FedEx: Near the Bottom

7 minutes for reading

FedEx: the beginning of the downtrend

As early as October 2018, in my article “FedEx Goes Looking for New Lows” I paid attention to FedEx (NYSE: FDX). The fundamental analysis then showed no reasons for the stock price to decline, so I dared to suppose that the negative news would follow later when the stocks start declining.

Unfortunately for the investors who bought the stocks, this exactly happened. And the company’s problems turned out to be much more serious than we had supposed.

In 2018, we forecast a decline to the area of 180 USD per stock, but in fact, the price broke these levels out and traded at 160 USD at the beginning of 2019.

A year later, in the article “FedEx: Still Heading for the Bottom” I turned back to the company. I corrected my forecast, pointing at the possibility of further declining, as long as the company had experienced no positive changes.

And I returning to this company today to comment that its position on the market of mail delivery has become even poorer. The reason is in the fact that the management did not take seriously Amazon taking up delivery. Now the former best client has become a severe rival to FedEx.

Amazon and the Delivery Service Partners

Let us recall how it all began.

A year ago, Amazon announced its new project DSP (Delivery Service Partners), allowing business people to organize their businesses delivering goods under the brand name Amazon. The segment had to cover up for the so-called “last mile” delivery. This means delivery from the classification unit to the client.

FedEx, having over 50 years of experience in cargo delivery and the largest number of aircrafts in the segment, was quite calm about Amazon’s idea, assuring the investors that the “last mile” delivery was not the company’s priority. It was chiefly concentrated on services for business as the profitability was higher there.

In other words, the company freed its place for the rivals, which was immediately taken by United Parcel Service Inc. (NYSE: UPS). They modernized their equipment, investing some 30 billion in it, reshuffled the personnel, and extended partnership with Amazon.

In the end, while the FedEx stocks were searching for the bottom, the UPS papers were recuperating and coming closer to their historical maximums.

FedEx contract with Amazon expired

Then another FedEx mistake followed: in summer 2019, they seized their partnership with Amazon, refusing to extend the expiring contract for air delivery. The investors were told that the partnership with Amazon brought no more than 2% of profit in this direction. Was it so or not, the investors did not believe and kept getting rid of the stocks.

Amazon forbidding FedEx to deliver goods

The situation has come to the moment when Amazon forbade FedEx the “last mile” delivery for Prime clients. The reason was untimely delivery; at the same time, UPS, which modernized its equipment, does a good job and remains a partner of Amazon. This was another blow for FedEx. This looks like a fight between Amazon and FedEx.

FedEx stocks hoping for a quick recovery

However, it should not be forgotten that FedEx is one of the largest mail companies in the world. Though Amazon is a large client, plenty of other companies in the world use FedEx services. So, it would be unwise to think that the end of the company is near.

In this situation, the decline could be taken as a good opportunity for buying stocks. Then we only have to wait for good news and see the profit grow. Yes, the same was with Facebook (NASDAQ: FB) and the scandal around the data leak. The stocks fell in price, and the investors starting buying them.

The investors decided to do the same with FedEx stocks. After a steep decline, the trade volumes grew significantly near 150 USD. During the three months to follow, the stock price almost reached 200 USD.

Unfortunately, this was the end of the growth. Instead of some good news, FedEx published an awful report for the second quarter, then for the third one. After the third report, the stock price dropped during one session by 12%, which was the largest decrease in one day during the last 11 years.

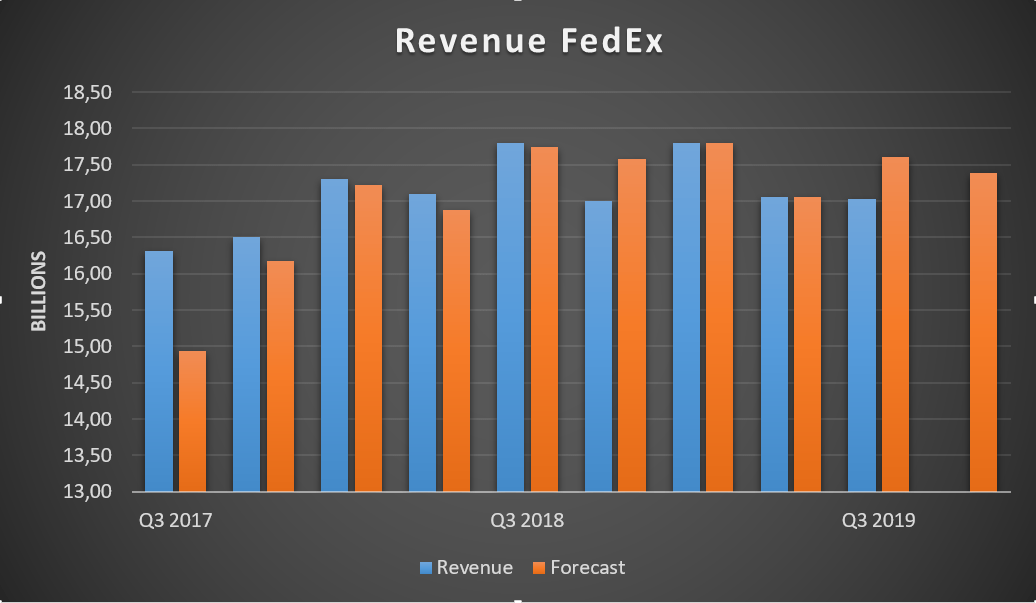

Financial report for the third quarter of 2019

The company's income reached 17.3 billion USD against the forecast 17.6 billion or 17.8 billion received in the third quarter of 2018. The net profit dropped from 935 million USD to 560 million.

