Triangle and Wedge Chart Patterns in Technical Analysis

8 minutes for reading

The Triangle pattern appears on different charts rather frequently. The classic technical analysis considers it a pattern signifying the continuation of the trend; however, in my opinion, this pattern may equally work in line with or against the existing trend.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

Description of the Triangle pattern

There are several types of the Triangle, each of them having its own specific features. On the chart, a Triangle is composed of the converging (less often diverging) support and resistance lines. To draw a Triangle, four points are to be marked on the chart, which are two subsequent maximums and two subsequent minimums; through these points, the sides of the Triangle (the support and resistance lines) are drawn. As a rule, five waves form inside the Triangle before it is broken through. After the price breaks one of the sides of the Triangle away, there is likely to appear a strong impulse (movement) towards the breakaway. It is similar to a spring that is squeezed inside the Triangle tighter and tighter until it shoots up or down.

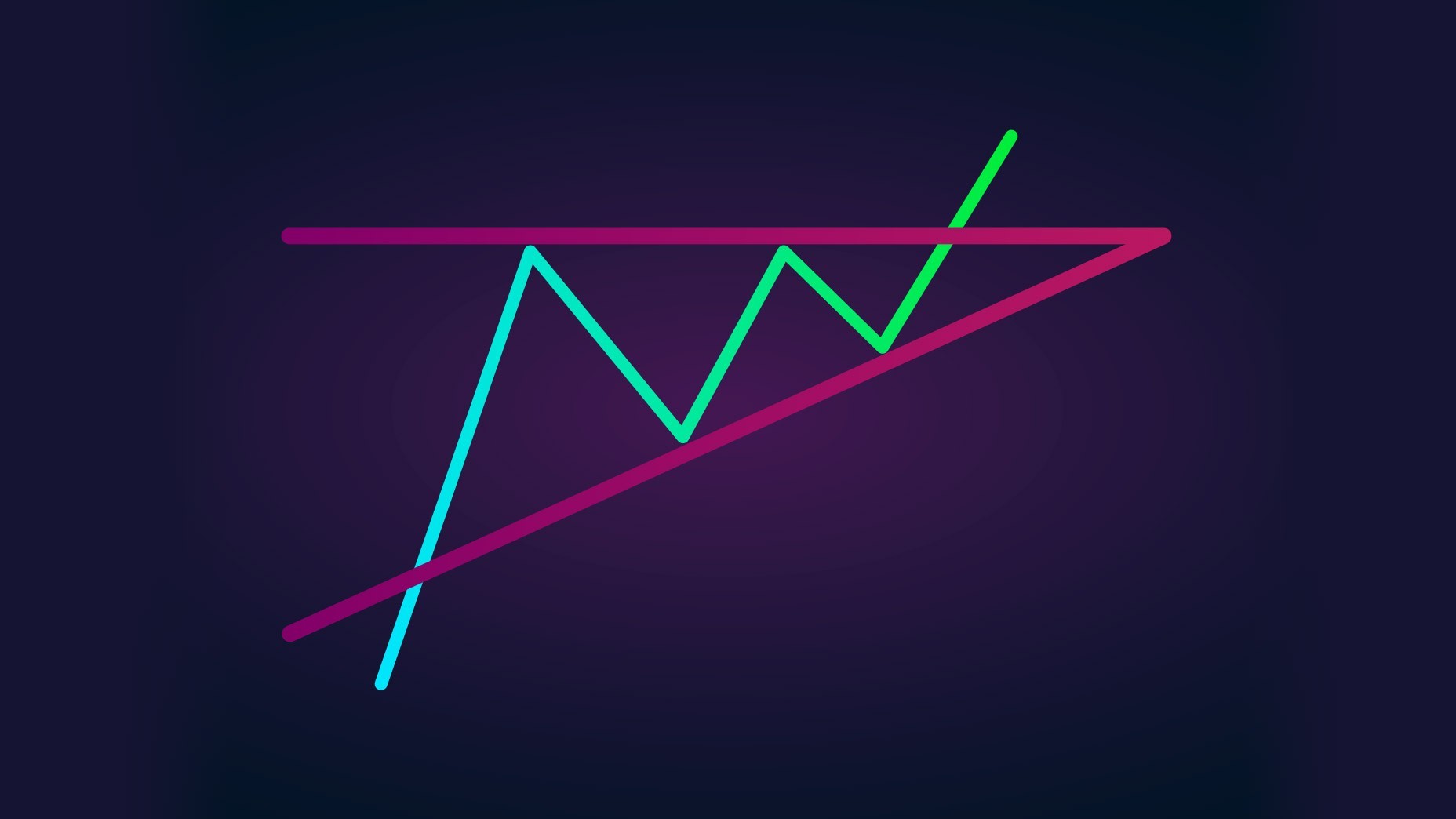

Types of the Triangle and their execution

There are four types of Triangle in technical analysis.

