Real Case: How I Earned 1427 USD in 10 Days on Cheap Stocks Using Pump and Dump

8 minutes for reading

Today, we will look a bit away from analytics and speak about the market and the situations that the trader may find themselves in, working by the Pump and Dump system. In more detail, you can read about trading by the Pump and Dump system in my previous article.

About Pump and Dump

I would like to note that the market is quite loyal to the traders using this system. Well, in fact, the traders who trade at a decline, restore the balance of the stock price. It is just important to choose the stocks for trading responsibly, analyzing the financial situation of the company and its perspectives of growth.

Of course, some young developing companies may not be profitable from the start. Earlier, Tesla (NASDAQ: TSLA) was also one of such companies. Many stockholders wanted to sell Tesla stocks because 7 years after the IPO the company kept suffering losses and no one believed it could reach its current level. However, in this circumstances we must realize that the money the company received was spent on increasing production and its own development, while the demand for electrocars kept exceeding production. That is why it is very risky to take a short position with such stocks at the start.

In other cases, working by the Pump and Dump system, we come across the companies that have long been on the market. Their stocks, before the agitated demand, trade below 5 USD, the reason for such a low price being the lack of investors' interest to them due to them having no profit or perspectives.

In such circumstances, the steep growth of the stock price of such a company is nothing but an ordinary "bubble". The exceptions are quarterly reports the results of which may demonstrate that the company is making a net profit. A profitable company may start paying dividends in the future, and as long as the stock price is very low, the annual dividend profitability of such companies may be a two-digit number.

In the end, this attracts investors, which leads to increased demand for the stocks, and the number of those who wish to sell them shrinks. So, if your selection of the stocks was good and you sold a security, ignoring the rules of the trading system, in MOST cases your position will turn out profitable anyway, you will only need to wait a little. I would like to emphasize the wording "MOST cases", which means there will be situations when the price does not return. That is why you need to have extra options of exiting the position. Mere hope is a silly thing to rely on fully.

Plus Therapeutics: 1427 USD in 10 days

I am going to tell you about my experience in trading by the Pump and Dump strategy, when I ignored the rules and admitted an early entry to the position.

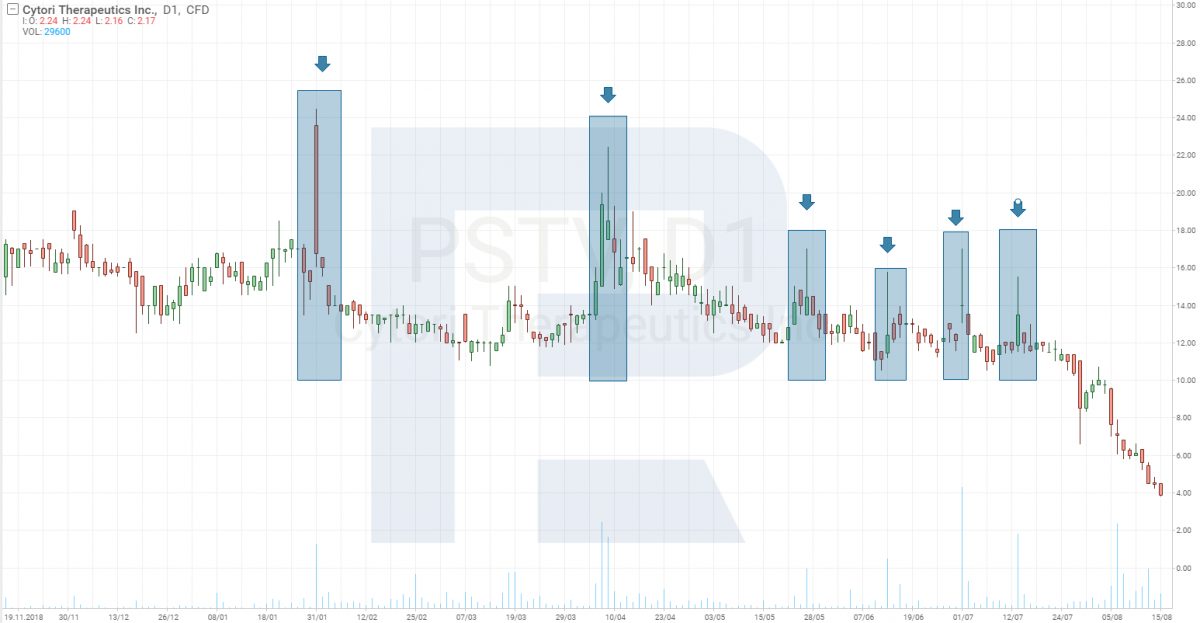

In the summer 2019, the Screener on the Finviz website showed me the stock of Plus Therapeutics Inc. (NASDAQ: PSTV). This company invents medicines for cancer treatment and other diseases. On August 15th, a report for the 2nd quarter of 2019 was published; the company’s management voiced its readiness to present the protocol of the second stage of clinical trials of the DocePLUS medicine in the second half of 2019. The management was looking for partners for the promotion of the new medicine.

