COVID-19 Second Wave: Which Stocks to Buy?

6 minutes for reading

Autumn has come. Before the pandemics, people would be coming from holidays, having had a rest, and ready to work.

Summer used to be a quiet time in stock markets; investors normally “woke up” closer to autumn. I would also like to note that the global falling of stock indices also started in autumn, most often.

This year, the situation is completely different. People have almost nowhere to go being on vacation. COVID-19 closed the borders, and the countries that do allow tourism are not enjoying active demand because potential travelers are afraid of the virus in a foreign country where you may have trouble seeking medical help.

All in all, this summer turned out abnormally active in stock markets, stock indices renewed all-time highs, and the stocks of certain companies doubled in price. However, even with such a summer, autumn started with a slump in stock indices, as scheduled.

For example, the S&P 500 during the last two days of the previous week dropped by 5%, while normally, the quotations more for 0.5%-0.8% per trading session.

Now those investors who missed the growth of stock prices in summer have to look for something to make money on.

Let us hope that we are not having another crisis this autumn. Apart from the bubble swelling in the stock market, there are no reasons for it now. A bubble may go on swelling for years but we need to stay alert.

What to pay attention to?

Unfortunately, autumn means not only an increase in the activity of investors but also in the cases of respiratory diseases, which means the second wave of COVID-19 is inevitable.

Russia states that it has the vaccine, and the population is already receiving injections as the third phase of testing. Compared to the world population, the share of vaccinated people will be insignificant, especially that many doubt the efficacy of the Russian vaccine. This means that not all countries will buy the vaccine from Russia but more likely tend to develop their own.

I would like to draw your attention to a company working on the vaccine against COVID-19. This autumn, this topic is becoming urgent again, so investors will turn to pharmaceutical companies as they did in spring.

We will not wait for the media but look for promising companies ourselves.

However, this time I will draw your attention to the companies that are just at the start of developing the vaccine instead of those that are close to its completion. The logic is simple.

Food and Drug Administration certificate

For a company to sell its drug in the USA and abroad, it needs to be certified by the US Food and Drug Administration. And for this, the drug has to pass 4 stages of testing. In more detail, I spoke about this in another article.

Most drugs withstand testing up to stage 3 but many fail it. However, as soon as the drug comes to each stage of testing, the company’s stocks sky-rocket; the chances that the product will get to stages 1 and 2 are very high. This is the reason why I advise paying attention to the companies that are just taking off.

IMV Inc.

One such company is Canadian IMV Inc. (NASDAQ: IMV).

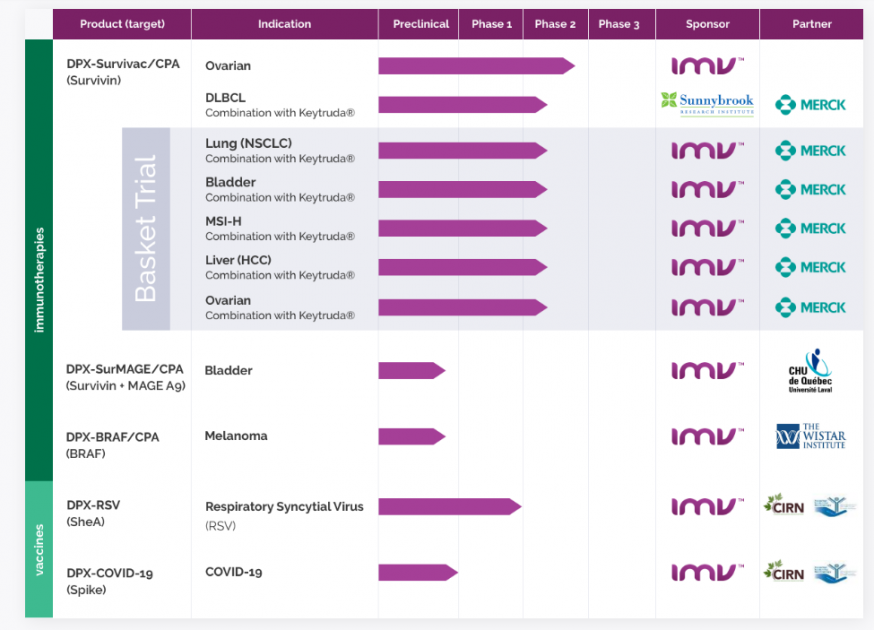

IMV Inc. is a biopharma company inventing anti-cancer immunotherapeutic drugs and vaccines by their patented technology. The company now has some 11 drugs passing different stages of testing, including a vaccine against the coronavirus called DPX-COVID-19 that is expected to be through pre-clinical testing soon and start a new phase.

Canadian government providing financial help

Each country struggles to create its own vaccine to be less dependent on other countries or companies. As a result, governments support financially the companies that work on the vaccine. IMV is no exception here.