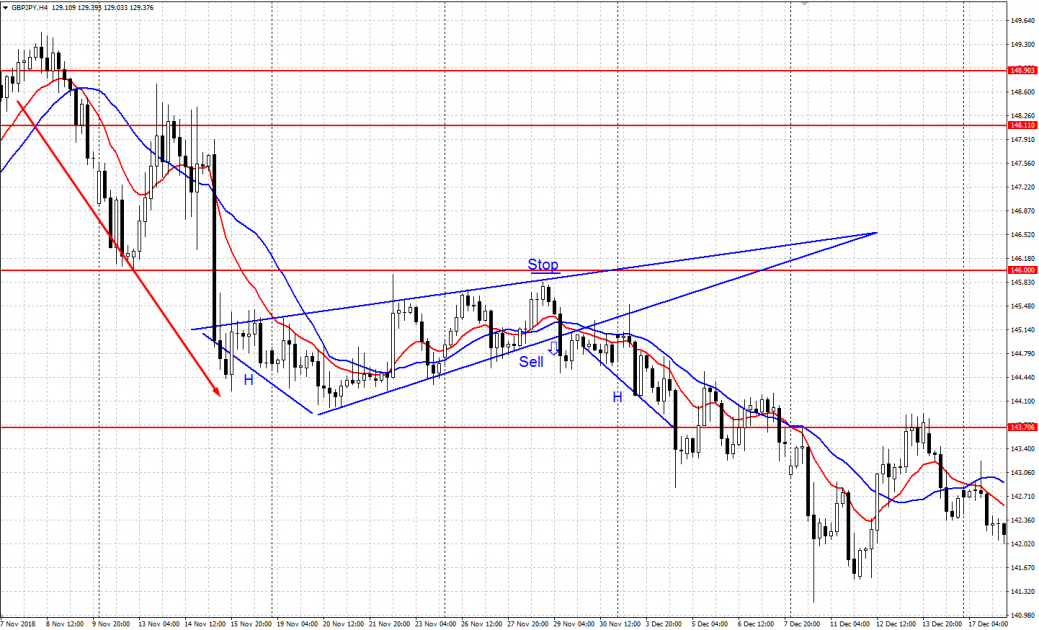

Equilateral, or Symmetrical Triangle

A universal pattern that can either continue the trend or go against it. It is formed by the converging support and resistance lines. The following picture emerges: the bears are gradually pushing the price downwards while the bulls are pushing it upwards from the support line. In the end, some of them turn out stronger, and the price breaks through the border of the Symmetrical Triangle, gathering Stop Losses and pending orders on its way.

A position should be opened in the direction of the breakaway after the price closes outside the borders of the Symmetrical Triangle. If the upper border is broken away, we buy, placing a limiting Stop Loss on the closest minimum of the Triangle; the execution is most likely to be the size of the base of the Triangle (the biggest wave) — let us call it H (the value in points). If the lower border of the Triangle is broken away, we sell, placing a Stop Loss on the closest maximum of the Triangle; the size of the execution of the pattern — the H value in points — will be the base of the Triangle (the biggest wave).

