Novavax Stocks: To Buy or to Sell?

8 minutes for reading

On January 29th, 2020 I published an article about Novavax (NASDAQ: NVAX) Which Stocks Grow During Coronavirus Epidemic?. I could not imagine then that the stock price of this company will sky-rocket to 100 USD. I turned out there were no limits to the greed of investors.

The Novavax stocks are overpriced

I am warning those who are still eager to buy Novavax stocks: most probably, the stocks are significantly overpriced.

If you have been holding the stocks of this company in your portfolio since January, it might be the time to think about taking profit as the price has already increased insanely.

In January, when I was writing the article, the Novavax stocks cost 8.50 USD each, now they have reached 100 USD per stock. In other words, 100 stocks bought in January at 8.50 USD per stock, would now be bringing 90,000 USD of profit while you would have needed 8,500 USD only to buy the volume.

Now let us figure out what has been happening in the company these 5 months and why the stock price has grown so much.

Why did the Novavax stock price grow?

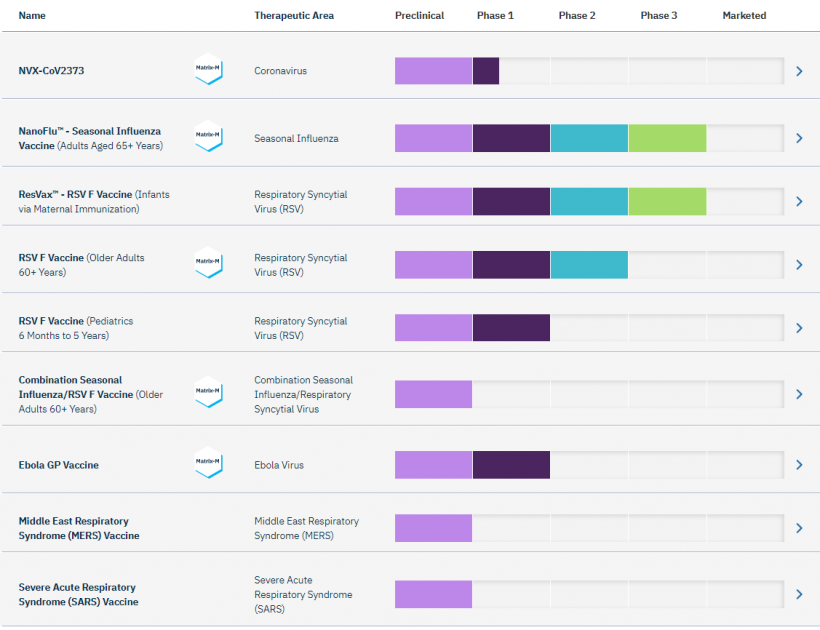

Novavax has never generated profit, i.e. it has always been a losing company. It only has 2 drugs that are undergoing the third phase of testing and may soon go to the market. These drugs are expected to generate future profits for the company.

However, the main hope is the coronavirus vaccine NVX-CoV2373 that is just preparing for the first phase of testing and will go to the market next year at best. Nonetheless, this vaccine attracted the attention of investors and provoked such stock price growth.

How to explain the behavior of investors?

The behavior of investors is quite easy to explain: they are buying the stocks of companies that promise future profits.

An example of companies producing electronic vehicles

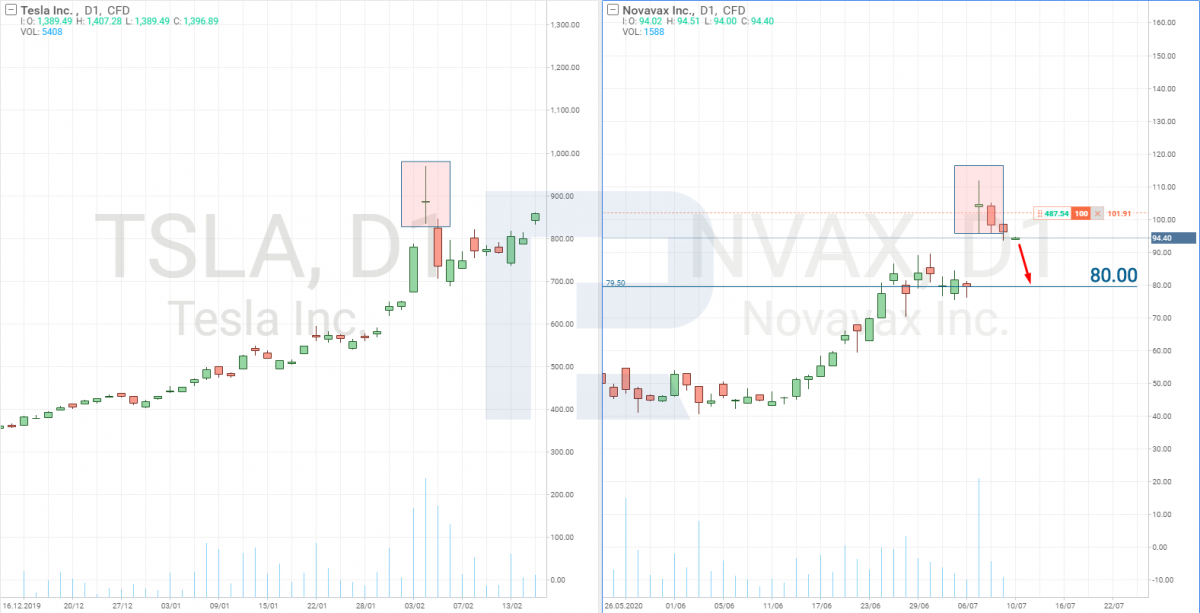

The same thing once happened to Tesla stocks. The company had been losing for 6 years but its stock price kept growing month after month.

