Avalanche of Profit: Testing the Expert Advisor

4 minutes for reading

Welcome to the RoboForex blog. Today, we will discuss an expert advisor for scalping: it works on H1 but makes a large number of trades. The Avalanche expert advisor is a high-frequency trading robot aiming at numerous trades even on large timeframes. The number of trades may amount to hundreds a day and thousands a month.

The working principle of the Avalanche EA

The trading algorithm of the robot is simple. For finding entry points, it uses 2 standard indicators: the Bollinger Bands and Relative Strength Index (RSI). The first one is a range indicator, hence, it may be used as a trend indicator for defining the general market direction. The second one is an oscillator, a special type of indicator which traders most often use for finding entry points. To put it simply, the expert advisor needs two signals from the indicators given simultaneously to open a position in a chosen point.

Unfortunately, I failed to find out how the expert advisor uses the indicators and what signals exactly it chooses. This is because the code of the robot wrote by the author is encoded and the working algorithm has a completely different style. All the sorts of the initial code I have managed to find are downloadable at the end of this article.

Only basic currency pairs suit for this robot: EUR/USD and GBP/USD; you may try it with other pair as the trading strategy of the robot is rather universal, however, it has been optimized for the named pairs.

The timeframe recommended by the developers is H1 as the strategy was designed for it. Frankly speaking, the timeframe is not that important: the Avalanche gives the same results on H1 and M5.

The expert advisor can both work with a fixed and dynamic lot (the latter increases proportionally alongside the deposit). The developers assure us that the expert advisor does not need optimization; judging by its parameters, I would say it is true.

The Avalanche advisor settings

- TimeFilter mode makes the expert advisor trade in certain hours only

- SessionStarts sets the hour when the trading session begins

- SessionEnd sets the hour when the trading session ends

- UseMoneyManagement switches on the built-in money management, i.e. the lot is calculated automatically depending on the risk

- Risk: the risk level is expressed in percent of the deposit for calculating the lot

- Lots is the lot that is used for each position if you opt for automatic money management

- MagicNumber is the unique number of the expert advisor meant for distinguishing between the trades of different robots

- Slippage is the maximal slippage in points, admissible if the requote from the broker is triggered

- Broker5Digits: activate this parameter if your broker sens 5-digit quotations to the terminal.

If you do decide to optimize the expert advisor, the only thing you should touch is the time of trading as the optimization of other parameters is useless: if you get better results, they will most probably be random.

The Avalanche 1.2 test drive

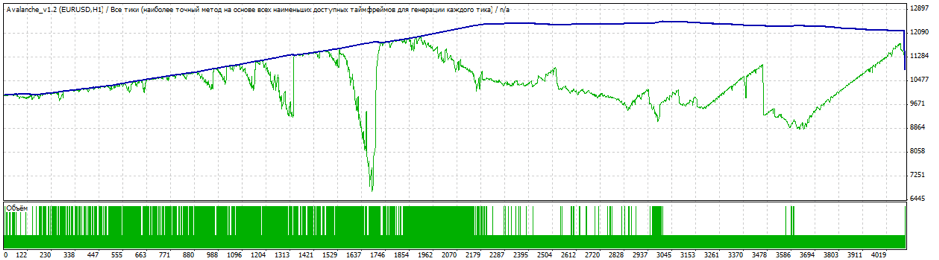

This is the only working version of the expert advisor that I have managed to find and test. Its code, of course, differs from the original quite a lot but the essence is the same. This robot does not, indeed, need optimization as even with the default settings it gave the following results. I tested in on the H1 of the euro:

As you may see, the results are more than satisfying; moreover, this version is written in a bit different way, so it is more flexible, and you may customize to before using real-time.

As long as the expert advisor is globally customizable and yields perfect results even with the default settings, no wonder that the Avalanche 1.2. can boast mostly positive feedback, which especially notes its simplicity and the possibility to use it without preliminary tests. Even so, always test all expert advisors on demo accounts real-time before trading your capital.

Recommendations on the use of the Avalanche expert advisor

As long as the expert advisor is based on mathematical indicators and has an open initial code, you may choose any parameters of the system, including the default settings of the indicators, if you know the MQL programming language well. Moreover, you may add your own parameters to standard ones. If you make the indicator settings easily customizable, you may enhance them by the built-in strategy tester of MetaTrader 4.

Also, note that the Avalanche has a fully mathematical trading strategy as it is based on indicators. Hence, it cannot show good results for a long time and needs constant control and re-optimizing.