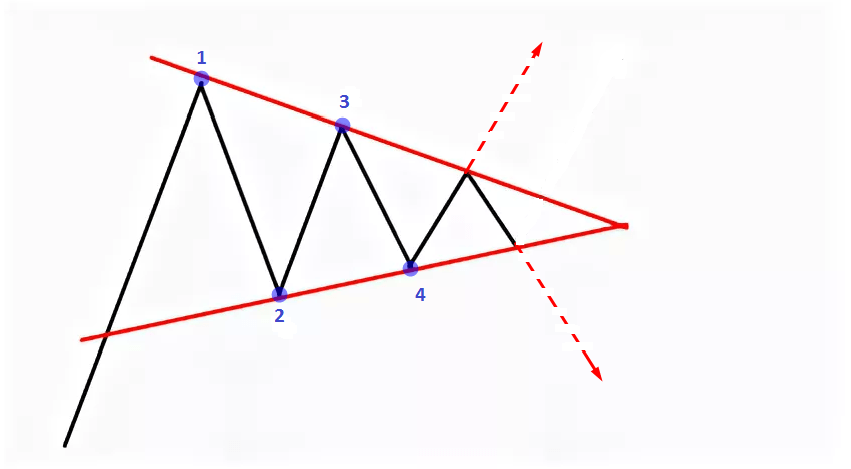

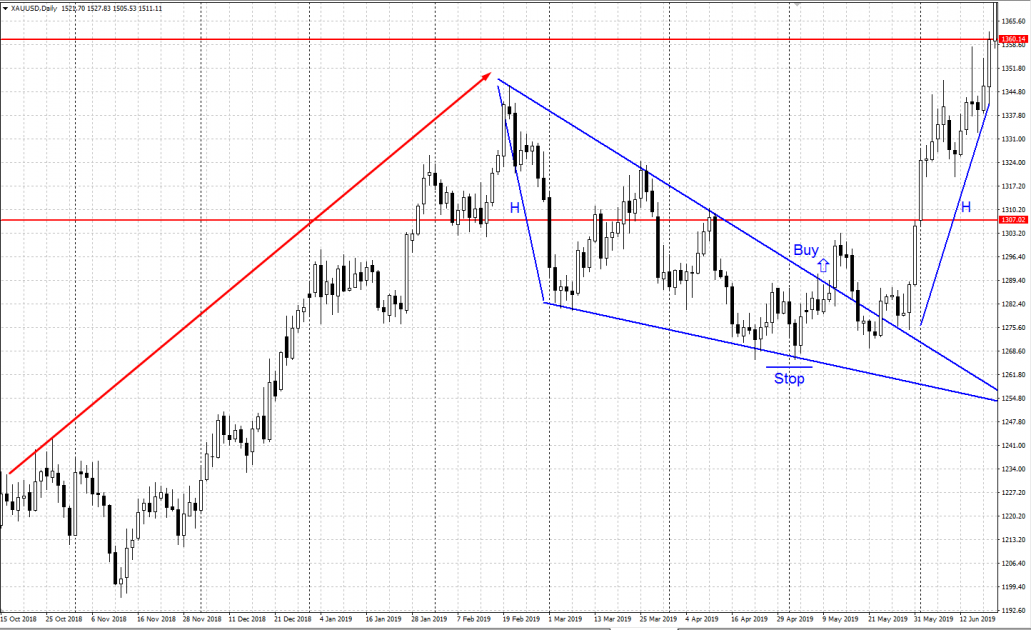

Ascending Triangle

This is the chart pattern of the uptrend continuation, though a reversal execution is sometimes possible. The Ascending Triangle forms between the horizontal resistance level and the ascending support line. In the uptrend, the bulls run into a strong resistance level that they fail to overcome at once. From this level, the price makes pullbacks downwards, which form the waves of the Ascending Triangle. Gradually, they become weaker, and at some moment the bulls, having bought all the bearish Sell orders, break this level away upwards, gathering Stop Losses and pending Buy orders.

Upon a breakaway of the upper border of the Ascending Triangle buying is recommended; the Stop Loss is placed below the closest minimum of the Triangle, the execution is the size of the Triangle base H (in points), which is the biggest wave.

