How to Make High Yield Stock Investments?

8 minutes for reading

I have already told you how to find promising stocks in Healthcare sector. In this article, I will tell you about how to choose stocks for high yield investments and give you particular examples of the stocks that may grow in price by dozens of percent in July.

How to find stocks for high yield investments?

To make a high yield stock investments in a short time, look for stocks with a relatively low price. For example, a stock that costs 50 cents may rise to 1 USD per stock inside one trading session thanks to minor news. As a result, you will make a 100% profit. A stock that costs 100 USD may never show equal profitability in such a short time.

The point here is the low p[rice of the stock which allows investing even with a modest starting capital, while limited trade volumes make the price react to the smallest increase in the demand.

All in all, for high yield stock investments with low risks and a holding the position for a short time, pay attention to cheap stocks which cost less than 5 USD. Let us try to find such stocks.

The first stage of selection

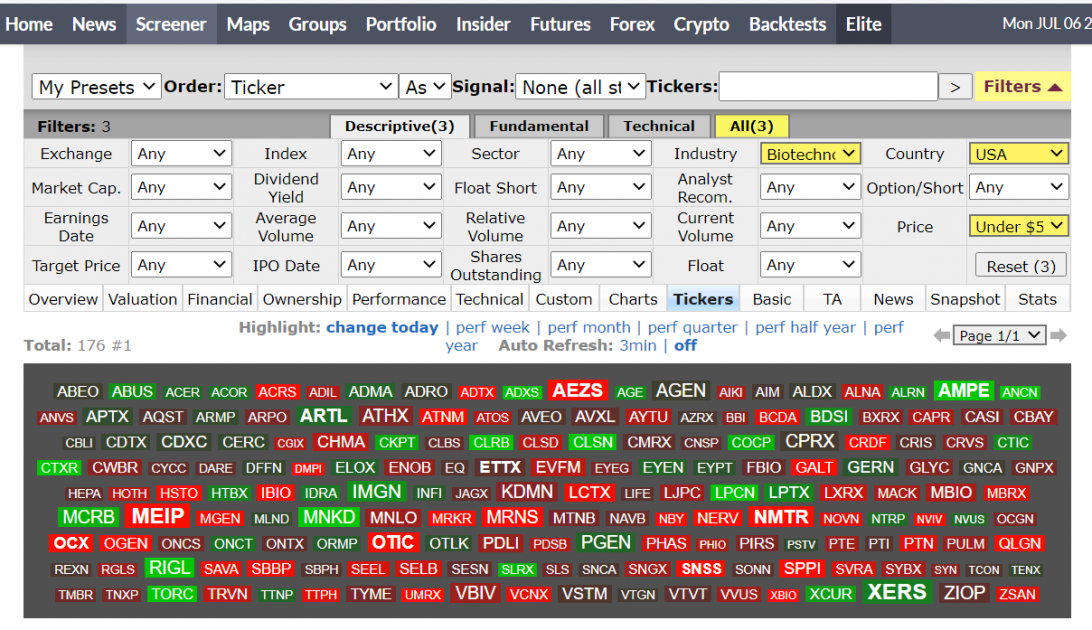

According to the scanner from the Finviz.com website, in the US stock market, there are currently 898 stocks that cost under 5 USD. Hence, you need to know in which sector to look for stocks and which events may push the price upwards.

If you have already read the article mentioned above, you must know that the most promising sector is biotechnologies as this is the sector in which abrupt stock price growth happens most often. The main type of event is the decision of the FDA about some drugs or treatment methods undergoing tests.

So, let us limit ourselves by biotechnologies. Here, Finviz.com selects 176 stocks.

Much better, but still too many. Now to the hardest part. Let us scrutinize the list and find the company that will fill our deposit with a good profit.

The second stage of selection

For the second step, let us think logically. If the decisions of the FDA influence the stock price, we need to have a look at the FDA calendar to find out, which drugs will be hearing the verdict in the nearest future.

FDA calendar

The FDA calendar is an extremely useful information source for those who plan to buy cheap stocks. Find it by the following link.

