Microsoft, Adobe, Apple: Will They Renew Highs?

5 minutes for reading

In the current global situation of the pandemics and a decline of the oil prices doubts about what stocks to buy become more and more urgent. How can one safeguard their capital? What branch of the economy should one invest in? However, there are more questions than answers.

Let us have a look at certain businesses.

Oil production

Oil production is having hard times, however, the stocks of many companies are restoring their positions step by step. Companies are agreeing to reduce oil production and looking for ways out of the current situation. There are many stocks to choose from after the drawdown. The stocks of large corporations may be as good for buying as of small companies. When oil production is reduced and the pandemics are over, the prices may return to their previous levels.

Ground and air transportation

Transport companies, including airlines, are also suffering huge losses; passenger airlines are trying to switch to cargo transportation, however, this is just a temporary rescue. For now, it remains unknown how long the pandemics will last and for how long passenger transportation will remain forbidden. If isolation lasts until the end of summer, the market may lose a lot of companies. Some will merge with larger companies that are still in business, while others will be gone forever. Thus, even large airlines may fall prey to pandemics.

Healthcare and biotechnology

In this sphere, the perspectives for buying look more cheerful. There are a lot of companies working in the medical sector. Many of them are now developing the vaccine against the coronavirus, which is good for us and the whole world. However, it is still unclear which company or group of companies to count on not to lose your money. You may go on estimating forever, studying the statistics of the companies, and scrutinizing their charts under a microscope but never guess it right. Even the smallest company with few employees may succeed. Nonetheless, this sector remains promising.

Why computer technology?

I have found a sector that is less prone to the general pandemic mood. This is the sphere of computer technology. In the era of global computerization, it might be safest to invest in this sphere. There are a lot of companies working in this sector, and I have chosen the most popular ones because their perspectives are most promising.

Experts say that all the companies below are recommended for purchases. Small traders and investors will not be able to push the price but an inflow of money from large market players may provoke serious growth. Plus, I have more trust in large corporations than in small companies. I have singled out undoubtful leaders, which are Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Adobe (NASDAQ: ADBE). They have been demonstrating good growth recently.

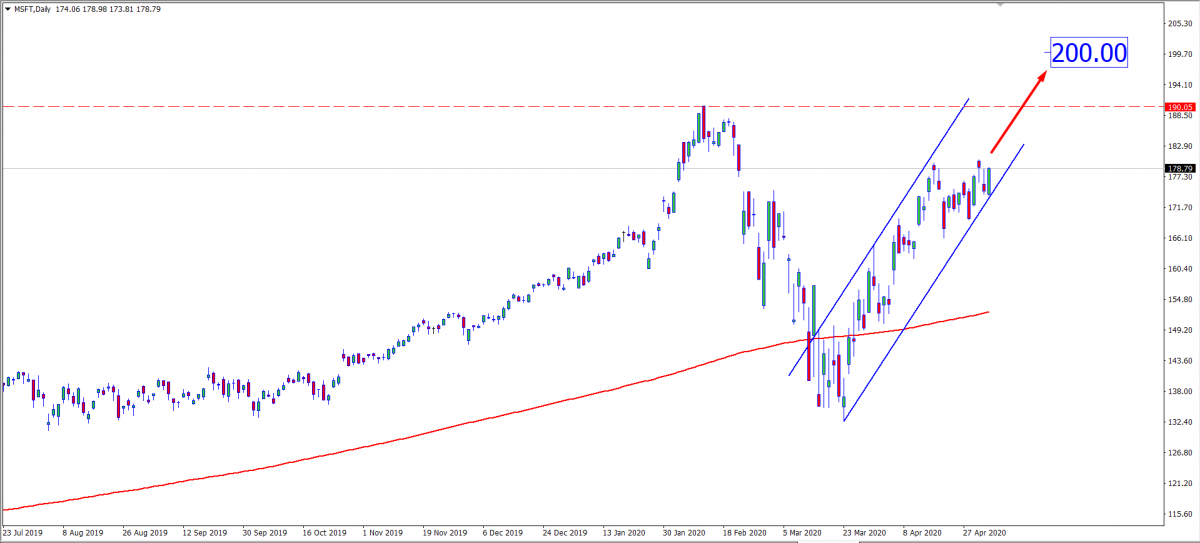

Microsoft goes on growing

During the last month, Microsoft almost restored its positions after the decline, which means things are getting better and the stocks may grow later. As we know, if the price is above the 200-days Moving Average, the market is ruled by the bulls. On D1, the price has long been in the bullish zone, which means an uptrend.

From the point of tech analysis, the price is moving inside an ascending channel, almost approaching the previous high. Short-term buys still do not look appealing. The reason is large corrections; however, in the long run, this company looks rather promising. If things go smoothly, after a correction, the price may go on growing; this month, the stocks may renew the highs, $190 per stock is not the limit. Judging by the current situation, a breakaway of $200 does not look impossible.