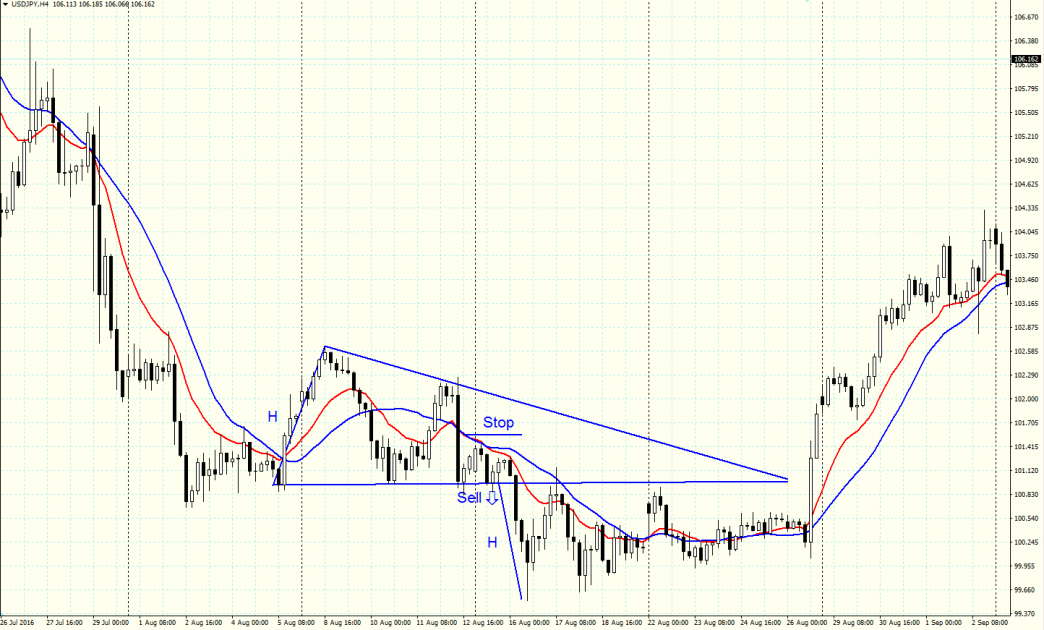

Descending Triangle

This is the chart pattern continuing a downtrend, though it may sometimes execute against the trend. It is formed by the descending resistance line and the horizontal support level. In a downtrend, the bears bump into a strong support level, which they fail to break through at once. Then several pullbacks from this level upwards follow, forming the Descending Triangle. In the end, the bears sweep all buying orders of the bulls away and break the support level through top-down, gathering Stop Losses and pending Sell orders. After the lower border of the Descending Triangle is broken through it is recommended to sell; Stop Loss is placed above the closest maximum of the Triangle; the size of the execution (H) is the size of the Triangle base, which is its biggest wave.

Diverging Triangle

This chart pattern is opposite to the Symmetrical Triangle; it may signal either the end of the current trend or vice versa, demonstrate a correction, after which the trend will resume. It is formed by the diverging support and resistance lines; the angle is looking to the left. The pattern is traded same as the Converging Triangles: to my mind, it is not really wise to trade it at the border breakaway as the latter happens at the base of the Triangle after the biggest wave, and a technically correct Stop Loss for the closest maximum/minimum will be too large, the stop/profit ratio almost 1 : 1.

So, a position should be entered in advance: if we are expecting growth, we should enter upon the bounce off the support line; if we are waiting for a decline, then — after a bounce off the resistance line. In this case the stop/profit ratio will be comfortable because the Stop Loss at the closest minimum/maximum will be small while the execution (profit) — much bigger, at least, spreading to the opposite border of the Diverging Triangle, and if it is broken through — as big as the latest biggest wave of the Triangle (base) as well. For a better understanding of trading in diverging price formations (such as the Diverging Triangle), I can recommend the article: "The Wolfe Waves: Description And Trading Strategy".

Description and execution of the Wedge pattern

Normally, the Wedge is considered a reversal pattern, forming on maximums and minimums of a price chart in an up- or downtrend. A Wedge is quite similar to a Triangle, forming between the two converging support and resistance lines. The main difference between the two patterns is the inclination of the two lines and the pattern itself: all the lines are inclined either upwards or downwards. In accordance with the inclination of the sides, the Wedge may be of two types: an ascending and descending ones.

Ascending Wedge

It is formed by the two converging and ascending lines of support and resistance. If the Ascending Wedge forms on the maximums of a price chart in an uptrend, it signals a probable reversal or correction. Upon a breakaway of the lower border of the Wedge, selling is recommended with a Stop Loss above the closest maximum of the Wedge and the execution sized as the H base (the biggest wave at the base of the pattern).

If an Ascending Wedge forms in a downtrend upon the renewal of the minimums, it signifies a correction, and in case the lower border of the pattern is broken through the downtrend is likely to continue. After a breakaway of the lower border of the Wedge selling is recommended, a Stop Loss is placed above the closest maximum, execution is sized as the H base of the Wedge (the biggest wave at the base of the pattern).

