Signify Health, Inc. IPO: Healthcare Services at Home

6 minutes for reading

I guess many of you faced a problem of completing their sick leave when you must go to a hospital even with a high temperature, cough, and running nose. In addition to that, some chronic diseases or civilian traumas also require you to go to see your doctor no matter how bad you might feel. Although many of them can be treated at home, the USA and the European Union experience a number of payment issues for such services. Signify Health decided to simplify procedures of home treatment and payment for healthcare services.

Signify Health Inc. Is going to hold an IPO at the NYSE on February 10th, 2021 года. The company’s shares will start to be traded the next day, February 11th, under the SGFY ticker. The company was demonstrating outstanding results even before the COVID-19 pandemic and this makes it all the more interesting to talk about its business model in more detail.

Signify Health business

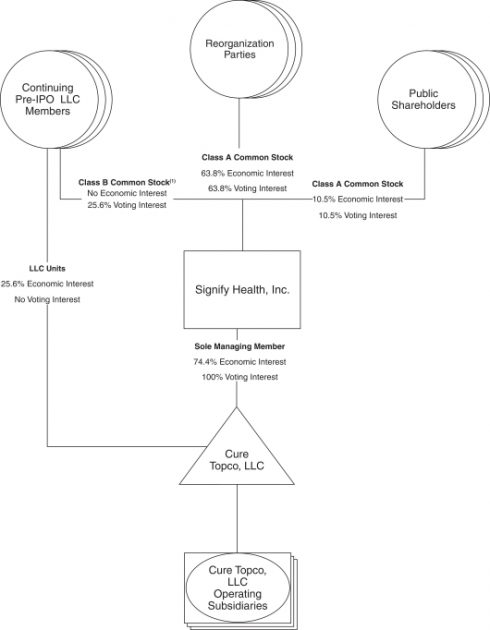

Signify Health, Inc. Was founded in 2017 and currently employs over 2,100 people. The company has become a leading healthcare platform that implements the most efficient analytics and technologies for helping patients: it determines whether it is necessary for a patient to be admitted to a hospital and looks for the most efficient and cheapest doctor for them. In cooperation with a nationwide network of healthcare service providers, Signify offers patients the opportunity to stay at home in case there is no dire need for stationary admission. The company’s structure after the IPO is shown below.

The company’s clients are several state governments, private companies, healthcare systems, and groups of physicians in private practice. Signify Health believes that the company has become leaders in the two rapidly-growing segments of the healthcare service market: homecare (some episodes of care) and In-Home Health Evaluations (IHE). For example, the company provides management within the frameworks of Medicare Bundled Payment for Care Improvement Advanced ("BPCI-A") with a budget worth $6.1 billion.

Thanks to the Signify platform, the number of people released from acute medical units increased by 15% in 2019, while the number of return visits reduced by 10%. As a result of this, the government has the opportunity to effectively streamline the healthcare sector operation throughout the country. In 2019, over 1 million households joined the company’s platform in 47 different healthcare programs.

Signify Health fully analyzes clinical, social, and behavioral factors that help to manage customer needs and minimize possible expenses. The company gets profit when it attracts customers to the healthcare program and they save money using its services. In such a way, Signify is result-oriented.

The company increases its market share by expanding cooperation with insurance companies, social organizations, and reporting healthcare entities. Of course, Signify Health competes with other companies in the market, given its substantial volume.

The market and competitors of Signify Health

The total spending on healthcare in the USA in 2019 was about $3.8 trillion. According to the company’s estimations, by 2025, 60-70% of this money will be spent on the improvement of quality and cost of healthcare services. In 4 years, Signify will work on the market with a volume of $2 trillion in the USA alone.

The company’s business model has demonstrated quick growth. Since 2015, the number of annual medical examinations appointed through the Signify platform has increased from 390K to 1.1M in 2019 with an average annual growth rate of 28,9%. Signify operates in 26 of the 50 best Medicare Advantage programs. When it comes to episodes of care, the growth is even more impressive: from 24K within the frameworks of BPCI in 2014 to 215K in BPCI-A by 2019.

The company’s key competitors are:

- UnitedHealth (UNH)

- Change Healthcare (CHNG)

- Humana (HUM)

- Matrix Medical Network

- Fusion5

- Archway

Financial performance

During the latest round of financing, the company received about $960 million from New Mountain Capital. At the time of the IPO, Signify Health doesn’t generate net profit, that’s why let’s pay attention to the company’s earnings dynamics.

