Trading Like Sperandeo: 1-2-3 Reversal and 2B Pattern

7 minutes for reading

In this article, we will discuss the trading methods of a famous Wall Street trader Victor Sperandeo. A long-time experience of trading on exchanges and managing investments as well as several books on trading have brought Sperandeo the popularity he deserves.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

How to draw a trend line?

According to the definition from tech analysis, a trend is a period when the price is moving mostly in one direction, either growing or declining. In other words, a trend is a price movement in one direction. A trend can be explained by economic, political factors or force majeure events.

Sperandeo singles out three types of a trend in terms of its length; they can be active simultaneously and move in opposite directions:

- Short-term trend lasts from several days to several weeks, 14 work days on average

- Mid-term trend lasts from several weeks to several months

- Long-term trend lasts from several months to several years.

Any of this trends can be traded; traders usually aim at short- and mid-term trends while investors – on mid- and long-term ones. To trade reversal patterns, we need the market to move in an up- or downtrend.

- An uptrend is a price move in which each next high is higher than the previous one and each next low is also higher than the previous one.

- A downtrend is characterized by each next high and low being lower than the previous one.

An important aspect of trend analysis is drawing the trendline. When the price breaks out the trendline, it signals the beginning of a correction or a trend reversal. For drawing the trendline, the following rules are used:

- The trendline in an uptrend is drawn on the chart through 2 points: the first point is the low preceding the absolute high of the trend; the second point is the first low the uptrend has started from. If the trendline crosses the chart, the second point (the farthest low) is transferred to the next closer low for the trendline not to cross the price chart.

- The trendline in a downtrend is drawn on the chart through 2 points: the first point is the high preceding the absolute low of the trend; the second point is the first high the uptrend has started from. If the trendline crosses the chart, the second point (the farthest high) is transferred to the next closer high for the trendline not to cross the price chart.

Trend reversal 1-2-3

The rule of Sperandeo trend reversal 1-2-3 comes into force when the price chart breaks out the trendline. This is the first signal of a possible trend reversal, which may precede a 1-2-3 reversal. Below, we will discuss in detail the rules of formation of this reversal and trading it in an up- and downtrend.

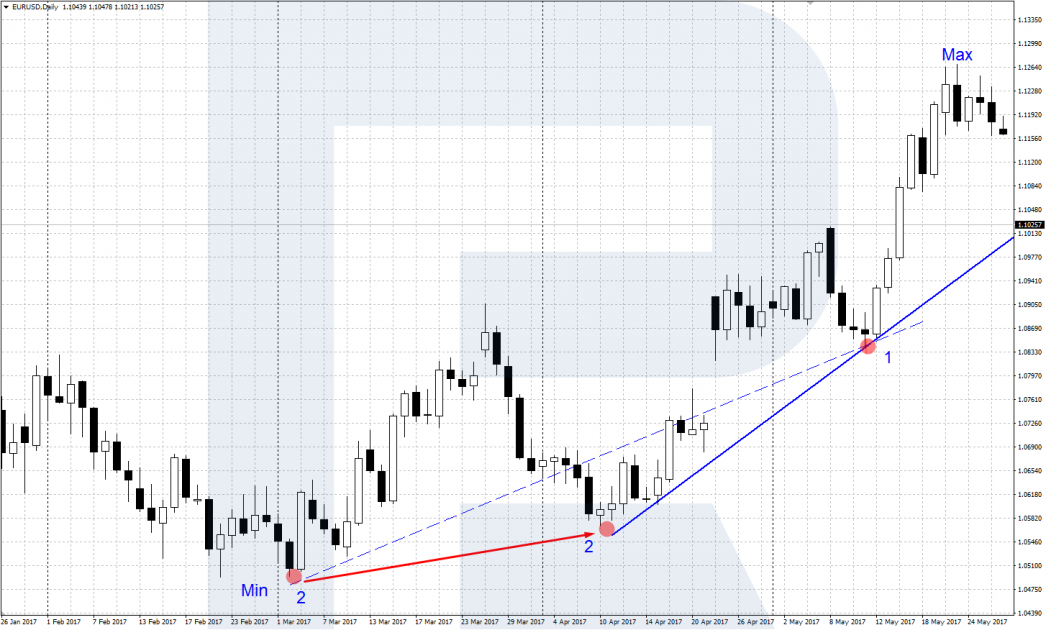

A 1-2-3 reversal in an uptrend

- Find an actual uptrend on the price chart and draw a trendline.