According to the calendar, in July, the FDA will make its decision on 29 drugs of different companies; out of them, only 5 stocks cost less than 5 USD. These companies are:

- Endo International plc (NASDAQ: ENDP)

- ObsEva SA (NASDAQ: OBSV)

- Abeona Therapeutics Inc. (NASDAQ: ABEO)

- Otonomy, Inc. (NASDAQ: OTIC)

- Celsion Corporation (NASDAQ: CLSN)

Now let us have a closer look at each company on the list.

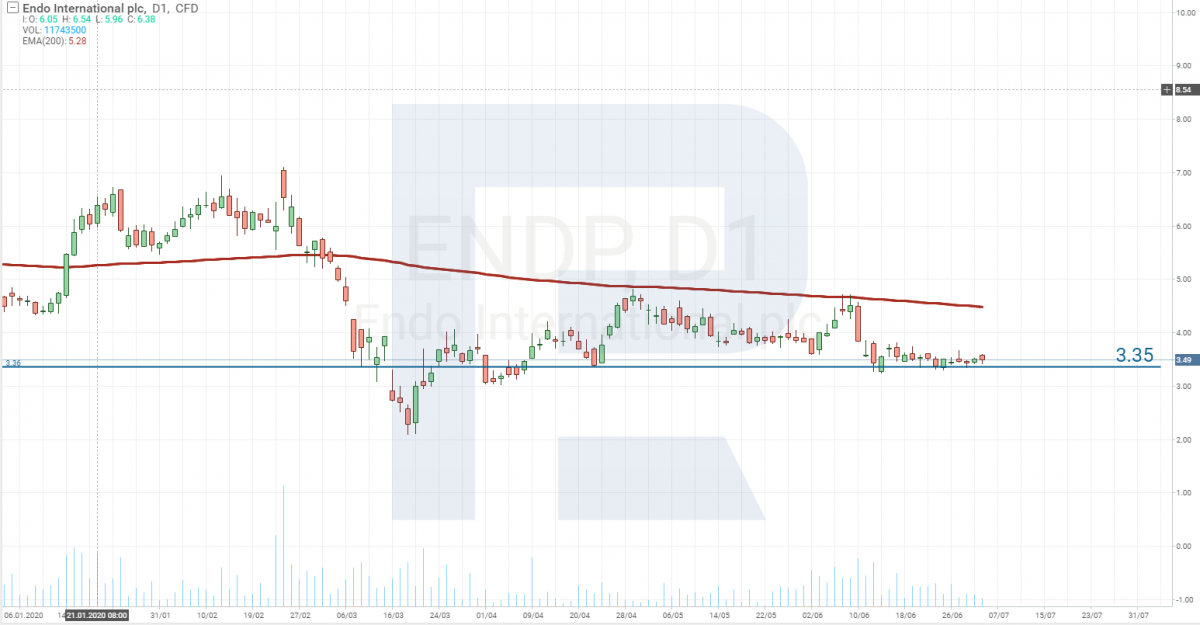

Endo International plc

The drugs undergoing tests have not been created by Endo International solely: they were designed together with a larger pharmaceutical company BioSpecifics Technologies Corp. (NASDAQ: BSTC). The two companies have created these two medicines:

- XIAFLEX (meant for Dupuytren's contracture treatment)

- EN3835 (meant for cellulite treatment in women).

The results will be known on July 6th.

The company selling the drugs is Endo International, so it will be the first to reap the profit. Hence, pay attention to Endo International.

By the time this article is published, we will have found out the results, so we will just have to look at the reaction of the stock. At the moment I wrote this article, the stock was trading at 3.49 USD.

ObsEva SA

Also, on Monday, July 6th, at the virtual session of the ESHRE (European Society for Human Reproduction and Embryology), ObsEva SA will provide the results of the third phase of testing the OBE2109 drug (meant for the reproductive health of women).

The stocks of this company are trading at 6.15 USD. For the last three days, the stocks have grown by over 20%; as with Endo International, we just have to wait and see the reaction of investors.

Abeona Therapeutics Inc

On July 10th, the company will present the results of the second phase of testing EB-101 cellular therapy.

