Trading the News: How to Earn on Interest Rates of Central Banks?

6 minutes for reading

The interest rate of the Central Bank is the most efficient instrument of the monetary and credit policy of a state. In essence, the interest rate is the price of loaned money. Increasing interest rates, central banks regulate the demand for loans, decreasing it, and thus decrease the expenses of citizens and slow down the speed of economic development.

Such a measure is most often taken to decrease the inflation speed and avoid the overproduction of goods. A decrease in the interest rate entails an increase in the demand for loans, speeding up economic development.

Why are interest rates important for traders?

Interest rates differ from country to country, which explains the difference in the interest rates in currency pairs. This helps define the attractiveness of one currency in comparison to another. The higher the interest rate of one currency, the more attractive it is for investors: they will invest in this currency to make a higher profit.

The size of the main interest rate is the base for the interest rates of other instruments, such as state and corporate bonds, credit rates for legal entities and physical persons. Central banks resort to changing interest rates rather seldom; such changes are considered major market events, and market players keep a close eye on them.

So, why are interest rate changes interesting for traders?

Well, they have a strong influence on currency rates and provide good opportunities for trading. Normally, an increase in the interest rate leads to an increase in the rate of the national currency and vice versa. Anyway, there will be a strong market movement suitable for trading. Below, you can see a table with the current interest rates of the world central banks.

| Central Bank | Current Rate | Next Meeting | Last Change |

|---|---|---|---|

| Federal Reserve (FED) | 2.00% | Oct 30, 2019 | Sep 18, 2019 (-25bp) |

| European Central Bank (ECB) | 0.00% | Oct 24, 2019 | Mar 10, 2016 (-5bp) |

| Bank of England (BOE) | 0.75% | Nov 07, 2019 | Aug 02, 2018 (25bp) |

| Swiss National Bank (SNB) | -0.75% | Dec 12, 2019 | Jan 15, 2015 (-50bp) |

| Reserve Bank of Australia (RBA) | 0.75% | Nov 05, 2019 | Oct 01, 2019 (-25bp) |

| Bank of Canada (BOC) | 1.75% | Oct 30, 2019 | Oct 24, 2018 (25bp) |

| Reserve Bank of New Zealand (RBNZ) | 1.00% | Nov 13, 2019 | Aug 07, 2019 (-50bp) |

| Bank of Japan (BOJ) | -0.10% | Oct 31, 2019 | Jan 29, 2016 (-20bp) |

| Central Bank of the Russian Federation (CBR) | 7.00% | Oct 25, 2019 | Sep 06, 2019 (-25bp) |

