Baidu: Negative Net First Time in 14 Years

6 minutes for reading

Baidu (NASDAQ: BIDU) reported negative net profit for the first time in fourteen years, which pushed the stock down by 16%. Hailong Xiang, the Senior Vice President who had been running the company since the IPO, resigned, his post being taken by Dou Shen, the former Mobile Product Vice President. This proves that the current company's scheme got obsolete and does not yield enough profit; Baidu is now likely to get mobile-oriented.

With the reforms only to take place later, some traders might have already known the company is facing issues, as the stock has been down over the last 11 months. But it was not until the company had reported a quarterly loss than it became absolutely clear that changes were necessary. Now more traders will turn to Baidu, which is likely to put the stock under more pressure. The short float is currently just 2.20%, though, with the investors probably hoping the new management will be able to resolve the issues.

The lagging crowd will now get active in the market, but one should not underestimate it; the herd instinct may drive the stock down, if for a short term only, and then a reversal may take place, once the volume is high (right now, it is not).

Baidu Fundamental Analysis

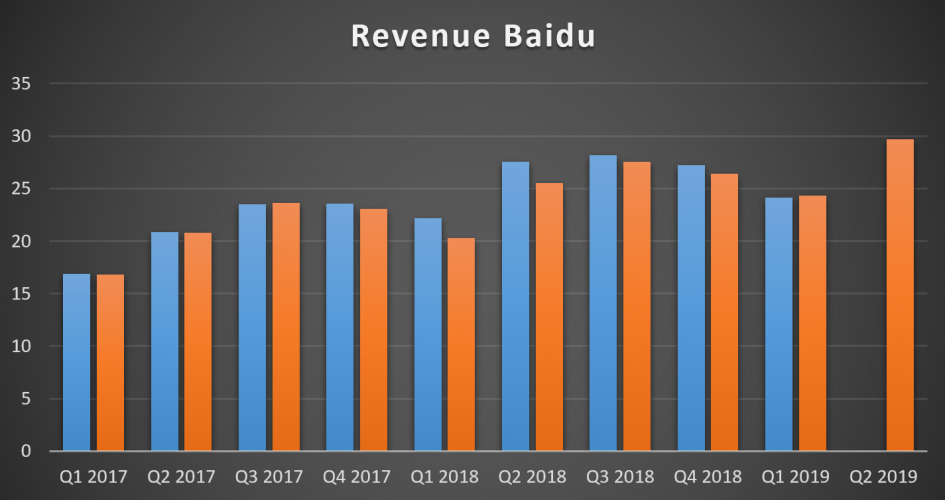

The revenues are season-dependent, while, the overall trend is ascending (see the chart). In 2017-2019 Baidu missed the expectations only twice. The chart does not show any issues, and did not show them a year ago, when the stock started forming a negative trend. However, regarding the net profit, the situation is quite the reverse.

