Affirm Holdings IPO: A Fintech Startup for Consumer Lending

8 minutes for reading

Buying consumer goods on credit has become a common phenomenon nowadays – such a scheme allows consumers to use the things they need and pay for them without any haste while using. That’s why retail chains try to accelerate the growth of consumer lending in any possible way in stores and malls. Since most parts of such purchases are made online, lending services gain popularity on the Internet as well.

On November 18th, 2020, Affirm Holdings, Inc., which specializes in lending short-term credits for buying goods, submitted an IPO request to the Securities and Exchange Commission (SEC) by the SEC S-1 form. The IPO was postponed until January next year at NASDAQ (AFRM), so we have plenty of time to gain insight into the issuer’s advantages and disadvantages.

Affirm Holdings business

Affirm Holdings, Inc. Was founded in 2012 by Max Levchin and Peter Thiel, who at that time already showed their management skills in PayPal. They became masterminds of new approaches to the assessment of the lendee’s reliability and credibility. According to Affirm Holdings management, previous scoring models reduced the profit made by lenders and merchants. The Affirm platform takes into account over a billion data points, which help increase the amount of provided loans without the growth of the “hopeless credits” rate.

The shopping process with Affirm is as follows: a client of an online store chooses goods and, when selecting a payment method, can choose Affirm. Later, a client chooses a payment lane in the app – there is an option to pay by installments.

The company’s scoring model allows increasing the number of approved loan applications by 20%. This, in its turn, drives sales and may increase the average order value (AOV). As estimated by Affirm, the AOV may go up by over 85%.

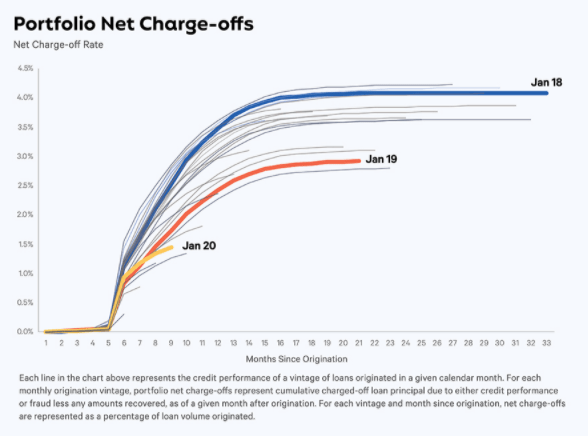

Thanks to Affirm, clients of online stores have the opportunity to get non-interest-bearing loans – in this case, the company earns on stores’ commissions. Also, there is an option of receiving a loan product with simple interests, which do not imply any additional fines or fees if a client is past their due. Such loyal conditions are very popular with consumers and the amount of non-accrual loans lost 4% by 2018 and 1.5% by 2020.

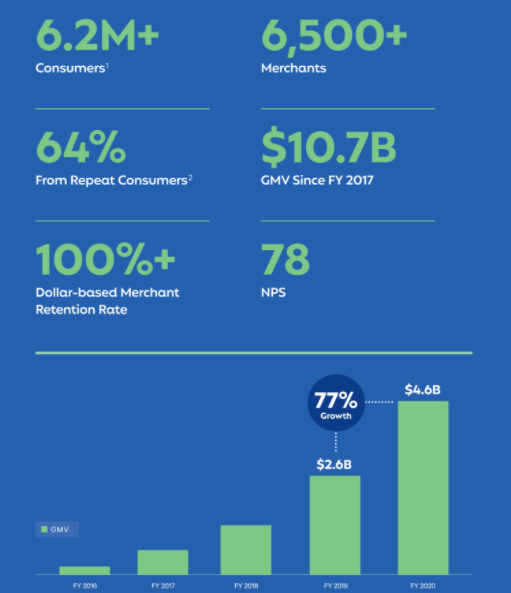

Affirm Holdings provides services to more than 6.2 million clients, while over 6,500 stores have already become the company’s partners.