- After the trendline is broken out, name the high preceding the breakout as point 1 and the low formed after the breakout – point 2.

- After point 2 is formed, a new ascending impulse in the direction of the trend forms. A short-term exceeding of point 1 is possible (it is called a false breakout) – it must be followed by a strong pullback down. The new high is named point 3.

- The 1-2-3 reversal comes into force if the price goes further down renewing the low in the point 2. Open an selling position, putting an SL above point 3.

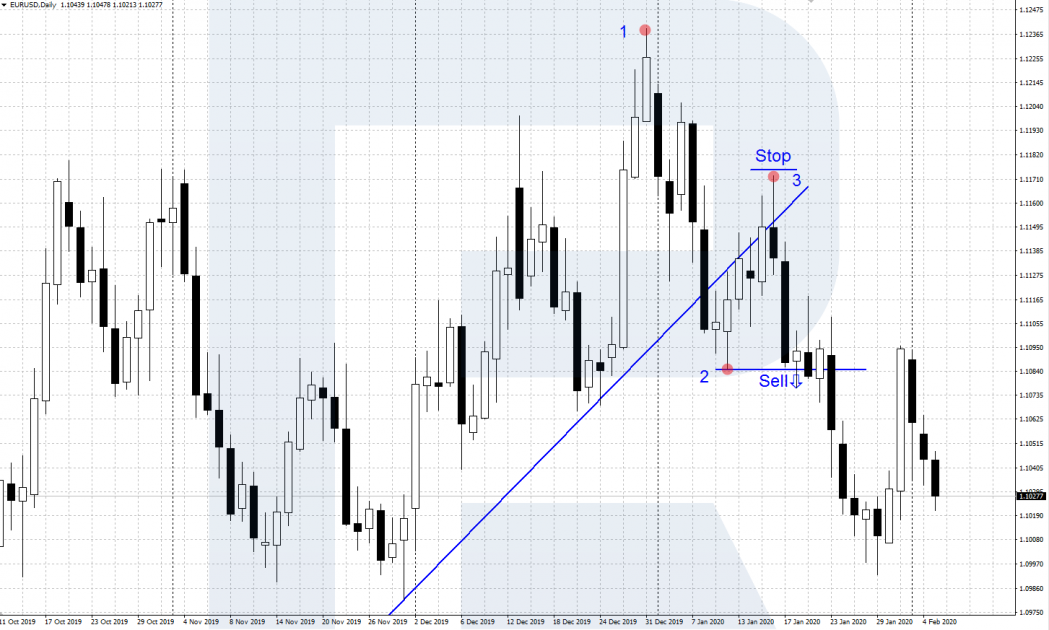

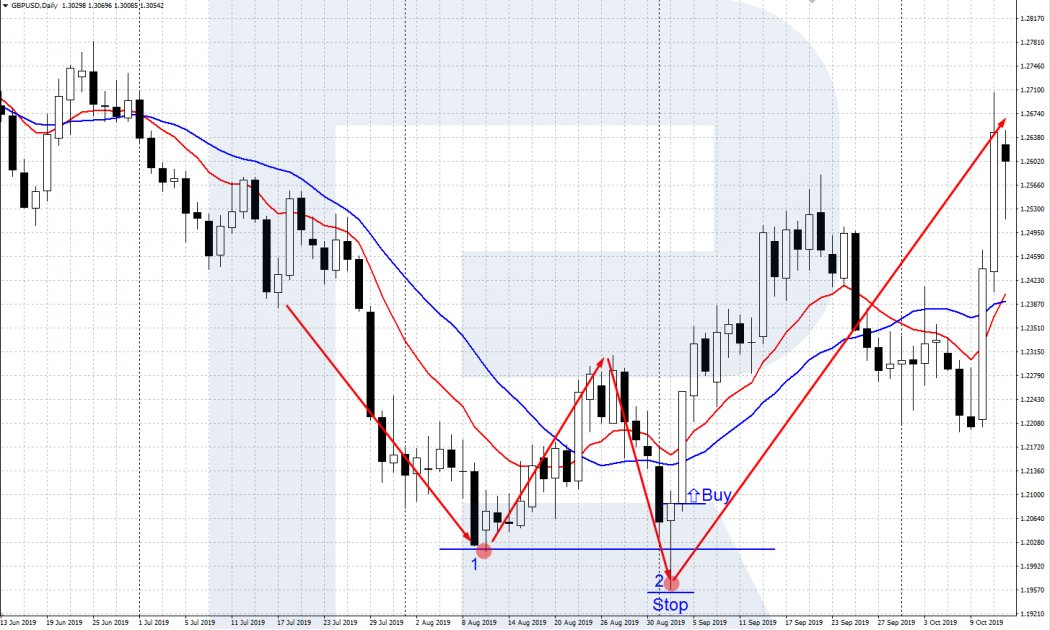

A 1-2-3 reversal in a downtrend

- Find an actual downtrend on the price chart and draw a trendline.

- After the trendline is crosses the chart upwards, name the low preceding the crossing as point 1 and the high formed after the breakout – point 2.

- Then, a new impulse downwards follows from point 2, remaining higher than point 1. A short-term renewal of the low in point 1 is possible (called a “trial” of the low) but it must be followed by a strong pullback upwards. The new low is point 3.

- The 1-2-3 reversal is considered fully formed only after the price goes further upwards, exceeding the high in the point 2. Open a buying position with an SL below point 3.

We have described an original conservative way of trading a 1-2-3 reversal by Victor Sperandeo. Sometimes, I use a more aggressive way of trading – I trade right after point 3 is formed. The signal might be a false breakaway or some Price Action reversal pattern. This is less trustworthy because the reversal has not been confirmed yet (point 2 has no been broken out) but this method allows to enter the market with a smaller SL and a more profitable profit to loss ratio.

2B Pattern

2B pattern or 2B indicator – as Sperandeo calls it in his book – is a reversal formation consisting of two adjacent market highs/lows. On the price chart, the 2B pattern looks like the Double Top formation ( or Double Bottom in a downtrend), and the trading principle resembles the Turtle Soup by Linda Raschke.