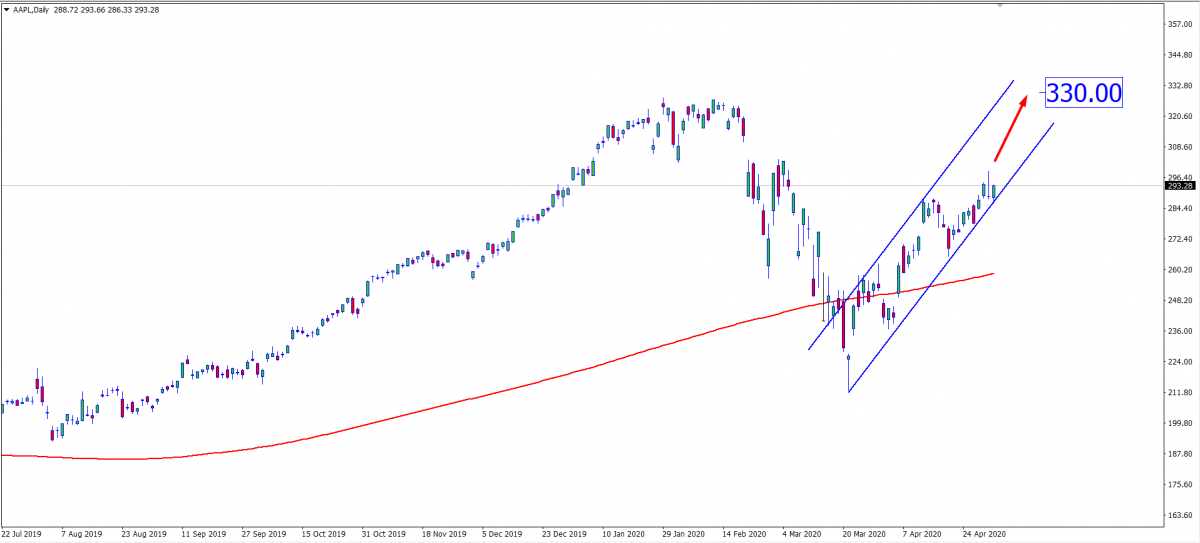

Apple: the correction is over

Apple, one of the rivals of Microsoft, demonstrates a similar picture on D1. Having lost its positions several months ago, the company is demonstrating prolonged growth. The quotations are trading above the 200-days MA, which means a bullish trend. Keeping in mind that on D1 pullbacks are frequent, we may consider buying the stocks if one more correction happens - this will let us buy the asset at a better price. Reaching the high looks rather possible. If no unexpected factors interfere, the price may have tested $330 by the middle of summer.

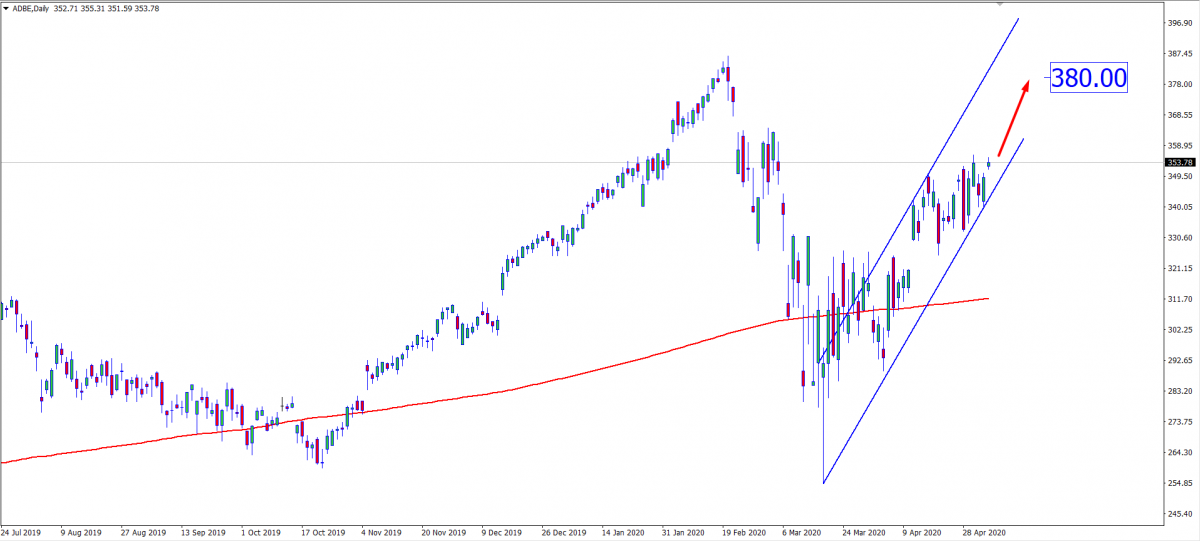

Adobe developing ascending dynamics

A software developer Adobe has been demonstrating growth and restoring lost positions recently. On D1, the price is above the 200-days MA, hinting on a bullish trend. From the point of tech analysis, there are prominent ascending dynamics on the chart. Moving inside a rather narrow ascending channel, the quotations perform small pullbacks. Further growth looks rather probable. The level of $380 per stock looks rather hard to reach but not impossible.

Closing thoughts

As long as the companies enumerated above are the leaders of the sphere, buying their stocks seems a good idea to me. Regardless of the current economic situation, the appearance of new or updated products by these companies may attract the attention of large investors.