It should be noted that 62% of clients have been repeated buyers in stores of the company’s partners. Affirm Holdings’ net promoter score (NPS) is 78. The company’s business model is distinguished by the originality and flexibility of its approach, otherwise, it would not demonstrate outstanding results in such a complicated and highly-competitive market. We’ll talk about competitors later.

Market perspectives

Affirm Holdings, Inc. operates on two markets, e-commerce and lending, simultaneously, that’s why we should consider the dynamics of each of them. According to eMarketer, the e-commerce market size in 2020 was $3.9 trillion and 63% ($2.45 trillion) of it is accounted for by a mobile sector. The annual average growth rate of the sector is 16.5%. Moreover, the e-commerce share in the global trading volume is 14% (in the USA – 16%). All these factors hint at a potential market growth up to $6.3 trillion by 2024.

Affirm’s client base mostly consists of millennials and Generation Z (born from 1981 to 2012 год), who will dominate among consumers for the next 20-25 years. This year, their total demand is about $2.5 trillion.

Another strategic market for the company is lending. This year, US citizens have loaned $3.6 trillion.

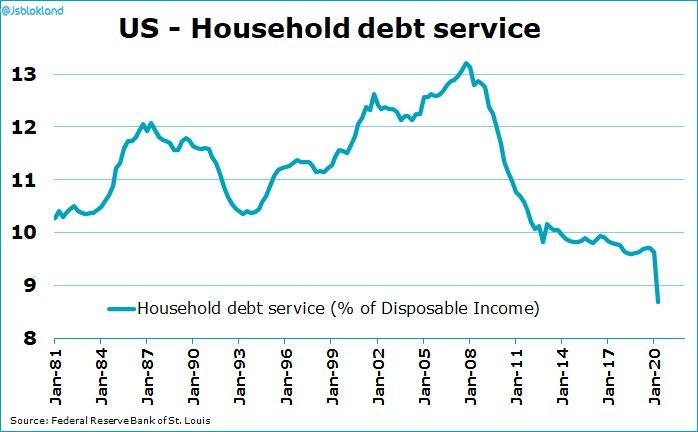

An average American is $29,000 in debt and spends up to 10% of their income to service a loan. This year, household spending on obligatory debt payments has been even lower than 10% of real earnings. Up to 16% of households have to pay over 50% to service their loans. Credit-card debt is about $1 trillion. In 2019, US citizens paid $121 billion in interests alone.

However, the situation is highly likely to change in the future. According to Statista, more than 70% of millennials and generation Z are against credit cards and prefer an online installment plan. There is even a movement called BNPL, “Buy now, pay later”. The share of BNPL is 1% of e-commerce payments; it is expected to reach 3% by 2023. In developing countries, the share of BNPL is 6%.

As a result, Holdings operates in two rapidly-growing markets and its target audience mostly consists of the dominating generation for the next 2025 years.

Affirm Holdings financial performance

Affirm does not generate profit at the time of filing for an IPO, that’s why let’s focus on analyzing its earnings. It’s important to note that earlier, during rounds of financing, the company received from $1.5 to $1.8 billion investments from 23 “donors”. The largest investors among them were Thrive Capital, Jasmine Ventures, Singapore Wealth Fund, Khosla Ventures, and others. During the latest round in September, the company attracted about $500 billion.