| Reserve Bank of India (RBI) | 5.15% | Dec 05, 2019 | Oct 04, 2019 (-25bp) |

| People's Bank of China (PBOC) | 4.20% | Sep 20, 2019 (-5bp) | |

| Central Bank of Brazil (BCB) | 5.50% | Oct 30, 2019 | Sep 18, 2019 (-50bp) |

Three steps of trading interest rates

Choosing the time of the trade

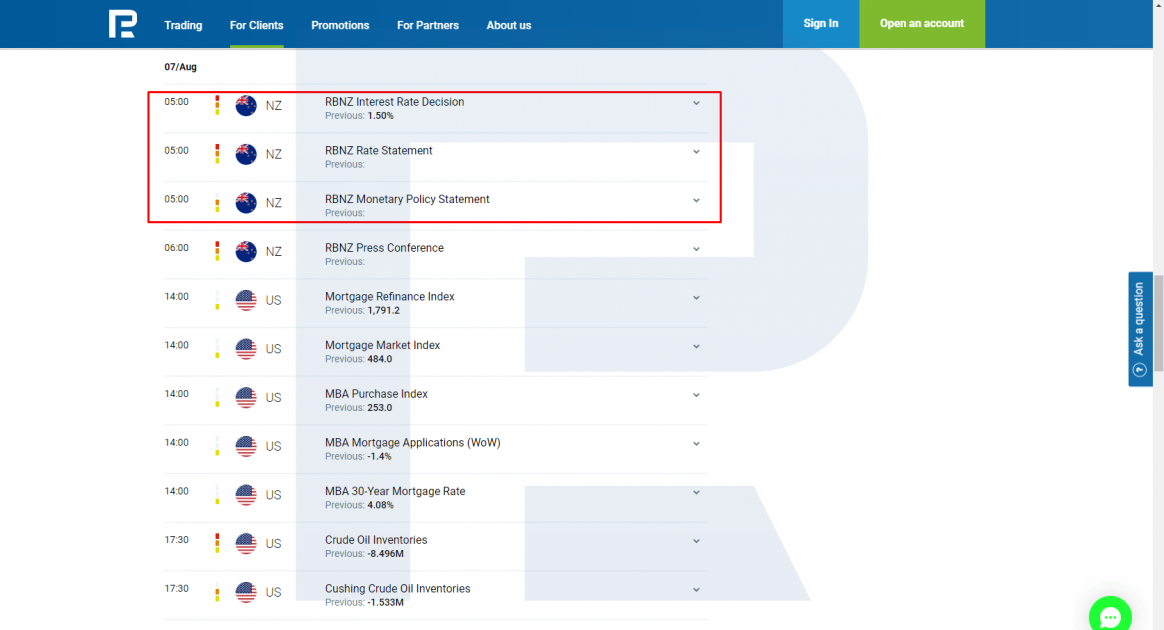

Open the economic calendar and find the date and time of publication of the CB decision on the interest rate. Let us take the decision of the Reserve Bank of New Zealand on August 7th, 2019 as an example. According to the calendar, the news is published at 5 a.m. Moscow time; by this time, we need to evaluate the technical picture, make forecasts, and prepare a trading plan.

Preparing a trading plan

First thing, evaluate the forecasts: in our case, the interest rate was expected to decrease by 0.25% with the probability of 50/50. In other words, an increase was not expected, the rate could either be left as it was, in which case the NZD would have strengthened its position or decreased, in which case the NZD/USD pair would have also declined.

Second thing, look at the technical picture to choose an optimal entrance point and see the perspectives of price movements. Draw the important lines of support/resistance and price patterns. A well-prepared trading plan contains clear criteria and conditions for entering the market.

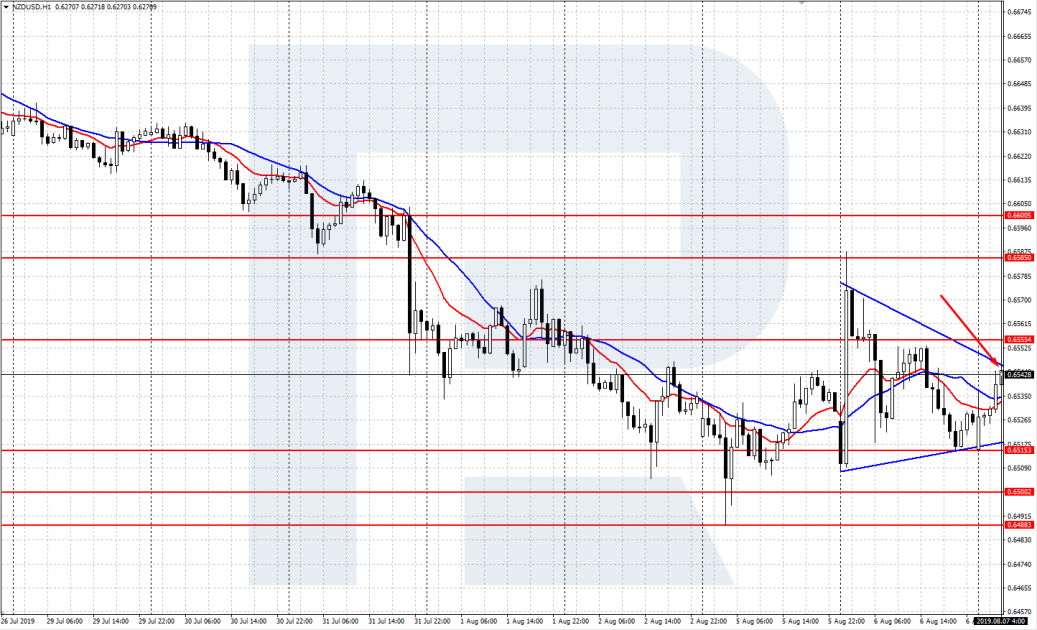

To prepare the plan, open the D1 of NZD/USD. The intraday trend is descending, so selling has more priority. Also, on H1, a pattern of the Symmetrical Triangle type is forming, suggesting an upcoming breakaway of the pattern.

