Investing in Airlines: Risks are Growing

7 minutes for reading

Several months ago, I though airlines were among the best and safest investment ideas. Since my article was published, the stocks of certain airlines grew by over 50%, which is immaculate profitability for three months. However, now, when airlines started presenting their financial performance in Q4, 2020, I changed my mind about the safety of this sector.

New lockdowns all over the world add up to general nervousness, especially in China, where the coronavirus seemed to be under control.

In this article, we will look at the financial reports of airlines and find out why investing in them is so risky.

Well, what are the digits?

United Airlines Holdings, Inc. reports:

According to the report for Q4, 2020, the losses of United Airlines (NASDAQ: UAL) reached 1.9 billion USD. Compare: in the same quarter of 2019, the company lost 641 million USD. Compared to 2019, the income dropped by 69% to 3.4 billion USD.

The airline is now busy surviving instead of developing. It keeps looking for ways of saving more money. Since three quarters ago it has managed to decrease expenses by 1.4 billion USD. Its daily spending in Q4, 2020 dropped to 19 million USD, which is two times less than in Q2, 2020.

At the end of 2020, UAL had on ots accounts 19.7 billion USD, which it can use for sustaining its business. With daily expenses of 19 million USD, this sum can last for over 10 years. In other words, there is a safety bag that investors neglect, for some reason.

The management states that it has stabilized the situation, and 2021 will be a transition period for the company, after which gradual recuperation will begin.

The pandemics increased the demand for cargo flights. In Q4, 2020, the income in the segment grew by 77% and rose over the pre-crisis level by 244 million USD.

Domestic flights are also popular, so that the company organized 43 lines more.

The main part of the company's revenue is generated by passenger flights, and here, performance is far from pre-crisis levels. In Q4, 2020, passengers brought 2.4 billion USD of income, while in the same quarter of 2019, the result was 9.9 billion USD.

We can currently admit that the potential for growth is huge, the only question is whether it will manage to return to the pre-crisis level and when. Remember that after the terror act in 2001, many US airlunes went bankrupt though no one shut any borders. The current situation is more complicated, and the influence of the coronavirus is prolonged.

The director-general of UAL Scott Kirby this time abstained from forecasting profits for the company. Experts say that recuperation might happen no earlier than 2023.

Reaction of investors to the report

Investors took the report negatively, dropping the stock price of the airline by 9%. As long as Kirby gave no clear indications of the time when the passenger flow might restore, investors cannot even play on expectations. In the end, we will have to track what the management of other companies will say and base our forecasts about the stocks on their words.

The falling of the stocks made the price break through the 200-days Moving Average, which means market participants are uncertain about the future of the price. Moreover, this signal might be interpreted as the beginning of a downtrend. However, for the bulls, not the whole game is lost. While the price is trading above the support level of 40 USD, it might still rise to 50 USD.

But if the price drops under 40 USD, this will mean the stock is under the bearish control. In this case, the quotations might fall to the lows of the last year — 32 USD per stock.

Delta Air Lines, Inc. reports

The management of Delta Air Lines (NYSE: DAL) is more optimistic about 2021. They expect gradual recuperation of the passenger flow in the second half of this year. However, it also ended Q4, 2020 with a loss of 755 million USD. Nonetheless, it is much better than in Q3 when the losses reached 5.3 billion USD.

The income of the airline even exceeded the expectations of experts. A revenue of 3.67 billion USD had been forecast while the company, in fact, made 3.97 billion USD.

Passenger flow generates the main revenue of the company; in Q4, 2020, it only brought 2.69 billion USD, while in 2019, it brought 10.2 billion USD. The situation is the same as in UAL: cargo transportation flourishes, and domestic flights make up for a significant part of the revenue.

The income from cargo transportation grew by 11%, while inner flights now bring 82% of the overall profit, amounting to 2.22 billion USD.

The company finished Q4 with 16.7 billion USD of cash that can sustain its business. Also, the airline has managed to cut down on its daily spending even more, bringing it to 12 million USD. In Q3, 2020, they spent 25 million USD daily.

Delta CEO Edward Bastian called 2020 the hardest in the company's history but highlighted the following: "While our challenges continue in 2021, I am optimistic this will be a year of recovery and a turning point that results in an even stronger Delta returning to revenue growth, profitability and free cash generation."

