Boeing Stocks Accumulating Growth Potential

8 minutes for reading

Boeing 737 has been acknowledged as the most widespread airliner in the history of passenger aviation. Since 1967, there have been produced more than 10,000 crafts of this series. According to the company data, the production volume has reached 57 crafts monthly.

This series of airplanes has also become the most profitable for the company. However, the last crash of Boeing 737 MAX 8 in Ethiopia led to a decline of the quarterly income of the company to the level of 2010; the net profit became negative, reaching the record loss of 2.94 billion USD (after the crisis of 2008 the loss amounted to 1.56 billion USD). Thus, the most profitable aircraft brought the biggest losses to the losses.

Traders are always eager to know what to do with the company's stocks in such a situation. What will bring more profit: selling or waiting for their price to grow? To make our mind about this, we need to look into the situation and decide whether the company has a chance to take Boeing 737 aloft and make the missed profit.

The requirements for the new aircraft models

Boeing keeps designing new models of airplanes, refining their characteristics and bringing them in compliance with the ever-increasing number of ecology and noise requirements of the regulators. However, when an airline decides to purchase a new aircraft model, it is not enough to just make it better than the preceding models.

An aircraft needs to be constructed in such a way that any pilot navigating this type of aircraft could immediately start flying it. In the end, Boeing 737 MAX was constructed in such a way that, according to the regulator, pilots did not need any additional practice to start flying the aircraft. This means the company did not need to send its pilots to training, freeing them from flights.

Boeing 737 MAX: demand exceeding supply

For the improved model of the aircraft, the orders were exceeding the supply. This model turned out to be the most sold in the company. Imagine that in 1967-2018 the company produced 10,000 airplanes of the Boeing family, while by 2019 — which was just 2 years after the first supply of the aircraft — the orders for 737 MAX 8 exceeded 2,000 machines.

Boeing 737 MAX banned from exploiting

Everything was going smoothly until the crash of a 737 MAX 8 in Ethiopia. After the incident, Chinese airlines ceased the flights of this model as they saw some connection between the crashes in Ethiopia and Indonesia (which happened several months earlier).

Then, the airspace all over the EU was closed for 737 MAX. Other countries followed their example, and the last one to let 737 MAX land was the USA. Due to these events, the stocks of Boeing lost 20 % of their price in two days.

Pilots do need learning

The stumbling block in the situation was the necessity for the pilots to learn. According to The New York Times, the pilots learned how to fly the airplanes on tablet computers as long as there were no simulators built.

The reason was that the model was constantly being developed, and there was no full access to the data for the simulator. In the end, the aircraft was ready while the simulators were not.

False conclusion

To start selling, permission from the regulator was required, including to confirm that pilots did not need additional learning. To get such permission, someone had to give a false conclusion. Unfortunately, such a person was found.

Mark Forkner was a leading Boeing expert in preparing pilots and he deliberately misinformed the representatives of the US aviation authorities, assuring them that pilots did not need further learning. He explained his action by the fear of losing his job in the company. However, he does not work there anymore, so was there any sense?

Consequences for Boeing

As a result, the whole 737 MAX series "hit the ground". Now, Boeing is spending lots of money on the maintenance of the planes, which influences the profit. To keep their investors from fleeting, they decided to leave the dividends at the same level of 2.05 per share (currently, it is just 2.44% per annum from the sum of investment). Also, they tried to use a trick.

In June, it was heard that the IAG corporation, which British Airways belongs to, was up to buying 200 737 MAX airplanes. It was just a memorandum signed at Le Bourget air show. This way, IAG was allegedly supporting Boeing, however, market participants did not notice their gesture.

Approval of the US aviation regulator

Now, Boeing has just one goal — to take the airplanes aloft, otherwise, their losses will keep growing while the investors' patience will come to its end. The expenses for 737 MAX maintenance keep growing: according to Credit Suisse, the company may spend 3.2 billion USD more in the next 4 months.

The trade war between the US and China made Boeing reduce the production of 787 airplanes from 14 to 12 units a month. The management declared that it is ready to follow the indications of the regulator, provide each spare part for analysis and answer any question as soon as possible.

The certification documents for the simulators and teaching software are submitted to the regulating body for approval. The approval is expected to be received by the end of 2019. As soon as it is received, the company is planning to execute most of the orders, presumably during the next year.

Potential for income growth

Boeing has not stopped producing airplanes all this time, but they were putting them to storage; however, now the company will have a chance to deliver the orders. Hence, the company will get an inflow of money, and its expenses for maintenance of the airplanes will be reduced, so, the stock price will start restoring. To cut the long story short, the approval of the regulator will be the most important news for Boeing stocks. Of course, it should be realized that if some major event is highly probable, the market will not wait for it to happen. Traders are used to assuming risks and will start acting in advance.