Before the publication of the interest rate, the NZD was trading in a small flat, between the support level at 0.6515 and the resistance level at 0.6555. The trading plan suggests trading the borders of the channel, favoring sells. To trade the breakaway of the lower border in the case of a decrease in the rate, we can use a pending Sell Stop order at the price of 0.6510. This allows entering the trade on a strong movement.

Trading the plan

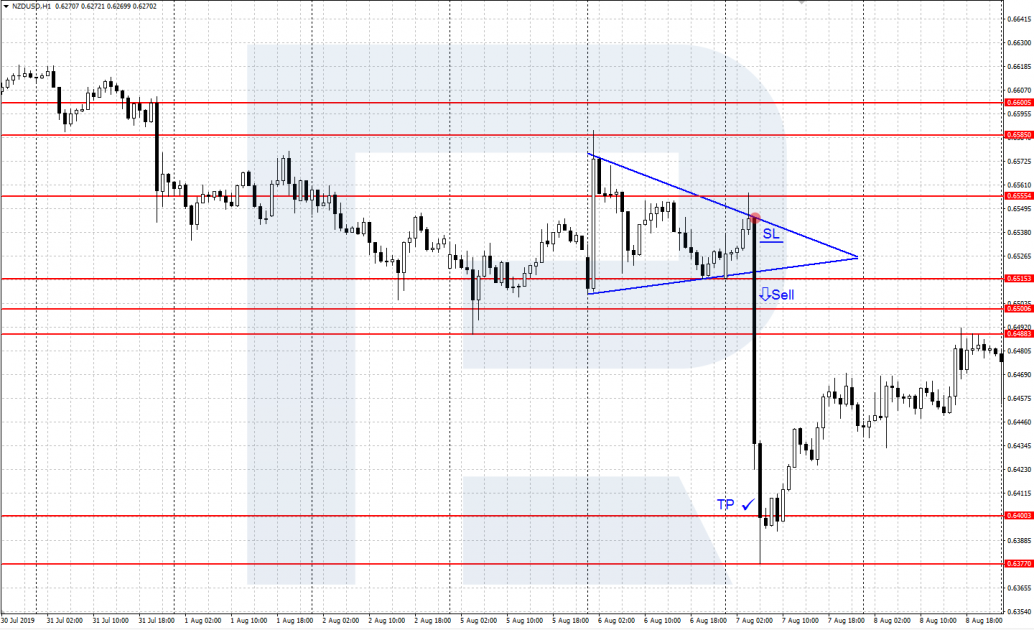

Just before the publication of the data switch to the minimal timeframe M1 or M5 and watch closely the price movements and its behavior on the levels specified in the plan. In our example, just after the publication of the data at 5 a.m. the NZD/USD pair declined steeply, so our pending order at 0.6510 would have triggered.

Opening a stop order (a Stop Loss or Buy Stop) at a strong movement, some "slipping" is possible, so that the position will open some points below the specified level. However, if you manage to enter a good movement at once, such slipping is insignificant. In a pending order, we put a stop order behind the closest level, which is in our case 20 points above the lower border of the channel at 0.6515.

To evaluate the perspectives of the movement, analyze the published data. In our case, the Central Bank of New Zealand decreased the rate by 0.5% at once. It was unexpected for the market as the forecasts suggested a decrease of 0.25%. As a result, the rate of the NZD fell abruptly; bearing in mind how negative the news was, we could expect a decline by some 100 points at once, to the area of 0.6400. And the price actually declined that low 2 hours after the publication of the news, so the profit could be locked in.

In the case of interest rates, the influence on the currency may be long-term. If we have not a single decrease/increase and the CB is planning a series of actions in one direction, such a policy can form a long-term trend.

A series of increases in the rate (toughening of the credit and monetary policy) entails a long-term uptrend, while a series of decreases (softening of the policy) causes a long-term downtrend.

In our case, a series of decreases in the NZD interest rate led to the appearance of a downtrend that has been actual since July.

Summary

The decision of the Central Bank on the interest rate has a strong influence on the rate of the national currency. In the case of an increase or a decrease in the rate, the currency of the state may grow or fall significantly, which provides additional trading opportunities.

It is for everyone to decide whether to trade the rate or not; anyway, it should be remembered that trading the news involves significant risk and may equally bring either a profit or a loss.