Coronavirus: Planning to Buy Stocks of Food Services

6 minutes for reading

The crisis goes on; however, it is time to choose the stocks worth buying. It is rather difficult to find the bottom of the stock market; nonetheless, in our situation, the coronavirus data will be the hint. Special attention should be paid to China, where the virus first appeared.

There, they have managed to stop the spread of the virus, and, according to the latest information, the number of the diseased is growing much slower. Last week, there were 82,057 infected people and this week, the number has grown to 82,574. For you to compare: during the same period, the number of the diseased in the US has almost tripled (from 124,660 to 337,637 people); note that there are 4 times fewer people living in the US than in China.

Hence, the measures taken by the Chinese government to stop the virus proved efficient. The main danger of the coronavirus is not its death rate (which is below 7%) but the speed of its spreading, which overloads the healthcare system and leads to its collapse. This, in turn, increases the number of patients dying from other illnesses, who fail to receive due medical care. The deaths of this type are partly included in the COVID-19 statistics, distorting the whole picture. At the moment of the emergence of the new virus in China, the death rate was below 2%.

Well, the city of Wuhan is getting back to life, the quarantine loosens, people are returning to the streets and their workplaces, reviving the country's economy.

It took China 4 months to stop the virus. Let us hope that the USA will cope with it much quicker, especially knowing that the vaccine against the coronavirus might appear soon; this means we must get prepared for buying stocks.

Starbucks Corp stocks

To begin with, let us have a look at Starbucks (NASDAQ: SBUX). In January, the corporation closed over the half of its cafes in China, the number of which amounted to 43,000.

Anyway, last week, Starbucks announced that more than 80% of the closed cafeterias are back in business. This is another proof of the revival of the Chinese economy. Naturally, the financial results of Starbucks in the first quarter will be deteriorated but no too seriously, as the income generated in China constituted only 10% of its overall income.

However, you should start investing in this company by small volumes because the coronavirus situation in the US and Europe has not yet reached its peak, and the work of the company in these regions may stop.

Currently, the stocks are trading at the support level of 60 USD. A bounce off this level may be regarded as the first signal of the growth of the stock price.

I will say it again that you should start investing small volumes because another wave of declining due to the spread of the virus in the USA and Europe may follow.

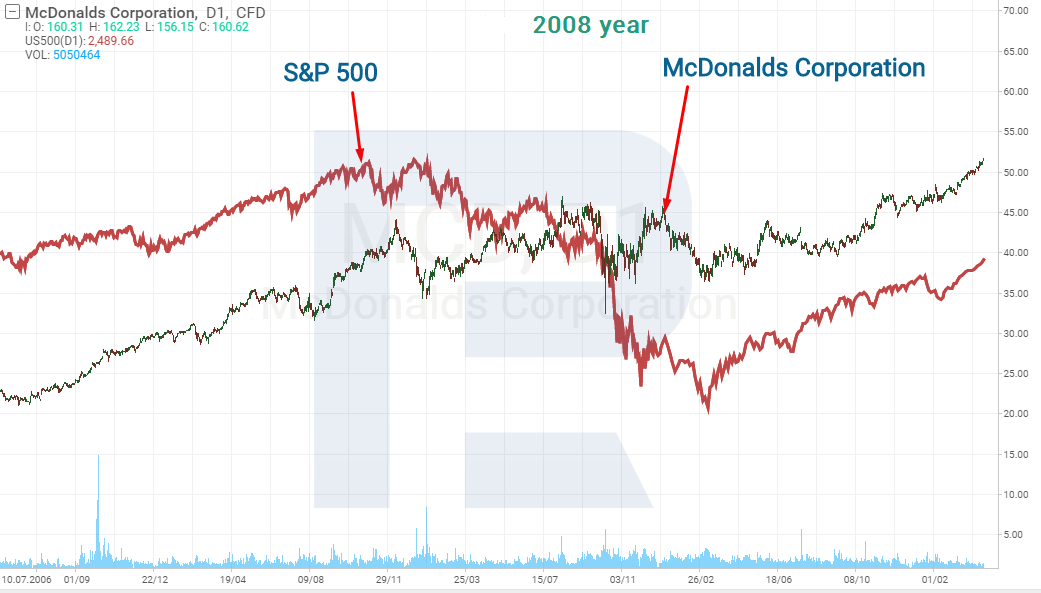

McDonald’s Corp stocks

In this situation, the stocks of the fast-food corp McDonald's (NYSE: MCD) look most attractive. The company survived the crisis of 2008 rather easily, and since then, its stocks have grown in price almost 5 times.

McDonald's has more than 38,000 restaurants all over the world, 90% of them working on a franchise. Thus, all the risks connected to the decrease in the number of clients, the expenses on the rent and the salaries of the employees, etc. are assumed by the franchisees, who also must pay the franchise itself to McDonald's.

The decrease in the number of clients all over the world stimulated the management of the company to grant a delay in the franchise payments. Thus they accumulate the potential for quick restoration of the company's income after their decline.

The delivery service launched by McDonald's several years ago will now, when people remain at home, help not only to keep the clients loyal but also to make a profit on their purchases.

