Alibaba Stock Price May Drop For 90% In July

8 minutes for reading

In the end of May I called Alibaba (NYSE:BABA) stocks the best investment on the declining market; however, today I am talking about the probability that their price falls for 90%. I have not changed my mind about the company and insist on their stocks being one of the best possible assets for investment, which seems even more so after the recent events on the market. But first of all I would like to speak about certain actions of companies on the exchange market which cause significant rises as well as falls of stock prices. In other words, we are going to talk about the stock split.

Stock Split

A stock split is an increase in the number of stocks in circulation achieved by splitting up the existing stocks; capitalization of the company remains the same. This method is chiefly used for attracting new investors by intentional lowering of the market price of stocks.

For example, Company X has 10,000 stocks in circulation, 1000 USD each. In order to buy a minimal number of 100 stocks, one has to have 100,000 USD on their account; this reduces the number of potential investors significantly as not everyone can afford such an investment. As a result, the company decides to make a stock split, i.e. to split the stocks at the rate of 1 to 10. This means that those investors who bought 1000 stocks before the split will have 10 times more stocks (10,000); simultaneously, the stock price will drop from 1000 USD to 100 USD. In other words, the sum of the investment will stay the same as 1000 stocks 1000 USD each cost 1,000,000 USD, and 10,000 stocks 100 USD each cost 1,000,000 USD. But now more investors can afford to buy the stocks as the price of one stocks has lowered to 100 USD, so 10,000 USD on the account will be enough to buy the minimal number of 100 stocks.

This example shows that split is common among the companies which stocks cost a lot. The price of the stocks scares off many potential investors so the stocks stop growing, and so does the return on the investment. If the company does not pay dividends, the investors lose interest in the stocks and start selling them because the growth of their price was the only source of income. Thus stock split is a positive event for all market players.

The Price After The Split

Most often the issuers that carry out stock splits are financially stable companies with good reputation on the market; investors keep an eye on them waiting for the opportunity to buy their stocks at a lower price. That is why the split enhances investor activity, and the low price grows. Thus a stock split is normally followed by the growth of the stock price.

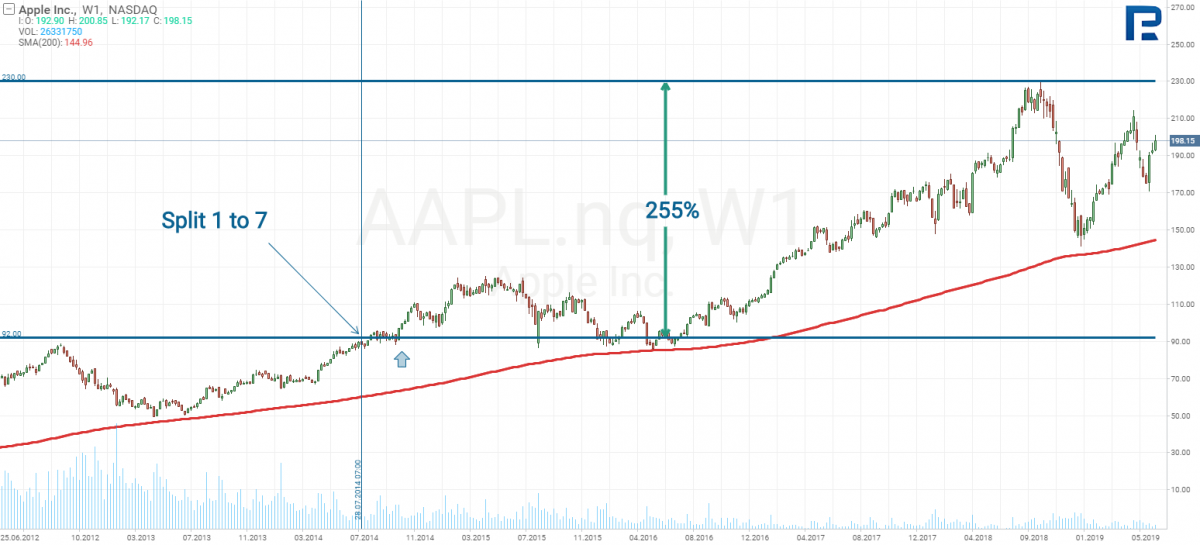

The Split Of Apple

In June 2014 a world-known company Apple (NASDAQ: AAPL) carried out a stock split at the rate of 1 to 7, i.e. a stockholder owning 100 stocks got 600 stocks for free, so that their portfolio grew up to 700 stocks of Apple. At the same time, the price of one stock dropped from 645 USD to 92 USD. Since that time the price has virtually never been lower than 90 USD, and by 2019 it reached its peak of 230 USD. Consequently, the rate of return of the investors who bought the stocks during the split would reach 250%.

The Split Of Google

A couple of months earlier in 2014 another company – Google (NASDAQ: GOOG) – carried out a stock split at the rate of 1 to 2. The price of a stock dropped from 1135 USD to 600 USD. Nowadays it is more than 1100 USD per stock. Thus everyone who bought some stocks during the split got a decent return, the split serving as an additional growth catalyst for the stock price.

However, there are companies that never make stock splits. The stocks of Warren Buffet’s investment company Berkshire Hathaway presently cost 313,000 USD per stock, which means a minimal number of stocks would cost 31,300,000 USD; daily average traiding volume is 250 stocks, i.e. the liquidity is almost zero. Warren Buffet intentionally avoids splitting to keep away speculators and minor investors, treating the stockholders of the company as loyal partners and co-owners.

Reverse Split

Apart form stock split proper there is also such a procedure as reverse split.