On the one hand, the company remained losing, though the losses decreased, and the new medicine could bring them a profit. That is why I did not risk opening short positions; instead, I decided to watch the situation and the reaction of other traders to the news. Also, I paid attention to the behavior of the stock earlier. Note that almost all situations of steep price growth ended up in even steeper declines.

The situation in question was no exception. Two days later, the stock was trading 50% lower than their extremes. I thought I had missed a good opportunity but 5 days later the stock of this company reappeared on the Screener, and I realized I was to use the situation.

There were no news at the moment; analysts had no explanation for such growth of the stock. It was logical to suppose that it was speculators’ activity aimed at simply making money.

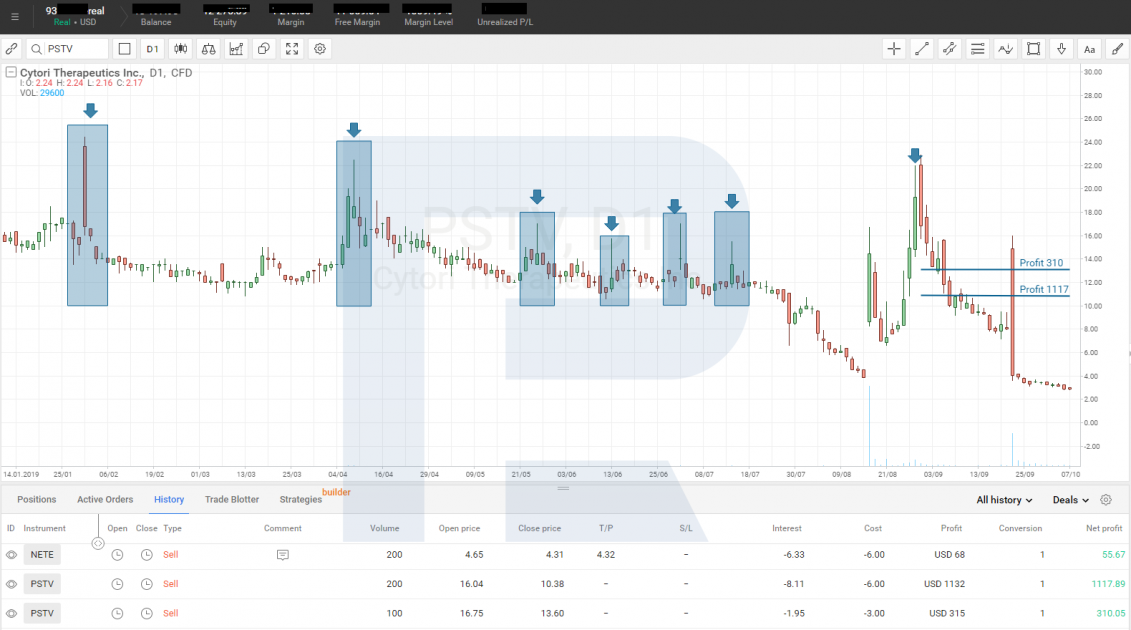

Before any support or resistance formed pointing at the beginning of a decline, I just sold my stock because the statistics showed they had started to fall after three days of bursting growth. But the problem was in the fact that I was selling the stock on the third day of the growth, not on the fourth one. This meant the stock could still go up, which exactly happened.

However, greed was before my eyes, and I worsened the situation, opening another selling position a bit higher. Here, the market played against me. The stock kept growing, increasing my losses.

Having calmed down a bit, I realized that the positions had been opened out of banal craving for money, against my own rules of trading. In the end, after the market closed, I came to a conclusion that there was still a chance for a decline, and if I followed the rules of trading, the stock price was to fall on the fourth day still. If this did not happen, I had to take in the loss.

The opening of the trading session on the fourth day was both cheering and disappointing. Firstly, there was a large gap which meant a high probability of falling, and this was good. However, on this gap, my losses exceeded 1000 USD, and to take it in, I had to wait till the end of the trading session, which could triple the loss.

So, I had nothing to do but watch. Fortunately, the bears became active quite soon, and, as I told you in the previous article, there started a battle between the buyers and sellers, so that levels started forming in the chart.