On the diagram, we can see, that in 2019 the income has never been higher than forecast, and its growth almost stopped. The director for finance Alan Graf, speaking at a conference, pointed at the stocks trading at the bottom. But as soon as the market was open, they kept on declining.

The investors stop believing in the company

The investors do not believe the management anymore. The company, what is more, has decreased its forecast of the return on the stock in 2020 from 11-13 USD per stock to 10.25-11.50 USD.

The failure of the third quarter Alan Graf explained, as usual by the trade war between China and the US. Apart from this, he pointed at some facts that were obvious previously. Among them are the loss of a large client (which is Amazon), a more competitive price environment, and a calendar shift, due to which the profit from the Cyber Week moved to the fourth quarter of 2019.

Relying on the Cyber Week, we can expect some increase in the company’s income in the fourth quarter, but the hopes are feeble as Amazon forbade the “last mile” delivery before Christmas and New Year.

I would like to stop talking about FedEx problems but there is another factor that needs to be mentioned.

FedEx is not ready for Brexit

After the parliamentary elections in Britain, Brexit is even closer, and Amazon starts looking for stock buildings out of Britain to keep delivering cargo to its European clients quickly and smoothly.

As for FedEx, in 2015 it bought the TNT mail delivery company in Europe for 4.8 billion USD, and the company does not yet have a plan for work in the case of tough Brexit. What is more, the company is not yet integrated fully in FedEx. All in all, this direction is also a failure, ready to entail additional expenses.

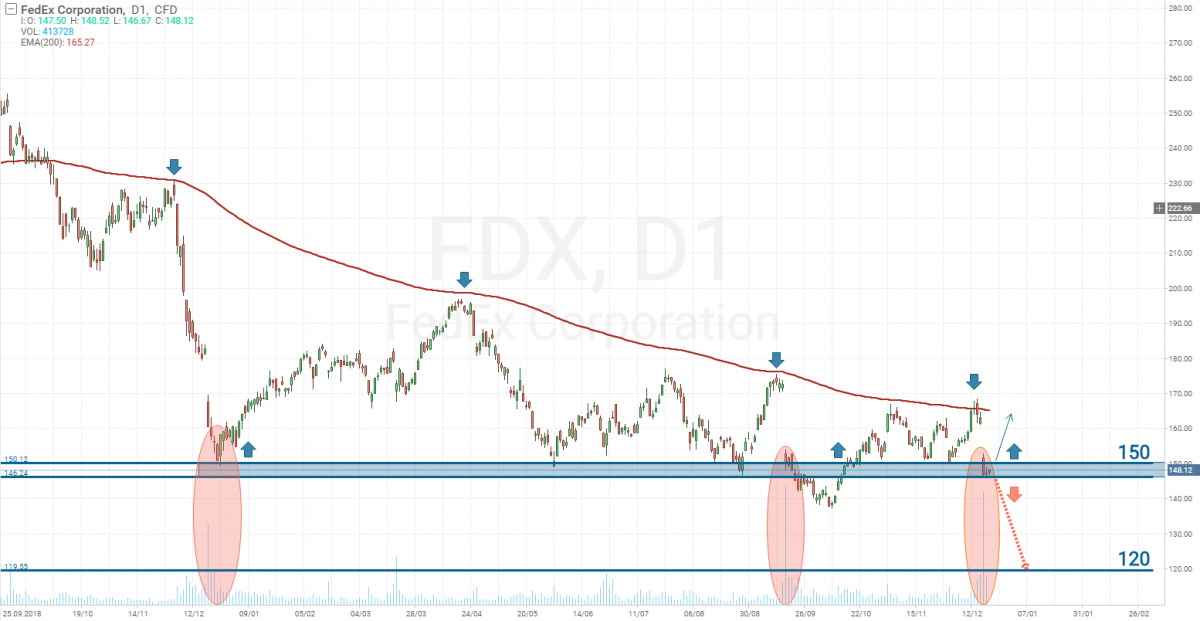

FedEx stocks tech analysis

When the fundamental data gives no hope, we have to turn to the tech analysis. Perhaps here we can find a hint on whether FedEx stocks have reached the bottom or will keep declining.

We all know how the market price forms. If the demand is high and the supply is low, the stock price grows, and vice versa. The stocks will stop falling if someone starts buying them. When the buyers become active, support levels appear on the chart, showing which prices the investors consider acceptable for buying.

Currently, on the FedEx chart, support has formed in the range between 146 USD and 150 USD per stock. In other words, everything below 150 USD is bought by investors. This might also be noticed by the volumes growing near these levels.

This range was broken out earlier, due to the bad financial report for the third quarter. However, the price recuperated later. Thus, the investors showed that they still hope for the growth of the stock price.

The quarterly income of the company turned out to be a failure again. I have lots of doubts that the investors will stick to the same opinion as a couple of months ago.

Summary

So, we conclude. If the stock price declines below 145 USD, the chance for a reversal of the downtrend in the upcoming 3 months will be almost zero, so there is an opportunity to earn money on the falling of the stock price again, and the next support level might be at 120 USD.

However, if the price manages to rise over 150 USD, the stocks may remain above this level until the publication of the financial results for the fourth quarter.

Anyway, what we can see is the investors buying FedEx stocks below 150 USD already, which means the bottom is near. But I would wait for 120 USD, as the company faces too many problems.