Trading with xSuperTrend indicators

5 minutes for reading

In this article, we’ll talk about a group of indicators called xSuperTrend, application of which, together with certain rules, may provide trading on the Forex market with positive mathematical expectations. The strategy, which I’ll describe below, should be used with М30. The list of instruments is limited down to Forex because these indicators are only available in MetaTrader 4.

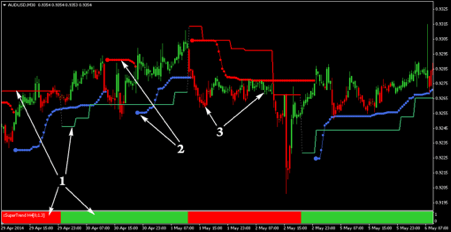

Desktop for trading with xSuperTrend indicators

Desktop explication

- The xSuperTrend MTF indicator (shows the tendency direction on Н4, as well as levels that may serve as support or resistance, or after a breakout of which the tendency may change to the opposite);

- The BBands_Stop_v1 indicator (serves as a support and resistance level, as well as shows the best spot for placing Stop Loss);

- The xSuperTrend Candles new indicator (an additional filter for making trading decisions).

A signal to buy when trading with xSuperTrend indicators

The following conditions should be met for a signal to buy to appear:

1. The xSuperTrend MTF indicator must be green;

2. The BBands_Stop_v1 must be blue;

3. The xSuperTrend Candles new indicator must be green;

4. The price must rebound from xSuperTrend MTF or BBands_Stop_v1 to the upside.

An example of a signal to buy when trading with xSuperTrend MTF

In this example, I used digits to show the fulfillment of a corresponding condition for a signal to buy to appear. The “rebound” area is circled, after which all conditions for entering a long position were met.

A signal to sell when trading with xSuperTrend indicators

Each of the following conditions should be met for a signal to sell to appear:

1. The xSuperTrend MTF indicator must be red;

2. The BBands_Stop_v1 must be red;

3. The xSuperTrend Candles new indicator must be red;

4. The price must rebound from xSuperTrend MTF or BBands_Stop_v1 to the downside.

An example of a signal to sell when trading with xSuperTrend MTF

In this example, you can see that there are both red and blue spots of the BBands_Stop_v1 indicator on a signal candlestick. In such cases, we don’t have to cancel the entrance to the market if all other conditions for selling (or buying) are met.

Stop Loss and Take Profit in trading with xSuperTrend MTF

The first Stop order in trading with this strategy should be placed beyond a signal rebound from xSuperTrend MTF or BBands_Stop_v1. When selling, you shouldn’t forget about the spread, especially if you’re trading one of the major currency pairs because the spread is changing depending on the market volatility. In such a case, it can barely present during the European trading session.

Further following of the position should be performed by moving the Stop Loss order beyond new blue spots of BBands_Stop_v1 when buying and red spots when selling. If you don’t trust the indicator or have other excellent methods of following your positions, then, of course, you can use them.

To move the position in the black, the Stop Loss order must be protected by the local extremum at least. Moving Stop Loss to the entrance level only because you want to is forbidden. However, there may be an exception from the rule when there is a clear threat to the position in the form of a big shadow against your direction or before some very important news is published.

Take Profit should be placed before the closest strong support level in the case of selling and the first significant resistance level in the case of buying.

Unfortunately, these indicators are useless for defining Take Profit, that’s why for correct trading with this strategy one must know how to find strong levels.

Of course, in some cases, we can do without placing Take Profit and it can be even more profitable. It may happen when there is an impulse that breaks all levels. But, as you know, the Forex market provides such opportunities less often than we want it to, that’s why it is not recommended to trade without placing Take Profit.

Management of capital in trading with xSuperTrend indicators

When trading using this strategy, the lot size should be such that your risk for each position doesn’t exceed 2%. There are no strict recommendations on whether you should risk the same percentage of the deposit or trade some particular lot size.

However, it is not recommended to use trading signals, in which a potential ratio between risk and profit is worse than 1 to 2. Most likely, following this rule will reduce the number of your entries to the market but it may later have a positive influence on your monthly, quarterly, and yearly reports.

By the time it’s been a year since you started using this trading strategy, you may enter the market with the ratio between risk and profit 1 to 1. Why? Because by that time you are supposed to feel the market much better and realize how efficient the strategy might be when applied to any given situation.

Example of trading with xSuperTrend indicators

The strategy described in this article requires a lot of attention because of its timeframe, М30. If this timeframe is no good for you, you can take a longer one provided you can set the correct settings for xSuperTrend MTF. Using shorter timeframes is strongly not recommended.