In August, the company got 4.75 million CAD of financial help from the Canadian government. The sum is not large but alongside it, the company got financed by the NRC IRAP, receiving 600 million CAD. The money is allocated directly to the development and promotion of the vaccine.

Currently, the company is keeping an eye on the inventions of other companies, assesses their results, and corrects its own project. Of course, testing may not be shortened, and even if the company gets the vaccine, it will appear in the market later than those vaccines that were begun in spring. However, now that we have much more information about COVID-19, the probability of failure is much less.

The management states that phase 1 of testing will begin in September and might take 3 months. Most attention in the research is paid to elderly people with weak immunity because they are in the risk group.

What do we know about DPX-COVID-19?

DPX-COVID-19 is a mixture of several SARS-CoV-2 peptides that provoked a strong immune response in animals during pre-clinical testing. The vaccine has good chances for quick and large-scale production, which is important because if it passes the tests demand will be higher than supply. More details about the drug – on the company’s website.

I am no physician and have a vague understanding of all those terms: I only evaluate probabilities and look for a company that might come to the center of attention. Spring-2020 demonstrated how much demand pharmaceutical companies may enjoy. In autumn, the situation may repeat.

IMV stocks already cost 4 USD each. In April, the price remained under 2 USD, but that time the company did not even have a candidate for the vaccine. Nonetheless, this did not prevent the price from doubling in price. Now the situation has changed radically, and there are reasons for the further growth of the stock price.

It is no secret that many companies are working on the vaccine. SO, there are many stocks to make a profit on if the COVID-19 topic comes back to the surface. In this case, you may choose out of two investment options.

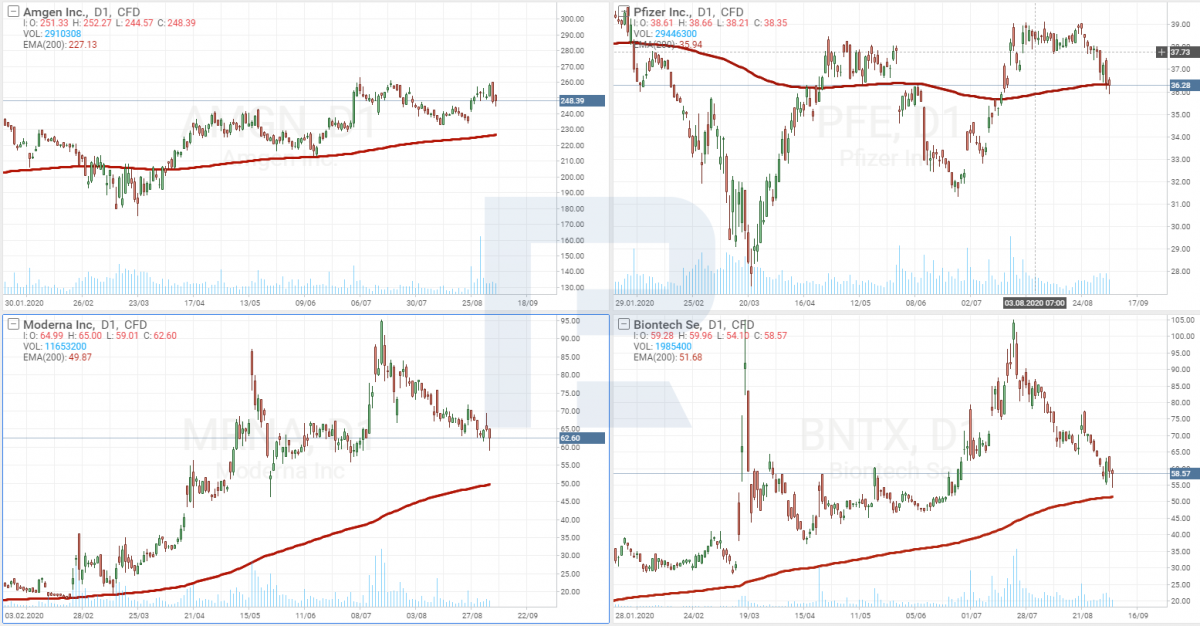

Option one is investing in the largest companies that are developing the vaccine. Such companies would be Pfizer Inc. (NYSE: PFE), Amgen, Inc. (NASDAQ: AMGN), Moderna Inc (NASDAQ: MRNA), and BioNTech SE (NASDAQ: BNTX). However, these companies are so large that the share of their income from selling the vaccine may not be as big as expected, in which case the stocks will not react by the growth of 500 or 1000%.

Option two is choosing small losing companies working on the vaccine. In this case, the profit from selling the vaccine will become the main driver of the stock price, and probability may be beyond expectations. And that is why I suggest considering IMV Inc.

Summary

The time has come to pay attention to pharmaceutical companies again. Today investors have much more information about the companies working on the vaccine than they had in spring, which makes choosing easier. However, you need to realize that investments in the biotech sector have always been the riskiest ones, even nowadays. That is why I recommend using minimal leverage.