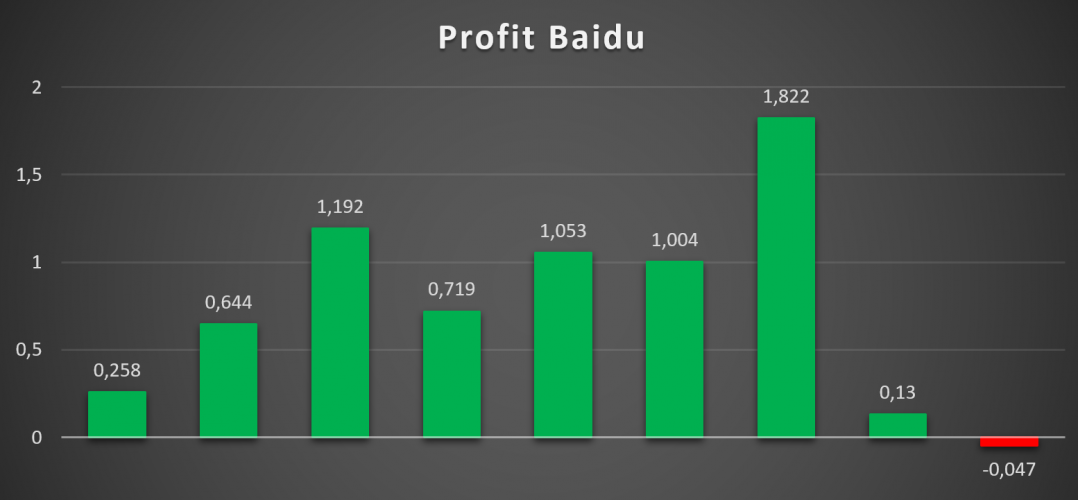

In Q3 2018, Baidu recorded its largest profit ever. Perhaps this made the management increase costs on new development, and that might have let them down.

By late 2018, the net profit went down by 92%, while in Q1 2019 the company reported a $47M loss, which was mostly due to iQiyi content and traffic acquisition costs, with the Christmas and New Year marketing promotion being especially expensive.

This is not the only reason, however. The Sino-US trade wars made a lot of companies lose their money, as the number of advertisers goes down, and the money spent on ads decreases as well. The Chinese government wanted to support the domestic economy and brought in strict control against advertising. Baidu already suffered because of that, but the management says it's going to get worse in the future.

Baidu invests a lot of money in new techs, from AI projects to driverless cars, while employees still must get their wages. The company thus missed the short video market, where TikTok, an agency founded in 2016, now took the lead across China.

Thus, losing everywhere, Baidu is under pressure, both from competition and the government sides. The company is losing desktop users that switch to mobile devices, where Baidu is not at all at the forefront.

So, is the overall outlook awful and does the stock have no chance to recover? Not strictly accurate. Over 19 years, Baidu survived political issues, economic crises, and tech advancements. From 2005 to 2018, the stock rose from $10 to $280, not just for nothing, but with good financial confirmation. Baidu has always been stable, bringing profits to the shareholders, and all issues were usually resolved in a few quarters. That helped the stock always follow an uptrend, the latter having tested the 200-day MA only a few times.

This time, the management says the will be some issues, but they can be resolved again. Meanwhile, in order to retain the investors, Baidu will buy shares worth $1B before 2019 ends.

Baidu Tech Analysis

Technically, Baidu is not likely to be going well, short term wise. After breaking out the 200-day moving average, the price stayed below it and started forming a descending trend. The trend lines was also broken out, with the price testing it afterwards.

The stock is now much volatile and the volume has gone up, but this may be none other than the crowd instinct.

For instance, with 10 traders going short, the price is going down. Now, for each of them to be profitable, the price should continue going down; however, there are no new traders that could push the price further, and thus, it will be unchanged until someone decides to exit and lock in their profit, at which moment the price will start going up. Once it has gone up decently, the price will be good again for going short; those who took profit will enter again, while those who are losing may start increasing their positions, and so the price will go down again.

This is, most likely, what is now happening to Baidu; after the volume went up last week, the stock may now correct to reach the trend line, and then plunge further to get between $80 and $100. After that, the price may start its reversal, but, as we're taking the W1 chart, the recovery is unlikely to take place before Q3.

Thus, the Baidu management seems right in saying that things are not that good for now, but the very management also says they are going to get it all settled before the end of the year.

Conclusion

When the stock went down, it was not fundamentally confirmed before the net profit went negative; by that time, Baidu had already slid from $280 to $180. Currently, the news is mostly negative, but as this is highly likely priced in the stock, a reversal may be quite near. Historically, the stock rose a few times 4 to 6 weeks after the volume got up, sometimes even breaking out the upper boundary and starting to form an uptrend.

The company's revenue is quite high (expected at 20% in Q2), so to turn the net profit positive, it will be enough to cut costs. However, even with the current costs, Baidu has a chance to release a positive net profit report in Q2. What one may do now is wait and watch the price; once it spikes in growth, a reversal may be very near.