Three Reasons to Buy Tesla Shares after Split

6 minutes for reading

At the beginning of June, Tesla (NASDAQ: TSLA) shares cost 1,000 USD. It took the company 10 years to reach this stock price; moreover, two months later, the stock price reached 2,000 USD.

As the saying goes:

"Only the first million USD is hard to earn”.

What to do with Tesla shares now? Should we buy it?

During such growth, tech analysis will naturally show an uptrend. Fibonacci levels help us find the next resistance level, which is at 2340 USD per share.

Fundamental analysis indicates that the growth is too swift and does not correspond to the profit that the company makes because it has just started making a net profit.

In this situation, a correction would be logical. However, Tesla is developing so rapidly that there is no chance for a correction. His fortnight, any decrease in Tesla shares was immediately bought out by investors

The split of Tesla stock

In August, the main driver of the price growth was the news about a split. When the public heard this news, the stock price grew from 1400 USD to 2295 USD, i.e. by more than 50%.

The split will artificially decrease the Tesla stock price, which will let investors who did not want to or could not buy the shares for 2,000 USD each, buy them at a much more affordable price. However, the problem is that the split is no positive news for the company, it does not influence its profit or capitalization. The procedure itself does not bring the company any profit, which means it gives no base for the stock price growth. So, we need to look for other reasons for the price growth after the split, and there are such reasons.

A battery that lasts 1 million miles

The first and very important reason is the storage battery, designed in a collaboration between Tesla and Panasonic, which lasts up to 1 million miles.

An event called Battery Day is scheduled for September 22nd. There, Tesla will present the battery; Elon Musk assures the media that the battery will become available for other car producers.

If this happens, Tesla will enjoy huge profits.

A battery that can last 1 million miles can compete with the combustion engine successfully. Businesses will switch to electric cars faster: they use cars a lot, and this is the type of battery that they have been craving for. A casual driver who never uses their car for business trips is unlikely to cover 1 million miles ever or, at least, they will need 15 years to do it. In developed countries, people seldom drive one and the same car for such a long time.

On the whole, the advantages of Tesla in the competition around electric cars are shrinking gradually, that is why the company tries to master other fields of business and constantly increases the quality and efficacy of its products.

Currently, the toughest thing about Tesla electric cars is their price; nonetheless, such speed of development that we are witnessing allows us to decrease it. In 2020, Tesla decreased the price of Model X, Model S, and Model 3 twice and Model Y – once; Tesla electric cars are becoming more affordable, which means the company will receive more orders.

Construction in China and Germany

The second reason is the enlargement of the floor area.

When Tesla just started producing electric cars, it got so many pre-orders that it was clear the company had no chance to complete them all. That is why Elon Musk kept investing so much in the construction of new plants, leaving the company losing for a long time.

By now, the company is already working out of the USA, producing electric cars in China, at a plant named Gigafactory 3.

Construction was approved on October 24th, 2018, and on January 8th, 2020 the opening ceremony was held. This is unbelievably quick for a plant of such scale.

Thus, the company entered the Asian market, and Gigafactory 3 will let it take a decent place there.

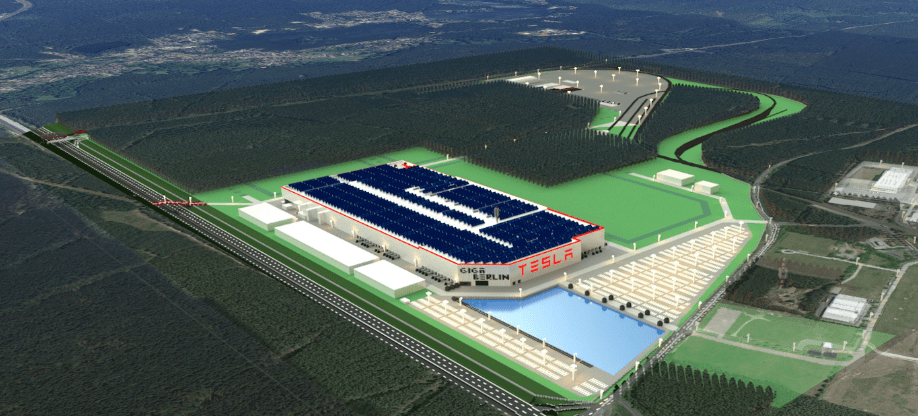

The next step is to the European market – Tesla is building Gigafactory 4 in Germany. There, they plan to produce batteries, battery banks, gearing systems, and Tesla Model Y electric cars. The company has already bought the land and has started construction. The launch is scheduled for July 2021.

Thus, Tesla is going to be present in all crucial markets, and the increased capacity lets the company satisfy the constantly growing demand for electric cars.

This year, the company is planning to supply about 500,000 cars to the clients, which is scarce, compared to, say, BMW that sells some 2.5 million cars annually. This again proves that Tesla is yet a developing company, and its share in the world market is tiny.

Tesla shares included in S&P 500

The third reason to buy Tesla shares is its possible inclusion in the S&P 500 index.

This index is comprised of the 500 largest US companies, and Tesla, with the capitalization of over 400 billion USD is among them already.

To be included in the S&P 500, a company must:

- be registered in the US;

- have its shares traded in NYSE, NASDAQ, or Cboe;

- have capitalization over 8.2 billion USD;

- remain profitable for over 4 quarters in a row.

The last obstacle for Tesla was the lack of quarterly profit. In July, the report for the second quarter of 2020 demonstrated that the company fulfilled this requirement as well. Since the second quarter of 2019, the company has kept reporting a constant net profit.

Now it is for the index committee to decide whether to include Tesla in the S&P 500. The committee meets once in a quarter. Its next meeting is scheduled for September. Tesla formally complies with all the rules.

What happens after Tesla finds itself in the index?

Large hedge funds, especially pension ones, have strict rules about the characteristics of companies that they can invest in. Naturally, the majority of such companies are included in Dow Jones, S&P 500, or Nasdaq-100 indices.

After Tesla finds itself in S&P 500, funds will have to buy its shares. The estimated sum of the buy is over 30 billion USD. Smaller hedge funds that keep an eye on the indices and individual investors will come along: during the last 5 years, the S&P 500 quotations rose by 100%, even in the times of the crisis.

Thus, the annual revenue from investing in the index stocks was 20%. This is very high profitability.

Summary

After the split, Tesla shares will become more available. There are reasons to buy them, still. However, Warren Buffett warns investors that there is a bubble swelling in the stock market, similar to that one which led to the Dotcom crisis. No one knows for how long the Tesla stock will keep growing, only that before the crisis, the speed of the growth is the highest.

Playing short is currently very risky, however, you may still make some money on buying stocks. Buffett warned of the bubble before the Dotcom crisis as well, and the stocks kept growing for a year after his words, some of the stocks increasing by over 100%. This time it may happen the same way because history repeats itself.