The first resistance level formed 40 minutes after the trading session began near 21.50 USD. According to the rules, I should have opened a selling position there. The second resistance level formed at 19.00 USD. The price kept falling, and the next day, I closed my first position with a 310 USD profit, and as long as the price was still falling, and new resistance levels emerged on the chart, I kept holding the remaining position, so that in the end its profit amounted to 1117 USD.

Thus, the profit from a stock amounted to 1427 USD.

However, if I had acted in accordance with my own rules, it could have been at least two times larger. Many will say that with such an approach a trader will not work on the market for long. Ok< I agree with this but I have something to add to the statement.

Having no experience in trading cheap stocks, opening short positions, ignoring their own rules of trading and risk management, a trader has very little chance for success. However, if you follow the rules of risk management at least, you can count on some success.

Tesla and a 3569 USD profit

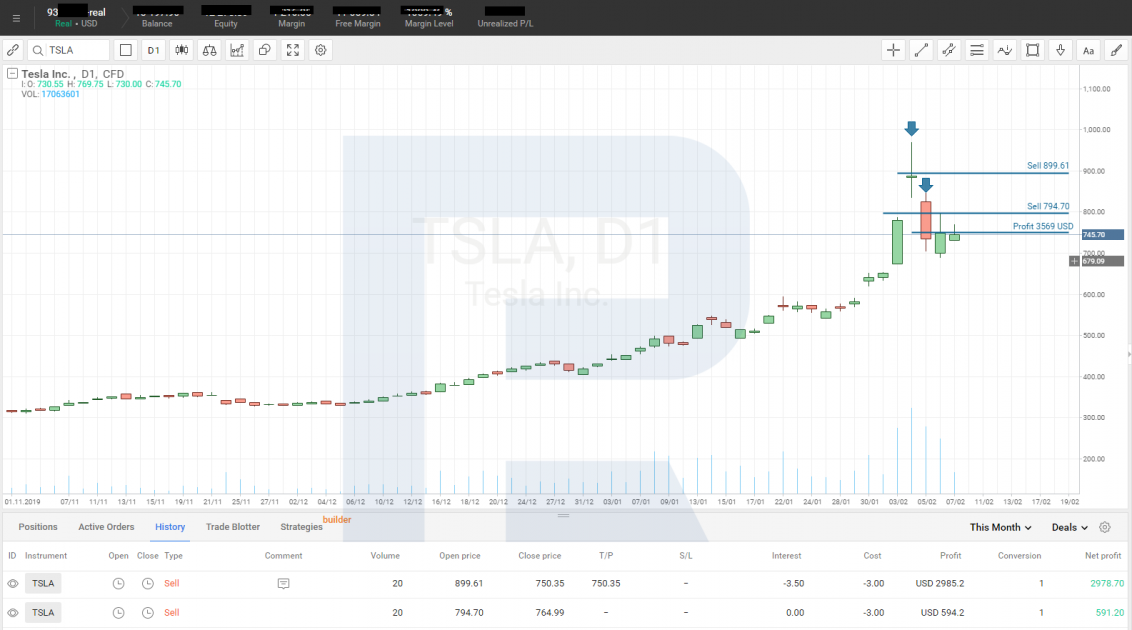

As you can see, there is nothing difficult here, and such situations emerge quite often. Let me tell you about another trade with the stocks of the company known by all – Tesla Inc. (NASDAQ: TSLA).

Just recently, there was high demand for Tesla stocks, which made the price grow from 650 to 970 USD in two days. On the one hand, they said that the price grew due to the traders close their short positions. On the other hand, some explained the growth by the electrocars becoming able to run 640 km without charging; some even connected the growth to the launch of satellites by Space X.

For me, the important thing was the chart on which I noted a quickly growing gap between two trading sessions. The stock was not cheap, so a mistake with entry could cost a lot. So, we had to wait for the right moment to come and enter the position in compliance with the risk management. I hardly ever trade expensive stocks but this time it was irresistible.

My scheme was standard. I waited for a level to appear and entered the position. As a result, I opened one position on February 4th and the other one – after I saw a Doji candlestick pattern on D1.

In the end, the profit from two trades in two days was 3569 USD; keep in mind I traded just 40 stocks.

The bottom line

The Pump and Dump trading system is as old as the exchange itself but the simplicity of the idea is attractive. We all know the sad statistics of business. Only 10 out of 100 new businesses remain on the market a couple of years later. The possibility that you will buy the stocks of a profitable company is 1 to 10, while the possibility that you will buy the stocks of a losing company is 10 to 1. I prefer the ratio of 10 to 1. Thus, I look for the companies that do not know how to make money, and they make the majority on the market, bringing me my profit.

The stock market gives traders amazing chances: it is just important to trade by the rules of your system and learn to wait for a good moment.