Tesla Stocks May Renew Historical Maximums

6 minutes for reading

Those who wanted to play short lost it again. It seemed that the losses of the traders (accumulating to 5 billion USD, according to some sources) who wished to make a fortune on the decline of Tesla (NASDAQ: TSLA) stocks should have taught the rest a lesson.

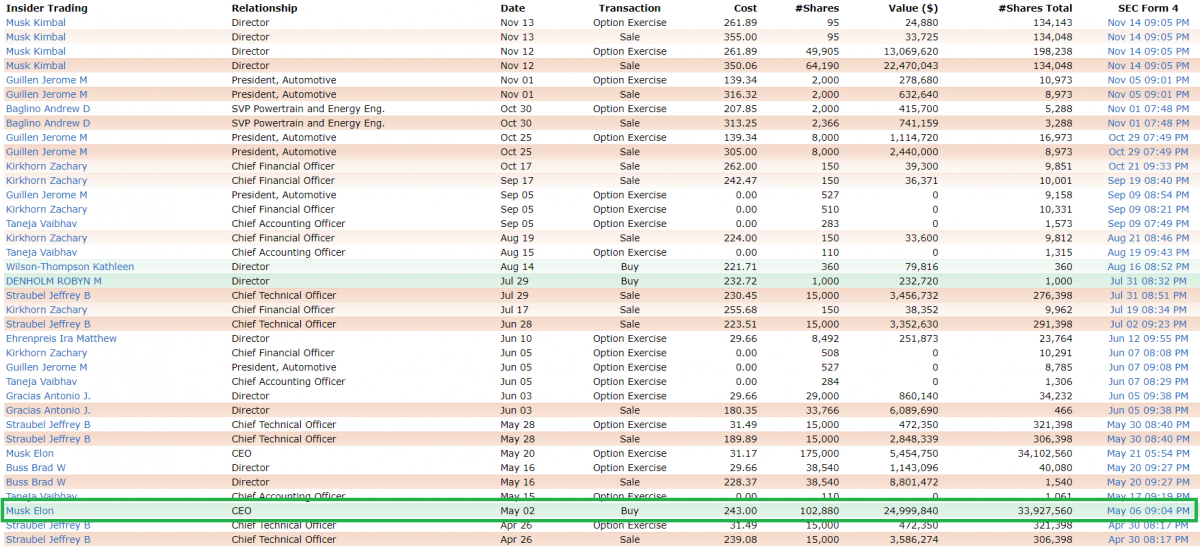

Alas, the current situation demonstrates that the bears still refuse to believe that Tesla stocks may go on growing. They still stake on their falling, no matter how often Elon Musk warned them against it. In confirmation of his own words, he bought Tesla stocks for 25 billion USD at the price of 243 USD per stock in May 2019. The current price is 350 USD, so the sum of his investment has increased by 11 million USD.

Musk turned out to be not only a talented engineer but also a good trader.

Quarterly report of Tesla

The report of Tesla for the third quarter turned out to give traders unexpected information. The company's income turned out to be 6.3 billion USD against the expected 6.43 billion USD and 6.35 billion USD in the previous quarter. Well, here nothing special happened, the company failed to exceed neither the forecasts of analysts nor the income of the previous quarter.

However, the return on stock was beyond expectations. It was forecast around -0.46 USD but turned out to be 1.86 USD. The net profit of the company was also a nice surprise. Even Musk himself admitted at the conference that he had expected the third quarter to end with a small loss but in reality, the company made a profit of 143 million USD against the loss of 408 million USD in the previous quarter.

Normally, financial results are compared to those in the previous year; however, in this case, such a comparison would be incorrect because last year the company was not building a plant in Shanghai; what is more, Tesla keeps increasing its production volumes.

For example, in the third quarter of 2018, the company managed to produce 80,142 electro cars, while by the end of the third quarter of 2019, the production had reached 97,000 electro cars; however, all funds were spent on the new plant in China.

To understand the scale of the spending on the construction, it is enough to look at the picture of Gigafactory Shanghai.

It is literally huge, and all we can see in the picture has been built in 10 months, which was unexpected for the investors.

In the end, now we need to track the dynamics of the company quarter after quarter. The demand for Tesla cars remains high. When the company manages to satisfy it and some surplus emerges, it will become legitimate to compare quarters year after year because the seasonal factor will start influencing the income.

Launching mass production

Last week, Tesla got permission from the Chinese authorities to start mass production of cars on the plant in Shanghai. The first delivery is due at the beginning of 2020.

Thus, with this plant, the company is planning to double the production of the most popular Model 3. Simultaneously, according to Tesla representatives, the expenses on the workforce will be 10 times less compared to those spent on American workers in California.

This is the way the business is solving the problems of the trade war initiated by Trump. They build plants outside the US to avoid fees and make their product competitive on other markets. At the same time, they create new workplaces in those countries and their economies develop.

Tesla plant in Germany

It is not surprising either that Tesla is starting the construction of a plant in Germany. The media pay a lot of attention to the conflict between the US and China; however, the same thought at a smaller scale is going on between the US and Europe.

In Europe, they have their producers of electro cars but Tesla remains the most popular one. The production of Tesla in Germany will increase rivalry and thus stimulate the development of the sphere. For the consumer, this will mean that high-quality cars will become available at lower prices.

It had been unknown until recently where the new Tesla plan will appear exactly. The company was choosing between Britain and Germany but the Brexit problem was one of the arguments against the latter. For the business, political stability and an understanding of what will be happening tomorrow are important.

The risks of the decrease in the net profit

So, upon completing the construction in China, Tesla will start building in Germany. This means the net profit may again become negative as the construction ion Germany will be much more expensive than in China due to the expensive workforce.

So, those who keep trying to make money on a decline in Tesla stocks will have a chance to sell, which they will for sure declare as soon as they see another losing quarter.

Anyway, it should be realized that Tesla is still developing. If we look at such giants as Ford (NYSE: F) or General Motors (NYSE: GM) we will see that they are not building but shutting their plants down, so investors clearly will choose Tesla.

Humankind has not mastered teleportation yet, so a car will remain the key means of transport for quite long, and the most promising branch here is the production of electro cars, and the leader here is Tesla.

Tesla perspectives

Tesla is not just increasing production but also increases the number of models available so the investors are optimistic about its future. It is worth noting that the development of the crossover Model Y is proceeding ahead of the schedule; mass production is planned for autumn 2020. Also, next year a limited series of Tesla SEMI is due.

The planned plant in Germany is expected to supply its first line of electro cars in 2021; while the plant in China will stimulate the production and sales of electro cars.

In the end, Elon Musk was right telling the investors to buy the stocks when they cost under 250 USD; now we can only watch them grow in price and wait for a pullback to buy them cheaper.

Tesla stocks tech analysis

In June, we had a post about Tesla in which we considered the possibility of the price breaking the historical maximums. The scenario has changed just slightly. The results of the third quarter of 2019 that surprised all, sped up the process.

Currently, the price is trading above the 200-day Moving Average indicating the renewal of the uptrend in the stock price. The beginning of the plant construction in Germany will influence the net profit which may affect negatively the stock price. So, we may suppose that it will reach the resistance level of 390 USD, after which it may correct to 300 USD. This very price may become a very good entry point for long-term investments.

However, this process should extend until the publication of the report for the fourth quarter of 2019 scheduled for February 2020 but the New Year rally and the optimism of the investors may correct the forecast. As a result, we may see the price break out 390 USD, after which the pullback to 300 USD will become very improbable.