Now the stocks of all companies dealing with electric vehicles are growing though no company has yet sold a single electric vehicle; moreover, all of them except Tesla are losing. Have a look at the charts of the companies below.

Risks of investing in biopharmaceutical companies

If you compare investing in electric-car producing companies and biopharma companies, the first case will be less risky.

Electric cars are the future, this sector will be developing inevitably, and those who are already in the market will be the first ones to make a profit.

On the contrary, investing in biopharma companies is very risky. Here, everything depends on the FDA decision. A drug may pass 3 stages of testing – and fail the last one, ruining the whole story. Investors start selling the stocks, while companies try to survive on loans and new finance sources. The same has already happened to Novavax.

Novavax failure at the 3rd stage in 2016

In 2015, Novavax stock price reached 282 USD per stock. The ResVax drug was on the 3rd stage of testing; investors believed in the company, and it easily attracted millions of dollars for new research.

However, in 2016, ResVax failed the tests, more precisely, the dosage used in the tests turned out inefficient. As a result, the stock price fell by 85% overnight, and the company had to fire more than 30% of employees to cut down on expenses.

Another Novavax failure at the 3rd stage in 2019

Novavax went on working, and in 2018, it was granted 89 million USD by Bill and Melinda Gates fund meant for the research and tests of ResVax – RSV F Vaccine that is used for protecting newborn babies from respiratory diseases by vaccinating their pregnant mothers.

In other words, a drug that failed in 2016, was again sent to tests on two groups of patients. The first group consisted of pregnant women and the second one – of elderly people over 65 years old. Such a combination increased the chances for the drug to pass the tests.

The news cheered investors up, and the Novavax stock price sky-rocketed from 20 to 50 USD.

However, in 2019, Novavax failed again. Testing yielded no positive results, and the stock price fell from 50 to 4 USD. This seemed to be the end. Many years of work, millions of dollars spent on research – all was wasted.

However, the end did not come. The employees accumulated colossal experience that they keep using for work. This experience attracted the attention of investors who believed that the company would create a vaccine against Covid-19.

Novavax announced the beginning of tests on people

In January, Novavax announced that it had a candidate for the vaccine that had passed tests on animals. This news made the stock price grow; at that moment I noticed the company, hoping for the experience of Novavax employees in healing viral diseases.

Novavax grants

A month later, Novavax was granted 4 million USD by the Coalition for Epidemic Preparedness Innovation (CEPI), and the stock price kept growing.

In other words, money started flowing into the company and triggered the natural process: investors noted the ccompany again and started buying the Novavax stocks.

In May, the CEPI investments reached 388 million USD. The stock price stepped over 50 USD each. June came, and Novavax received another grant sized 1.6 billion USD from the US government.

This was the event that became the main driver of the Novavax stock price growth. The price sky-rocketed from 50 to 100 USD. The only next positive event possible is the vaccine going to the market.

Risks of investing in Novavax stocks

Now let us come down to earth from the clouds. Novavax has 9 drugs undergoing tests but none is yet making a profit.

The vaccine against Covid-19 called NVX-CoV2373 is one stage one only. And we know that previously, drugs failed on even stage 3. This means the probability of failure is very high.

Next, the Novavax stocks already cost 100 USD, while in January, the price was below 10 USD. To put it simply, the current price is not so attractive for investors. The stock price growth is directly connected to the grants that the company received; Novavax is still a losing company.

Finally, history shows that when the stock price is extremely high, you will not be able to close the trade with a small loss in the case of a failure. The stock price drops by dozens of percent before the market opens, leaving no chance for closing with a minimal loss. All that the stocks are growing on now if the hope for possible success in creating a vaccine against Covid-19.

The government is granting money to everyone who is working with vaccines: it is cheaper to invest billions in vaccine research than trillions in supporting the economy.

However, these are not all risks. Novavax will start the tests much later than its rivals. Hence, it is highly probable that some of them will succeed earlier.

Preliminary results of the tests will become available only at the end of July. Personally, I would not risk having a buying position at 100 USD per stock at the end of the month.

Technical analysis of Novavax stocks

Technically speaking, the stock price experienced a gap and then formed a candlestick called Long-Legged Doji which indicates a possible decline.

In Tesla stocks, the situation was the same when the stock price started growing thanks to the agitation around the company.

Currently, an optimal level for buying might be 80 USD per stock. However, this is only for those who are ready to risk.

Closing thoughts

I do not try to say that Novavax stocks will not grow anymore. However, from a trader’s point of view, the current levels are too risky for buying. I believe in the company and its success in creating the vaccine, I am ready to buy its stocks – but at a lower price.

The greed of investors, of course, may pull the price even higher – but this will not be normal market behavior. The demand and supply may lose balance abruptly, which will provoke extremely high volatility, dangerous for inexperienced traders, and threatening a loss of a large sum.

However, the expected results of testing are the scariest: if they turn out negative, the stock price will drop to the lows where it was in January.

Hence, the risk to profit ratio here is unattractive. You may now make a profit of 100% of your investments; however, be ready to risk 80% of the same sum.

In January, the potential profit was very high, while the risk was below 50% as the stock traded at its lows.