EB-101 is autologous, gene-corrected therapy meant for the treatment of a rare connective tissue disease in children. In other words, this drug enhances regenerative processes in damaged skin.

The stocks have already broken away the level of 2.60 USD and secured above it. The security is currently trading at 2.86 USD. In May, the trade volume reached 3 million papers with an average of 1 million papers per session. This means investors are interested in the company.

Otonomy Inc

Otonomy Inc has not specified the date of presenting the results of testing the OTO-313 drug. We only know that it is happening in July.

The drug is meant to treat tinnitus. In 2009, the first trials of the drug prototype were conducted on 6 patients who marked the pronounced improvement of their state. However, the results are invalid as no one was given a placebo.

This time, two groups of patients participate in the tests: one receive placebo, while the other one – OTO-313. We will know the results in July.

On the whole, analysts are interested in this company and recommend buying the stocks. Also, the enhancement of the company’s financial results is expected.

During the last three months, the stock price doubled.

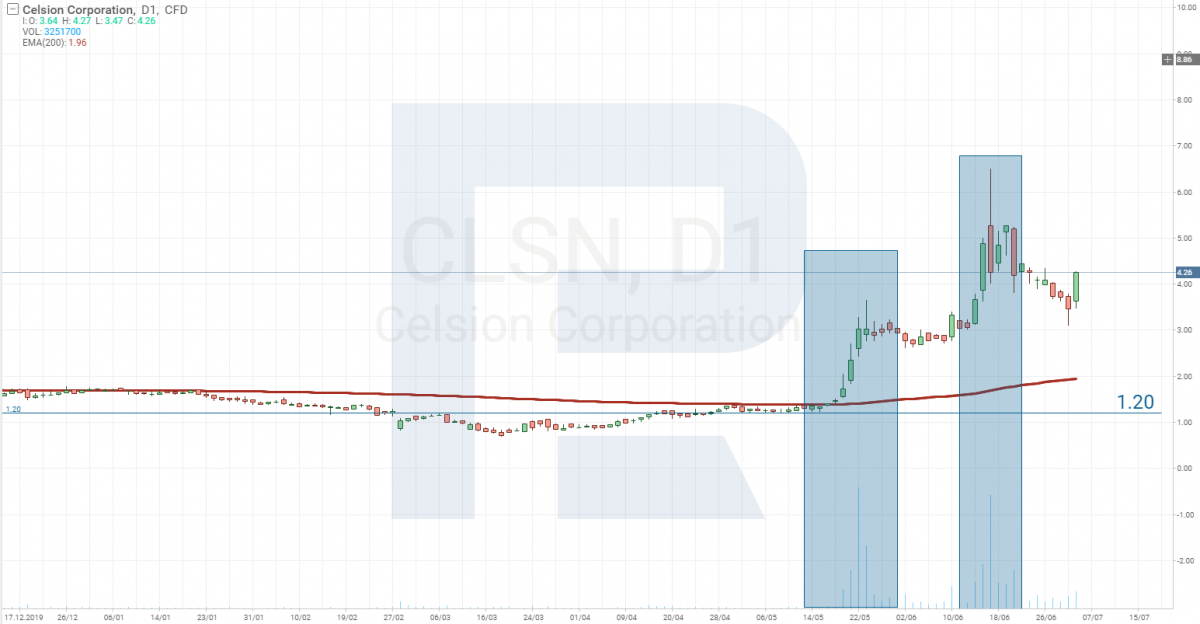

Celsion Corporation

The last but not the least is Celsion Corporation specializing in cancer. In July, the company will present the results of the third phase of testing the OPTIMA treatment method of liver cancer. In the research, 556 patients from various countries take part. Earlier tests revealed a decrease in the death risk of patients by 30%.

The volatility in this company’s papers has been increasing since May. The stock price has grown by over 500%.

On June 24th, the company sold 2.5 million stocks for 9.2 million USD. The company plans to use the money for the next research of cancer.

Which stock to buy?

Now we only have to choose the stock for buying. As long as all the stocks enumerated above have a low price, I advise buying all of them.

The results of the tests are hardly predictable because we do not have enough data. However, I will show you the reaction of stocks to the results. Let us begin with a negative example.