Reverse split means consolidation of stocks by aggregating them, which reduces the number of stocks in circulation but increases the price of one stock. While normal stock split is mostly meant for large companies aiming at enhancing stock liquidity and the amount of investors, reverse split is a method for companies which are at the brim of exclusion from the market because their stocks are already sold at a very low price.

The point is that Nasdaq, for example, sets a minimal price of 1 USD per stock. If the price of a stock breaks through this level, the market send the issuer a warning and requires to raise the price by a certain date, otherwise the company may be excluded from the market. The second reason for companies to carry out reverse splits are investment funds. As a rule, investment policy statements require buying and keeping stocks that cost over 10 USD; consequently, if the price of a stockfalls lower than 10 USD, the stock escapes the field of vision of investment fund managers; if they had those stocks in their portfolio, they will have to sell them which will yield pressure on the price, and the stock will drop even lower.

Unfortunately, such an artificial increase of price most often leads to its subsequent decrease, and if investors had no interest in the company before the reverse split they will hardly have it after.

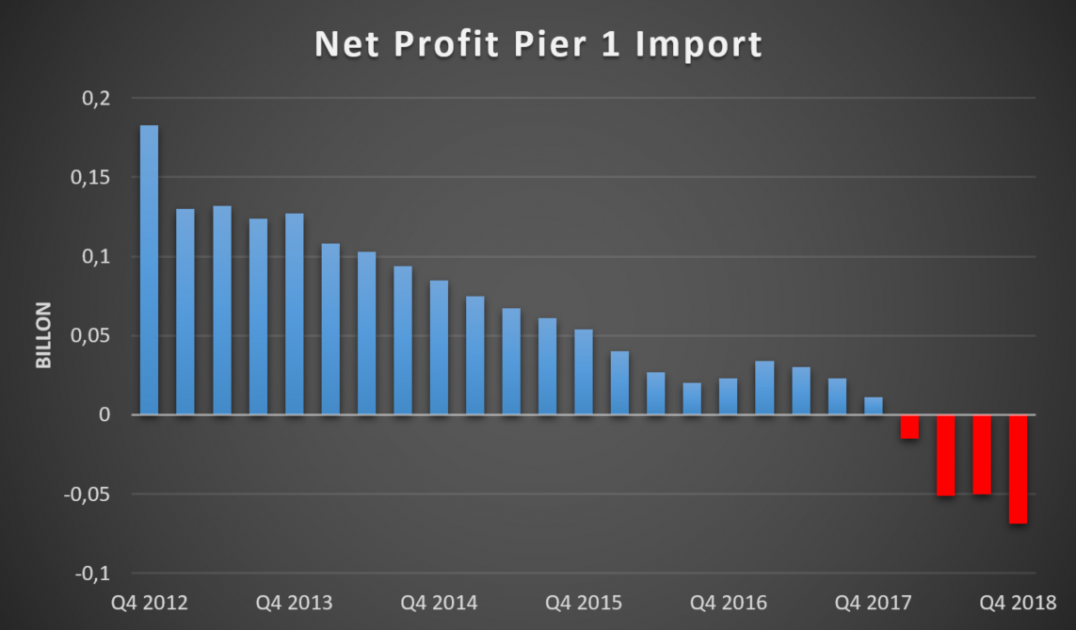

On June 20th Pier 1 Import Inc (NYSE: PIR) carried out a reverse split at the rate of 20 to 1, i.e. 100 stocks in an investor’s portfolio turned into 5; however, while initially the price per stock was 0,68 USD, now it reached 10,50 USD.

At market opening, right after the reverse split, the price reached 14 USD. But as you may see an artificial increase of price does not change anything in the company’s position on the market. The management of Pier ventured on reverse split after NYSE warned them that the company did not meet listing requirements, and demanded to raise the stock price. However, such a dramatic drop of price should have been preceded buy some negative events; if you look at the net profit rate of the company you will notice it decreasing since 2012, and in 2018 losses started growing, doubling every quarter.

Thus, we may conclude that reverse split is characteristic of companies that have long been in financial trouble.

Now back to Alibaba. As you may have guessed, the management is planning a split at the rate of 1 to 8, i.e. the amount of stocks in circulation will increase by 8, while the price of a stocks will decrease from 170 USD to 20-23 USD (depending on the price at the moment of the split). On July 15 at the annual meeting the stockholders will vote for the split at the rate of 1 to 8; the board of directors have already approved the initiative.

To all appearance, the company is chiefly preparing for secondary offerng of stocks. Low price will provide for advantageous offering and attraction of sums enough for the following development of the company. However, Alibaba management refused to comment upon the rumors about the secondary offering.

Secondary offering has an adverse effect offering on stock prices; it increases their amount in circulation but there is a huge gap between secondary offering and stock split. Secondary offering means selling the company’s stocks on the market. If the price is low, the demand will be high and cause an increase of price. Split does not mean selling the stocks on the market, they are just added to those already in investors’ portfolios, hence demand and supply do not influence their price.

Conclusion

The split of Alibaba stocks is an excellent opportunity to buy them at an affordable price. In the situation when the S&P 500 index is near its historical maximum, investors need a serious reason to buy stocks, which are also nearing their historical maximum, and financially stable companies are already quite expensive. Imagine Porsche decided to sell their cars with a 90% discount to everyone. Even those who have never taken interest in Porsche produce will create demand: some will want to own and use a car, some will want to make a profit selling the car at a higher price.

Alibaba lowers the investment threshold for traders for 90% which is a great opportunity for investment on the current market. Alibaba stocks are available on R StocksTrader platform by RoboForex. If you are planning to hold the stocks for more than a month it is recommended to open an account with a leverage 1 to 1 in which case no fee will be charged for rollover.