The profit starts growing

The data for the 3rd quarter has begun demonstrating some positive dynamics. The net profit has grown from a loss of 2.9 billion USD to a profit of 1.16 billion USD.

Thus, we might state that the worst times have passed. However, it is too early to relax as long as 737 MAXs are still on the ground. The Credit Suisse bank has forecast expenses amounting to 3.2 billion USD by the end of the year, so the profit may yet shrink. In other words, the probability of negative events should be taken into consideration.

What is more, it should be kept in mind that the approval may be postponed till 2020. Southwest Airlines (NYSE: LUV) has suspended the flights till February 8th, United Airlines (NASDAQ: UAL) and American Airlines (NASDAQ: AAL) — till January, Air Canada (TSE: AC) — till February 14th, and Norwegian Air (OTCMKTS: NWARF) — till the end of March. They are all hoping for the problem to have solved by the end of 2019. If everything goes smoothly, 2020 will be an active year for Boeing.

The upcoming presidential elections in the USA are not to forget about either, which means there may be a thaw in the relationship between the US and China. Donald Trump assessed his success as President including by the growing stock market, so he will do everything for the market to keep growing.

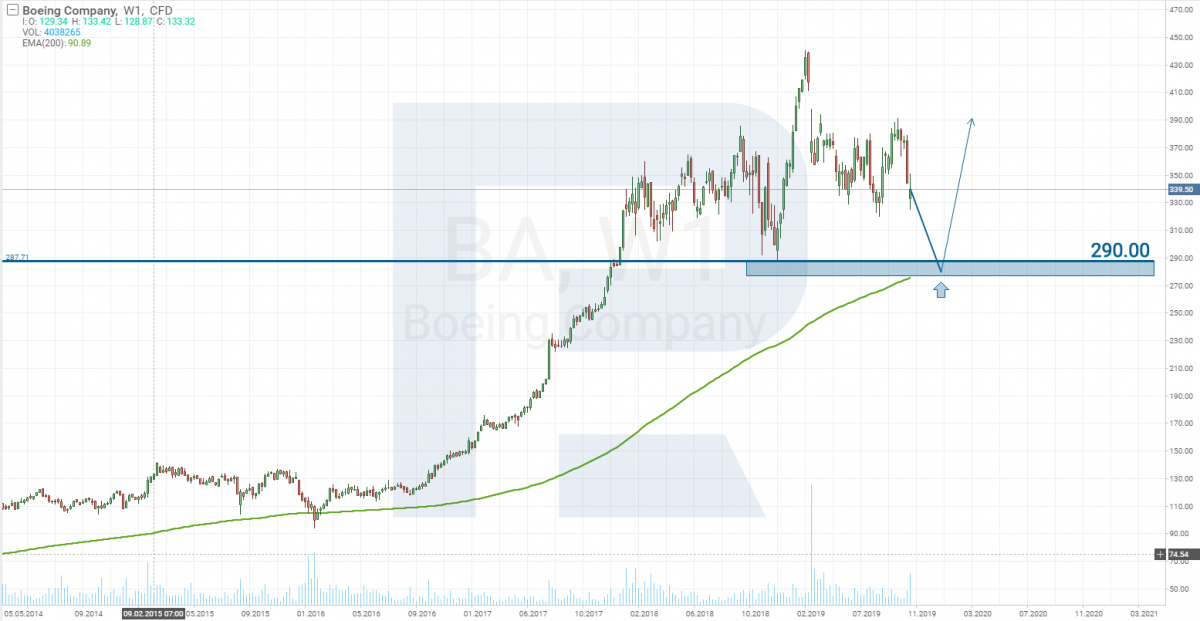

Boeing stocks tech analysis

On W1, Boeing stocks keep trading in an uptrend, which is indicated by the 200-days Moving Average. Last time, it was tested in 2016. Currently, in the case of some negative events, the price might test the MA again, and only after a bounce off it, the stocks may begin the growth to their historical maximums.

However, the price behavior is hard to forecast, so we should consider growth from the current levels as well. What is more, the company's income has started to restore. What might signal growth is a breakaway of the resistance level of 350 USD on D1. The growth is also confirmed by the trendline on the MACD.

Summary

Imagine an erupting volcano with a lid on top. For a moment, the eruption will stop, but the pressure inside will be growing. It will result in the lid fly high in the air, and the eruption will go on. Boeing keeps producing 737 MAX airplanes but neither sells them nor gets any new orders. Thus, it creates postponed demand that can be satisfied at the moment by the machines in storage.

In 2020, we will most probably see the company's income and net profit sky-rocket, which will be a very good influence on the stock price. So, the current stock price might be the most appealing one for a mid-term investment in Boeing.