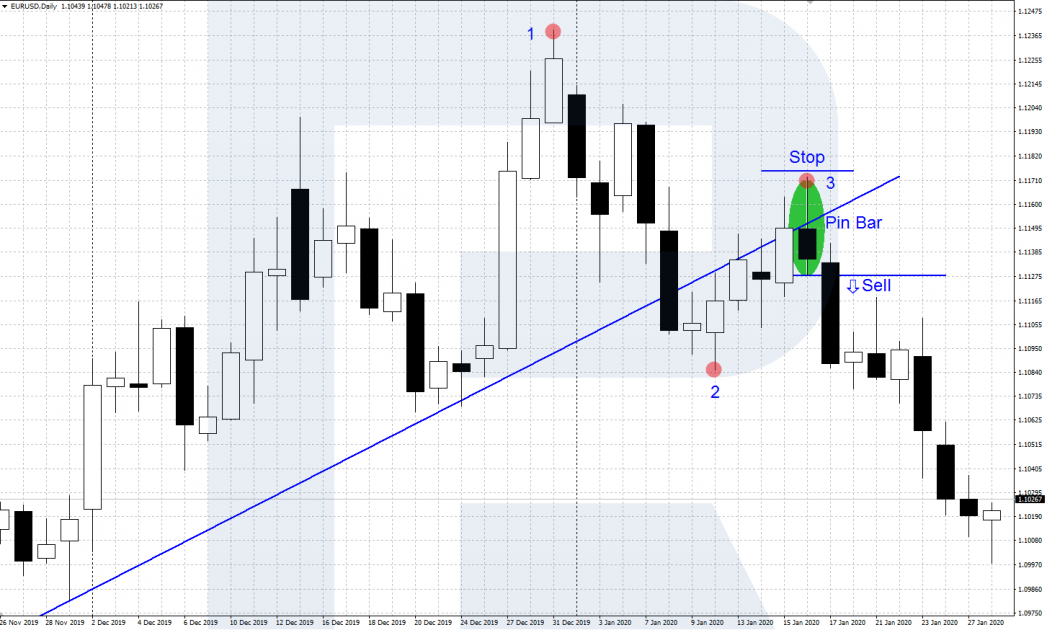

The 2B pattern in an uptrend

In an uptrend, two close-by tops are formed on the price chart. The price of the last high is a bit higher than the first top but it cannot remain at this level for long and starts going down, i.e. forms a false breakout of the first high.

After the price closes below the level of the first high again, we open a selling position with an SL behind the high of the second top. As for the TP, in mid-term trading, Sperandeo recommends making it 5 times larger than the SL. Thanks to such a ratio, one profitable trade covers up for 2-3- losing ones easily.

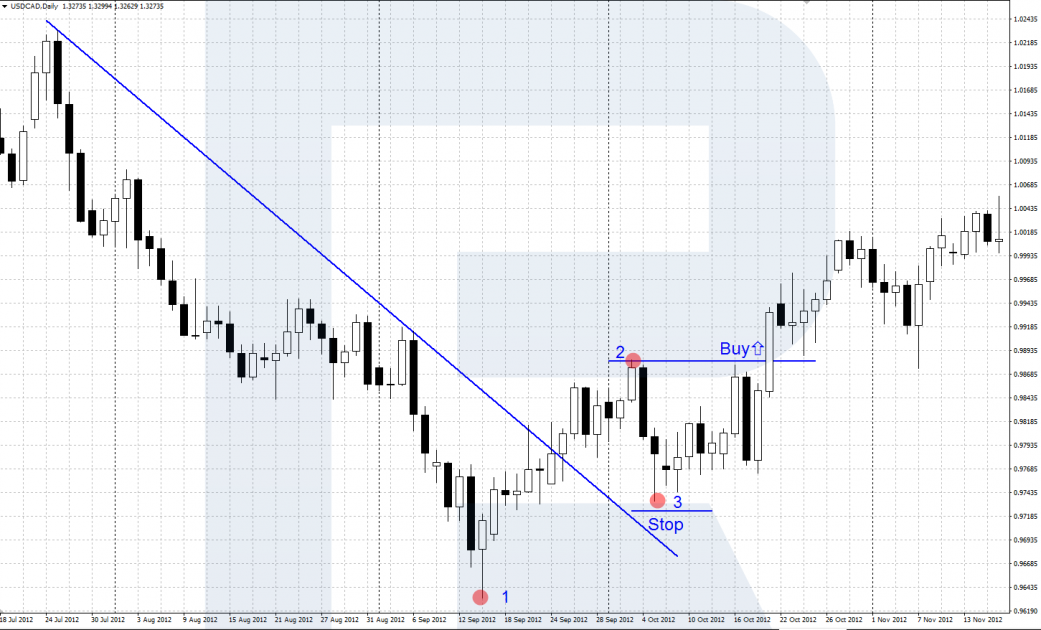

The 2B pattern in a downtrend

- On the price chart, two subsequent bottoms form in a downtrend.

- The price on the second bottom goes lower than the price of the low of the first one but cannot remain there for long and starts going up.

- After the renewal of the first low, a subsequent return and closing of the price above it, we open a buying position. The SL is below the last bottom, the TP is 5 times larger than the SL.

Closing thoughts

Due to Sperandeo’s long-time experience of trading on exchange markets, his methods have become popular among traders. The ways of trading described in his books still work well, bringing profit to those who have mastered all the details of his approach and their application on practice.

In this article, we have discussed how to draw a trendline by Sperandeo, how to trade a 1-2-3 reversal and 2B pattern. For a fuller and more detailed understanding of the author’s strategy and approach, I recommend two of his books: “TRADER VIC – Methods of a Wall Street Master” and “TRADER VIC II – Principles of Professional Speculation”.