Technically, on the McDonald's stock chart, the support level lies between 150 and 140 USD. A bounce off this area may lead to the growth pf the stock price to 190 USD.

PepsiCo, Inc. stocks

Well, as for PepsiCo (NASDAQ: PEP), in today's crisis it has even announced recruiting 6,000 new employees in addition to 90,000 people already employed. What made the management extend production and hire new employees is increased demand for the products.

On April 28th, the company will present its financial results for the first quarter of 2020. The growth of the income to 13.15 billion USD is forecast, which is 2.73% more than in the same quarter of 2019. Most analysts are optimistic about the PepsiCo stocks and recommend buying them.

Tech analysis also confirms the high probability of price growth. On H4, there has formed a Head and Shoulders pattern, which signals possible growth, the nearest resistance being just the level of 137.00.

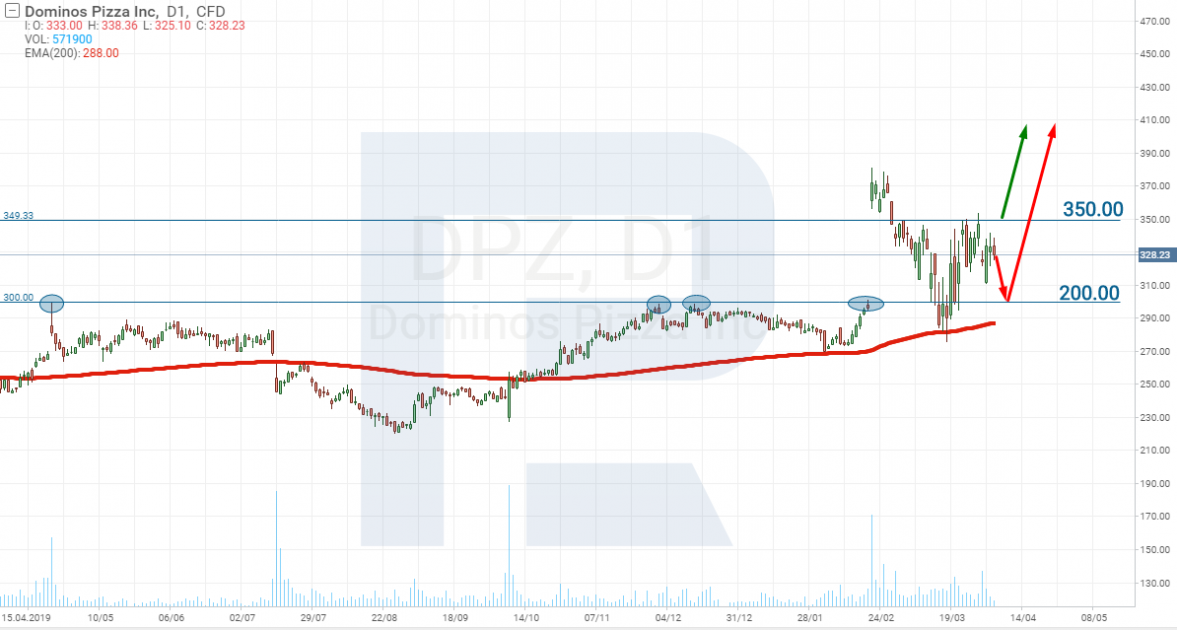

Domino’s Pizza, Inc. stocks

The company that suffers an even severe lack of employees is Domino's Pizza (NYSE: DPZ). Almost all of its restaurants remain open in the USA. Internationally, some spots were closed temporarily; however, in China, for example, they have started working again and the sales are even growing rapidly.

At the end of March, the management, evaluating the situation, decided to hire about 10,000 new employees. The company needed delivery people, operators taking orders and cooks, i.e. the personnel serving clients directly.

On D1, the stocks are trading under the 200-days moving average, which indicates an uptrend, preserving even in the crisis.

Papa John’s International. Inc. stocks

However, the leader in hiring new employees is Papa John's (NASDAQ: PZZA). During the pandemics, the income of this company has grown not only in the USA but also in other countries. The growth of sales in the first quarter of 2020 amounts to 5.3% in the USA and 2.3% worldwide. Due to this, the company has decided to recruit 20,000 new employees. Food delivery is now one of the most popular services. The advantage of a food service company is its capability to increase the production volume rapidly and deliver the product to the clients, so the demand for workforce growth; the employees do not need to be qualified.

By now, the stocks have played back over 50% of the drop that happened at the beginning of the year and are trading just 20 USD below its all-time highs. A breakaway of 56.00 may lead to further growth of the stocks and bring them to the pre-crisis levels.

Closing thoughts

More and more often, we can hear rumors that the coronavirus pandemics will have weakened by summer. If this happens, the stocks of food services will soon return to their pre-crisis levels. During the quarantine, many companies switched to food delivery to survive. This must lead to the growth of the number of clients in the future because when the quarantine is over, some clients will return to the restaurants while others will keep ordering food delivery. That is why now you should pay attention to the companies that have adapted to the situation successfully and developed or strengthened their positions in serving clients online.