Testing of MarSe Expert Advisor

5 minutes for reading

General strategy of MarSe

The name MarSe was derived from the names of two trading strategies – Martingale and Surfing. The Surfing strategy has been created by Victor Borishpolets for daily trading on Forex and the stock market. The system is based on the RSI.

The main feature of this strategy is that it can be used without deep knowledge of the market, such as how large banks and market players work, where they accumulate their positions, how macroeconomic processes flow etc. Its main task is to catch strong and continuous movements in the trend. The strategy uses such indicators as the RSI, Envelopes and Moving Average.

The best trading period is the time from the start of the European session till the start of the America one.

Speaking about the MarSe advisor, it has the following algorithm built in: the analytical module determines he direction of the trend, then the market situation is analyzed at the crossing of the previous candlestick with the Moving Average indicator (MA). False entrance signals are eliminated by the RSI and MA; then a pending order is made. If it triggers and the positions opens but the price does not reach the expected level of Take Profit (TP) and makes a reversal, the Martingale model launches.

Martingale principle in trading works as follows: if a trader enters a bargain with 1% of the deposit and it results in a loss by a Stop Loss (SL), the next operation will take 2% of the deposit, then 4% and so on in the geometric progression.

An important feature of the Martingale in the MarSe is the function of increasing the step for opening each new level of the series of orders. Each time the step and the volume of the bargain increases. This model is often called Stretching. For example, the second bargain opens 50 pips away from the previous one, the third – 100 pips away, the fourth – 200 pips away, and so on. Such approach makes the work of the advisor more stable but might stretch the time before closing the bargain.

Another feature of the MarSe is using of an additional money management pattern by Larry Williams. That very Williams who took part in the famous year contest of traders Robins World Cup Trading Championship in 1987 and won it, having turned 10,000 USD into more than 1,100,000 USD in 12 months’ time. This record has not been renewed though 30 years have passed. I suppose, ideas of such trader are worth taking into consideration.

Money management by Larry Williams

A set of rules of operating one’s assets, i.e. money management, is meant for avoiding too risky decisions. The model in question can be characterized the following way: “The volume of the lot will equal the equity (free money on the account left for the robot to manage) multiplied by the risk coefficient that the trader specified”.

General advice:

- Trading instruments – any currency pairs

- Timeframe – M1

- Working hours – 24h

- Leverage – 1:200 and higher

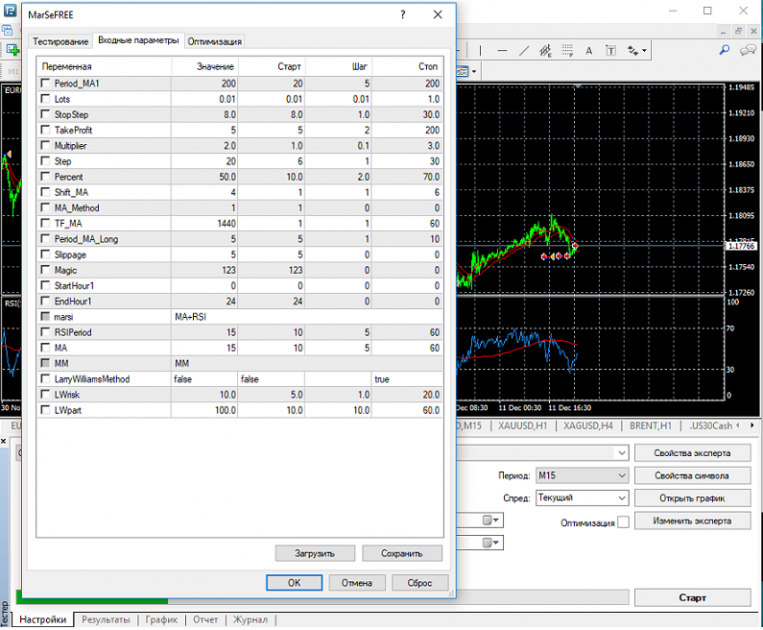

Setting up the Marse expert advisor

Period_MA1 – period for the indicator Moving Average 1. It is a key setting determining the frequency of bargain opening. The optimal parameters are between 10 and 20. If it is lower, the trading will be too aggressive, and the Martingale will trigger more often.

Lots – the volume of an order. This setting may only be customized when money management function is off.

StopStep – the distance in points between the Min/Max of the previous candlestick to the placement of a pending order.

TakeProfit – the level of locking in profit in points.

Multiplier – Martingale multiplier (the index of increase of the next order).

Step – distance (in points) to the next order in the series (the distance to the next order according to Martingale).

Percent – the percent of the deposit that, when achieved, triggers the advisor to close all open orders and go on trading.

Shift_MA – shift of the Moving Average.

MA_Method – method of calculation for the Moving Average 1 and Moving Average 2 (we recommend setting it up as 0 – Simple or 1 – Exponential).

TF_MA – the timeframe of the Moving Average for trend analyzing. It is not, of course, the only timeframe suitable for trading; it is necessary for setting up the MAs. You can leave settings by default – 1440 (D1).

Period_MA_Long – the period of the Moving Average meant for trend defining.

Slippage – slippage in points (the maximum possible price change during the time from the moment the advisor sent an order to the broker server till the moment of its execution).

Magic – unique number (magic number) that helps the advisor distinct its bargains from other ones.

StartHour1 – time when trading begins (not recommended to change).

EndHour1 – time when trading ends (not recommended to change).

RSIPeiod – period of the RSI.

MA – period of the Moving Average for the RSI.

LarryWilliamsMethod – switching on/off (True/False) of Larry William’s money management method.

LWrisk – percentage of risk (percentage of capital for opening a new position). The range between 5% to 20% is recommended.

LWpart – the percentage of the deposit assigned to the advisor.

Testing and optimizing the Marse advisor

Judging by the practice of using this advisor, it may be said that even its default settings help work stably and make profit on long timeframes, provided that the money management is adequate.

The first settings to customize are Moving Average 1 and Lots. It allows to make trading more stable and efficient and maximize the profit.