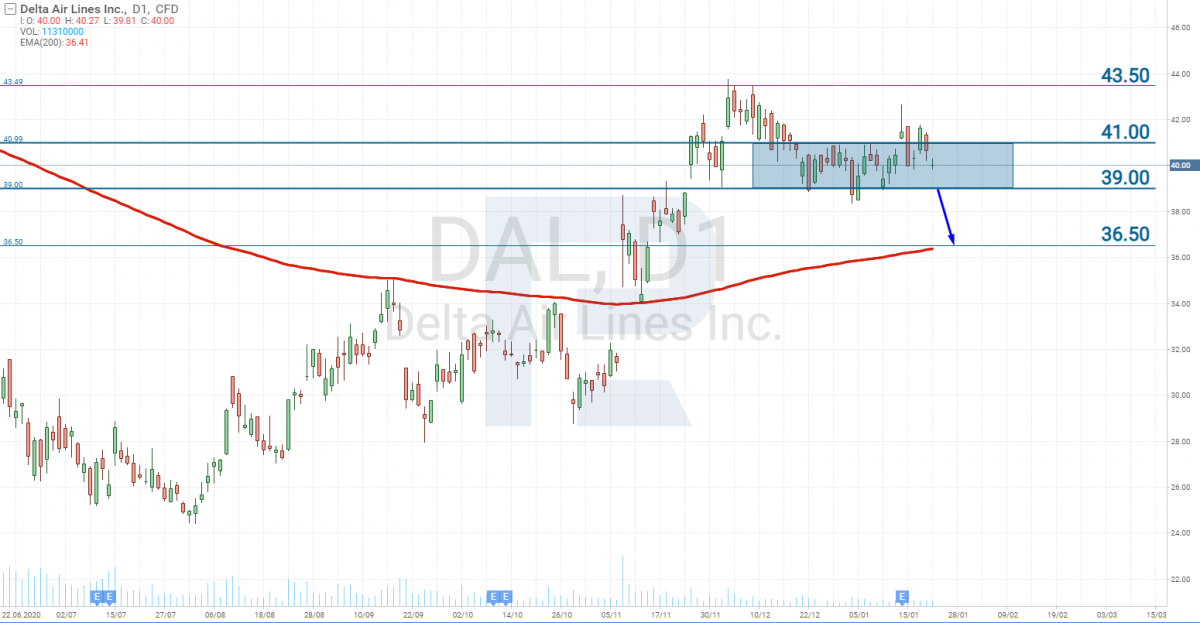

Unfortunately, the report dropped the stock price of Delta Air Lines. However, the stocks are still trading above the 200-days MA, which means the uptrend preserves. However, a breakaway of 39 USD might provoke furthet falling to the support at 36.5 USD. This decline will be regarded as correctional.

Quarterly reports of other airlines — American Airlines Group Inc. (NAASDAQ: AAL), and Southwest Airlines Co. (NYSE: LUV) — are also likely to be negative. They are due on January 28th. Judging by the losses of DAL, there are zero chances for these companies to make anu profit.

Airlines pull Boeing along

If airlines are having hard times, those who provide them with airlines will also struggle. By "those" I mean The Boeing Company (NYSE: BA).

If airlines do not make a profit, Boeing will not take new orders, which means it will not improve its financial situation seriously deteriorated by the pandemics.

Boeing will show its quarterly report on January, 28th; however, its stocks already tested the support level of 200 USD three times. Vague perspectives of the passenger flow restoration harm the company's stocks. Investors switch to less risky sectors, such as green energy or electric cars.

All in all, a breakaway of 200 USD might cause a serious decline in the stock price. The investment that I called quite safe a couple of months ago is now becoming more and more dangerous.

New lockdowns

The vaccination has started but no one is in a hurry to open the borders yet. On January 12th, we heard that China is imposing new quarantine measures on the territories around Beijing. Germany will remain strictly locked down until February 14th. France is getting ready for the third lockdown. The media keeps raising the topic of the new strain.

In the end, it becomes way too hard to forecast the opening of borders. The longer they remain locked, the more airlines will struggle. Feeble passenger flow will make airlines sell airplanes that lie idle, which will send another blow on Boeing.

Bottom line

Strange as it might seem, before the vaccine appeared, investors were more optimistic about the future of airlines, which pushed the stock prices up, giving a good chance to make money.

Then, after the vaccination started, the stocks started correcting, i.e. investors took the profit. Now it could be the time to buy the stocks at a more affordable price, as long as, according to the reports, airlines have pushed off the bottom, the losses have started to shrink. However, market players are not interested in this sector anymore.