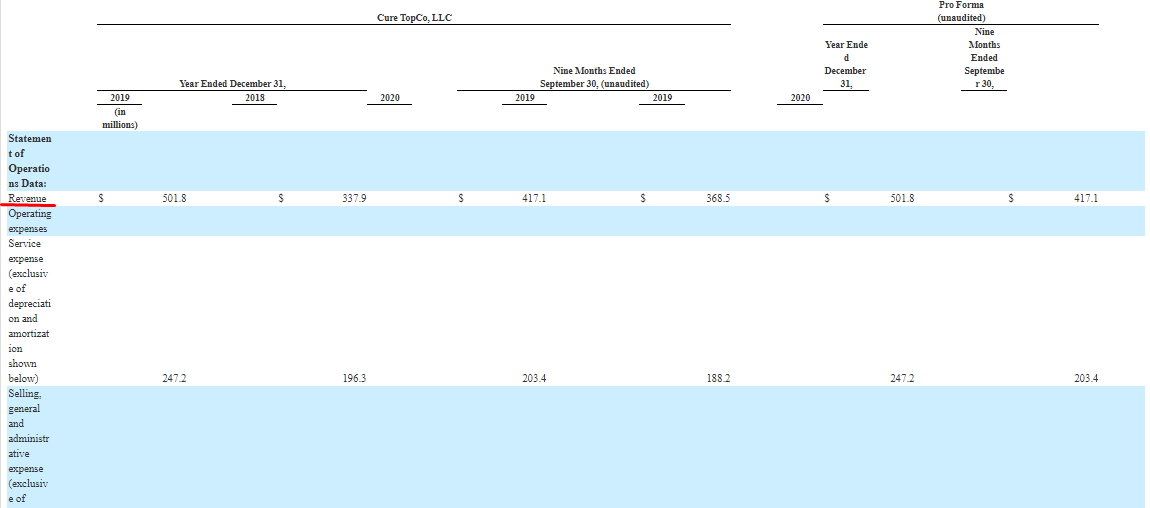

The company’s earnings over the previous 12 months since the report date were $550.4 million. Projected earnings for 2020 are $568.04 million. Over three quarters of 2020, the company’s earnings were $417.1 and that’s a 13.2% increase when compared with the same period of 2019. Over the entire year of 2019, Signify’s earnings reached $501.8, which is 48.5% more than in 2018. As we can see, the growth rate slowed down last year. However, an average growth rate is over 30% and that’s quite okay for young companies that have been operating in the market for less than 5 years.

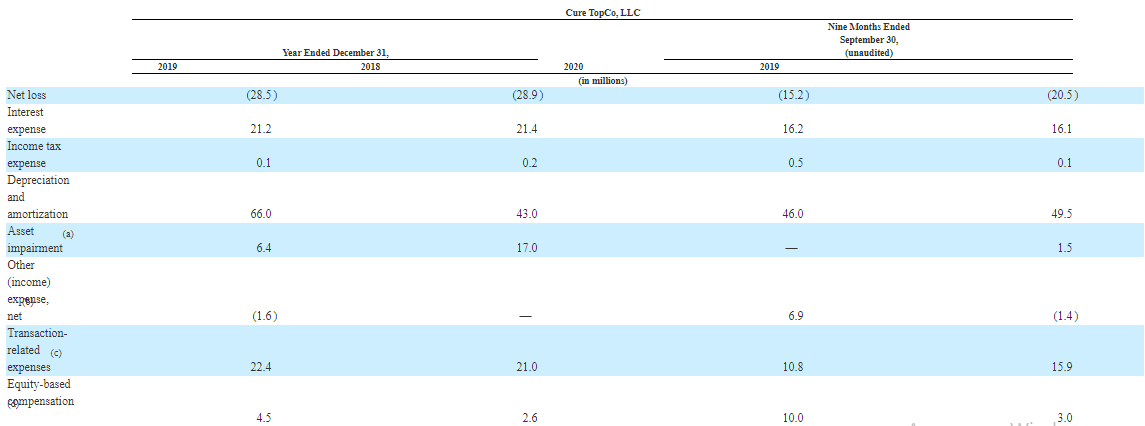

We should also note that the net loss of Signify Health tends to decrease. Over three quarters of 2019, this indicator was $20.5 million, which is by 25.8% more than over the same period of 2020, thus implying a decline in expenses at the time when earnings are expanding. If the company’s management is able to keep this momentum, then it might have the net profit in 3 or 4 years.

The company has $88 million in cash on its accounts with total liabilities worth $413 million. Signify’s assets are estimated at $1.5 billion.

In general, it’s necessary to pay attention to the growth of earnings, gross profit, and cash flow from business operations.

Strong and weak sides of Signify Health

Now let’s analyze all pros and contras. The company’s strong sides are:

• Experienced management

• Trustworthy brand and long-term relations with customers.

• The company has been operating in the healthcare service market worth over $2 trillion.

• Advanced analytical platform.

• Successful cooperation cases within frameworks of Medicare and Medicaid programs.

• Positive experience in business model scaling.

Major risks of investing in this company are:

• The company’s earnings depend on a limited number of high-profile accounts.

• The company is dependent on government contracts in major healthcare programs, such as BPCI-A.

• The company neither generates net profit nor pays dividends.

• Earnings growth rate is slowing down and may remain at the same level.

• The company depends on the healthcare legislative framework and may incur significant losses if it experiences difficulties with adaptations to the changes.

IPO details and estimation of Signify Health capitalization

The underwriters of the IPO are J.P. Morgan Securities LLC, Robert W. Baird & Co. Incorporated, William Blair & Company, L.L.C., Goldman Sachs & Co. LLC, Barclays Capital Inc., Deutsche Bank Securities Inc., BofA Securities, Inc., UBS Securities LLC и Piper Sandler & Co. Signify Health is planning to sell 23.5 million shares at $17-19 per share for $423 million.

The IPO money will be used for expanding its market presence by merging smaller companies. Details are not disclosed. After the IPO, the company’s capitalization is expected to be $4.2 billion.

To assess the growth potential of Signify Health shares, we use the Price-to-Sales ratio (P/S Ratio). At the moment of the IPO, the ratio is 7.63 (4,200/550.5). In the medical technology market, the ratio may be up to 10, that’s why the Company’s shares upside may reach 32% during the Lock-up Period.

Considering the company’s current financial state and its potential market, we recommend Signify Health shares for mid-term investments.