S&P500 Recovery: Which Stocks Overperformed?

6 minutes for reading

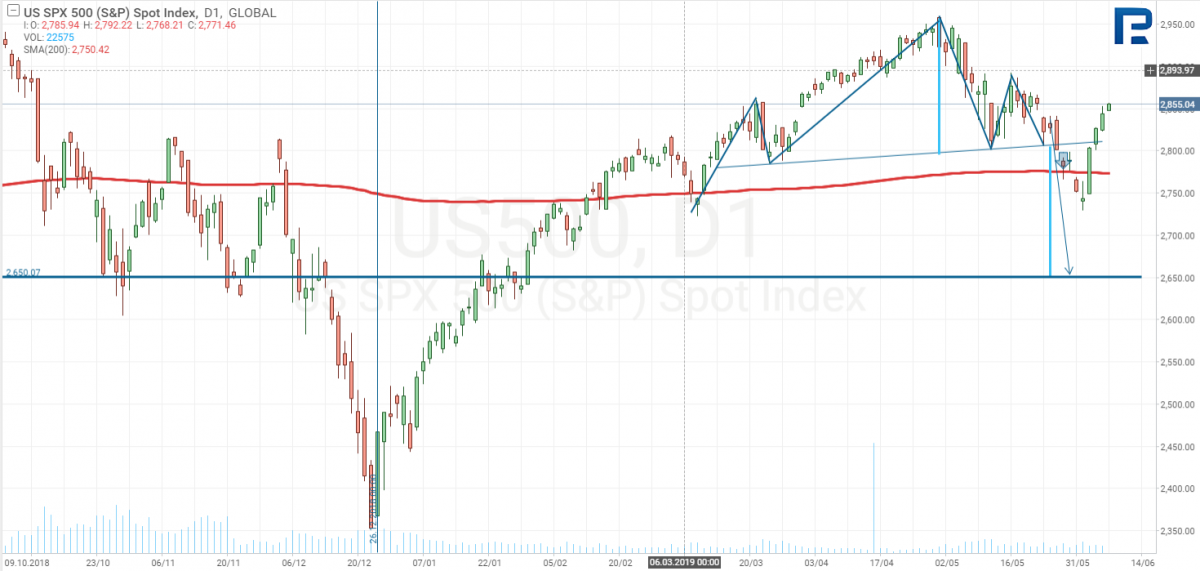

In an article posted in April, we expected the S&P500 to reach a record high and then correct, with the investors seeing no reasons for the index to go further up.

S&P 500 tech analysis

Most stocks had then already hit their highs, and going long in the long term was quite risky. Waiting for the prices to go a bit down first was, conversely, a good idea. Thus, the S&P started pulling back down indeed, having formed a head and shoulders reversal pattern and being ready to hit 2,650.

With the neckline broken out, the price continued declining, and would have definitely reached its goal, but for a very unexpected event. Jerome Powell, the Fed governor, hinted he could lower the interest rate in case it were necessary.

This would be a very ordinary thing, as central bank governors often give hints on the rates, if it were not for some facts that make us recap the recent history.

The influence of Donald Trump on economics

Over the last four years, Donald Trump is taking an active part in the US economy. During his presidency, the indices rose by over 200%, which confirm his policy was quite good. However, is it really him who made the indices rally, or was it Barack Obama who had managed to create a strong economy well before? Trump's policy should be judged once he starts his second term (if there is any), when the scheme he created starts working in full. Back then, Trump wanted to employ protectionism and make all trading partners equal, but what he got was actually the trade war and large tariffs against those who, in his opinion, damaged the US economy. Perhaps he did not think that those countries would retaliate, not just agree every time they were made to accept inappropriate conditions. As a result, the countries against which Trump employed tariffs depreciated their currencies in order to make the consequences milder. The renminbi, for instance, got 11% cheaper; i.e. the goods from the US got 11% more expensive for Chinese consumers, and thus less competitive. Besides, China imposed its own tariffs on the US goods, which made the scenario even worse.

Of course, such conditions made the indices rally virtually impossible. Trump's policies finally led to a 20% decline (this was made by Trump, for sure), while Jerome Powell added fuel to the fire by hiking the rate four times in 2018. A real stab in the president's back, indeed, as it was Trump who assigned the Fed governor's post to him. And while in mid 2018, Trump was still patient about commenting on the Fed's decisions, later in the year he said the central bank had 'gone nuts' when hiking the rates while the market was falling, the major threat now being not China, but the Fed. Despite this criticism, however, Powell said he was going to be hawkish further in the future, i.e. continue hiking. Then, all of a sudden, he says he might reconsider his policy in case the trade wars go beyond measure.

