Presentation Will Not Change Investor Attitude to Apple

10 minutes for reading

The market capitalization of Apple Inc (NASDAQ: AAPL) is 965 billion USD, net profit in 2018 was 59.43 billion USD; 132,000 employees generate annual revenue over 260 billion USD, which is higher than the GDP of some countries with a population of several million people.

| No | Country | GDP in 2018 (IMF data), billion USD | No | Country | GDP in 2018 (IMF data), billion USD |

|---|---|---|---|---|---|

| 1 | USA | 20 494.050 | 40 | Pakistan | 312.570 |

| 2 | China | 13 407.398 | 41 | Chile | 298.172 |

| 3 | Japan | 4 971.929 | 42 | Finland | 275.321 |

| 4 | Germany | 4 000.386 | Apple Inc. | 261.61 | |

| 5 | Great Britain | 2 828.644 | 43 | Egypt | 249.559 |

| 6 | France | 2 775.252 | 44 | Czech Republic | 242.052 |

| ... | ... | ... | 45 | Vietnam | 241.272 |

In 2010, Warren Buffett sold not a single stock of the company. Conversely, he increased his investments from 61 billion USD in 2010 to 200 billion USD by 2019, now owning 5% of all Apple stocks. According to Buffett, he would buy more if the stocks cost less. This means that if the coming autumn there is going to be a correction of stock indices and this tide of pessimism drags Apple stocks down as well, it is highly probable that Buffett will increase his volume of investments in the company.

Dividends and repurchase of stocks

Apple is one of the few largest companies in the world that pays dividends to its stockholders. Apart from the dividends, the company spends huge sums on the repurchase of the stocks in order to maintain the market price.

In 2019 only, Apple repurchased stocks for 41 billion USD with the average price of stock around 195 USD. This is quite far from the minimum of 140 USD per share this year. Such actions mean that the management is certain about the future of the company and ready to buy its stocks even at a price near historical maximums.

The second reason for the repurchase is the fact that the company generates a mighty flow of money which there is nowhere to invest at present. For those who practice scalping, Apple stocks is a perfect trading instrument. Scalpers have no need to read the news, study the information about the company's income or upcoming presentations and other events. What they care about is the liquidity and volatility of the instrument. Along with intraday traders, the stocks of the company may be of interest to those looking for long-term investments; those who aim not only at saving but also at increasing their capital.

Apple presentation

On September, 10th the company will present its new devices; the exact information about the products is kept secret. Keeping in mind the number of Apple users, this is going to be an event of world importance, so there are plenty of rumors about the gadgets that are going to be presented.

Three new models of the iPhone are expected. They are supposed to be the sequels of iPhone XS and iPhone XS Max under the names of iPhone 11 Pro and iPhone 11 Pro Max and the sequel of a cheaper iPhone XR under the name of iPhone 11. Perhaps, other products will be the new version of the operational system of iOS 13, the fifth generation of Apple Watch or the new version of the Air Pods earphones.

Currently, the company is testing a broadcasting service Apple TV that is going to be replaced by a full-scale broadcasting service Apple TV+. This topic is also expected to be raised at the presentation.

iPhone sales

Earlier, the appearance of new iPhone models by Apple gathered long queues in approved stores and were sold out the very first day. Each time, the company reported record sales, its income grew, its stocks renewed historical maximums, its investors received profit, and everyone was happy about its success. Even those who did not have an iPhone by Apple were happy to sell their place in the queue, taken several days before the sales, to those who were really "in need".

However, these days the agitation has shrunk, and for the last three years, the company has been losing its share on the smartphone market. It is most noticeable on the Asian market where there are such rivals as Huawei, Samsung, etc. Due to this, in 2020, the company is planning to launch sales of a new iPhone SE, sized as iPhone 8 since 2017. Half of the Apple sales in developing countries is represented by cheaper and older models. iPhone SE will be a new model with a lower price of around 500 USD.

Apple nowadays is not just a smartphone, a tablet, or a TV set; it is a whole new world that the user enters upon buying one of the devices. The company has been deliberately creating its environment in such a way that it would be hard for the user to switch to some other software. We should admit that Apple provides its users with the best tech solutions, requiring, though, a higher price than its competitors.

For example, a subscription to Apple TV+ will cost 9.99 USD while Disney charges 6.99 USD, and Netflix — 8.99 USD for the same service. In this situation, the company's advantage will be a huge user base amounting to 900 million clients that are used to paying for Apple services. Google has taken another path: the company provides free services but collects user data, selling it to large companies. In the end, Google customers are not used to paid services; Apple clients are different, and this is the company's advantage as it can lower the price of a service or make it totally free at any moment. Thus it preserves the potential for attracting new users. It is also possible that at the presentation some details about the video game service called Apple Arcade will be revealed, which means the company is reaching the video game market as well.

Maintenance of Apple devices

According to the latest quarterly report, services are generating 21% of the company's revenue at the moment, and the management is right to bring the investor attention away from the number of smartphone sales to the dynamics of development on the whole. The goal now is not only to sell new iPhones but also to keep the users of older smartphone versions.

On August 29th, the management announced that the company would be providing original Apple spare parts to independent repair shops, i.e. now an iPhone can be repaired in any maintenance shop that Apple provides spare parts to. This will provoke rivalry in the segment and lowering of the prices for maintenance. Thus, the client will stay with Apple and bring it income for longer.

