Is It Worth Buying Tesla?

6 minutes for reading

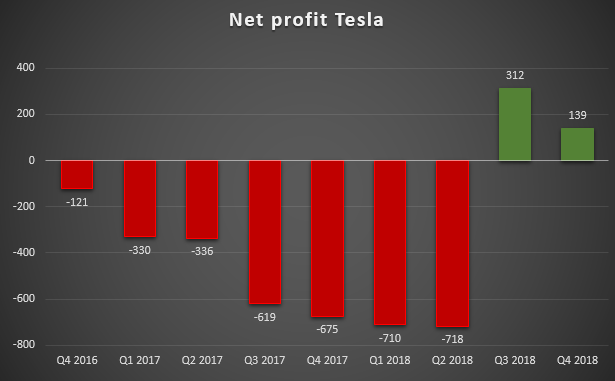

In 2018, Tesla (NASDAQ: TSLA) booked its first net profit since the IPO. This could have pushed the price even higher and make the money flow rapidly into the stock, but in fact the rising tide active since 2010 stopped, while the bears were finally able to start their short selling.

Tesla stock fundamentals

Fundamentally, the stock should stop rising indeed, with the company's losses making higher highs and hitting a historical high in 2018.

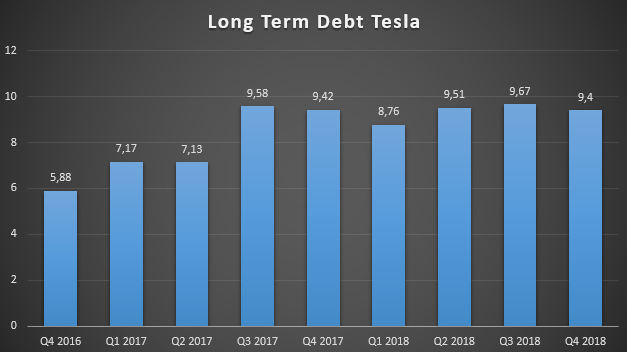

Tesla's debt has also been rising, now being around the highs as well.

Of course, short selling seemed the best thing to do. While Elon Musk was constantly talking about larger production, the time lines were postponed a few times, and no promises were kept, with the sellers being even more sure of their positions. Musk even tweeted a warning to the bears, but those got even more active, trying to 'beat' him and show him he was wrong. They were those who were finally beaten, though; during 2016-2018, the sellers lost around $5B. This proves that fundamental analysis is not always the best thing to follow.

Were the sellers really so much mistaken?

Every product's value is as much as people put into it. Sometimes, the price may be hundreds or even thousands times higher than the 'fair' one, as long as the product is heated by the demand. Thanks to Elon Musk, Tesla has always been at the top. The company developed techs not used by large automotive manufacturers before, and, as usual, the investors tend to follow and like things that are not well-known. Tesla got so much into focus that the name itself shortly became a famous brand, and owning a Tesla car started being considered prestigious, similar to owning an iPhone.

In 2013, 4,750 Tesla Model S cars were sold at $95,000; this is more expensive than Mercedes Benz S or BMW7, the latter being quite reliable and famous. In case of Model S, the owner got an electric car with limited infrastructural capabilities and the autopilot function that was still imperfect and had already been to blame for a few lethal accidents. The mere demand, however, shows that the investors didn't want to notice the risks and inconveniences. Meanwhile, the sellers just analyzed the financial indicators and remembered that Tesla was about to go bankrupt - and not just once. With higher debt and insufficient sales, the company had to sell bonds, which made the debt even larger.

Once the US economy had slowed down, Tesla would have been among the first to go bankrupt. This is why Musk made haste to increase the production capacity, and succeeded, although the conservative sellers just did not believe this could happen, taking into account that the latest US crisis happened over 10 years ago, and it was high time a new one would start. It may start soon indeed, but the sellers have already been unable to make it: Tesla booked its net profit, making this selling strategy totally irrelevant. Not that the bears did not know well what they were doing, it's just the crowd finally beat them.

Tesla: What Comes Ahead

Tesla is feeling much better than a couple of years ago, while the electric cars are still in demand. Owning a Tesla car is considered high class, while new cars will now be also released outside US, namely in China, where the company is ready to launch its first factory in May. This is happening because of the Sino-US trade wars that are threatening with more tariffs on non-US cars. Thus, Tesla is taking very important strategic decisions, to say nothing of the technical ones, such as reducing the battery charge time. Conquering the markets and risk management is what matters primarily.

Traditional car manufacturers are already having problems, which may be proved with General Motors and Ford factories being closed, while Tesla may even buy some facilities from GM in order to increase the capacities. It looks like large automotive corporations thought they could last with combustion engines forever. Nevertheless, the cars of this type have already been dominating for too long. Over the last few years, hydrogen, water and other types of engines were invented, even a firewood one; these techs have not been developed yet just because the respective resources are not regulated by anyone, while oil and electric power belong to governments and corporations.

Tesla: What to Expect

Tesla is quite unique; there are many companies producing electric cars, but no stock of those costs over $50. GM gets over $38B quarterly, with the P/E at 7.21, while the stock costs just $38. Ford stock, with even better earnings and P/E, is just $8. Meanwhile, Tesla's quarterly earnings are $7.2B, the P/E is 44.97, and a single share costs $284.

One doesn't even need to be a market expert to understand that Tesla stock is very much overpriced. This happens only because of the high demand which currently is falling. Meanwhile, with the stock going down, more negative events, such as closing land-based stores and going online, appear in the news; some may even think Tesla is getting ready to stop selling the cars, while this is of course untrue.

On the other hand, people are already speculating on the Q1 2019 earnings report, some saying Tesla won't be able to hit the net profit. Elon Musk has not yet dealt with the legal action against him, after his announcement on planning to make Tesla private. Some time ago, Tesla price went to the moon thanks to the media, and now the very same media may push the price drastically down. Technically, the price may even soon hit $200, while this may only happen when the 200-day SMA, the last support, gets broken out. If this is the case, one should carefully think before buying Tesla, which is already quite overbought.

Conclusion

Tesla is unique anyways and is certain to stay among the largest electric car manufacturers. The company's major purpose now is conquering non-US markets, which will require investment, and increase debts and risks. In the long term, investing in Tesla at the current price is not the best idea, although those who bought it at $370 will hardly agree.

A good price for buying is somewhere near $200. If the price fails to fall to this level, one should probably find a good competition instead, such as NIO, which costs $7 per share and is very likely to rise by 100% in the coming years. Currently, Tesla is not paying any dividends, which means one may only earn though the stock price rise. Elon Musk is not planning to change this, although some think different. If Tesla still starts paying dividends, this will make it much more attractive for investment.