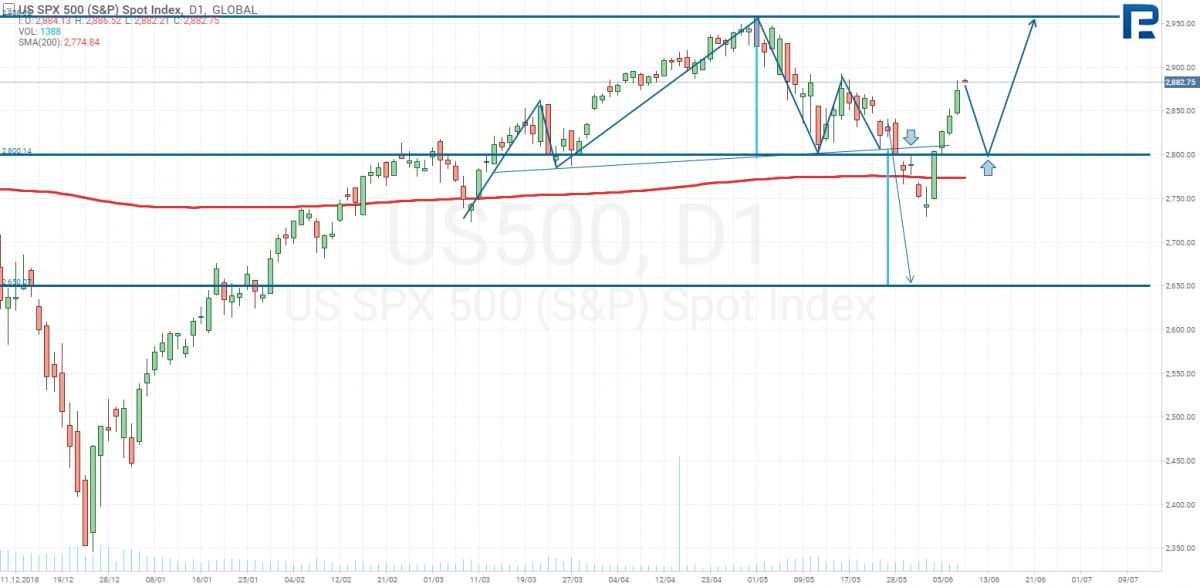

Trading signals

This was a very good buy signal: the S&P500 stopped going down before it should, reversed and has already recovered 6%. Meanwhile, the job data on Friday was lackluster: the NFP had been expected at 185K, but in fact it came at just 75K. The NFP is a very important indicator, which is also considered by the FED when taking interest rate decision. With the current data, the central bank may take stimuli, which will be good for the stock market.

This was perhaps exactly what the market needed in order to gain some more optimism. With the interest rate down, the USD might get weaker against other currencies. In fact, this is also happening, with the EUR adding +1.70% against the greenback, the AUD and the CAD adding +2% each, and the British pound getting 1.50% more expensive.

A month ago, Trump's team said it could impose tariffs on the countries with undervalued currencies, thus starting another kind of war: currency wars. The markets have already been under pressure because of that, especially the business sector. Some companies listed on the US exchanges are also based in other countries, such as General Electric that has some production units in Mexico, against which Trump already imposed aluminum tariffs. With the currency wars going on, the US goods are also going to suffer. The logic behind that is not quite clear. With more tariffs on Mexican goods, the export there will decline, while the import will stay the same; thus the trade balance will go down, the peso will be less in demand and will get depreciated against the USD. Trump will finally say the currency is again undervalued and will impose more tariffs. This may go endless. With this in mind, a weaker dollar is a good signal saying currency wars are not that likely, and the investors may start choosing stocks for their long term portfolios.