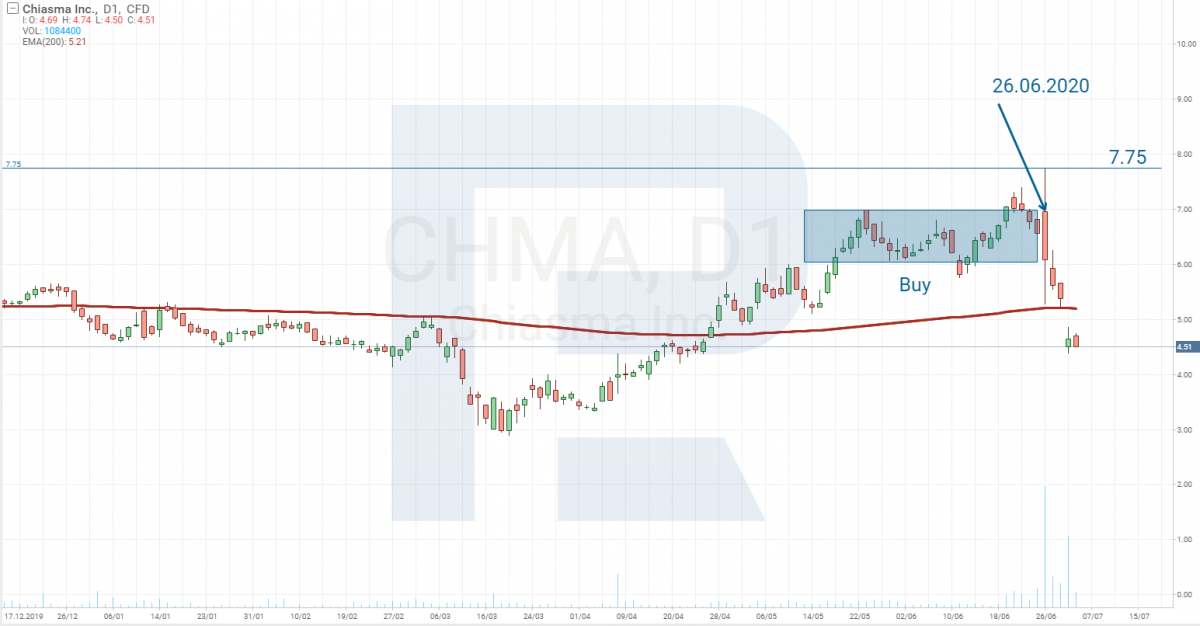

Chiasma Inc

On June 26th, Chiasma, Inc. (NASDAQ: CHMA) got their MYCAPSSA capsules, meant for prolonged treatment of patients with acromegaly, approved by the FDA.

The news was good, and at the moment, the stock price reached 7.75 USD, growing by 10% during a trading session. However, a bit later the price started falling. By the end of the day, it dropped to 6.07 USD.

By the principle, I described above (searching for a stock to buy in advance), you should have bought the stock in the range between 6 and 7 USD. Thus even with the worst buying price you could either close the position with a profit or lose no more than 12% at the closing of the trading session.

And now, a positive example.

Ekso Bionics Holdings Inc

On June 25th, the company Ekso Bionics Holdings Inc (NASDAQ: EKSO) got its exoskeleton for people with brain injury approved for selling by the FDA. A couple of days before the event, the stocks were trading under 3.80 USD each. By the end of the trading session, the price reached 7.30 USD, and the next day, it sky-rocketed to 10 USD.

Thus the yield of the stock investments turned out over 100%, which definitely covered the losses from buying the stocks which price has fallen due to some bad news or sales by those who wish to take the profit.

Closing thoughts

This way of choosing stocks may bring high yields for stock investments; however, any profit is connected to the risk of a loss. Anyway, here, we may receive yields much larger than a potential loss.

Another advantage of the method is the fact that your risk is limited by the zero stock price – it has no room for falling deeper. Meanwhile, your profit is unlimited. The greed of investors may raise the price by 1000%. This means, per 5 securities you buy, you need only one to cover up the expenses and bring a profit.