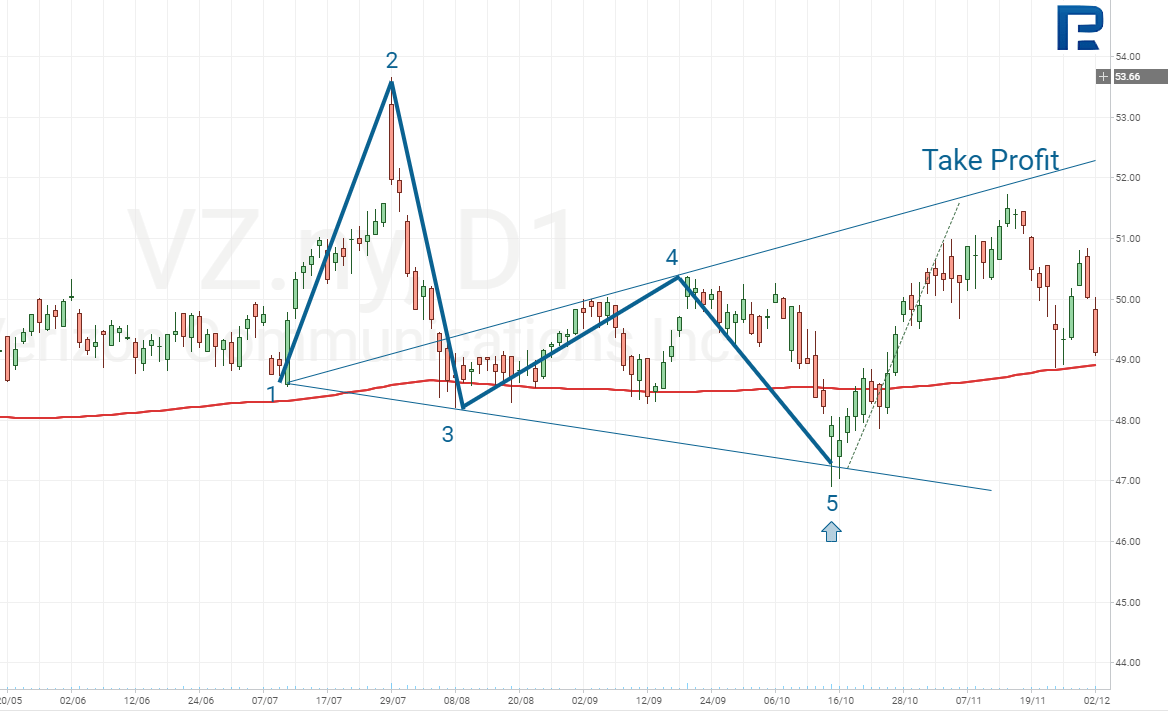

5 waves of the Wolf model

When the price bounces off the bottom line at 5, this is considered a buy signal.

In Pfizer's case, the price already made this bounce and started moving towards the target.

As mentioned before, tech analysis sometimes helps identify the events we are not quite aware of. Here, the bullish pattern started forming as early as in October 2018. At that time, there was nothing that showed it, but in January it was already visible.

Fundamentally, Pfizer merged with GlaxoSmithKline in December, with the sales reaching $12.70B. The market reacted positively, sending the price by 10% up, but then the stock reversed and went down by 11%.

By January 28, the Wolf pattern was already in full, and the buy signal could be triggered with any major event. This event was the earnings report released on January 29. The report beat the expectations and sent the stock higher. All this had been signaled with the tech analysis.

So the fundamental factor helped the price in the beginning, but now the stock needs good news every now and again to reach the target. One of such pieces of good news was the approval of the European Commission of Zirabev, a medicine designed to treat some types of cancer. This pushed the stock up and helped it form a resistance at $43, which may then lead to the price reaching $46.

Besides, Tanezumab, a medicine against backache, is undergoing clinical studies and is so far doing good. In the US, around 40% of employed people suffer backache, that's why the Department of Health is supporting the new drug and the company.

In 2017, Pfizer's patent on the famous Viagra expired, and any other company may now release similar drugs. Pfizer lowered the price by twice in order not to lose the market share and created a cheaper comparable. The marketing campaign around Viagra was so massive anyway that people will still buy it, especially at a lower price. From Dec 1 2018 to Jan 31 2019, around 65% of all prescriptions in the US involved Viagra.

Inlyta, another drug, this one combined with Keutruda by Merck (NYSE: MRK), may also act as a driver. This combination shows the best results in cancer treatment compared to all others.

Conclusion

Pfizer is the largest pharmaceutical company. After the merger with GlaxoSmithKline, the competition will have even more problems dealing with it. The profit, meanwhile, depends not only on the drugs amount, but also on the number of patients. The UN stats say the Earth population is going to grow; thus, the number of patients and, logically, the demand for medicines, will increase, too. What will happen with the company in a couple of years yet remains to be seen, but for the following month, the stock looks quite good to buy till it reaches $46.