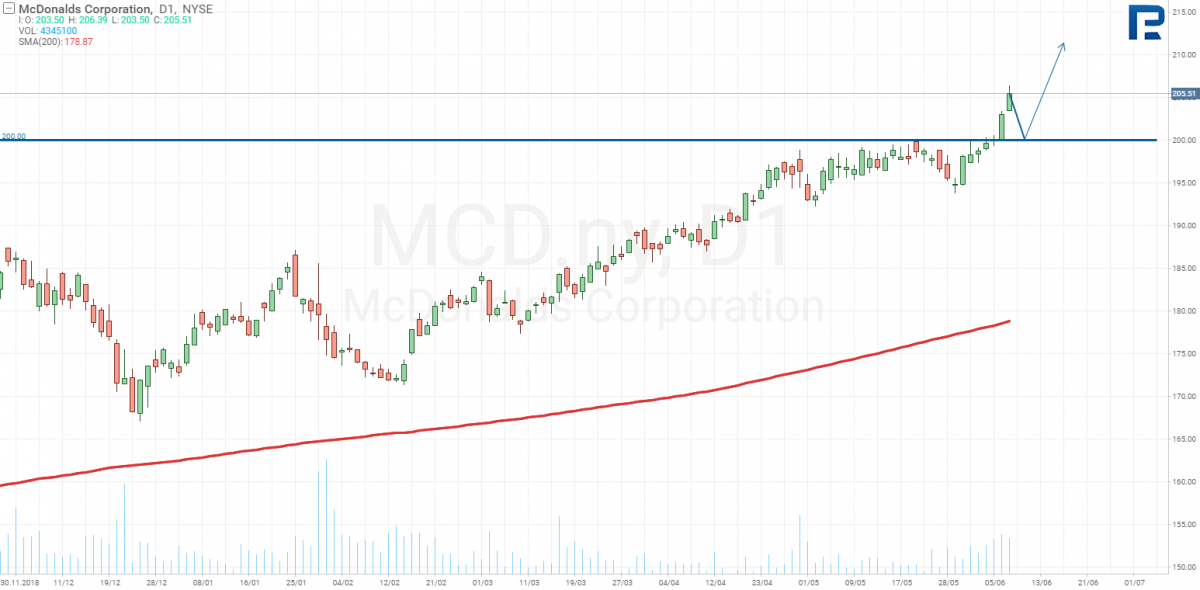

McDonald’s

Meanwhile, a few companies overperformed and barely reacted to the S&P500 going down. The least affected company is McDonald's (NYSE: MCD), which lost only 10%, twice as less than the benchmark in 2018, without losing barely anything now.

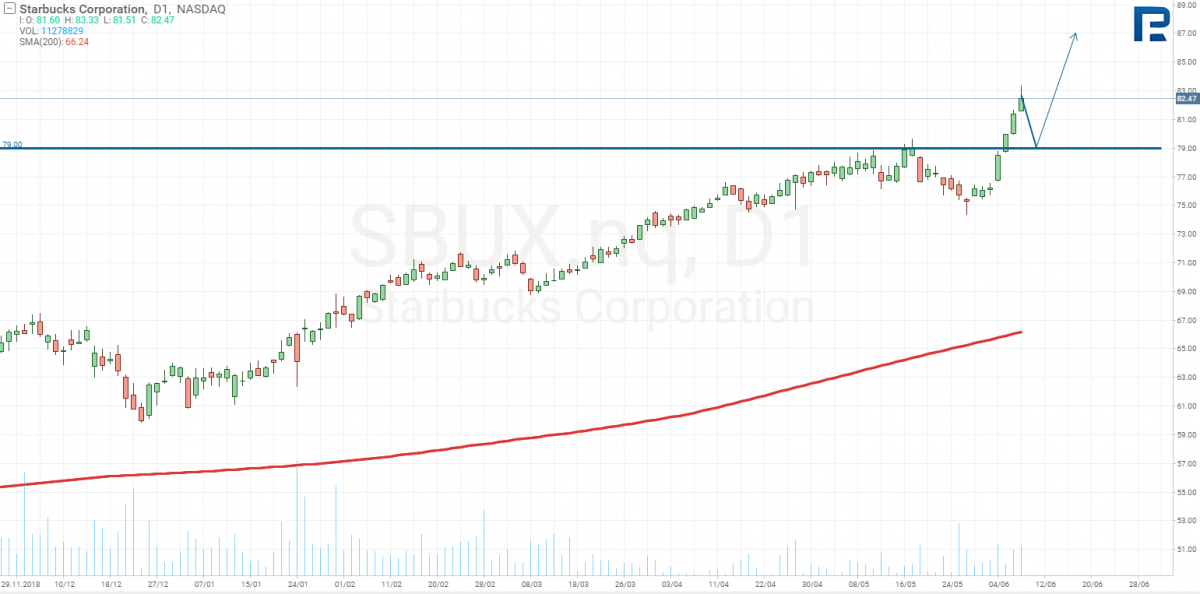

Starbucks

Starbucks (NASDAQ: SBUX), a competitor of McDonald's, did not differ much, having already reached its record high.

YUM! Brands Inc

Another food company, YUM! Brands Inc (NYSE: YUM), added 10% over the last eight days, also hitting its records.

As one can see, catering companies have not suffered from either the trade wars or the rate hikes.

Coca-Cola and PepsiCo

Coca-Cola Company (NYSE: KO) and PepsiCo (NASDAQ: PEP) also head up; even with no financial data at hand, one can see the investors are massively buying the stocks.

Unlike Tesla, where 90% of the price is backed by Elon Musk's PR campaigns, Coke or Pepsi are not such one-person brands. The Earth population is rising, so any threat to any catering company may come only from the competition.

The market is currently clearly signaling, which companies are leading. If you want to invest in the long term, a RoboForex R Trader account with 1:1 leverage is the best choice for you. Once you have opened an account, wait until the stocks start correcting, and then consider buying them. With a 1:1 leverage account with R Trader, you won't be charged any overnight swap. Moreover, you will get dividends paid by the companies, while the platform is free of charge.

You can learn more about R StocksTrader multi asset platform from the post here.