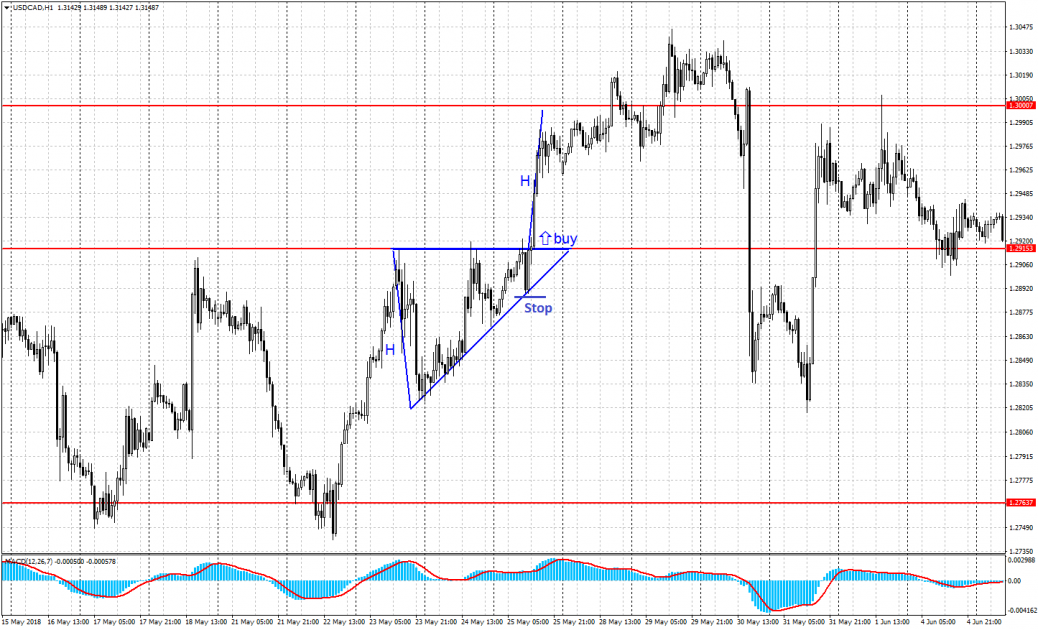

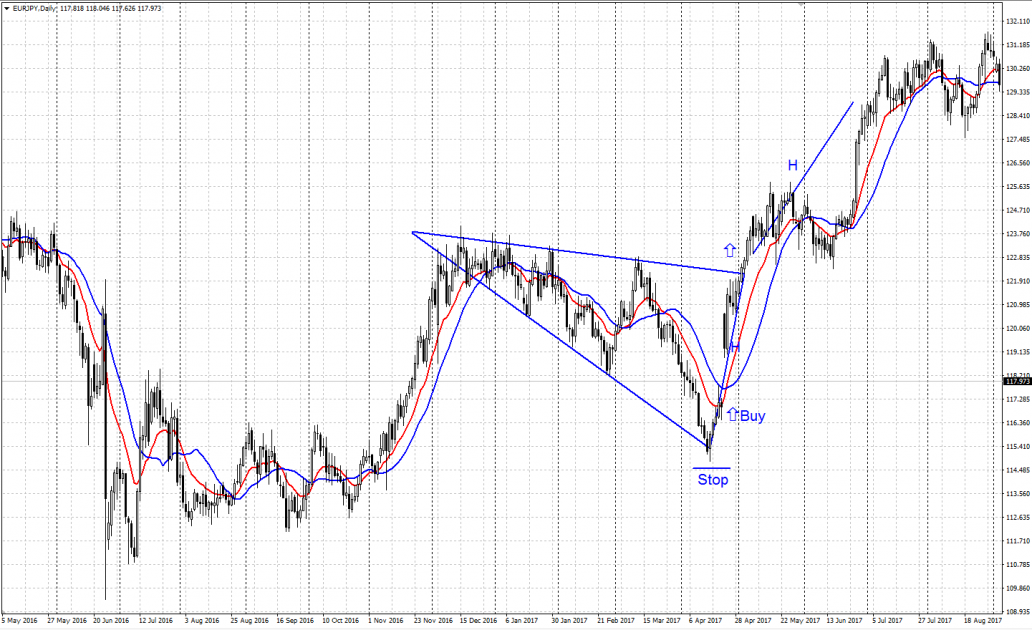

Descending Wedge

This Wedge pattern is formed by the two converging and descending lines of support and resistance. If a Descending Wedge forms on the minimums of a price chart in a downtrend, it signifies a possible correction or even a reversal. In case the upper border of the pattern (the resistance line) is broken away, buying is recommended, with a Stop Loss below the closest minimum. A profit is locked after growth to the size of the H base (the biggest wave at the base of the pattern).

If Descending Wedge forms after renewing the maximums in an uptrend, it may signal the continuation of the trend. In this case a Descending Wedge is a correction after the growth; in case the upper border is broken away, buying is recommended, with a Stop Loss below the closest minimum of the pattern; the execution is expected at least the size of the H base (the biggest wave at the base of the pattern).

Summary

The Triangle and Wedge chart patterns of technical analysis are rather frequent to appear on charts and may be rather helpful in assessing the perspectives of future price movements. The probability of their execution seems to me rather high, and they are worth including into the portfolio. Only, practice is needed in finding patterns on the price chart and reacting on all other factors, such as the current trend, the stop/profit ratio, and fundamental factors.