The trade war and the fares

While most people at the presentation will pay attention to such ordinary things as the number of cameras, the quality of pictures in the dark, etc., large investors will keep a close eye on the pricing of older versions of the device. The trade war between China and the USA has led to the introduction of tax fares on both sides. Apple has 41 of 200 of its providers situated in China, so the accessories the company is importing from there are now subject to the fares, which should, in the end, lead to an increase in the prices for iPhones. Earlier, upon issuing a new model, Apple first priced it and than repriced the whole line of older iPhones, lowering their prices by 100 USD. It used to be quite a predictable process, but the conflict between the US and China might influence the company's policy. The investors wonder whether the expenses are going to be included in the price or will the pricing remain the same. The investor reaction here is hard to predict. The company earns enough to afford to leave everything as it is, showing that it is caring for new users and ready to pay the expenses. On the other hand, if the company includes the expenses in the price, it may drop the sales. In the end, it seems better not to change the pricing and make a profit later providing services than to make a profit on the price growth but get fewer new users.

Apple Inc. rival

The main competitor of Apple Inc. is Microsoft (NASDAQ: MSFT). Microsoft dominates the market of operating systems for personal computers and high-performance software; Apple, in its turn, is the leading producer of portable devices, such as smartphones, tablets, smartwatches, etc. Currently, Microsoft is the world leader in terms of market capitalization, which has overcome 1 trillion USD. Apple, with its capitalization of 965 billion USD, is the at the second place. Microsoft's income is more diversified, while Apple still depends on iPhone sales, unfortunately.

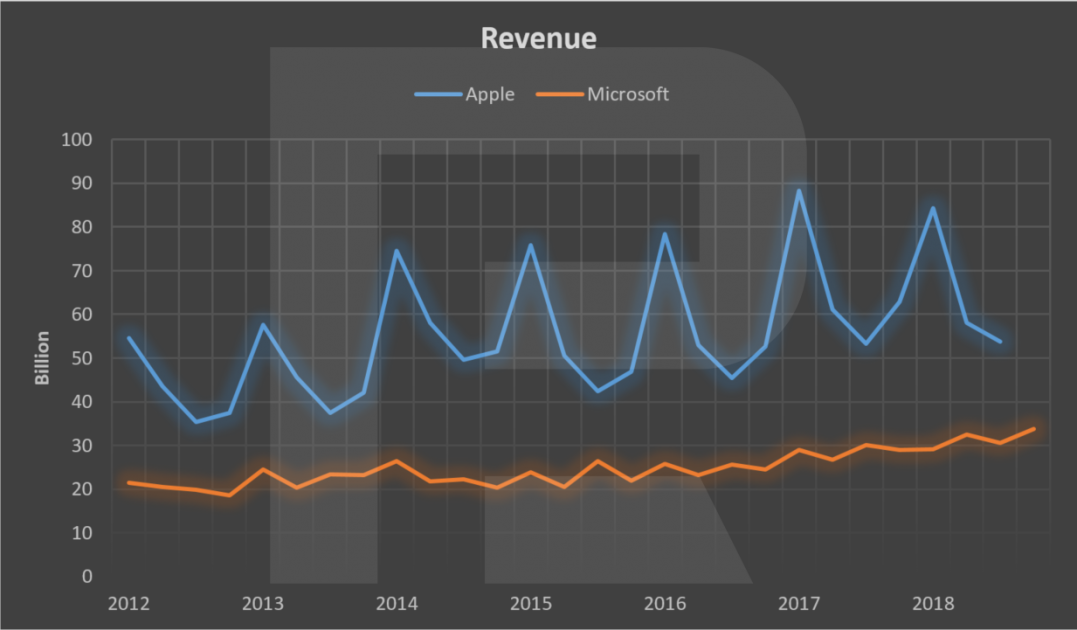

The diagram of quarterly income shows that Apple's income reached its historical maximum in 2017, and then its growth stopped. Even worse, a small decline in profit compared to the same quarters of the last year is present.

As for Microsoft, the growth of income is quite robust here, likely to reach the level of Apple soon. The diagram also shows the dependence of Apple on the sales of its devices, as the main income growth happens in the 4th quarter, i.e. before Christmas and New Year Eve. The Microsoft revenue is not prone to the seasonal factor.

After such a comparison, Microsoft looks like a more interesting company in terms of long-term investments. Its income is diversified, it keeps increasing its profit and is less sensitive to the trade wars between the USA and China. Apple, conversely, is rebuilding its income structure, accumulating the potential for future growth; it spends most of its free capital on repurchasing its stocks, supporting the stockholders.

Apple stocks price tech analysis

Technical analysis shows that a stock is trading above the 200-days Moving Average that has been acting as the support line since 15 years ago. This means the uptrend preserves.

The reaction of the investors at the presentation should not have much influence on the stock price. In the worst case, there might be a correction that large investors will use for buying stocks at a lower price. Judging by the Triangle pattern, we should soon expect price growth to the area near 290 USD. However, the main event for the investors will be the quarterly report, giving a chance to analyze the tendency of iPhone sales. If the sales keep declining, this may have a negative effect upon the stocks of the company and bring the price to the support of 170 USD.

Summary

Apple has a large number of users and enough capital to develop any sphere of business. Apple fans are ready to pay for their services and always get high-quality products and software. Apple is not just a smartphone or a tablet, it is a whole world, and not many wish to leave it; on the contrary, the army of Apple users grows every year. A cheaper iPhone will yield more clients on the Asian market, particularly in India. Apple still has good perspectives with the only possible negative influence caused by another crisis on the stock market. However, Apple is one of the few companies in the world with free capital over 94 billion USD, which will let it survive any crisis.

The company has managed to attract loans over 7 billion USD easily in order to pay off a debt with a rate higher than that it is now paying for the loan. Investors are ready to put their money in the company which means Apple will remain a reliable source of investments with a perspective for years or even decades.