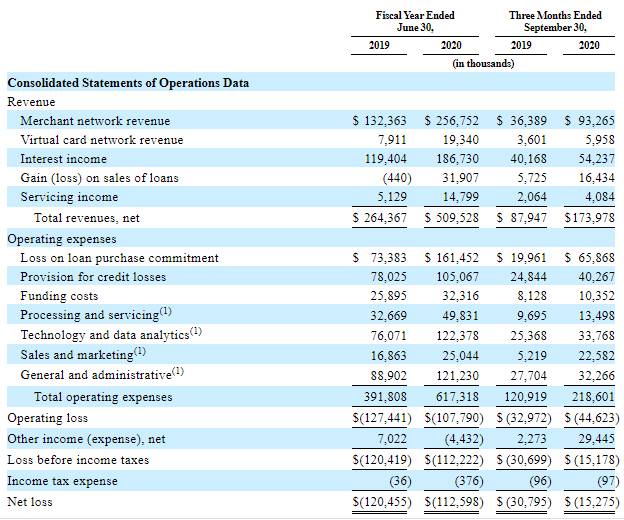

In the 2020 fiscal year, the company’s earnings were $509.5б which is 93% more than in 2019. Half of this money is commissions from stores, the total sum of which is $256.7 million. More than a third of earnings is interest payments from clients. in addition to that, Affirm issues virtual cards for online shopping.

The company’s operating expenses in 2020 added 57% up to $617 million in comparison with 2019. As a result, the net loss in 2020 was $112.5 million, which is $7.9 million less than in 2019. Overall, Affirm helped to sell goods for the total amount of $4.6 billion, which is a 77% increase as compared with 2019.

We can draw intermediate conclusions: most part of the company’s earnings comes from a quite promising movement, BNPL. In addition to that, earnings are expanding faster than operating expenses, and that allows us to suggest that the company may have solid profits in the long run.

Competitors and weak sides of Affirm Holdings

The company’s major competitors are AfterPay, an Australian company (shares are traded at the Australian stock exchange), and Klarna from Sweden (one of its key investors is VISA). The first one has 6.5K partner stores in the USA, while the second – more than 200K all over the world. In addition to that, Affirm’s indirect competitors are:

- VISA and MasterCard.

- Various online wallets, for example, Pay Pal with "Pay in 4".

- Banks, such as J.P. Morgan Chase, Capital One, Bank of America.

- Online banks.

Thereby, among the risks of investing in this company are:

- Strong competitors with advanced BNPL technologies, which prevents the company from expanding to new external markets (AfterPay and Klarna made great strides in it).

- The company’s earnings, which are seriously dependent on a single buyer, Peloton (30% of sales).

- Lending infrastructure, which is supported only by Cross River Bank, a company that actively cooperates with other fintech startups, such as Upstart (UPST).

- The company’s unprofitability and lack of plans to pay dividends even if there is profit.

- Double share structure, which allows the company founders to control it. There is a possibility of a conflict of interests of founders and shareholders.

All above-mentioned disadvantages are compensated by the promising market the company operates in and its financial performance. At the time of the IPO, there will be an updated S/1-A form, where one should pay attention once again to the dynamics of the company’s earnings over the last 12 months.

IPO details and estimation of Affirm Holdings capitalization

The company has filed for an IPO to attract $100 million but closer to the date this sum may increase. The underwriters of the IPO are Deutsche Bank Securities Inc., RBC Capital Markets, LLC, Goldman Sachs & Co. LLC, Truist Securities, Inc., Siebert Williams Shank. Co., LLC, Morgan Stanley & Co. LLC, Allen & Company LLC, Barclays Capital Inc., and Credit Suisse Securities (USA) LLC. As we can see, the list includes all leading operators of the IPO market. The date was rescheduled to January because $500 million attracted in September will be enough for six more months. According to different estimates, the IPO can attract $2-3 billion for increasing expenditures on marketing and return initial investments to “donors”.

The Price-to-Sales ratio (P/S Ratio) will be used for assessing the company’s capitalization. For the fintech sector, an average value is 4.3. As a result, the company’s capitalization may reach $2.1 billion ($0.509 billion *4.3). The company’s investors won’t like this estimation because it equals the sum of their investments.

An average ratio of the industry leaders is 7.9 – in this case, the company will get an estimation of $4.02 billion, which is also pretty far from the earlier announced $10-13 billion. We assume that the company wants to file for an IPO after reporting on the 4th quarter, which may help it to get a better assessment from market players.

With all that said, we recommend considering this company for mid-term investments. Especially if the company’s earnings will have reached $1 million over the last 12 months at the date of reporting.